The FTSE 100 index is heading to its seventh consecutive day of gains today as the British stock index is advancing 1.2% at 6,262 on the back of vaccine hopes.

The “footsie” rebounded strongly off its late-October lows, in a move initially fuelled by a post-US election buying frenzy and further supported by Pfizer’s announcement of the efficacy of its COVID-19 vaccine in a small subset of the thousands of volunteers currently enrolled in the company’s Phase 3 clinical trials.

According to Pfizer (NYSE: PFE), the vaccine proved effective in preventing patients from contracting the virus in 90% of cases.

These results were part of a small interim analysis conducted by the firm on 94 patients within the study who were infected with the virus, with only nine of them getting the vaccine, which means that the efficacy of the treatment has only been proven in eight patients so far.

Meanwhile, this latest bull run also comes at the same time the British government introduced new lockdown measures to curb the advance of the virus, as the number of daily cases in the country surged to record levels in late October.

At this point, the market seems to be shaking off lockdown worries and could be following its natural forward-looking nature, possibly seeing effective vaccinations in the country by early 2021 and a corresponding economic rebound once things get back to normal.

Banks, oilers, and travel push the FTSE 100 higher

Nearly all of the shares that constitute the FTSE 100 index had a positive performance during the past week, while only 10 shares saw losses during that period.

Banks were among the most benefitted by the latest bull run seen by FTSE 100 shares, with Barclays, Standard Chartered, and Lloyds Banking Group posting double-digit weekly gains, followed by other firms in the financial services sector such as British insurer Aviva (AV) and financial services company Hargreaves Lansdown (HL).

Meanwhile, shares in the aerospace and travel industries such as IAG Group (IAG) and Rolls-Royce (RR) also advanced more than 30% since last week, along with those in the energy sector, including BP and Shell, which moved 14% and 12% higher during that period.

Finally, leading the winners’ board, RSA Insurance saw a 52% jump in its share price after the firm was approached by Canadian insurer Intact and Danish insurer Tryg for a proposed takeover.

It is important to note that the FTSE 100 is mostly comprised of stocks that were heavily affected by the pandemic, which means that the British index could see significant upside ahead as it emerges off its currently depressed levels.

What’s next for the FTSE 100 index?

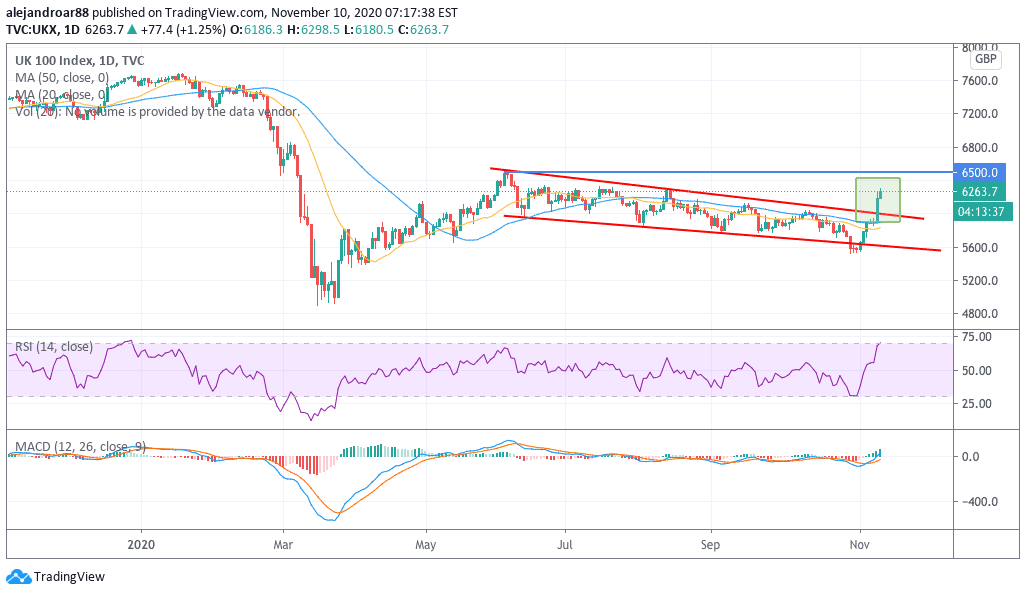

The latest price action seen by the FTSE 100 has managed to break a downward price channel dating back to the index’s June highs, with the benchmark now approaching those levels at a fast pace.

At this point, the British index is just 3.8% away from retesting those highs, although a technical pullback could be expected over the next few days as market players take some profits off the table before resuming the bull run.

Although there are still some uncertainties looming in the backdrop, such as the prospect of a no-deal Brexit and an uncontained virus situation, the markets could look past those worries now that there’s some light at the end of the tunnel to put the pandemic in the rear-view mirror.

For now, the first target for the footsie would be the index’s 6,500 June highs, followed by a bull trap seen on 5 March at 6,800.

Question & Answers (0)