How to Buy IAG Shares UK – With 0% Commission

International Consolidated Airlines Group SA, also known as IAG, is a British-Spanish multinational airline holding firm and the parent company of British Airways, Iberia, Aer Lingus, IAG Cargo, Level, Avisos Group, and Vueling. The IAG group was formed in 2011 after a merger between British Airways and Iberia and its share price enjoyed a steady upward climb for 8 years up until 2020. With all the Covid-19 pressure, it’s not a surprise that IAG shares dropped nearly 80% since the beginning of the year.

However, as many governments have announced that domestic and international flights will be resumed soon, investors can keep an eye on IAG shares as the situation develops.

If you are considering buying shares of International Airlines Group, this guide can help you get answers. We’ll explain what is the best way to buy shares of IAG in the UK, and discuss the company’s past performance and key strengths going forward.

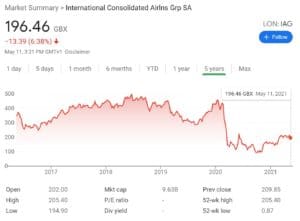

To help you find the right broker, below you will find two popular UK stockbrokers that allow you to buy and International Airlines Group shares. The Covid-19 pandemic has had a huge impact on the airline industry due to restrictions on traveling and the lockdowns implemented by many governments. Like most aviation companies, IAG had a difficult year, with a drop in sales, profits, and the share price. With this in mind, the IAG share appears to be trading at a fairly reasonable valuation so it is important to do your own research before you make an investment and find out whether it is the right time to buy shares of IAG. International Consolidated Airlines Group SA is one of the world’s largest airline groups was formed on January 21, 2011, following a merger of two airlines – British Airways and Iberia. Since then, the firm made several acquisitions including BMI, Aer Lingus, Vueling, and Air Europa. In 2012, International Airlines Group has created IAG Cargo, which is the handling division of IAG. IAG (ISIN: ES0177542018) is part of the FTSE 100 and is publicly listed on the London Stock Exchange (LSE) and the stock exchange in Madrid. Since the merger, IAG shares were trading in an upward trajectory, reaching the all-time of £292.17 per share on the 22 of June 2018. The IAG share had a minor drop in 2019 but then reached another peak in early 2020 (January) of 270.31 GBX. But since the Covid-19 pandemic was declared as a global pandemic in February-March, the IAG share dropped to £66.37 on 31 July 2020, the lowest level since 2013. Over the next three months, the share recovered to £93.26. The recovery of the IAG share can be attributed to the announcement of Hedge fund Marshall Wace to take a large stake in IAG and the fact that some governments have lifted the lockdown restrictions. In addition, the multinational airline company launched a discounted €2.75bn rights issue in September to cover the Q2 losses. At the time of writing, IAG has a market cap of 9.6B. The EPS for IAG is 57.09 EUX at the time of writing, with an EPS growth of -2%. The current p/e ratio is 5.7. International Airlines Group has been a favorite share for dividend investors as the company pays annual dividends since 2015. Typically, IAG has a dividend yield of around %7-%8, which is way above in the aviation industry. However, like many other aviation companies operating in the industry, IAG has scrapped the 2020 annual dividend for shareholders due to the losses and the impact of the coronavirus pandemic, and it is not yet clear when the company will resume paying dividends. IAG shares dropped significantly in 2020, largely due to the coronavirus pandemic that has hit the travel industry. After all, this company makes its income from domestic and international flights. But the company is expected to make a recovery at some point. As a matter of fact, the share price quickly recovered thanks to the company’s issue of €2.97 billion of new shares at 92 cents and the announcement that the giant hedge fund Marshall Wace has taken a large stake of 3% in the total holding of IAG. The rights issue that was launched on September 10 will definitely strengthen IAG’s balance sheet which could help the airline to prevail the current economic storm. Another factor to take into consideration is the company’s announcement to make several senior management changes. As such, Sean Doyle, the chief executive of the Irish carrier Aer Lingus, will replace the current British Airways CEO, Álex Cruz. Finally, IAG is also highly affected by the coronavirus stimulus packages that would provide aid to airline carriers. Overall, International Airlines Group is far from being in a stable condition right now, largely due to external factors like the Covid-19 pandemic. The coronavirus situation has caused passenger demand to collapse and it is not yet clear when the travel industry will rebound. Investors are growing increasingly bullish about IAG, and we are, too. The rollout of vaccines from Pfizer and Moderna means that international air travel could resume as early as the summer of 2021. While the airline industry as a whole – and IAG in particular – will take longer to recover, that bodes extremely well for this airline stock. There’s a lot of potential upside for investors if IAG can recover. Right now, 17 analysts at MarketBeat provide a price target of 308.25 GBX for IAG in the upcoming year. In addition, the shares remain 55% below the price they held just before the COVID-19 pandemic shut down air travel Over the long term, IAG’s dividend is very attractive. While there’s no guarantee that the company will restore the 7% yield offered before the pandemic, a dividend in this range would send the shares soaring. If you are willing to hold the IAG share for decades or at least several years, it could be a great investment decision. We think IAG shares are a strong buy at today’s prices. Shorting a share involves selling a borrowed financial instrument with the anticipation of purchasing the same share back at a lower future price. IAG seems to be trading at a fairly cheap price right now, and as such, it might be a great long term investment opportunity. However, it is important to know that you also have the option short sell the IAG share in order to make a profit from the expected fall in price. This simply allows you to trade the IAG share in both directions and is particularly useful for active day/swing traders. The easiest and most cost-effective to short-sell shares like International Airlines Group is via CFD brokers like IG, and Plus500. This is because they do not maintain high margin requirements like other UK brokerage firms. The majority of CFD brokers require you to hold only 20% of the total value of the position. In summary, many investors will be waiting to see the true impact of the Covid-19 pandemic before investing in any airline company. After all, the implications of the coronavirus pandemic will be profound and are likely to last for the next years. However, the airline industry has already experienced a similar situation following the 9/11 terror attack, and while it is estimated that one-third of all airlines will not survive the pandemic (particularly low-cost carriers), the International Airline Group is one of the airlines that is more than likely to survive the current economic crisis. Ready to buy IAG shares? Simply click the link below to get started!

