Revolut Trading Review – Fees, Features, Pros and Cons Revealed

Revolut is a hugely popular mobile banking app that allows you to access most of the same features that you would find with a traditional high street branch.

This includes the ability to send money to family and friends, receive funds, and make purchases with the Revolut debit card.

With that said, the mobile banking app has since diversified into other key markets – including investments. This includes the ability to buy shares directly from the app – as well as CFD instruments like Bitcoin and gold.

In this guide, we explore the Revolut Trading app from top to bottom. We’ll discuss what assets you can buy, what fees you should expect, supported payment methods, and whether or not your money is safe.

-

-

What is Revolut?

Revolut is a banking app that was first launched in 2015. Since then, the app has attracted over 12 million customers – many of which are based in the UK. There are several reasons for this.

Revolut is a banking app that was first launched in 2015. Since then, the app has attracted over 12 million customers – many of which are based in the UK. There are several reasons for this.For example, Revolut allows you to facilitate most of your banking needs completely through your mobile phone. This includes the ability to send and receive funds at the click of a button.

You will be given a unique UK bank account number and sort code – as well as a fully-fledged debit card. The app is also popular with people that seek to exchange currencies or transfer funds overseas. This is because Revolut offers industry-leading transaction fees.

Outside of its core retail bank services, Revolut has entered a number of other marketplaces. On top of insurance and premium financial services, the app now allows you to access the stocks and shares scene. In fact, not only will you be able to buy shares on a commission-free basis, but Revolut also supports ‘fractional ownership’.

This means that you can invest from just $1 into your chosen stock – irrespective of how much its shares are trading for. We should also note that that the Revolut trading department allows you to access cryptocurrencies and commodities. The former includes the likes of Bitcoin and Ethereum, while the latter covers gold and silver.

What Shares Can You Buy on Revolut?

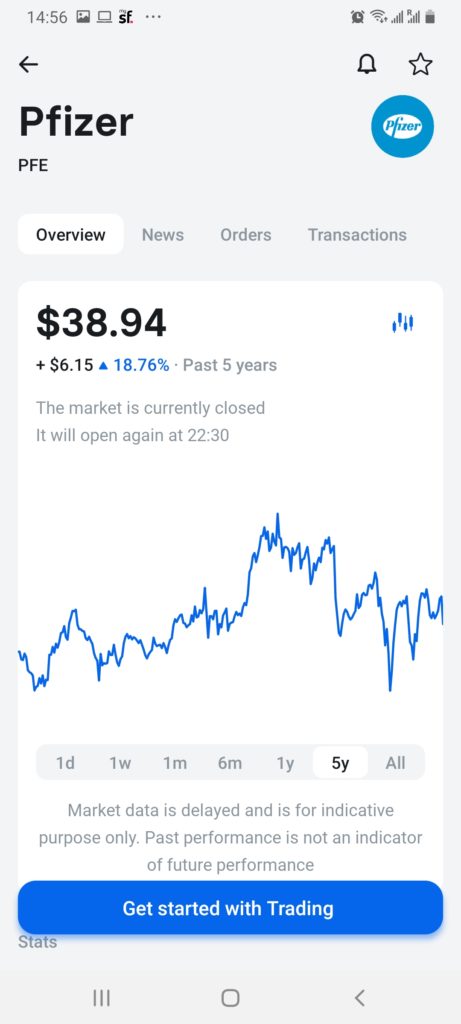

Put simply, Revolut only gives you access to shares listed in the US. This covers both primary markets – the NASDAQ and New York Stock Exchange. This means that you will have access to some of the largest companies in the world.

Think along the lines of:

Crucially, if there is an American stock that you are interested in buying, you’ll likely find it at Revolut. This is because the platform hosts over 750+ companies on the app.

On the flip side, you are missing out on a big chunk of the global stock market – especially those in the UK. For example, you won’t be able to buy FTSE 100 shares or AIM shares by using Revolut. You will also miss out on other key international markets – such as Canada, Japan, and Germany.

If you feel that US stocks won’t quite cut it, then you might want to consider using an alternative investment app.

Fractional Shares

Although it is somewhat disappointing that Revolut only supports the US stock markets, we feel that the banking app does make up for this by offering ‘fractional shares’. For those unaware, this is a new and exciting concept offered by several new-age brokers active in the investment scene.

As the name implies, you will be able to buy a ‘fraction’ of a share – as opposed to needing to buy a full stock. For stocks listed in the UK, this wouldn’t really be of much value.

After all, shares listed on the London Stock Exchange are priced in pennies. Even AstraZeneca shares – which has one of the highest stock prices in the UK, would cost you just 8,633p each (£86). Most, however, have stock prices worth less than £5.

With that being said, the fractional ownership offering at Revolut is super ideal, not least because US stocks are usually priced in the hundreds of dollars each. In several cases, share prices run into the thousands. For example, Booking Holdings Inc – the parent company of Booking.com, has a current share price of over $2,000.

This means that to buy just a single share, you would need to fork out about £1,500. Then you have the likes of Amazon – which is currently trading at $3100, or about £2,300. Fortunately, by using the Revolut app to buy expensive US shares, you can invest from just $1. This gives you access to shares that you otherwise might not be able to afford.

Let’s look at a quick example of how a fractional share purchase on the Revolut app would work.

