In an interview, US Treasury Secretary Janet Yellen said that tightening credit conditions post the banking crisis might ‘substitute’ for the Fed’s rate hikes.

Yellen made the comments on CNN’s “Fareed Zakaria GPS” which is set to be aired on Sunday. Notably, Yellen was the Fed chair before Jerome Powell and began raising rates in December 2015.

After Powell took over, he carried over the rate hike cycle before cutting rates to zero-bound in March 2020 amid the COVID-19 pandemic.

Fed has been on a rate-hiking spree

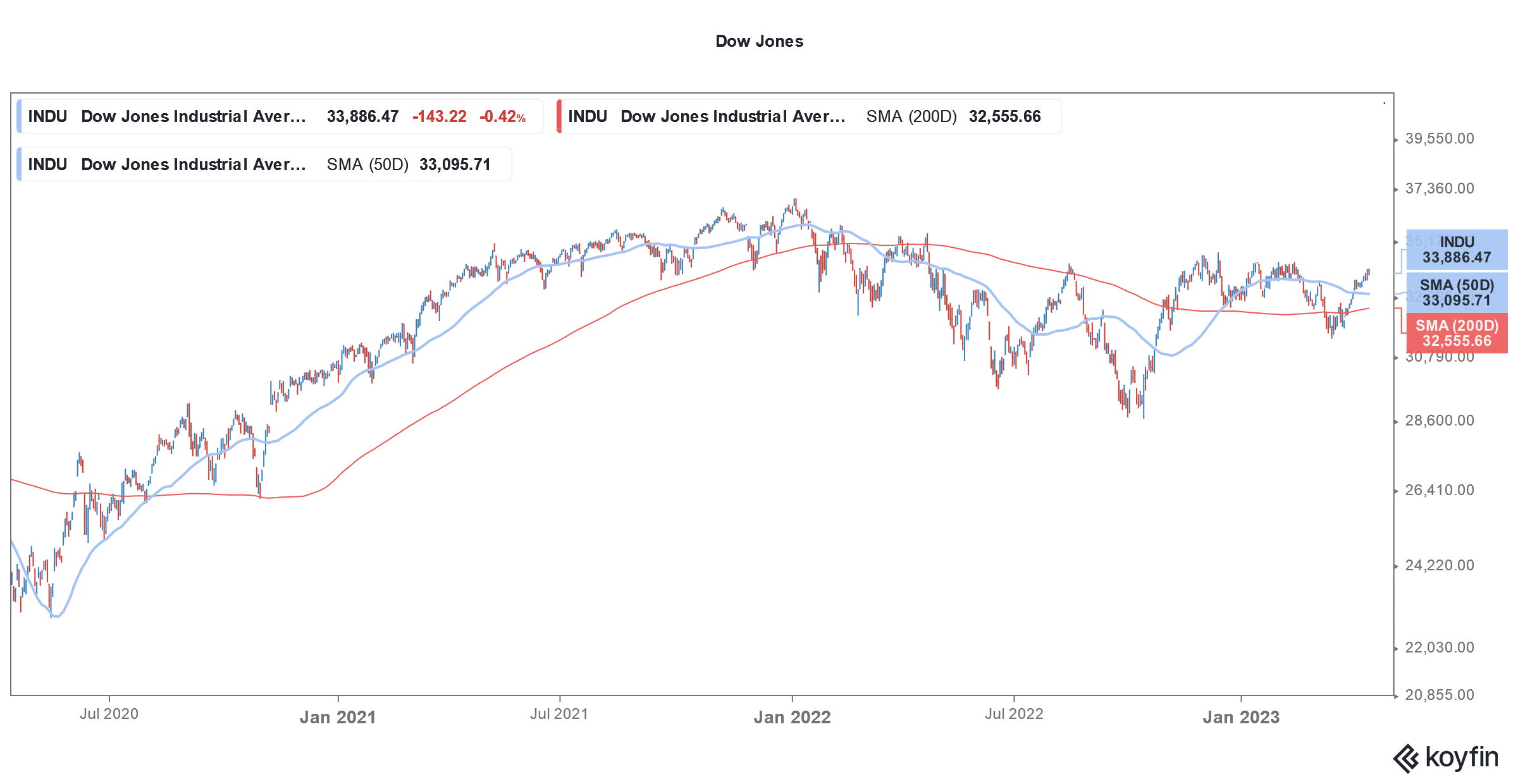

The Fed has been on a rate-hiking spree for over a year now. It raised rates by 25 basis points in March 2022 and by 50 basis points in May. In the next four meetings, it raised rates by 75 basis points each before lowering the pace of hikes to 50 basis points in December.

