Tesla has raised Model Y prices in the US for the third time in the last two months. Is the demand for EVs (electric vehicles) improving?

The company raised Model Y prices by only about $250 post which starts at $47,740. It did not raise the prices for any of the other models. Notably, in the previous rounds of price hikes also, Tesla did not raise Model 3 prices.

Tesla raises Model Y prices

Tesla produced 440,808 cars in the first quarter of 2023 which was 44% higher YoY. The company delivered 422,875 vehicles; a YoY rise of 36%. Together Model 3 and Model Y accounted for around 97% of the deliveries and the share of higher-priced Model S and Model X has gradually come down to low single digits now.

Tesla does not provide the breakup between Model 3 and Model Y but reports suggest that the latter is holding off relatively well. In the first quarter of 2023, the Model Y was the best-selling model across the world if we leave out pickups.

It was the first time ever that an all-electric model was the best-selling car globally.

As for Model 3, the model was launched in 2017 and is now ageing. Also, the demand for sedans has been relatively weak as compared to SUVs.

Tesla hasn’t made any major refresh to the Model 3 since its launch but leaked images recently showed that the company might be working on a Model 3 revamp.

Tesla decides car prices dynamically

Meanwhile, despite the recent price hikes, the Model Y or for that matter all the other TSLA cars are still priced below what they were at the beginning of the year.

During the Q1 2023 earnings call, the company’s CEO Elon Musk said, “We’ve taken a view that pushing for higher volumes and a larger fleet is the right choice here versus a lower volume and higher margin.”

Musk said that Tesla decides car prices based on real-time demand and supply dynamics. The recent price hikes for Model Y show that the demand for the model might be improving further.

That said, the price cuts have taken a toll on Tesla’s margins and its operating margins tumbled to 11.4% in Q1 2023 – down from 19.2% in the corresponding period last year.

EV price war

Tesla slashed car prices at the beginning of 2023 only and continued to lower prices until mid-April. Other automakers also reacted to its price cuts and both Ford and Xpeng Motors lowered car prices which raised fears of an EV price war.

Notably, even NIO – which previously said that it won’t join the price war – recently slashed car prices. The company’s gross profit margin was a mere 1.5% in the first quarter and the price cuts won’t help the cause either.

