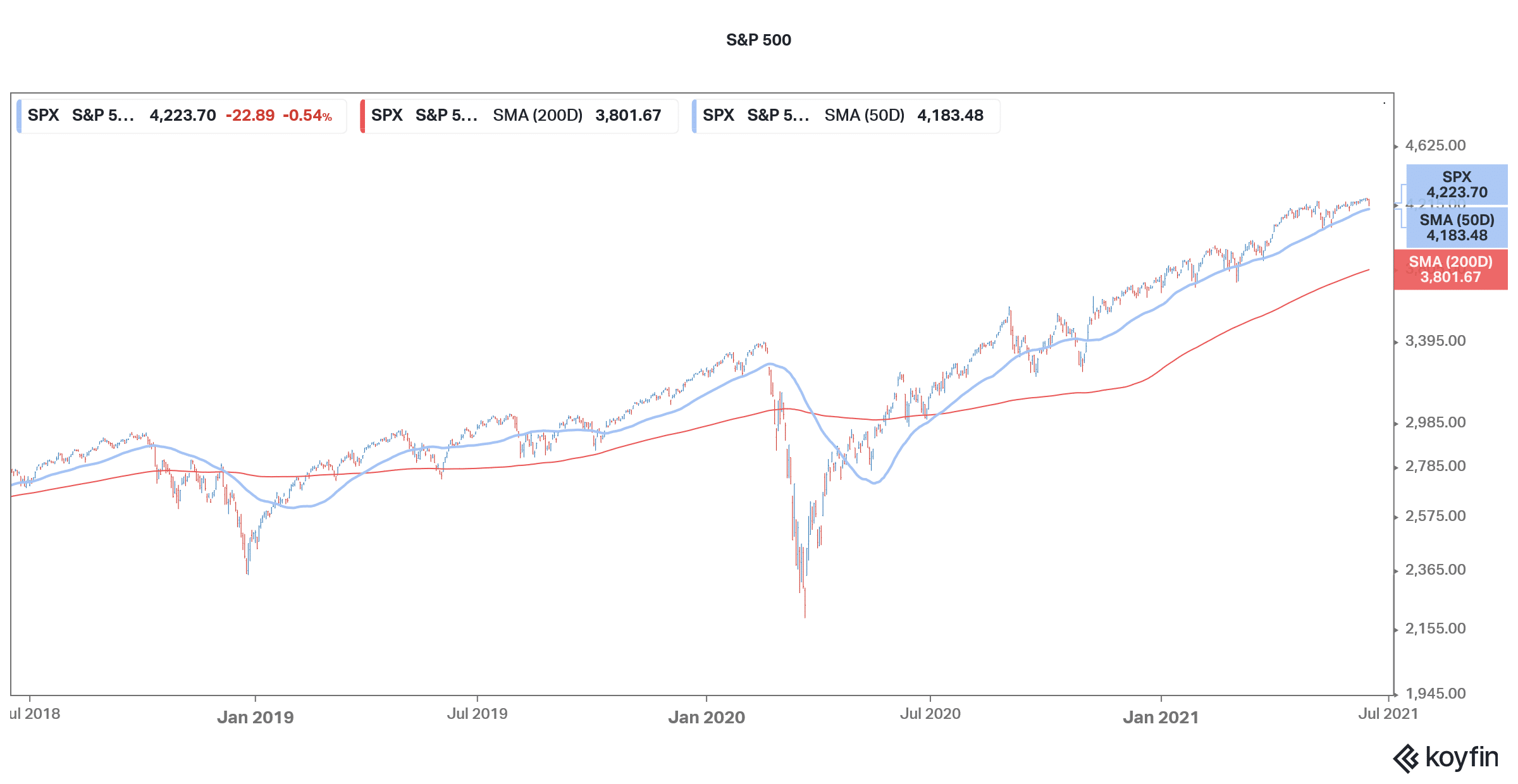

US stock futures were pointing to a lower opening today after the US Federal Reserve increased the inflation forecast and brought forward the timeline for interest rates hikes.

The Federal Reserve meeting was the most important event for the markets this week. The meeting came just after the US inflation data showed prices rising at the fastest pace in years.

