How to Buy Johnson & Johnson Shares UK – with 0% Commission

Johnson & Johnson is one the largest companies globally – with a current market capitalization of over $400 billion. Although the conglomerate is listed on the New York Stock Exchange (NYSE), you can easily buy Johnson & Johnson shares online in the UK.

In fact, if using an online broker that supports debit/credit cards or e-wallets, the investment process should take you no more than 10-15 minutes.

In this guide, we show you how to buy Johnson & Johnson shares in the UK in the easiest and most cost-effective way. We’ll also discuss the best UK brokers to do this with, alongside some background information on where Johnson & Johnson shares are headed in both the short and long term.

-

-

Step 1: Find a UK Stock Broker to Buy Johnson & Johnson Shares

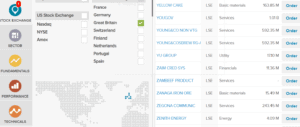

In order to buy Johnson & Johnson shares in the UK, you will first need to locate a broker that gives you access to the American stock markets.

Bearing in mind that the NYSE is the largest stock exchange globally, most UK share dealing platforms will offer Johnson & Johnson (JNJ) shares. As such, you need to consider how much your chosen broker charges in fees, what the minimum investment is, and what payment methods it supports.

To help point you in the right direction, below you will find a small selection of UK stock brokers that allow you to buy Johnson & Johnson stock online.

1. Fineco Bank – Affordable Share Dealing Platform

You will pay this fee when you buy Johnson & Johnson shares, and again when you cash out. Other than that, you will benefit from free deposits and withdrawals, and there is no inactivity fee.

In fact, you’ll have access to thousands of shares across dozens of UK and international exchanges. In the UK alone this covers over 1,200 stocks from both the London Stock Exchange and the AIM.

In addition to stocks and shares, Fineco Bank also offers ETFs, investment funds, and passive portfolios. You can also trade CFD instruments – which gives you access to leverage and short-selling. The minimum deposit at Fineco Bank is an affordable £100.

You won’t, however, be able to do this with a debit/credit card or e-wallet. Instead, Fineco only supports bank account transfers. Finally, Fineco is a safe option if you decide to use the platform to buy Johnson & Johnson shares. This is because it is licensed by the FCA and partnered with the FSCS.

Pros

- Charges just £2.95 per trade when buying and selling shares

- Access to thousands of UK and international shares

- Deposit funds with a UK bank account

- Heavily regulated, including an FCA license

- Suitable for both newbies and seasoned investors

- Great research and educational department

- Established way back in 1999

- All personal data protected

Cons

- 0.25% annual fee

Your money is at risk.

Step 2: Research Johnson & Johnson Shares

So now that we have discussed the best UK stock brokers to buy Johnson & Johnson shares online, we are now going to cover some core research materials on the company.

This will give you the required background information to determine whether or not a Johnson & Johnson (JNJ) investment is right for your financial goals.

What is Johnson & Johnson plc?

Founded way back in 1886, Johnson & Johnson is a large American conglomerate. This means that it is behind a fully diversified portfolio of products and services. This covers everything from consumer goods, skin and beauty products, to medical devices, pharmaceutical treatments and drugs.

Some of the best selling Johnson & Johnson products include:

- Remicade

- Stelara

- Imbruvica

- Band-Aid

- Listerine

- Tylenol

- Darzalex

- Ibuprofen

As we cover in more detail shortly, this healthcare and biotech company is also working on a promising vaccine for COVID-19. As the vaccine in question requires just one dose, this is potentially more favorable than the two doses required by Pfizer and Moderna.

Johnson & Johnson Share Price History & Market Capitalisation

Johnson & Johnson is one of the oldest stocks globally – with the firm undergoing its public listing in 1944. Listed on the NYSE, Johnson & Johnson now carries a market capitalization of well over $400 billion. This makes it one of the largest companies in the US – and one of the biggest constituents of the SP 500.

Shareholders have been rewarded handsomely since Johnson & Johnson went public – with the firm not only going through the first and second world war but heaps of recessions. Back in 1980, you would have paid just $2 for a single Johnson & Johnson shares (adjusted for stock splits).

Fast forward to late 2020 and the same stock will cost you over $152. In terms of its recent performance, Johnson & Johnson started 2020 at $145 per share. It then hit lows of $111 in March 2020 – translating into a 3-month decline of over 23%.

The shares have, however, recovered all of their COVID-19 related losses. In fact, had you bought shares in this vaccine candidate at the start of the year, you would now be looking at modest gains of 4.8%. There could be room for further growth in the coming months if the firm’s coronavirus vaccine is approved by the FDA.

Johnson & Johnson EPS and P/E Ratio

At the time of writing in late 2020, Johnson & Johnson shares carry a P/E ratio of 24. In terms of its EPS, this stood at $2.20 in its most recent earnings report of Q3 2020.

Johnson & Johnson Shares Dividend Information

Although capital growth is always going to be somewhat modest with a blue-chip giant like Johnson & Johnson, it is important to remember that the firm is a Dividend Aristocrat.

