Disney shares were trading lower in US premarket price action today after reporting mixed earnings for the fiscal second quarter. While its bottomline was better than expected, its revenues and subscriber growth numbers disappointed markets.

Disney reported earnings for its fiscal second-quarter 2021 for the period ending 3 April yesterday after the markets closed. It reported revenues of $15.61 billion in the quarter while analysts were expecting the metric at $15.9 billion. The company’s revenues in the quarter were about 13% lower than it had posted in the corresponding quarter in 2020.

Disney reported lower than expected earnings in the quarter

Its revenues in the fiscal first half fell 18% year-over-year to $31.8 billion. Looking at the segment-wise performance, the fall in revenues was due to the 44% decline in revenues of Disney’s Parks segment. The company’s theme parks were shut in California in the quarter. However, the parks have now reopened with safety precautions.

Disney Media and Entertainment Distribution, which is the company’s biggest vertical reported a 1% year-over-year rise in revenues in the quarter. Within the vertical, Disney’s direct-to-customer segment reported a 59% increase in revenues. The segment’s revenues rose to almost $4 billion in the quarter.

Subscriber growth was below expectations

Meanwhile, after reporting stellar growth numbers for its streaming service over the last year, Disney is seeing some slowdown in the subscriber addition numbers. It added 8.7 million subscribers in the quarter while analysts were expecting the company to add over 14 million subscribers in the quarter.

At the end of the quarter, Disney had 103.6 million paying subscribers as against expectations of 109 million. Rival streaming service Netflix had also reported tepid subscriber growth in the March quarter.

Rival legacy media companies have also pivoted towards streaming. ViacomCBS shares spiked earlier this month after the company reported strong subscriber numbers for its streaming service. CBS All Access and Showtime OTT reported subscribers of 13.5 million in the first quarter which were 50% higher than the corresponding quarter in 2020. Pluto TV, the company’s free streaming service, also saw its monthly active users swell to 24 million.

While legacy media companies are reporting stellar growth in subscribers it is arguably coming from a lower base effect as Netflix has already reached a critical mass. However, their growth does signals that Netflix is getting tough competition in the streaming market.

Netflix is also seeing a growth slowdown

Netflix added 3.98 million global paid subscribers in the first quarter of 2021, which was lower than the 6.2 million that analysts were expecting and also below the 6 million that the company had projected previously. The subscriber growth fell sharply during the quarter and the company had 207.64 million paying subscribers globally at the end of March.

Netflix’s subscriber growth numbers surged in the first half of 2020 as lockdowns boosted the demand for its services. Now, with streaming competition heating up and cinemas reopening across the US, streaming companies are having a tough time in repeating last year’s growth.

Disney reported better than expected earnings

Coming back to Disney’s earnings, while the company missed revenue estimates its EPS of $0.79 was almost thrice of what analysts were expecting. However, given the centrality of streaming service for Disney, slowing subscriber growth more than offset the earnings beat and the shares skid almost 4%.

Meanwhile, Disney’s CEO Bob Chapek sounded optimistic about the company’s performance in the quarter. “We’re pleased to see more encouraging signs of recovery across our businesses, and we remain focused on ramping up our operations while also fueling long-term growth for the Company,” said Chapek in his prepared comments.

He added, “This is clearly reflected in the reopening of our theme parks and resorts, increased production at our studios, the continued success of our streaming services, and the expansion of our unrivaled portfolio of multiyear sports rights deals for ESPN and ESPN+”

Disney narrows losses in Direct-to-Consumer business

Looking forward, the reopening of theme parks would help Disney improve its earnings in the coming quarters. The company’s Direct-to-Customer business is currently posting losses but the operating losses narrowed to $0.3 billion in the March quarter as compared to $0.8 billion in the corresponding quarter in 2020.

According to Disney, “The decrease in operating loss was due to improved results at Hulu, and to a lesser extent, at ESPN+.” Disney’s average revenues per subscriber are below what Netflix earns. In the fiscal second quarter of 2021, the average monthly revenue per paid subscriber fell from $5.63 to $3.99 which the company said was due to the launch of Disney+ Hotstar.

Netflix has higher revenue per customer

ESPN+ reported an increase in average revenue per customer and the metric increased from $4.24 to $4.55 due to higher retail pricing. The average revenue per customer for Hulu was almost flat over the period “due to a lower mix of wholesale subscribers and an increase in per-subscriber premium add-on revenue, partially offset by a decrease in per-subscriber advertising revenue and a higher mix of subscribers to the bundled offering.”

Netflix has been witnessing a gradual increase in average revenue per subscriber and the metric rose 5% in the first quarter to $9.71. In an apparent reference to many of the streaming peers that have low revenue per subscriber, Netflix said in the release, “When comparing services, subscriber figures alone tell only part of the story (given bundles, discounts and other promotions) so it’s important to also focus on engagement and revenue as key indicators of success.”

Disney plans to rival Netflix

While Disney’s average revenues per subscriber are lower than Netflix, its growth has been much faster. The company has outlined aggressive growth plans for its streaming business and expects Disney+ subscriber numbers to rise three-fold by fiscal 2024 to between 230-260 million. After accounting for Hulu and ESPN+ subscribers, the company expects to have been 300-350 million subscribers by the end of 2024.