The US central bank raised rates twice in 2023 by 25 basis points each. After multiple rounds of rate hikes, Fed fund rates have risen to 4.75%-5.0% – the highest since October 2007.

The Fed’s dot plot calls for one more rate hike in 2023 which would push Fed fund rates beyond 5% for the first time in decades.

Meanwhile, Yellen believes that the recent banking crisis which saw the collapse of Signature Bank and SVB would lead to the tightening of credit conditions.

Yellen said, “Banks are likely to become somewhat more cautious in this environment.”

She added, “That does tend to lead to somewhat greater restriction in credit that could be a substitute for further interest-rate hikes that the Fed needs to make.”

Jamie Dimon says there is no “credit crunch”

JPMorgan Chase CEO Jamie Dimon admitted to tightening credit conditions following the banking crisis. During the company’s Q1 2023 earnings call, he said, “Obviously, there’s going to be a little bit of tightening, and most of that will be around certain real-estate things.”

He however emphasized, “It’s not like a credit crunch.”

JPMorgan Chase reported earnings beat in the quarter while its revenues surged to a record high. Wells Fargo and Citigroup also posted better-than-expected earnings for the first quarter of 2023.

Bank earnings helped allay fears of a contagion effect from the recent bank failures. However, Dimon stressed that the banking sector is still not out of the woods.

Some Fed officials considered a 50-basis point rate hike in March

Last week, the Fed released its March minutes that show that some members are thinking on the same line as Yellen.

The minutes stated, “Some participants noted that given persistently high inflation and the strength of the recent economic data, they would have considered a 50 basis point increase in the target range to have been appropriate at this meeting in the absence of the recent developments in the banking sector.”

They added, “However, due to the potential for banking-sector developments to tighten financial conditions and to weigh on economic activity and inflation, they judged it prudent to increase the target range by a smaller increment at this meeting.”

Yellen is hopeful that the US can avoid a recession

Yellen is meanwhile hopeful that the US can avert a recession. She said, “The outlook remains one for moderate growth and continued strong labor market with inflation coming down.”

Last year, President Joe Biden also mocked economists who have for months been predicting a US recession.

However, the Fed thinks otherwise and its March minutes said, “the staff’s projection at the time of the March meeting included a mild recession starting later this year.”

Several economists now believe that a US recession is imminent as the macroeconomic situation has only worsened with the recent bank crisis.

Fed is expected to raise rates by 25 basis points in May

Most analysts believe that the Fed would raise rates by 25 basis points in May and then pause its rate hikes. Also, markets seem to be pricing rate cuts later this year – even as Powell has ruled out rate cuts for this year.

Meanwhile, US inflation has dipped meaningfully over the last year and the CPI rose at an annualized pace of 5.0% in March which is at a nearly two years low. The CPI peaked at 9.1% in June 2022 and has since fallen gradually.

Falling inflation coupled with slowing economic activity could prompt the Fed to halt its rate hike cycle.

Yellen on the Russia-Ukraine war

During the interview, Yellen admitted to the potential fallout from the Russian sanctions on the dollar.

She said, “So, there is a risk when we use financial sanctions that are linked to the role of the dollar, that over time it could undermine the hegemony of the dollar, as you said. But this is an extremely important tool we try to use judiciously.”

Yellen added that while countries like Iran, Russia, and China are looking at alternative currencies, it’s easier said than done.

Countries are working on dollar alternatives

Notably, India also started paying for Russian oil in its domestic currency. The country is part of BRICS which is said to be working on an alternative currency to replace the US dollar.

Responding to a question on whether the frozen Russian assets should be used for rebuilding Ukraine whose cities have been shattered by the war, Yellen acknowledged that Russia should “pay for the damage.”

She however stressed, “But, you know, there are legal constraints on what we can do with frozen Russian assets, and we’re discussing with our partners what might lie in the future.”

Question & Answers (0)