International Airlines Group is listed on many exchanges including the US OTC market, France, Spain and the UK. Its primary listings are on the London Stock Exchange (LSE) under the ticker symbol AIG.L and the Madrid stock exchange under the ticker symbol 'IAG

Yes, the company typically pays dividends to shareholders in th. However, in July IAG scrapped its annual dividend payment over the Covid-19 high-risk situation.

International Airlines Group owns a fleet of more than 570 aircraft in the UK, Ireland, and Spain.

Qatar Airways is the main holder of IAG with a stake of 25.1% of total shares. Other major shareholders include Comair (18%) and Royal Air Maroc (1%).

IAG's current Chief Executive is Alex Cruz.

Yes, most providers in the United Kingdom will allow you to buy IAG shares through these means. WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site. Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. BuyShares.co.uk © 2024 All Rights Reserved. UK Company No. 11705811.

Step 1: Find a UK Stock Broker That Offers IAG Shares

Step 2: Research IAG Shares

How Much Are IAG Shares Worth? IAG Share Price History & Market Capitalisation

IAG EPS & P/E Ration

IAG Shares Dividend Information

Should I Buy IAG Shares?

IAG Shares Buy or Sell?

How to Sell IAG Shares

The Verdict

FAQs

What stock exchange is IAG listed on?

Does International Airlines Consolidated Group pay dividends?

How many aircraft does IAG own?

Who owns IAG?

Who is the CEO of IAG?

Can I invest in IAG via a SIPP account or stocks and shares ISA?

Tom Chen