Declared Ex-Date Record Payable Amount Type Oct 22, 2020 Nov 23, 2020 Nov 24, 2020 Dec 08, 2020 1.01 U.S. Currency Jul 20, 2020 Aug 24, 2020 Aug 25, 2020 Sep 08, 2020 1.01 U.S. Currency Apr 14, 2020 May 22, 2020 May 26, 2020 Jun 09, 2020 1.01 U.S. Currency Jan 02, 2020 Feb 24, 2020 Feb 25, 2020 Mar 10, 2020 0.95 U.S. Currency For those unaware, this means that the stock has increased the size of its dividend every quarter for at least 25 years. In the case of Johnson & Johnson, the conglomerate has been doing this for almost six decades straight.

As such, if you are seeking the best dividend stocks to add to your portfolio, Johnson & Johnson is well worth considering.

Should I Buy Johnson & Johnson Shares?

So now that you have a firm understand of what Johnson & Johnson does – as well as how its shares have performed over time, we are now going to explore what the future potentially holds for its stocks.

Coronavirus Vaccine

As a Johnson & Johnson investor, you will benefit from relatively predictable incoming cashflows. With that said, the most exciting thing surrounding the company at present at that its COVID-19 vaccine is now in phase 3 of its clinic trials.

This is a huge trial that includes 45,000 participants. On the one hand, the US has already approved two coronavirus vaccines – those backed by Pfizer and Moderna. However, both of these vaccines require the end-user to take two individual doses on separate occasions.

In addition to this – at least in the case of the Pfizer vaccine, this needs to be stored in freezing conditions. This makes it difficult in terms of storage and situation – especially in the third-world. This isn’t a requirement with the Johnson & Johnson vaccine, meaning that if approved, demand may supersede that of Pfizer and Moderna.

Defensive Stock

During times of economic uncertainties, investors will flock to defensive stocks. These are stocks that are historically unaffected by wider economic conditions – not least because they sell products and services that are always in demand.

Bearing in mind that almost 50% of Johnson & Johnson revenues come in the form of pharmaceutical products, it is fair to suggest that it should continue to do well even when the wider stock markets are moving in the wrong direction.

As we covered earlier, Johnson & Johnson has been a public stock since 1944. This means it has gone through plenty of global recessions – and always bounced back.

Dividend Aristocrat

As we mentioned just a moment ago, Johnson & Johnson is a leading member of the Dividend Aristocrat club. When you consider that the firm has increased the size of its quarterly dividend for over 58 years, this is super impressive.

In fact, while many stocks either cut or suspended their dividend payment as per the pandemic – Johnson & Johnson continued with its increase as done for almost six decades.

Super Strong Balance Sheet

Many companies were unable to ride out the coronavirus storm due to a weak balance sheet. This is in stark contrast to Johnson & Johnson, which has an extremely strong financial outlook. Not only does this include a huge balance of cash and cash equivalents, but a relatively low short-term debt obligation.

This ensures that no matter what is happening with the wider economy, Johnson & Johnson has a balance sheet that is prepared for all potentialities.

Johnson & Johnson Shares Buy or Sell?

Although there is a buzz surrounding Johnson & Johnson at present because of its phase 3 coronavirus vaccine trials, the general consensus on this stock is that it is a strong buy anyway. The strong and stable blue-chip stock is just under 5% up for the year – and it continues to retain its 58-year status as a Dividend Aristocrat.

The Verdict?

In summary, as one of the largest companies globally, you can buy Johnson & Johnson online in the UK with ease. The most important thing is that you do this with a trusted broker that offers low fees and manageable account minimums.

If opting to buy Johnson & Johnson shares through our top-rated FCA broker, the investment process can be completed in minutes. You won’t pay a single penny in commission and you can instantly buy the shares with a debit/credit card or e-wallet.

Simply click the link below to get started!

Other Vaccine Shares

Interested in investing in other pharmaceutical companies that are involved in developing a coronavirus vaccine? Check out the list below.

FAQs

Are Johnson & Johnson shares a good buy?

Johnson & Johnson is a strong and stable blue-chip stock with a proven track-record that now spans well over a century. As such, while you might not get rich with this particular stock, it has historically rewarded shareholders with steady returns.

What stock exchanges are Johnson & Johnson shares listed on?

Johnson & Johnson is listed on the New York Stock Exchange (NYSE) – as it has done since 1944.

What is the Johnson & Johnson P/E ratio?

At the time of writing in December 2020, Johnson & Johnson has a P/E ratio of 24.

Does Johnson & Johnson offer dividends?

It certainly does. In fact, Johnson & Johnson is a Dividend Aristocrat, as it has increased the size of its quarterly dividends for 58 consecutive years!

How much is Johnson & Johnson valued at?

At the time of writing, Johnson & Johnson has a market capitalization of over $400 billion. This makes it one of the most valuable companies in the world.

Who is the Chief Executive Director of Johnson & Johnson?

The CEO of Johnson & Johnson is Alex Gorsky. He also holds the chairman position.

Can I invest in Johnson & Johnson via an ISA or SIPP?

Yes, there are no restrictions on ISAs or SIPPs when it comes to buying foreign-listed shares like Johnson & Johnson.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up