Barclays shares are up 8.3% at 113p per share this morning after the British lender shattered earnings expectations for the third quarter of the year on the back of lower loan-loss provisions and higher trading revenues.

The banking sector – and the FTSE 100 index for that matter – is being lifted by Barclays’ positive news, with the British stock index rising almost 1.6% at 5,874 during mid-day stock trading activity.

Barclays saw its revenues decrease by 6% during the three-month period ended on 30 September at £2.05 billion, with the firm’s Corporate and Investment Banking segment seeing the biggest jump in revenues, primarily driven by a 29% jump in the fixed-income unit, followed by a 39% increase saw by the equity trading unit as well.

These positive results in the bank’s trading business helped cushion the blow that its UK banking operations saw during the quarter, as Barclays UK saw its total income drop by 16% at £1.28 billion, while international banking operations also saw a drop in interest and fee income of 15%.

Meanwhile, net interest margins declined almost 60 basis points down to 2.51% during the quarter, compared to 3.10% the bank reported during the same period a year ago although the rate remained unchanged compared to the previous quarter.

On the other hand, Barclays’ managed to grow its profits to £611 million during the quarter, which almost doubled the £273.5 million forecast analysts had set forth for the banking giant, as the British lender cut its credit impairment charges to £608 million, down more than £1 billion from the provision it took the previous quarter, although still £150 million higher than what the firm provisioned during the third quarter of 2019.

In this regard, Barclays CEO James E Staley said: “We expect the impairment charge in the second half of the year to be materially lower than the first half” as the deterioration of the macroeconomic landscape has been “partially offset by the estimated impact of central bank, government and other support measures”.

How are Barclays shares reacting to these results?

Barclays’ positive third quarter is lifting the entire banking sector today, with shares of HSBC, Lloyds Banking Group, and Standard Chartered advancing alongside those of the British lender, while also providing a boost to the FTSE 100 index.

Barclays surprising results are in line with those seen by large American banks such as JP Morgan, as financial institutions in both the US and the UK have managed to cushion the hit their consumer banking segments took amid the pandemic through higher trading, advisory, and investment banking revenues.

That said, Barclays shares remain 37% down for the year, as the outlook for the banking sector continues to be uncertain, especially now that the Bank of England has made multiple comments about the potential introduction of negative interest rates.

In that regard, only a few days ago, Chief Executive Staley told CNBC that he thought it was “very unlikely” that the UK will go into negative interest rates due to the effect that this would have on consumers’ minds and in the way they spend.

However, this scenario remains a possibility and Barclays shares are reflecting that reality as they continue to trade at severely depressed levels despite the positive results seen in this latest quarter.

Where are Barclays shares headed?

