Hargreaves Lansdown Fees UK – Compare Commissions & Spreads

Hargreaves Lansdown sits at the forefront of the UK stock broker scene. The provider was launched way back in 1981, has over 1.3 million customers, and is now itself listed on the London Stock Exchange. By opening an account with this provider, you will have access to thousands of shares, ETFs, mutual funds, and more.

But, this does come at a cost.

In this Hargreaves Lansdown Fees Review, we cover each and every charge that you are likely to come across at the broker. Not only does this include share dealing fees, but charges surrounding funds, transactions, IPOs, and ISAs.

-

-

Hargreaves Lansdown Overview

Hargreaves Lansdown is an online stock broker that allows you to buy a full selection of financial assets from the comfort of your home. This includes a hugely comprehensive stocks and shares department that covers several markets. In the UK, for example, you will have access to shares listed on the London Stock Exchange. You can also buy shares listed on the AIM (Alternative Investment Market).

If you’re looking to expand your investment horizons, Hargreaves Lansdown also covers a number of international exchanges. In particular, this includes US stocks listed on the NYSE and NASDAQ. In addition to the stocks and shares, Hargreaves Lansdown also allows you to invest in funds. This covers mutual funds, index funds, and ETFs. The broker is also one of the few UK platforms that allows you to buy bonds. Not only do this consist of corporate bonds, but government securities and PIBBs, too.

Hargreaves Lansdown is also a popular option if you want to invest in UK IPOs (Initial Public Offering). This is when companies hit the London Stock Exchange for the very first time. In terms of accounts, Hargreaves Lansdown offers a range of options. For example, you can place your investments into Stocks and Shares, Junior, or Lifetime ISA. The broker also offers support for pension plans via SIPPs and Annuities.

When it comes to regulation, Hargreaves Lansdown is authorized and regulated by the Financial Conduct Aurhotyt (FCA). The platform is also covered by the Financial Services Compensation Scheme (FSCS). As noted above, the broker’s parent company is listed on the London Stock Exchange. With a huge market capitalization of almost £7 billion, Hargreaves Lansdown is a constituent of the FTSE 100.

Hargreaves Lansdown Trading Fees

So now that you have a firm idea of what Hargreaves Lansdown offers, we now need to look at that all-important factor – fees. Due to the sheer size of the Hargreaves Lansdown platform, we have decided to break the broker’s fees down by the respective financial asset – starting with stocks and shares.

Hargreaves Lansdown Stocks and Shares Fees

Most UK investors use Hargreaves Lansdown to buy shares. After all, it’s simply a case of opening an account, depositing some funds, and choosing the company that you wish to invest in.

However, as we are about to elaborate on, Hargreaves Lansdown is actually one of the most expensive UK stock brokers to buy shares from. In fact, if you’re only looking to invest a small amount from time to time, this broker is going to make the investment process super-unviable.

Here’s why:

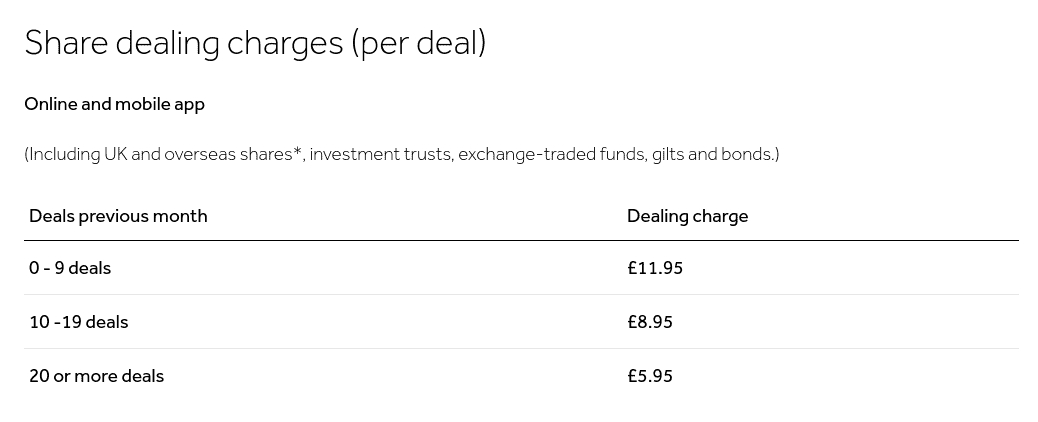

As you can see from the above screenshot, buying shares at Hargreaves Lansdown will cost you a whopping £11.95. Now, to put this fee into perspective, let’s assume that you wanted to buy HSBC shares at the minimum investment amount of £100. In doing so, you would be paying an effective commission rate of 11.95%!

But wait – there’s more. When you get around to cashing your HSBC shares out, you would again need to pay a further £11.95. As a result – and irrespective of whether or not you make a profit, buying and selling shares at Hargreaves Lansdown will cost you a total of £23.90.

