How to Buy Compass Shares UK – Invest in CPG with 0% Commission

Although Compass Group plc isn’t a name that crops up in the financial news regularly, it is actually one of the largest companies on the FTSE 100.

With a market capitalisation of over £21 billion, this firm is a major supplier of contract-based food services across more than 45 countries.

If you want to buy Compass shares online in the UK today, this guide will show you what you need to do. On top of discussing the best UK brokers to buy Compass shares from – we’ll also explore its past performance and conduct a broker forecast to help you decide whether it’s the right investment for you.

-

-

Step 1: Find a UK Stock Broker to Buy Compass Shares

Compass shares are listed on the London Stock Exchange (LSE) and also form part of the FTSE 100 index. With this in mind, buying Compass shares online in the United Kingdom is easy. There are many brokers that allow you to do this by funding your account instantly via a UK debit/credit card or e-wallet.

However, you need to look at other factors too – such as what fees/commissions the broker charges and whether or not it has a good reputation. To save you countless hours of research, below you will find two of the best UK stock brokers to trade or buy Compass shares online.

Step 2: Research Compass Shares

Before you buy Compass shares, or shares in other food and beverage companies like Beyond Meat or Diageo, we would advise you to spend some researching the company. This will ensure that the firm represents a viable investment and crucially – that it’s the right stock for your financial goals. In the sections below, we’ll cover some background information on Compass Group plc and its shares – alongside some important considerations to make before you proceed with a purchase.

What is Compass?

Compass Group plc (ticker LON:CPG, ISIN: gb00bd6k4575) is a UK-based company involved in food contract services. Through its subsidiary companies, it supplies food to a variety of sectors and is the world’s largest contract caterer. This includes hospitals, offices, schools, offshore oil rigs, correction facilities, and more. It also provides support services to clients, such as cleaning services and office services.

At the time of writing, Compass Group is active in over 435 countries – employing more than 600,000 people along the way. Launched way back in 1941, Compass Group has since grown to become a major, multi-billion pound company.

As of October 2020 – it is a key constituent of the FTSE 100 with a market cap of over £21 billion.

Compass Share Price History

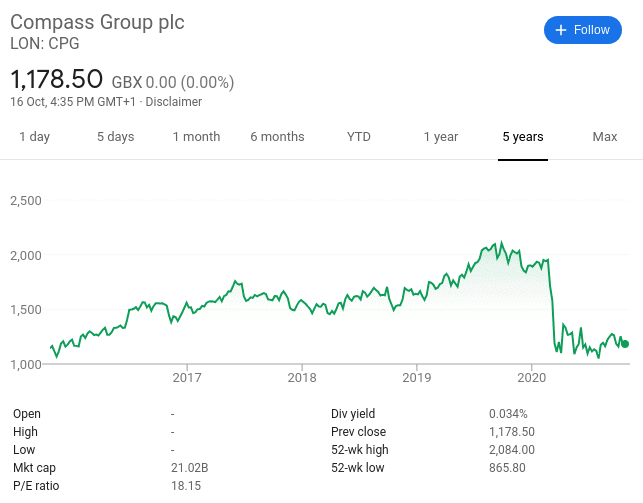

Compass Group plc has been a public company for more than three decades. Since then, the shares have gone through several ups and downs in terms of volatility. With that said, Compass went on a swift upward trajectory between 2008 and early 2020. Going from around 262p to over 2,000p during this period, this represents 12-year returns of over 650%.

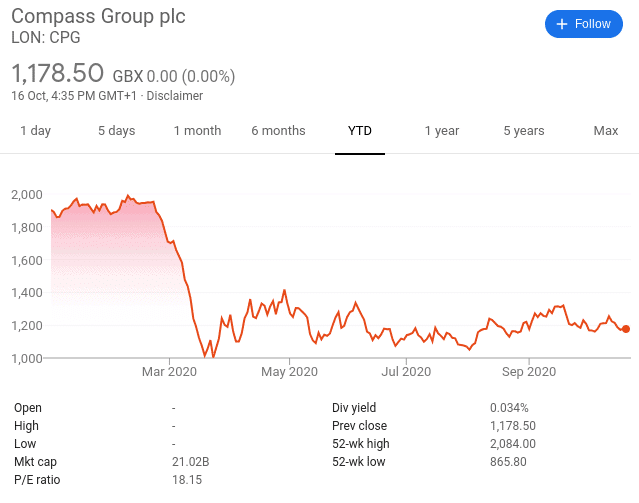

However, Compass Shares have since dropped off a cliff – with the vast bulk of this capitulation starting in February 2020. As of October 2020 – the Compass shares are worth just 1,178p. To put these figures into perspective, this means that in just 8 months of trading – the firm has lost 40% of its share value.

