The FTSE 100 index is plunging 2.3% during afternoon stock trading in London at 5,796 as renewed lockdown fears weigh on European equities.

This would be the fourth consecutive day of losses for the UK’s large cap stock index, which is now retesting key support levels as the region heads to a severe second wave of COVID infections. The United Kingdom has imposed a tiered system that aims to qualify the severity of the spread on a per-region basis before enforcing quarantine measures.

The index’s performance today is in line with that of other European benchmarks including the German DAX and the Euro STOXX 50 index, both of which are sliding more than 2.5% as daily virus cases reach record levels in multiple countries in the region including France and Italy.

Oil & gas shares are taking the strongest blow during the session with BP shares sliding 4.3% at 203.53p while Royal Dutch Shell shares are also down nearly 5%.

Meanwhile, shares of the travel and leisure industries are also plunging, with EasyJet leading the tally booking a 4% loss at 476.5p followed by Carnival and IAG shares, both of which are losing 3.6% and 2.8% respectively.

Finally, prospects of a prolonged economic downturn are weighing on bank shares as well, as reflected by Barclays and Lloyds Banking, which are sliding 3% each during afternoon trading activity.

Brexit talks and pandemic management on sight

A combination of two variables keeps contributing to the FTSE 100’s latest performance: ongoing negotiations related to the UK’s exit from the European Union and measures taken by the government to deal with rising virus cases.

The performance of the FTSE 100 continues to lag behind other major indexes due to the first of those two variables, but now the virus situation is back on the table, adding further uncertainty to the benchmark’s outlook as trade negotiations could stall if the virus situation gets out of hand and the government is forced to shift its focus towards the health emergency.

With the December deadline approaching and no additional extensions on the table, the UK is increasingly facing the risk of a disorganised Brexit, a situation that could plunge the country’s domestic economy into an even more severe recession.

Furthermore, with economics pains now spilling over the fourth quarter of the year, the prospect of a swift economic recovery from the pandemic appears to be fading, a scenario that could keep the FTSE 100 index trading range-bound – or even lower – if businesses start to withdraw guidance for what remains of the year or if shutdowns are back on the landscape.

What’s next for the FTSE 100 index?

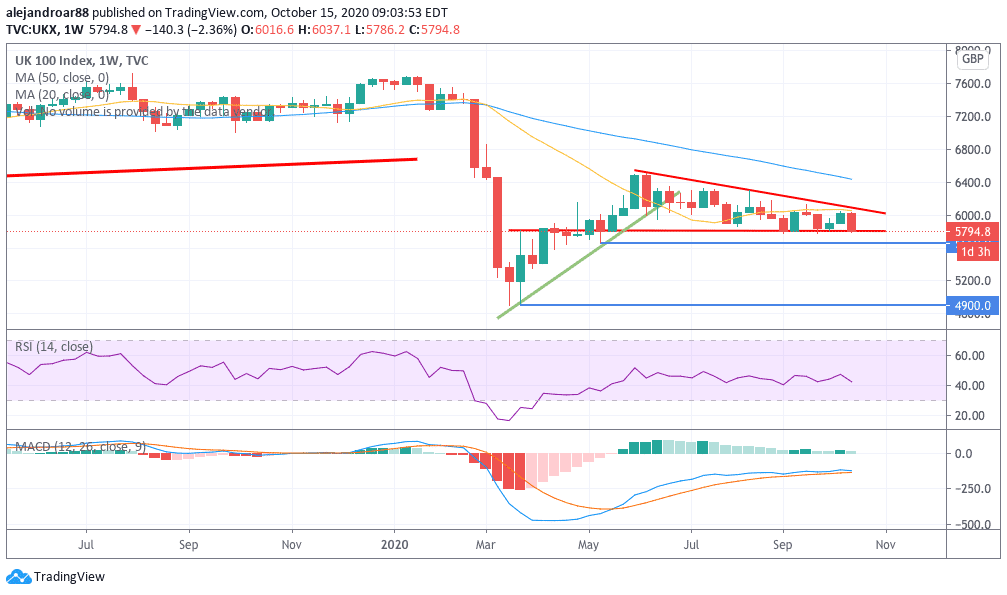

The weekly chart shown above shows how the British stock index has failed to make a new high since its June post-pandemic peak, with the benchmark finding support multiple times at the 5,800 level – the red straight line in the chart.

Although that line has served as support so far, a break seems imminent as bulls have failed to push the price higher for the past few months, a situation that could end up discouraging buyers, leaving the road paved for bears to take over.

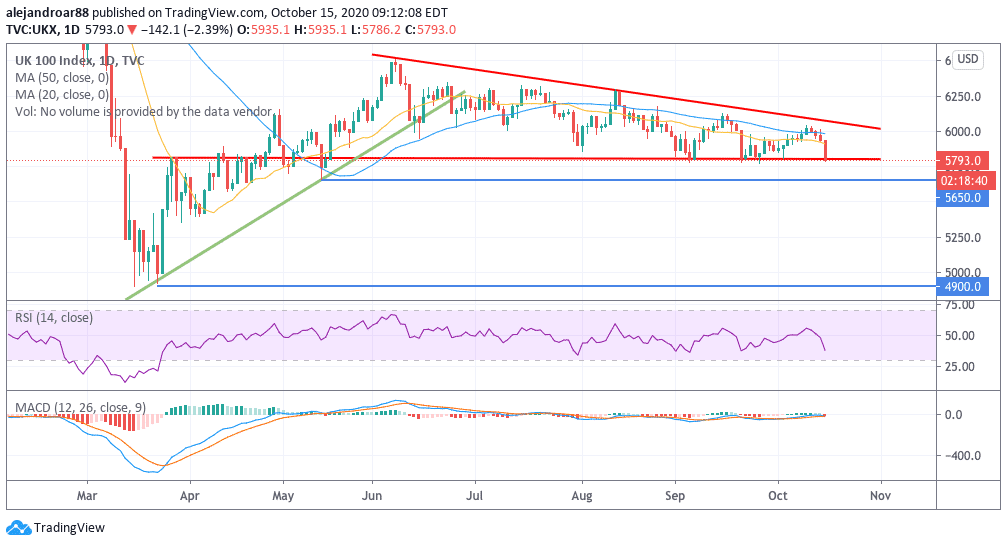

Meanwhile, today’s plunge in the FTSE 100 is resulting in a move below both the 20-day and 50-day moving averages while momentum remains on the negative end based on the reading of the MACD oscillator.

The 5,800 remains a key level to watch as although today’s price action is finding support at that price, the next few sessions could end up breaking below. If that’s the case, the next support would be found at the 5,650 level, a potential last line of defense for the index that, if broken, could end up triggering a broad-market sell-off as bulls will probably take the back seat for a while.

Question & Answers (0)