Pfizer (PFE) shares look poised to continue their rally today after UK health regulators moved to approve its COVID-19 vaccine, making it the first Western country to give the green light to the US drugmaker’s treatment.

Shares of the pharmaceutical giant have advanced in five of the last seven sessions, with the stock jumping 2.9% yesterday to $39.41, while also moving 3.6% higher today in premarket stock trading action on Wall Street, priced at $40.81.

UK regulators said that the distribution of the Pfizer (PFE) vaccine will start as soon as next week, prioritising care home residents, health staff, and other highly vulnerable groups.

A spokesperson for the Depertment of Health and Social Care said that the approval “follows months of rigorous clinical trials and a thorough analysis of the data by experts at the Medicines and Healthcare products Regulatory Agency who have concluded that the vaccine has met its strict standards of safety, quality and effectiveness”.

The UK has already secured a total of 40 million doses of the Pfizer/BioNTech vaccine, which consists of two doses administered one month apart.

The UK’s population numbers 67.8 million people, although Health Secretary Matt Hancock has emphasized that children will not receive the vaccine in the first stage of the vaccination rollout.

British shares tick higher on the news

The British FTSE 100 index is almost the only stock index in Europe advancing this morning amid the vaccine news, as traders react positively to the prospect of en-masse vaccinations during the first quarter of the year.

The ‘footsie’ is currently trading 0.3% higher at 6,402, while other indexes like the German DAX and the French CAC 40 are retreating 0.4% each.

Banks and oil & gas companies are leading today’s uptick, with shares of BP Plc and Royal Dutch Shell advancing 1.3% and 1.1% respectively, while HSBC and Standard Chartered shares are leading the banks with 1.7% and 1.2% in gains respectively as well.

What’s next for Pfizer shares?

Despite the recent rally, Pfizer shares have only delivered a 5% gain since the year started, as the impact of the vaccine on the drugmaker’s bottom line will not be as big as it may be for smaller firms like Moderna (MRNA).

Yesterday’s session was quite interesting, with Pfizer’s shares surging as much as 5.7% during the day, but ended up settling 2.9% higher as significant selling began eating into gains throughout the session.

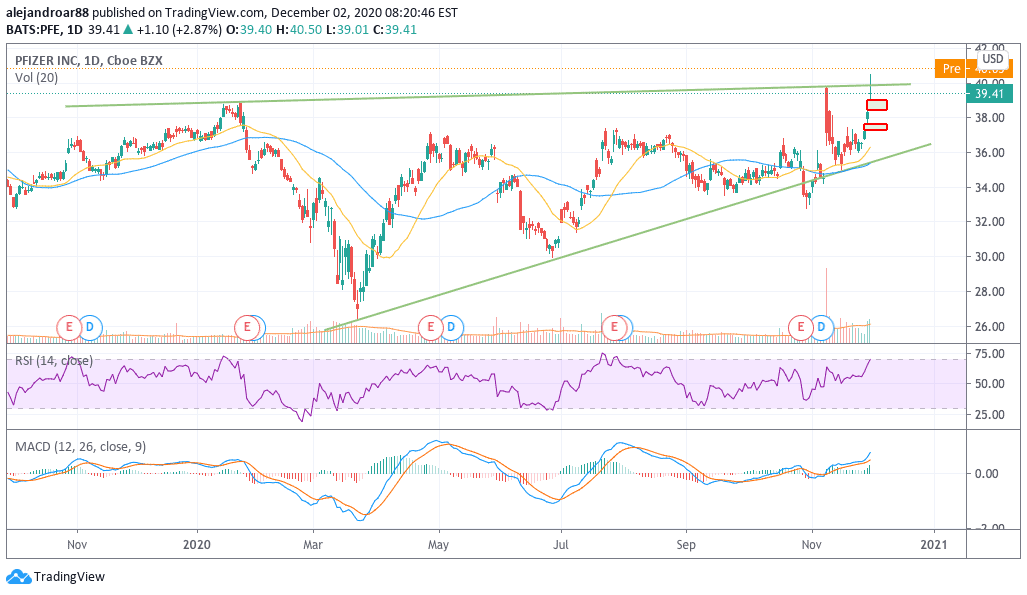

Volumes have been barely above their 20-day moving average in the past two sessions, which corresponds with the latest gap-ups in Pfizer’s share price, as existing shareowners seem unwilling to let go of their shares, while interest keeps increasing.

The current upside for Pfizer would be around 5% to 10%, with traders possibly aiming for the $42 and $44 levels over the next few weeks as the company’s vaccine is likely to receive the OK from other regulators around the world.

To accomplish that, the price action must break the upper trend line shown in the chart – which was breached in yesterday’s intraday activity, and may hold above that level today if the premarket action spills over into the regular session.

At that point, selling volumes will determine if the price can sustain itslef above current resistance levels. However, weakening volume around those price points could indicate that traders are waiting for a more advantageous price to dump their positions, once the shares’ potential short-term upside is reduced – a situation that could end up hammering the price despite the latest news.

Question & Answers (0)