Expectations of strong growth in the streaming business have helped in the expansion of Disney’s valuation multiples as markets gave it a premium valuation for the high growing streaming business. Chapek meanwhile did not see tepid subscriber growth numbers and said “every single market has exceeded expectations,” in the quarter. He also sounded optimistic about the second-half performance.

Disney suspended its dividend in 2020

Disney suspended its dividend last year as the lockdowns took a toll on its earnings and cash flows. While many investors were expecting the company to talk about a timeline for the dividend during the earnings call, surprisingly the question did not crop up during the earnings call. Ford and General Motors are the other two major companies that suspended dividends last year and are yet to restore them despite the business recovering from the 2020 lows.

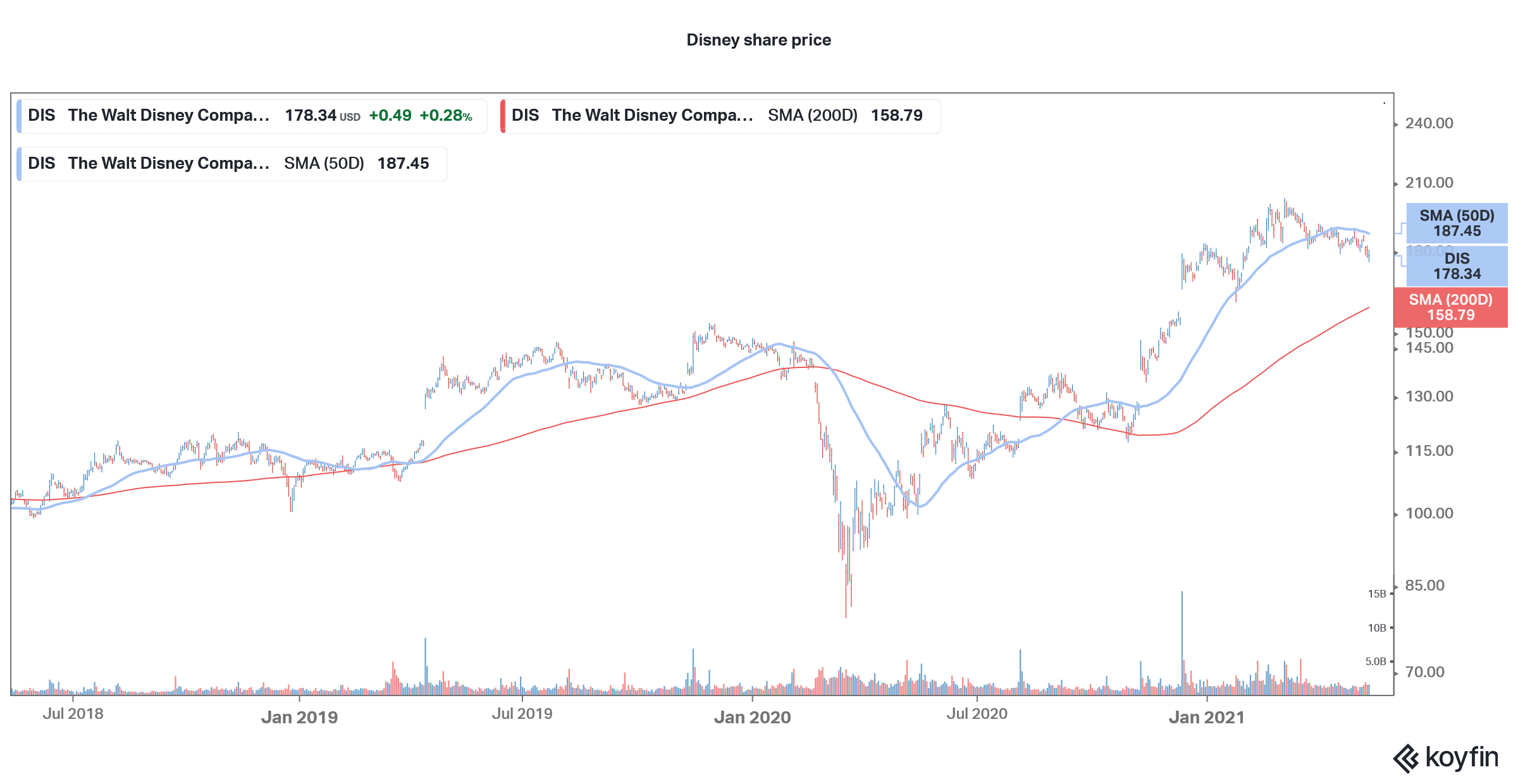

Disney shares are underperforming in 2021

Disney shares are down 1.6% so far in 2021 and are underperforming the S&P 500 which is in the green and sitting near record highs. Disney shares have fallen 12.3% from their 52-week highs and are in the correction zone. The shares were down almost 4% in US premarket trading today as markets gave a thumbs down to its quarterly performance

Question & Answers (0)