- You want to invest in Tesla shares – which is currently priced at $410

- This amounts to about £158

- By using the Revolut app, you decide to invest just $4.10 (about £3.10)

- This means that you own 1% of a single Tesla share

So what does this mean in practice? Well, let’s suppose that Tesla shares increase by 50% a few months later – taking the stocks to $615 each. You invested a total of $4.10 at Revolut, so you will also benefit from a 50% increase. As such, your $4.10 investment is now worth $6.15.

Although Tesla does not pay dividends, if you were to buy stocks in a company that does make distributions, you would also be entitled to your share. For example, if Tesla paid an annual dividend yield of 10%, you would also be entitled to 10% – proportionate to the amount you have invested in the stocks.

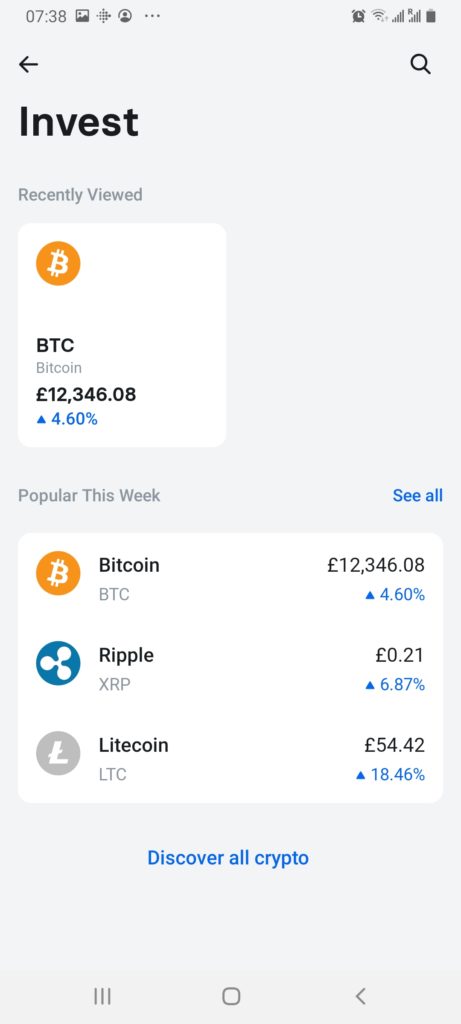

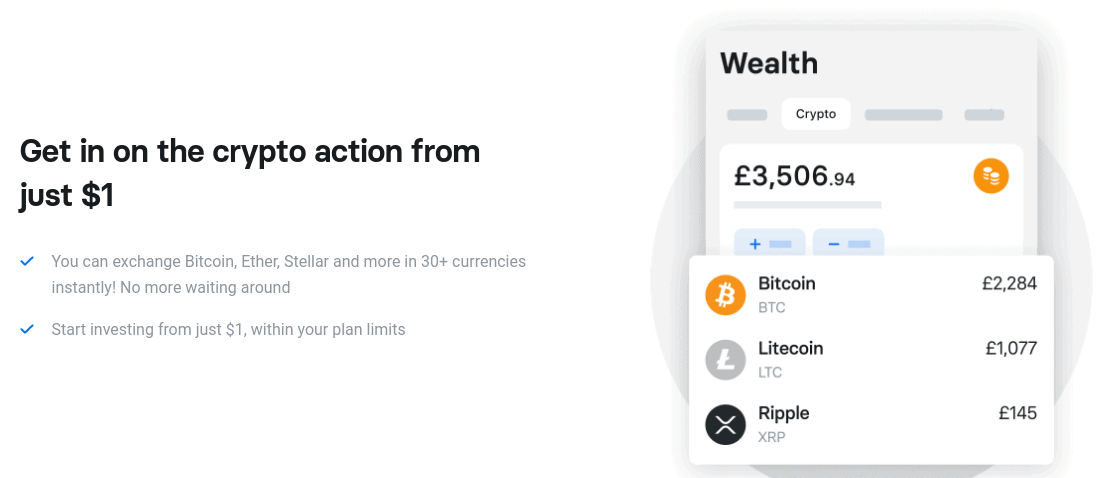

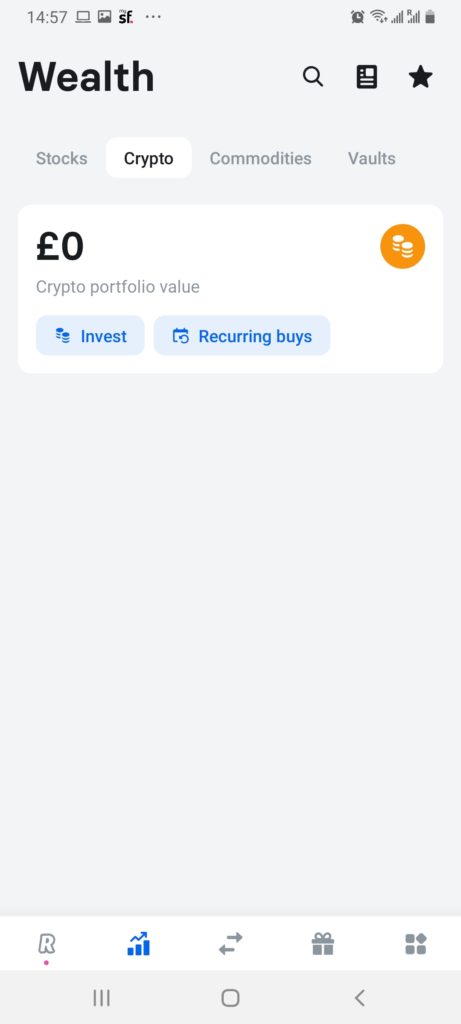

Cryptocurrencies

On top of its US stocks and shares offering, the Revolut trading app also gives you access to cryptocurrencies. However – and as we are going to explain in a lot more detail shortly – there is more than meets the eye.