Now, it is crucial to remember that the overarching reason behind this rapid decline is that of the COVID-19 pandemic. After all, some of its core markets – notably schools and universities, were shut for several months during the lockdown. In some countries that Compass Group is active, this is still the case.

Compass Group EPS & P/E Ratio

At the time of writing, the Compass Group EPS is 70.00p, with an EPS growth of 6%. The current Compass Group p/e ratio is 24.6.

Compass Shares Dividend Information

Ordinarily, Compass Group plc is a strong dividend payer that makes distributions twice per financial year. This was the case until April 2020 whereby the board decided to suspend its dividend policy – as per the COVID-19 pandemic.

Crucially, management at Compass Group notes that they will keep “future dividends under review and will restart payments when it is appropriate to do so”. In other words, Compass shares will not attract any dividend yield payments for the foreseeable future.

Should I Buy Compass Shares?

While Compass shares have lost significant value in 2020 – it is important to remember that this is largely due to the wider impact of the pandemic. With that said, it should not be assumed that all companies on the London Stock Exchange will survive the fallout of the virus, which is why it’s super-important to perform in-depth research before making an investment.

Here’s what you need to know.

Financials Hit Hard by the Pandemic

The coronavirus has hit Compass Group hard in most areas of its financial results this financial year. As noted above, the firm put a suspension on dividend payments in April and this will remain the case until further notice. In terms of operating profits, this is expected to drop by 28-29% in the first 6 months of 2020.

Net spending was up significantly to £400 million during the same period. It does, however, have access to credit facilitates in excess of £2.8 billion – so liquidity is not an issue at present. However, Compass Group board members have committed to a salary reduction of 25% in response to the figures, which at the very least will free up some much-needed capital.

Pre-Pandemic Price Action

If you believe that Compass Group has the financial resources to see it through the pandemic, then it is important to look at how the shares were performing prior to the collapse. After all, this will give us an idea of whether or not the shares were in good shape before the virus came to fruition.

So, in the 5 years prior to writing this article, Compare shares were trading at 1,144p. Fast forward to February 2020 and the shares peaked at 2,084p. As such, Compass Group returned stockholders with gains of 82% in just 5 years. This does not include dividend payments distributed nor the impact of compound interest.

Put simply, Compass Group was enjoying an extended period of upward price actions – subsequently outperforming the wider FTSE 100 by a considerable amount. With this in mind, a medium-to-long-term price target of the previously achieved 2,084p is more than reasonable. Crucially, if you agree with this sentiment, you stand the chance of buying Compass shares at a significant discount (43% based on current prices).

Compass Shares Buy or Sell?

On the one hand, Compass was performing extremely well before the pandemic hit – with shareholders looking at gains of over 80% over the prior five years of trading. As such, you have the chance of buying the shares at a discount based on current prices.

In addition to this, the firm has secured a credit facility in excess of £2.8 billion – which is crucial in ensuring it is able to weather the storm until things return to some form of normality.

On the other hand, there is no guarantee that Compass shares will ever return to pre-pandemic prices. As a result, whether or not you decide to invest should be based on in-depth research and never on the back of somebody else’s advice.

The Verdict?

As a major FTSE 100 company listed on the London Stock Exchange, there are hundreds of UK brokers that allow you to buy Compass shares online.

FAQs

Are Compass shares a good buy?

Compass shares have been hit particularly hard by the coronavirus pandemic - as per major disruptions to its supply network. However, it is important to remember that the shares were on a prolonged period of upward price action before the virus hit the wider markets. As such, if Compass is able to get back to where it was pre-February 2020 - then the shares can now be purchased at a huge discount.

What stock exchange are Compass shares listed on?

Compass is listed on the London Stock Exchange. As a company with a £21+ billion market valuation - the shares also form part of the FTSE 100 index.

What is the minimum number of Compass shares you can buy?

While some brokers have minimum deposit policies in place that require you to invest in excess of £500.

Does Compass pay dividends?

Compass was historically a consistent dividend payer - with distributions being made twice per year. However, the board suspended its dividend policy in April 2020. This will remain the case for the foreseeable future.

Which countries is Compass active in?

Compass Group is active in 45 countries at the time of writing.

Who is the CEO of Compass Group plc?

Compass Group's CEO is Dominic Blakemore. Gary Green is the Chief Operating Office of the Group's North America division.

Can I invest in Compass shares via an ISA or SIPP?

Yes, most UK providers of stocks and shares ISA and SIPP accounts will allow you to invest in Compass.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up