Federal Reserve

In May, the US consumer price index (or CPI) rose to 5%, ahead of the 4.7% which analysts were expecting. The CPI was the highest since August 2008. The so-called core inflation that excludes volatile energy and food prices came in at 3.8% in May. The core inflation in May was the highest since May 1992 and was higher than the 3.5% which analysts were expecting. Several observers have been concerned over rising inflation even as so far, the Federal Reserve had maintained that the rise in prices is transitory and reflects the strong demand in the US economy.

However, at its recent meeting, the Federal Reserve raised the inflation forecast by 100 basis points to 3.4%. However, Powell said, “Our expectation is these high inflation readings now will abate.” Prices of almost all commodities are rising which is putting pressure on inflation. Also, the increase in fuel prices is contributing significantly to higher inflation. There are also supply-side disruptions as many people have still not returned back to the job market. Also, the global chip supply situation is also contributing to inflation by leading to higher prices for manufactured goods.

Federal Reserve keeps rates at zero

Talking of this week’s meeting, as expected the Federal Reserve kept the interest rates at zero. The US Federal Reserve’s accommodative monetary policy, which central banks across the world also embraced, helped the US economy avert a much deeper recession.

But then, Federal Reserve meetings are more about the guidance, comments on the interest rate outlook, and reading between the lines.

Fed is thinking of raising rates

In March, the Federal Reserve’s so-called dot plot pointed to no rate hikes by 2024. However, after the recent meeting, the dot plot was updated to show two rate hikes by 2023. While Powell cautioned against reading much into the dot plot by saying they are “not a great forecaster of future rate moves” investors take them quite seriously.

Meanwhile, the US Federal Reserve now expects rates to rise faster than it had previously guided for. “You can think of this meeting that we had as the ‘talking about talking about’ meeting,” said Federal Reserve chairman Jerome Powell. He was referring to his comments in 2020 when he had famously said that the US central bank was not even “thinking about thinking about raising rates.

Warren Buffett had also raised concerns about inflation

But then rising prices have been making a lot of analysts apprehensive. Even Berkshire Hathaway chairman Warren Buffett talked about rising prices at this year’s annual meeting which was held virtually. Treasury Secretary Janet Yellen had also talked about the need to raise rates. “It may be that interest rates will have to rise somewhat to make sure that our economy doesn’t overheat,” she had said in May. Yellen added, “Even though the additional spending is relatively small relative to the size of the economy, it could cause some very modest increases in interest rates.”

Janet Yellen

As the Federal Reserve chair before Powell, Yellen had begun the process of normalising the US interest rates by increasing rates in December 2015 for the first time in a decade. Powell also went ahead with normalising the rates before the plans went awry because of the COVID-19 pandemic.

Assets react to Federal Reserve meeting

Meanwhile, US stock futures and gold fell after the Federal Reserve meeting as the tone was more hawkish than what some observers were expecting. “If you’re going to get two rate hikes in 2023, you have to start tapering fairly soon to reach that goal,” said Kathy Jones, head of fixed income at Charles Schwab. “

That said, the expectations of interest rate hike haven’t exactly come out of the blues and markets were expecting rates to rise sooner than later. Also, unlike in 2013, when the Fed created a storm by talking of tapering but actually took two years to proceed with the rate hikes, things are different this time.

“This is what the Fed has been doing for the last several months — warning that an inflation surge was coming but that it is transitory so no need to taper,” said Leuthold Group chief investment strategist Jim Paulsen. He added, “Moreover, this is probably the most expected outcome from the Fed meeting.”

JPMorgan on the Federal Reserve meeting

However, the Federal Reserve’s announcement on raising rates possibly came a bit sooner than what some market participants were expecting. “We still think it would be pretty rushed to see tapering begin before December,” said JPMorgan economist Michael Feroli.

All said, given the still-fragile recovery of the US economy, the US Federal Reserve might take a gradual approach to raise rates and not get too aggressive with the hikes as they may derail the recovery in the US markets and also put pressure on asset prices.

Nasdaq futures were almost 0.3% lower in US premarket price action today. We might see growth shares react to the Federal Reserve news but overall, it seems markets were braced for a sooner than expected rate hike.

Question & Answers (0)