That is to say, while the Revolut app gives existing account holders the capacity to invest in the future value of cryptocurrencies like Bitcoin, you won’t be able to withdraw the coins out. Instead, the coins remain within the Revolut digital wallet at all times, meaning that you have no access to your private keys.

Before we get to the significance of this, let us first outline the digital currencies that the Revolut trading app supports.

- Bitcoin

- Ether

- Litecoin

- Ripple

- Bitcoin Cash

- Stellar

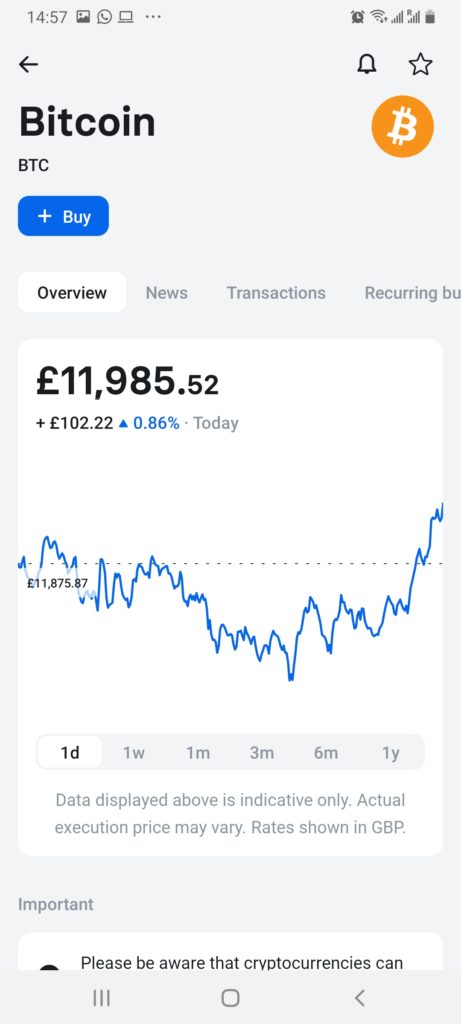

All of the above cryptocurrencies are priced in British pounds, which makes it a lot easier for UK investors to assess the value of the coin they are buying. Ordinarily, cryptocurrency platforms will price coins against the US dollar – as this is the primary currency used in the space.

So, when you go through the process of ‘buying’ a cryptocurrency at Revolut, the banking app will make the purchase from one of their supported partners. Amongst others, this includes Coinbase and Bitstamp. Then, once you complete the investment, you won’t actually have the ability to withdraw the coins out to a private wallet.

Instead – and noted above, the investment will remain in your Revolut trading account until you decide to cash out. In one way, this operates like a CFD trading transaction, insofar that you are only speculating on the future value of the cryptocurrency that you decide to invest in. But, it is important to note that unlike CFDs, you do legally own the underlying cryptocurrency when you invest via Revolut.

Confused? Most people are when exploring cryptocurrency trading at Revolut, so let us elaborate with a quick example.

- You load up your Revolut trading app and head over to the cryptocurrency section

- You see that Bitcoin is priced at £11,500

- You decide to invest £500

- A few months later, Bitcoin is worth £13,800

- This means that your investment is worth 20% more

- You are happy with your profits – so you instruct Revolut to sell your Bitcoin

- A few seconds later, your Bitcoin position has been closed and the money is returned to your Revolut GBP account

As per the above, you were able to profit when the value of Bitcoin (or your chosen cryptocurrency) increased. In other words, your investment increased by the same amount that the price of Bitcoin rose by. In this case, that was 20% – meaning you made a £100 profit on your £500 stake- taking your new GBP balance to £600.

We should, however, note that Revolut does not allow you to ‘go short’ on cryptocurrencies. This is a trading tool that allows you to profit if you think that a cryptocurrency will go down in value. If this is something you are interested in, you will need to use an FCA broker that supports CFD positions.

Fractional Crypto

Much like we discussed in the stocks and shares section, the Revolut trading app also supports fractional ownership of cryptocurrencies. This is particularly useful when you consider just how expensive Bitcoin has become. For example, at the time of writing in late 2020, the price of one Bitcoin amounts to just under $16,000. In pounds and pence, that’s about £12,000.

It goes without saying that the vast majority of you reading this Revolut Trading Review have no interest whatsoever in investing this much into a high-risk asset like Bitcoin. With this in mind, Revolut allows you to invest from just $1 into your chosen digital currency.

Not only is this great for affordability purposes, but it also allows you to diversify with ease. For example, if you invest £120 into Bitcoin when it is worth £12,000 – you would own 1% of a single coin. If Bitcoin one day increased to £120,000 (10x) – your fractional investment of £120 would then be worth £1,200.

