ETF Trading UK Guide 2022

So, what is ETF trading? With ETF trading, you can speculate on an entire industry or market sector in a single position.

In this guide, we’ll explain how ETF trading works and highlight some ETF trading strategies. We’ll also review three popular brokers offering access to ETF trading in the UK today.

What are ETFs?

ETFs are baskets of assets that trade on the stock market. A single ETF might give you financial exposure to, say, hundreds of different stocks or more than a dozen different commodities. ETFs have become very popular alternatives to mutual funds and investment trusts because they trade just like stocks and can be purchased through most UK stock brokers.

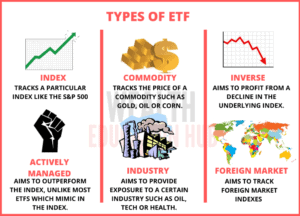

Different Types of ETFs

ETFs can contain many different types of assets, in a wide variety of combinations. Let’s take a closer look at some of the most popular types of ETFs in the UK.

Before we move on, you’ll be pleased to learn that you can buy and sell ETFs from the comfort of your home via the most popular ETF apps.

Stock ETFs

Stock ETFs, as the name suggests, are baskets of stocks. When you buy a stock ETF, it’s almost the same as if you were to buy shares – except that you are buying many different shares at the same time.

There are several different styles of stock ETFs.

Index ETFs are designed to mirror the major stock market indices, like the FTSE 100 or AIM 50. They contain all the same blue chip stocks so that changes in the value of the ETF mirror changes in the broader market.

Dividend ETFs invest primarily in dividend stocks. The value of these ETFs might not change very much over time, but you can realize a return from dividends paid out by all the companies held by the fund.

Industry ETFs give you exposure to a selection of stocks from a particular market sector. For example, you can use industry ETFs to trade pharmaceutical shares, oil shares, or cannabis stocks.

There are many other styles of ETFs, too. Some focus on growth stocks, while others look for undervalued stocks. If you want to trade penny shares, there are also ETFs for that.

Bond ETFs

Bond ETFs are bundles of bonds. Often, these ETFs offer returns through distributions from the bonds they contain. However, the value of bond ETFs can go up or down as interest rates and bond prices change.

Commodity ETFs

Commodity ETFs give you exposure to a wide variety of commodities – like sugar, coffee, and oil – at once. Commodity ETF trading is a way to jump into commodity trading if you want to speculate on agriculture or energy broadly, rather than on the price of a specific product.

Forex ETFs

Forex ETFs typically contain currency futures contracts, giving you exposure to a bundle of different forex pairs. Trading these ETFs is one way to get into forex trading while avoiding costly currency conversion fees.

What is ETF Trading and How Does It Work?

ETF trading in the UK is a form of trading that focuses on buying and selling ETFs for a profit. This is distinctly different from ETF investing, in which it is much more typical to buy a fund and hold it for months or years at a time. Many ETF traders engage in day trading or weekly swing trading.

ETF trading depends on the fact that ETF prices change throughout the trading day. However, the way that ETF prices move is slightly different from how stock prices move.

Whereas stock prices are primarily driven by buying and selling action, ETF prices are primarily driven by price changes in the assets they hold. Let’s look at an example tech industry ETF that contains Amazon, Apple, and Facebook shares. If the share prices of all three companies rise by 5%, then the value of the ETF will also rise by 5%.

Importantly, since ETFs hold multiple assets, the change in value of the ETF reflects the average price change of its underlying assets. So, if Amazon rises by 5%, Apple falls by 2%, and Facebook rises by 1%, the value of the ETF will only rise by 1.33%. So when ETF trading in the UK, it’s critical to think about how market news or events will affect all of the assets that an ETF holds.

ETF Trading Fees

Since ETFs trade on major exchanges just like stocks, ETF trading in the UK is usually subject to the same commissions and fees as stock trading. Many UK brokers offer commission-free trading on ETFs, although some charge a fee of several pounds every time you buy and sell. If you are trading ETFs using contracts for difference (CFDs), you may pay a spread of around 0.1% per trade or more.

ETF trading does come with an additional cost that stock traders don’t bear. ETFs typically have management fees that can range from just 0.01% of your investment per year to 0.5% per year or more. ETF traders typically don’t have to worry about these fees, since they are very small when you are only holding an ETF for a couple days at a time.

Popular ETF Trading Platforms

So, let’s take a closer look at three popular UK ETF brokers you can use to start trading today:

1. Plus500

Another benefit to Plus500 for ETF trading is that this broker allows you to trade with leverage up to 1:5. That’s significantly more than most competing online brokers. So, if you’re looking to maximize your ETF positions, Plus500 is the broker of choice. Helpfully, Plus500 also offers fractional ETF shares through its CFDs.

Plus500 gives traders access to an easy-to-use charting software both online and through a mobile investment app. It comes preloaded with nearly 100 technical indicators and includes a useful price alerts feature. However, you cannot create your own indicators or backtest an ETF trading strategy.

2. IG

Another benefit to IG is that you can choose how you want to trade ETFs. The broker offers CFD trading, spread betting, or outright investing. CFD trading and spread betting are commission-free, although the spreads can be surprisingly high. Outright ETF trading carries a commission of up to £3 per trade.

One of the things about IG is that you get access to the incredibly advanced ProRealTime ETF trading platform. With this software, you can create custom technical indicators and backtest your trading strategy against historical price data. It also comes with customizable price alerts and a mobile trading app.

Sponsored ad. There is no guarantee you will make money when trading CFDs with this provider.

ETF Trading Fees

Want to get a better understanding of the fees involved with ETF trading? Here are what the most popular ETF brokers charge.

| UK ETF Broker Fees | Charge Per Trade | Annual Fee | Conversion Fee |

| Plus500 | Variable spread | Free | 0.50% |

| IG | £0 -£10 | £24 per quarter (less than 3 trades) | 0.50% |

Conclusion

ETF trading allows you to speculate on entire market sectors or industries in a single trade. By giving you exposure to a wide range of assets, UK ETF trading can partially reduce your trading risk compared to trading individual assets. Plus, ETFs are easy to enter and exit and don’t require a large amount of money to trade.