In other words, a minimum investment of £100 would require your share purchase to grow in value by at least 23.90% just to break even. Bearing in mind that the FTSE 100 is worth less than it was five years ago, attempting to make this much just to cover your commission fees is simply unrealistic.

In comparison, there are plenty of UK stock brokers that allow you to buy UK shares at a lower commission. For example, fellow old-school brokerage firm IG charges £8 per trade, while Barclays charges £6. However, both of the aforementioned platforms also charge quarterly fees if certain minimums aren’t met.

Hargreaves Lansdown Fees on International Shares

If you’re planning to use Hargreaves Lansdown to buy foreign shares like Facebook, IBM, or Apple – you should know that the fees are even higher. This is because you will pay the same share dealing fees listed above – plus a foreign exchange charge.

- Anything invested up to the first £5,000 will attract an FX fee of 1%

- After that, investments between £5,000 and £10,000 stands at 0.75%

- You’ll pay 0.50% for investments of between £10k and £15k

- The lowest you can get the FX fee down to is 0.25% – which is for all foreign share purchases over £20,000

Taking the above into account, let’s look at a practical example of how much you will be charged to buy non-UK shares at Hargreaves Lansdown.

- Let’s suppose you decide to buy £500 worth of Disney shares

- You will pay a share dealing fee of £11.95

- You will pay an FX fee of 1% – which amounts to £5 (£500 x 1%)

- Assuming that you sell the shares when they are worth £750, you again pay an £11.95 share dealing fee

- Again, you will also pay a 1% FX fee – which amounts to £7.50 (£750 x 1%)

As per the above, you bought £500 worth of Disney shares and sold them when the stocks were worth £750. This left you with £250 in profit, less all-in fees for £36.40. As such, your net gains were £213.6.

Hargreaves Lansdown Bond Fees

If you’re looking to use Hargreaves Lansdown to buy bonds, the fee that you pay will depend on how the purchase is made. We say this, as the vast majority of bonds at Hargreaves Lansdown need to be bought over the phone. As we mentioned earlier, this carries a fee of 1%.

The minimum and maximum fees are £20 and £50, respectively. Once again, this is actually expensive. For example, if you were to invest just £500 into your chosen bond instrument, this carries an effective commission of 4% when you factor in the minimum telephone dealing fee of £200.

With that said, a small selection of bonds at Hargreaves Lansdown can be purchased online. If this is the case, then the fee mirrors that of the share dealing commissions listed above. To clarify that’s £11.95 per trade unless you made 10 or more deals in the prior month.

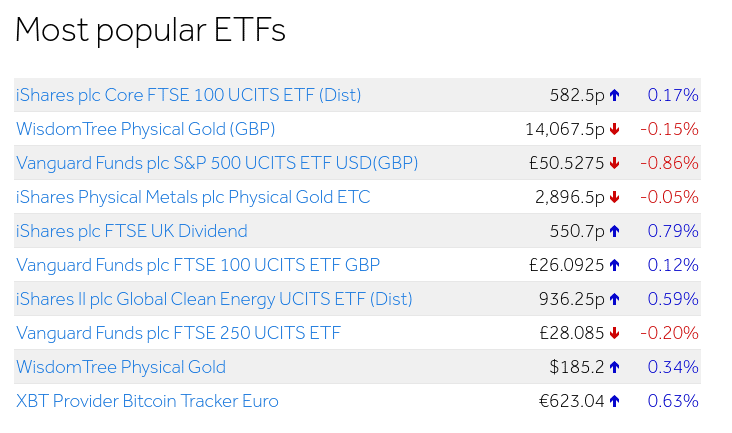

Hargreaves Lansdown ETF Fees

ETFs are great for diversification purposes as you will get to invest in hundreds of shares and/or bonds through a single trade. At Hargreaves Lansdown, you will have access to heaps of ETFs from well-known providers like iShares and Vanguard. In terms of fees, Hargreaves Lansdown charges the same £11.95 as per its stocks and shares department.

Note: Hargreaves Lansdown also offers various investment trusts. The fees here mirror that of its ETFs and shares.