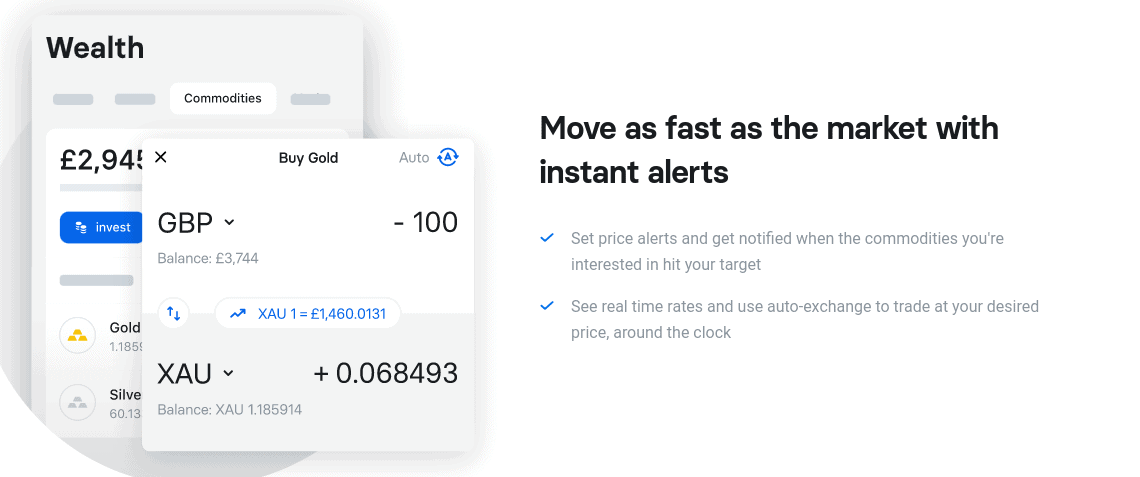

Commodities

If you’ve got an interest in commodity trading, you’ll be pleased to know that the Revolut app gives you access to a select number of markets. At present, this includes two precious metals – gold and silver. The main concept here – much like cryptocurrencies, is to benefit from an increase in asset value.

That is to say if the value of gold increases by 20% and you invest £100 – your money will be worth £120. At the other end of the spectrum, if the price of gold declines by 5% – your £100 investment would be reduced to £95. It is important to note that you do not have physical access to any of the gold or silver that you purchase via the Revolut trading app.

This shouldn’t be an issue though, as you likely wouldn’t want to take physical ownership of a precious metal anyway – especially if you are investing for financial gain. Revolut, on the other hand, personal purchases and stores gold and silver with an unnamed financial institution. This allows you to invest in a 100% secure manner.

When it comes to cashing out your silver or gold trading investment, the process is once again straight forward. You simply need to place a sell order via the Revolut trading app and then the precious metal in question will be sold at the current market rate. In turn, the funds will be placed into your GBP account.

Fractional Gold/Silver

Once again, the Revolut trading app allows you to invest in gold and silver on a fractional basis. Much like shares and cryptocurrencies, this starts at just $1.

Revolut Dividends

If you invest in dividend stocks via the Revolut trading app, you will be entitled to your share. When the funds are distributed by the respective company, Revolut will credit your trading account. This can then be used to buy more shares, cryptocurrencies, or precious metals. Or, you can simply transfer the cash back into your Revolut GBP account.

Revolut Trading Fees & Commissions

So now that you know which assets the app gives you exposure to, we now need to explore how well-priced Revolut is when it comes to trading fees and commissions.

The specific fee that you pay will depend on the specific market. As such, we’ll break the fees down asset-by-asset.