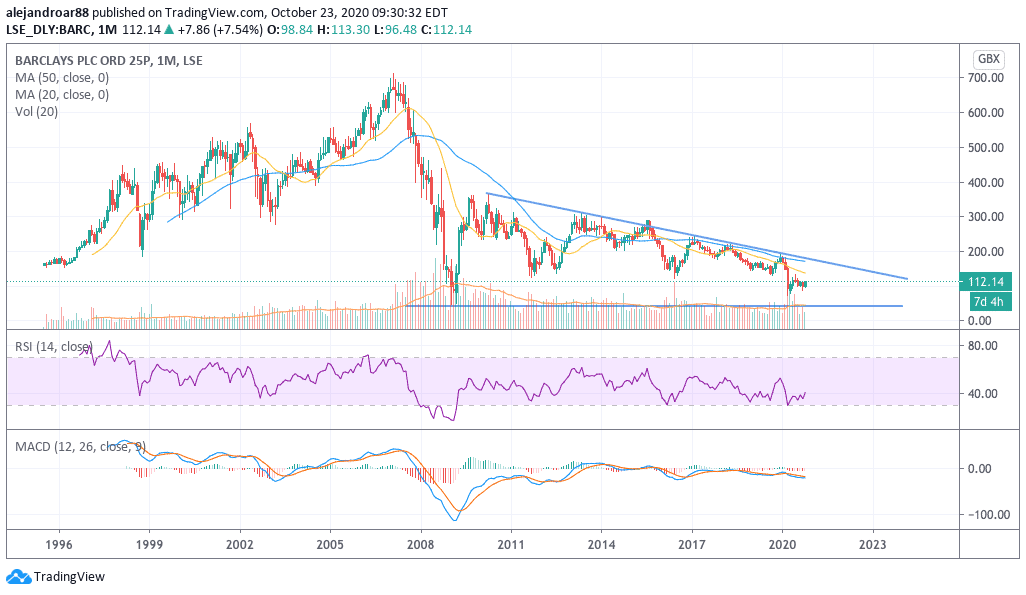

From a long-term perspective, Barclays shares have been trading at levels that were only seen during the 2007-2008 financial crisis, which points to the degree of pessimism that market players feel about the future of the banking business.

Most of this perception is associated with declining revenues coming from a low-interest-rate environment that will likely persist for the next few years as central banks have injected significant amounts of liquidity to the financial system to contain the virus fallout and that liquidity is not going to go away any time soon – as it hasn’t since the financial crisis.

For now, Barclays shares have enjoyed the support that this non-recurring growth in the bank’s trading business has seen, but once activity levels on investment banking and other similar segments get back to normal the bank’s consumer lending units will start to weigh heavier on Barclays top line.

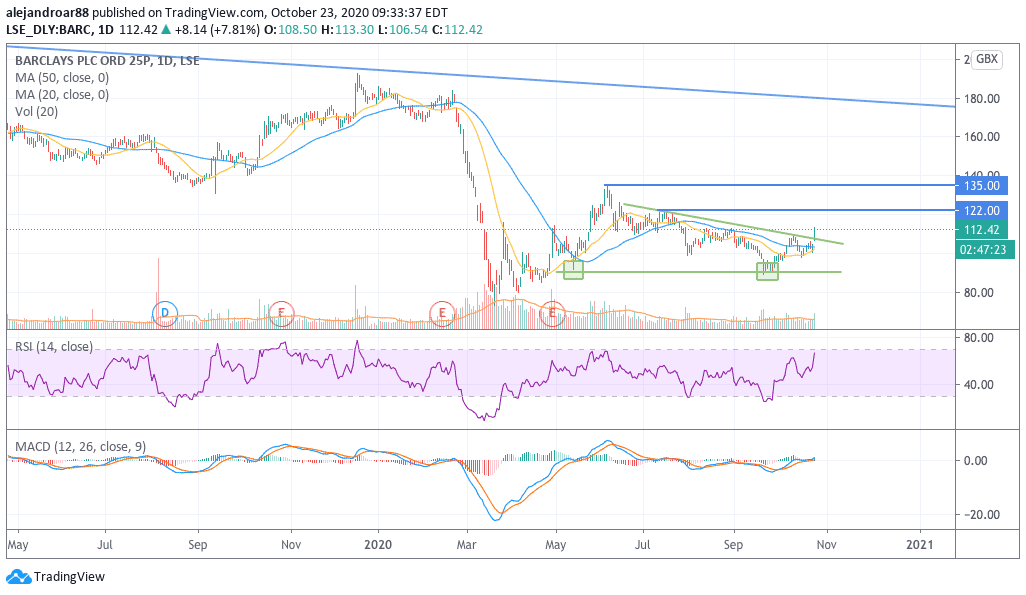

On the other hand, the short-term outlook for Barclays shares seems positive, as the price action has made a double bottom at 90p per share in May and September, with this level serving as a floor for the latest bull run.

Meanwhile, today’s jump has broken above the upper trend line of a descending triangle, with the price possibly aiming to reach the 122p level seen in July on the back of these positive results.

That said, given the negative backdrop that European markets are facing now, traders should take long positions cautiously as the introduction of stricter lockdowns could turn the tables against banks again, while the long-term outlook for the industry as a whole remains bearish.

Question & Answers (0)