Hargreaves Lansdown Fund Fees

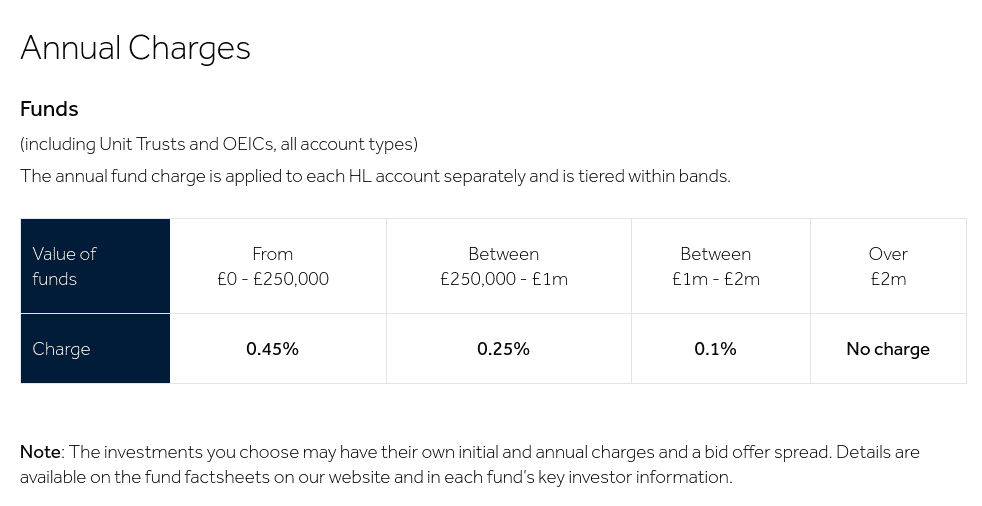

While shares, ETFs, investment trusts and bonds all attract the uniform flat commission of £11.95 per trade, funds at Hargreaves Lansdown are priced differently. This is because there is no dealing charge to buy or sell funds at the broker. There is, however, an annual fee that comes into play.

As you can see from the screenshot above, the specific fee will depend on how much you have invested at the platform. With that said, unless you are planning to invest more than £250,000 into funds, Hargreaves Lansdown fees amount to 0.45% per year. As such, if you were to invest £1,000, you would pay a fee of £4.50.

Hargreaves Lansdown ISA Fees

If you’re planning to open an ISA at Hargreaves Lansdown, additional fees will apply on the following financial assets:

- Shares

- Investment trusts

- Exchange-traded funds

- VCTs

- Gilts

- Bonds

On top of the standard dealing fee of £11.95, you will need to pay 0.45%. This is capped at £45 per year. Taking these additional fees into account, you might want to reconsider opening an ISA. This is because you can make up to £13,400 in the 2020/21 financial year without being liable for capital gains tax.

In addition to this, you can receive up to £2,000 in dividends without paying any tax.

The only exception to this rule is if you are looking to invest huge amounts that will result in annual gains of more than £13,400.

Hargreaves Lansdown Deposit & Withdrawal Fees

Although Hargreaves Lansdown is arguably one of the most expensive stock brokers in the UK, the good news is that the platform does not charge anything on deposits and withdrawals. Don’t forget though, there is a minimum deposit amount of £100 or £25 per month is signing up for a direct debit.

Hargreaves Lansdown Inactivity Fee

Much like in the deposit and withdrawal department, there are no Hargreaves Lansdown fees if your account is marked as dormant.

Hargreaves Lansdown Account Management Fee

Whether you or not you need to pay an account management fee at Hargreaves Lansdown will depend on several factors. For example – and as we covered earlier, ISAs at the platform are charged at 0.45% per year. If you decide to invest in a fund (non-ISA), you will also pay 0.45% per year.

On the other hand, if you simply buy stocks, bonds, and several other eligible assets – and you keep them in a standard dealing account, you won’t pay any annual fees.

The Verdict

All in all, Hargreaves Lansdown is a great broker for several reasons. Whether it’s the sheer size of its asset library, strong regulatory standing, or top-rated research department – it’s clear to see why Hargreaves Lansdown has attracted over 1.3 million clients to its platform.

However, where the broker most certainly does not stand out is fee department. This is because the Hargreaves Lansdown fees schedule is one of the highest in the UK share dealing scene. At £11.95 per trade – plus a further 1% on non-UK shares, this is super expensive.

FAQs

Is Hargreaves Lansdown free?

In terms of opening an account with Hargreaves Lansdown and subsequently making a deposit - yes this is free. But, it is not free to make investments. For example, buying shares will cost you £11.95 per trade.

Do HL charge to sell shares?

Yes, Hargreaves Lansdown charges a flat rate of £11.95 on all deals. This means that you will pay £11.95 when you buy the shares and again when you sell them.

What are the Hargreaves Lansdown fees on deposits?

Hargreaves Lansdown does not charge any fees on deposits and withdrawals. You will, however, need to deposit at least £100 or commit to a monthly direct debit of £25.

What is the Hargreaves Lansdown fund fee?

Hargreaves Lansdown charges 0.45% per year on funds for all investments of £250,000 and less. The platform notes that additional fees might be charged by the fund provider itself. If it is, this is passed on to you .

What is the Hargreaves Lansdown telephone dealing fee?

If you decide to buy shares over the telephone, Hargreaves Lansdown will charge you 1% of the purchase amount. This stands at a minimum and maximum fee of £20 and £50, respectively. Some assets - like the vast majority of bonds offered by Hargreaves Lansdown, can only be purchased over the phone.

Does Hargreaves Lansdown charge fees to buy foreign shares?

Yes, in addition to the standard share dealing fee of £11.95, non-UK shares attract an FX fee. For all investments of less than £5,000 - this stands at 1%.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2024 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up