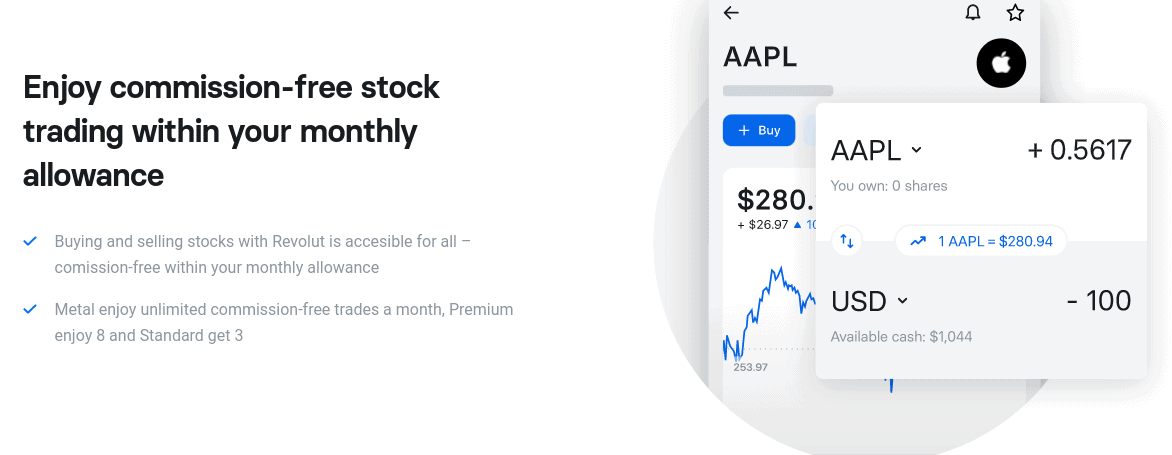

Stocks and Shares Fees

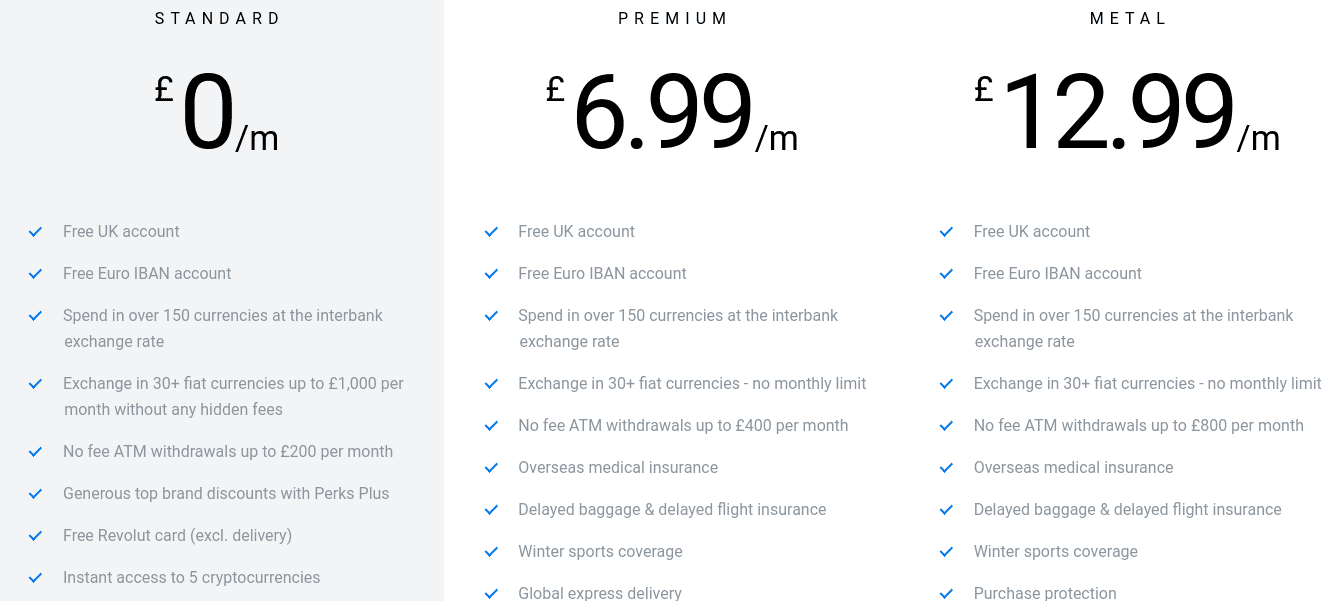

The Revolut app advises a commission-free stock trading service. This means that you can buy shares without paying any dealing fees. But – the number of commission-free trades that you can deploy each month will depend on which Revolut account you are on.

- Standard Account (FREE): If you are on the free Standard account, then you can place 3 commission-free trades per month.

- Premium Account (£6.99): If you are on the Premium account, then you can place 8 commission-free trades per month.

- Metal Account (£12.99): If you are on the Metal account, then you can place an unlimited number of commission-free trades per month.

Take note, any investments placed in addition to what your Revolut account type permits will be charged at £1 per trade.

- For example, let’s suppose you are on the Standard account.

- You invest in three different US stocks and sell two of the stocks later in the month.

- This means that you have placed five trades in total.

- The first three trades were commission-free, while the remaining two were charged at £1 each – costing you a total of £2.

Put simply, this is very competitive. For example, if you were to open an account with leading UK stock broker Hargreaves Lansdown – you would pay an entry-level share dealing fee of £11.95.

Sticking with the same example as above – where you placed five trades in a single calendar month, this would have cost you £59.75 (£11.95 x 5). On the Revolut trading app, this cost you just £2.

Custody Fee

In addition to the above, all stocks and shares portfolios on the Revolut trading app come with a custody fee. This is charged at a rate of 0.1% per year – and debited from your account each month. The amount is based on the total portfolio value. For example, if you hold an average of £1,000 worth of stocks at Revolut over the course of the year, you would pay an effective custody fee of £1.

Commodity Trading Fees

The Revolut app charges differently in the commodity trading department. This is because you will not benefit from a commission-free experience – like you get when you buy shares. Instead, you pay a ‘mark-up’ fee that is charged on top of the current gold exchange price that Revolut gets from the London interbank market for precious metals.

If trading during the week, this is charged at 0.25%. In effect, this operates just like a spread, insofar that you cannot see the actual fee directly. Instead, you are overpaying by 0.25% meaning that this is how Revolut makes money from the transaction. In simple terms, if you invested £500 – the 0.25% mark-up would leave you with £498.25 of your chosen precious metal.

Is this competitive? Yes, absolutely. After all, some online trading platforms charge a flat fee in excess of £10 per transaction. This would make it hugely unviable when investing smaller amounts. Ultimately, we like the variable fee system here – as even if you were to invest just $1 – you would pay the same effective rate as somebody investing thousands of pounds.

However – there is a slight chink in the armor that we need to mention. Firstly and foremost, this 0.25% fee is only available for Premium and Metal users. If you’re on the free Standard account, your commission is ballooned 1.5%. As such, a £1,000 purchase would yield an indirect fee of £15.

