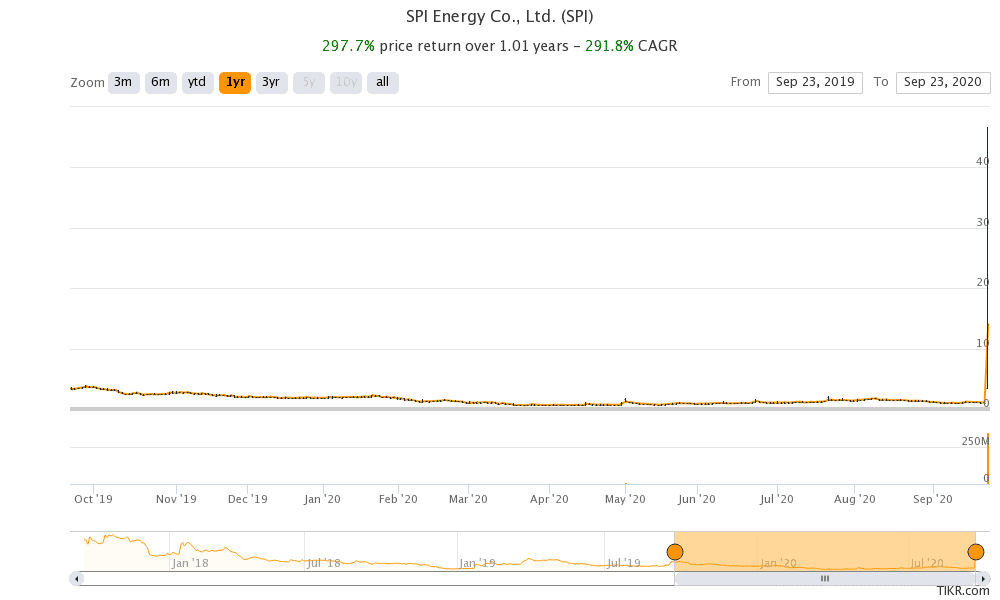

Shares of SPI Energy, a company most investors likely haven’t heard of until now, soared over 4,400% in intraday trade yesterday. Although SPI Energy shares pared gains, they still closed 1,259% higher at $14. Shares were trading sharply higher in pre markets today also as market excitement about the company’s electric vehicle plans grows.

SPI Energy announces electric vehicle plans

SPI Energy, a vendor of renewable energy solutions and provides photovoltaic solutions, announced plans to start an electric vehicle subsidiary yesterday. The company will be named EdisonFuture and be a wholly-owned subsidiary of SPI Energy. It would design and develop electric vehicles (EVs) and EV charging infrastructure.

2020 and the EV mania

EV stocks and renewable energy investment funds have been in focus this year as investors flocked to them, raising valuations to astronomical heights. Tesla stock is up over 350% for the year despite the crash this month. At its peak, Tesla’s market capitalisation exceeded the combined market capitalization of Volkswagen, Toyota Motors, Fiat Chrysler, Ford, and General Motors.

NIO, also known as China’s Tesla, is also up 347% for the year. The company is currently posting losses and had a positive gross margin for the first time in the second quarter of 2020.

As their share prices rose, both Tesla and NIO accessed capital markets, issuing shares twice this year. In Tesla’s case, CEO Elon Musk had categorically denied a share issuance in January during the company’s fourth quarter 2019 earnings call.

Nikola was accused of “deception”

In July, Nikola shares soared to almost $80 per share and its market capitalisation went above that of Ford Motors. The shares listed this year through a reverse merger using the SPAC (special purpose acquisition company) route. However, shares have since fallen almost 75% from their all-time highs.

Many had raised concerns over Nikola’s valuation, especially as it does not has any significant current revenues. The allegations made by Hindenburg Research, whin which SPI stands accused of “deception”, and the subsequent exit of its founder Trevor Milton, has pressurised the stock this month.

Along with Nikola, QuantumScape, Canoo, Fisker, and Lordstown Motors also announced SPACs this year.

Can SPI Energy repeat Tesla success?

SPI Energy pointed to Tesla’s success while announcing its EV plans. “This is an important milestone for SPI Energy. As Tesla has demonstrated, an end-to-end business model in the renewable energy space can generate significant value. With the addition of EV and EV charging segments to our diverse solar business, we are positioning SPI Energy for the future of renewable energy,” said Xiaofeng Peng, SPI Energy’s CEO.

Currently, EVs account for a tiny percentage of global vehicle sales but their sales are rising fast. According to BNEF (Bloomberg New Energy Finance), passenger EV sales quadrupled between 2015 and 2019 to reach 2.1 million cars. Tesla delivered 367,000 electric cars this year and expects to deliver around half a million cars in 2020.

BNEF estimates that EV sales fill fall to 1.7 million in 2020 due to the pandemic. However, it expects EV sales to rise to 8.5 million in 2025 and 54 million by 2040.

SPI Energy is also targeting EV charging infrastructure

SPI Energy is also planning to venture into the EV charging space. Currently, Tesla leads other automotive companies in EV charging with its vast network of Superchargers. The company has 1,971 Supercharger stations with 17,467 Superchargers. Tesla’s EV charging infrastructure is among its competitive strengths over other automakers.

In its release, SPI Energy said: “Publicly accessible chargers accounted for 12% of global light-duty vehicle chargers in 2019, most of which are slow chargers. Globally, the number of publicly accessible chargers (slow and fast) increased by 60% in 2019 compared with the previous year, higher than the electric light-duty vehicle stock growth.”

Notably, as EV stocks have rallied this year some of the ancillary plays on the EV industry have also surged. For instance, Blinks Charging that provides charging infrastructure is up 315% this year.

Does SPI Energy’s bounce reflect a bubble in EV stocks?

Many commentators have pointed to a bubble in EV stocks. For instance, Tesla trades at an NTM (next 12-month) enterprise value to sales multiple of 14.1x. The sharp rise in SPI Energy stock is another indicator of irrational exuberance towards EV stocks.

It’s worth noting that even the established automakers haven’t been very successful in their EV plans. While Tesla has managed to increase its deliveries multi-fold, the company is not making much in the way of profits. Even Musk has admitted that Tesla might never be super profitable.

However, markets don’t seem to care much about EV stocks’ fundamentals for now, and investors are for now still willing to pay a premium for EV stocks in anticipation of an all-electric future.

Question & Answers (0)