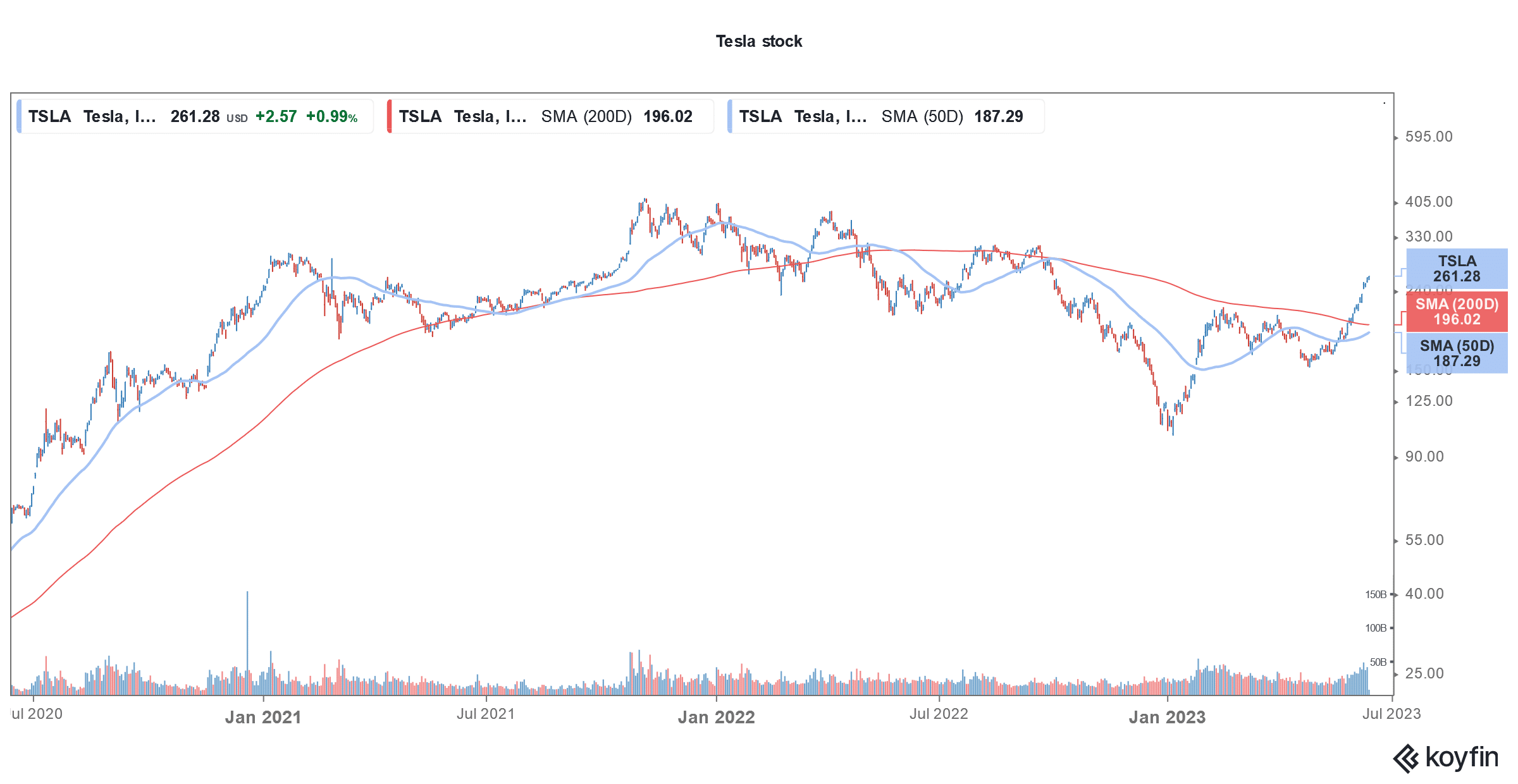

TSLA share has spiked

While TSLA share is trading slightly lower in early US price action today, it closed with gains for a record 13 sessions before that and rose 42% over the period. The rise in Tesla shares has once again made a big hole in short sellers’ pockets and they are sitting on paper losses in excess of $6 billion.

Over the last couple of weeks, Tesla has signed deals with Ford and General Motors to share 12,000 of its Superchargers. The deal would help Tesla earn revenues whenever the cars recharge at the Superchargers.

While the range of EVs has risen gradually due to improvements in battery technology, many potential buyers still suffer from range anxiety. As the charging network expands and more charging stations have interoperability, it would help address range anxiety.

The increase in the charging network is crucial for higher EV adoption. Countries globally are providing incentives to spur EV adoption. It especially holds true for countries which are net oil importers.

Musk has also said that he is open to sharing self-driving technology with other automakers.

Tesla is targeting an annual production capacity of 20 million

Tesla has two plants in the US and one each in Germany and China. It is the market leader in the US EV market and according to Motor Intelligence, it sold 161,430 EVs in the US in the first quarter of 2023.

It now has around a 5% share of the total US automotive market and has an impeccable lead in the EV market. Take for instance, General Motors, which surpassed Ford to become the second largest EV seller in the US in the first quarter, sold just 20,670 EVs in the quarter.

TSLA is targeting an annual EV production capacity of 20 million by 2030 and Musk has said that the company would need to set up more Gigafactories to meet the goal.

The company has already announced the next Gigafactory in Mexico and is rumoured to announce the next location before the end of this year. Countries ranging from France to India are trying to lure the company to set up a plant.

Morgan Stanley is overweight on TSLA shares

Morgan Stanley reiterated its overweight rating on Tesla today and said that the market wants TSLA to be an “AI name.”

It also said, “We think investors should prepare for Tesla to begin building a large full-scale captive financing subsidiary as the market matures, to facilitate the potential IRA leasing rules (which could become a major driver) and several other factors.”

Notably, recently Tesla announced that all its Model 3 variants are eligible for the full $7,500 EV tax credit. This would mean that in states like California, the Model 3 would be available at an effective price of around $30,000.

Model 3 is eligible for the full $7,500 EV tax credit

After the multiple price cuts, the Model 3 anyways starts at just under $40,000 which is the lowest it has ever been.

All said, TSLA has yet again proven bears wrong and the shares have more than doubled this year. The shares crashed 65% last year amid the terrible sell-off in growth shares coupled with controversies surrounding Musk’s Twitter acquisition.

Musk has since relinquished his post as Twitter’s CEO and handed over the baton to Linda Yaccarino. Markets took a sign of relief as there was a perception that Twitter was taking too much of Musk’s limited bandwidth.

Question & Answers (0)