Secondly, and as you might know – commodities like gold can be traded 24 hours per day, 7 days per week. While this is great for entering and exiting the market at any given time, it does come at a surcharge when trading over the weekend. Well, at Revolut, anyway.

In a nutshell, if you buy or sell a commodity over the weekend at Revolut, the 0.25% mark-up available to Premium and Metal users is amplified six-fold to 1.5%. Standard account holders will pay 2.25% instead of 1.5%.

This very quickly makes the Revolut commodity trading platform expensive. As such, if you are looking to buy or sell over the weekend, you are bests advised to wait until Monday morning.

Cryptocurrency Trading Fees

Much like in the case of commodities, buying and selling cryptocurrencies on the Revolut trading app will come at a variable fee. Similarly, the amount that you pay will depend on what account type you are on.

You’ll find the respective fees outlined below:

- If you are on the free Standard account and you buy or sell cryptocurrencies, the fee is 2.5%

- If you are on the Premium or Metal account and you buy or sell cryptocurrencies, the fee is 1.5%

Take note, the above commissions are charged based on the amount that you invest. For example, on a £1,000 Bitcoin purchase, your 2.5% fee amounts to £25.

The same transaction on a Premium or Metal account would cost you £15. Don’t forget, these fees are charged at both ends of the trade. This means that you’ll pay a variable commission when you buy a cryptocurrency and again when you cash out the investment.

So, how do these cryptocurrency fees compare? Well, this depends on the broker.

For example, a lot of first-time buyers will use a cryptocurrency broker called Coinbase. The platform is home to millions of users as it offers a simple and burden-free way of investing in digital currencies.

However, this does come at a premium. For example, Coinbase charges 3.99% if you were to deposit funds with a debit card. Then, a 1.5% trading fee comes into play – which mirrors that of the Premium and Metal account commission charged by Revolut.

This is because the broker does not charge commissions, so it’s only the spread that you pay. At the time of writing, the spread on BTC/USD (the most traded Bitcoin market) is 0.75%. As such, your all-in fee to buy a Bitcoin at the platform would be 0.75% of the purchase amount.

Note: A couple of important points to note about trading fees at Revolut. Firstly, our Revolut Trading Review found that the fee structure is somewhat difficult to grasp at first. This is further amplified by the amount of digging we had to do to figure out exactly what you will need to pay. Secondly, you also need to factor in wider Revolut account fees – which we discuss in the section below.

Revolut Trading Account Types

First and foremost, it is highly unlikely that you are going to open a Revolut bank account purely with the aim to invest and trade. After all, there are arguably much better investment apps out there – both in terms of tradable markets and fees.

On the flip side, you’d probably be better using the trading department at Revolut only if you plan to use the provider for its core banking services. This is because you will benefit from an ‘all-in-one’ hub that covers everyday financial transactions and investment services.

The main point here is that you can easily transfer money back and forth between your main Revolut bank account with that of your trading balances.

Taking all of the above into consideration, we should now briefly discuss the three account types that you will get to choose from when using the Revolut trading app.

Standard Account (FREE)

The Standard account at Revolut can be used free of charge. This allows you to perform all banking services offered by the app – such as sending and receiving funds, as well as using the Revolut debit card. You can also create savings pots, exchange currencies, and benefit from cutting-edge features like automatic transaction notifications on your mobile.

In terms of how this relates to the trading segment of the site, as noted earlier you will get 3 commission-free stock trades per month. Your cryptocurrency and commodity trading fees will also come at a higher variable rate in comparison o the paid-for account types.

Premium Account (£6.99 per month)

The Premium account will cost you £6.99 per month. This comes with a variety of additional perks – such as priority customer support, higher fee-free ATM and best FX rate limits, and free airport lounge passes if your flight is delayed.

In terms of trading-specific benefits, this will get you 8 commission-free stock investments per month, up from the 3 available on the Standard account. As noted earlier, this also gets you more competitive commission rates when investing in commodities and cryptocurrencies.

So, that begs the question – if you were to upgrade from a Standard account to a Premium Account, would it be worth it to benefit from more commission-free stock investments? The simple answer here is no.

- For example, if you were to place 8 trades in a month on the Standard account, the first 3 would be commission-free and the remaining 5 would cost £5 in total (£1 each).

- If you were on the Premium account, the same number of trades would cost you nothing. But, you’d end up paying £6.99 for the month, meaning that this would actually work out more expensive.

That is, of course, unless you use one of the other perks afforded to Premium account holders. This might be investing in commodities/cryptocurrencies at a more beneficial rate or utilizing some of the core banking features discussed a moment ago. These are key decisions that you need to take into account when attempting to find the best Revolut plan for your personal needs and financial goals.

Metal Account (£12.99 per month)

The Metal account at Revolut is the most expensive plan offered by the banking app. As is to be expected, this comes with even more perks than found with the Premium account. This includes travel insurance and monthly cashback. In terms of how you get in trading-related perks, you can place an unlimited number of commission-free stock trades.

This would be useful if you plan to trade on a super-frequent basis. For example, let’s supposed that you placed a total of 20 trades throughout the month.

- On the Standard account, the first 3 trades are commission-free, while the remaining 17 are charged at £1 each. This would cost you £17 in total.

- On the Premium account, the first 8 trades are commission-free, while the remaining 12 are charged at £1 each. This would cost you £12 in commission and then £6.99 in monthly fees – taking your total expenditure to £18.99.

- On the Metal account, all 20 trades are commission-free. As such, taking the monthly fee into account, your total expenditure is £12.99.

As per the above, placing 20 trades on the Metal account would save you £6 for the month compared to the Premium account, and just £4.01 compared to the Standard account.

However, as you begin placing more trades – or make use of the core banking features that come with the Metal account, this could work out even more cost-effective. Once again, it will ultimately depend on how you plan to use your Revolut account.

Revolut Trading Features and Tools

Our Revolut Trading Review found that the app offers some really cool features that you likely won’t find elsewhere.

This includes:

Auto-Exchange

As the name implies, the auto-exchange feature allows you to automatically buy cryptocurrencies when a specific price is hit. For example, you might decide to buy £100 worth of Bitcoin every time it drops below £10,000.

When it does, Revolut will automatically take the funds from your GBP account and make the purchase on your behalf. Although this does sound very similar in nature to a more conventional limit-loss order, the auto-exchange option is far more beneficial if you are looking to invest on a regular basis.

This is because you are not required to deposit any funds to cover the order – on the proviso you have sufficient money in your Revolut bank account. You also have the option of updating your entry price whenever you see fit.

Commodity Purchase Round-Up

We really like the ’round-up’ trading feature offered by the Revolut app. Put simply, this allows you to automatically buy more gold or silver every time you make a debit card transaction. For example, let’s suppose that you spend £9.50 in your local supermarket.

As per your instructions, Revolut can round the transaction up to the nearest £1 – which in this case, is £10. The £0.50 balance would then be used to purchase invest more into your chosen commodity. You would be surprised just how quickly this can begin to add up.

Recurring Investments

This particular Revolut trading feature is potentially our favourite. This is because the app allows you to engage in recurring investments. This means that you can set-up a long-term, consistent investment plan. For example, you might elect to invest £100 at the end of each month.

In doing so, you don’t need to worry about manually buying your chosen stock, commodity, or cryptocurrency. Instead, the app will take the £100 investment from your Revolut bank account and buy the asset accordingly.

On top of monthly payments, the app also allows daily or weekly. Now, the importance of this Revolut trading app feature should not be understated. The reason being, this allows you to build a pot over many, many years. Even if you only invest a small amount each week or month, this can and will very quickly add up over the course of time.

Plus, if you’re really shrewd, you’ll also be reinvesting your dividend payments as and when they arrive. This will allow you to grow your capital even faster.

Vault

The Vault is a feature offered by Revolut that allows you to save money for a specific financial goal. The Vault will continuously give you updates on whether or not you are course to meet your specified objective. But, best of all – the Vault feature is not only compatible with traditional currencies. On the contrary, you can add commodities and cryptocurrencies to the Vault.

For example:

- Let’s suppose that you want to save £10,000 for a mortgage downpayment

- You transfer £2,000 in cash and £4,000 worth of Bitcoin

- A few months later, Bitcoin goes on a super-long upward swing – increasing in value by 100%

- This means that your Bitcoin is now worth £8,000

- Add this to the £2,000 cash you deposited and the Vault has now reached its target of £10,000

- You will receive an instant notification when this happens and thus – you can cash out your Bitcoin

As you can see from the example above, the Vault at Revolut allows you to combine savings goals with financial assets.

Price Alers and Notifications

Although this feature is offered by a good number of stock trading apps, it is valuable nonetheless. In a nutshell, Revolut allows you to set up notifications that are sent to your phone in real-time. You can do this when your favourite asset hits a predefined price. For example, you might be interested in buying Apple shares, but not at the current price of $120.

Instead, you want to buy them if the stock price hits $110. In doing so, you can buy the shares at a discount – so to speak. Additionally, you can also elect to receive notifications when your chosen asset makes a big market move. For example, you might be keen to keep an eye on Amazon shares.

If Amazon shares jumped up by 4% in a single day of trading, you would likely receive a notification. This will also be the case with any assets you are currently invested in – which is a great way to keep tabs on how your stocks, cryptocurrencies, or precious metals are performing.

Revolut Trading Leverage

A lot of traders in the UK like to apply leverage to their positions. This allows them to place larger trades in comparison to the amount of capital they have in their account. In the UK, retail investors can place up to 1:30 leverage when trading currencies, and less on other asset classes.

Unfortunately, this isn’t a feature currently offered by Revolut. In some same, this kind of makes sense. After all, leverage can be a hugely risky tool to deploy at the best of times. But, when you factor in the direct link between the Revolut trading department and your bank account balance – so can be a dangerous relationship.

Revolut Trading Platform

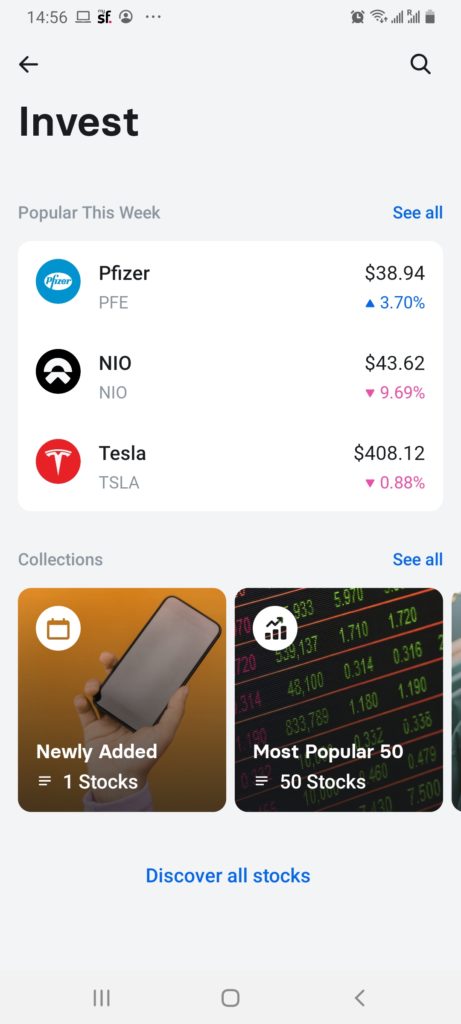

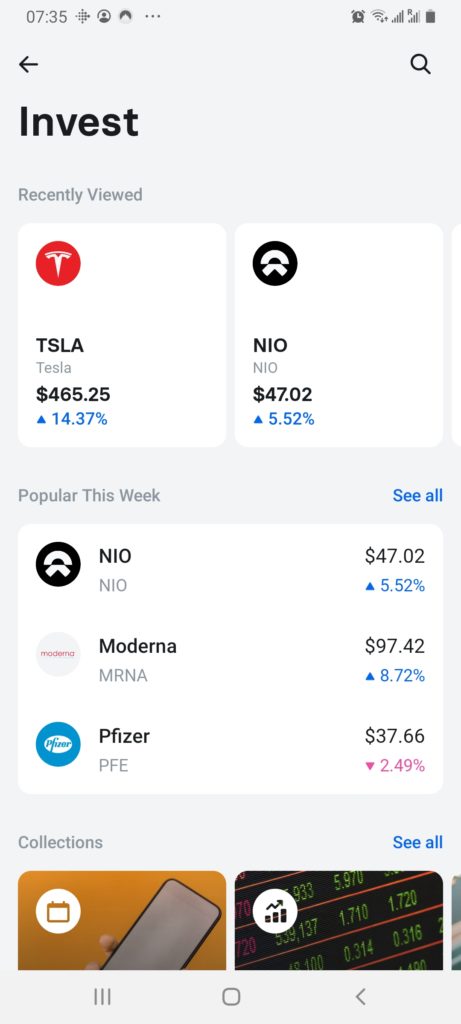

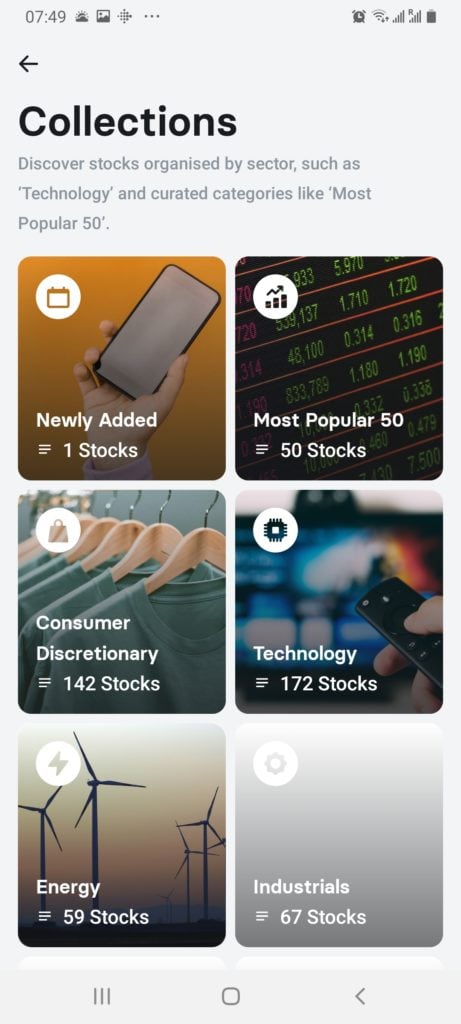

Put simply, all trades and investments on the Revolut app are conducted via the app. You will be required to log in to the app as normal, and then click on the ‘Wealth’ icon to access your required trading market. In terms of user-friendliness, it doesn’t get more simple than Revolut.

Everything is laid out clear and you can even make use of a search filter. For example, if you know the specific stock that you want to buy, just search for it and you will be taken to the respective trading page. Or, you can break the 750+ stocks down by the sector – such as technology or energy.

Once you have decided which asset you wish to trade, it’s then just a case of entering the amount that you wish to invest. For example, if you want to buy £500 worth of Bitcoin, simply opt a one-time order and enter £500 into the ‘amount’ box. Or, you can make use of the previously discussed recurring investment plan. Either way, the process at Revolut is super-easy.

Research, Analysis and Education at Revolut

Make no mistake about – Revolut is as basic as it gets in the world of online trading. That is to say, if you are looking for a full suite of advanced trading tools and technical indicators – the Revolut app is not going to be right for you. Similarly, if you’re looking to perform technical analysis – you’ll need to consider another trading site.

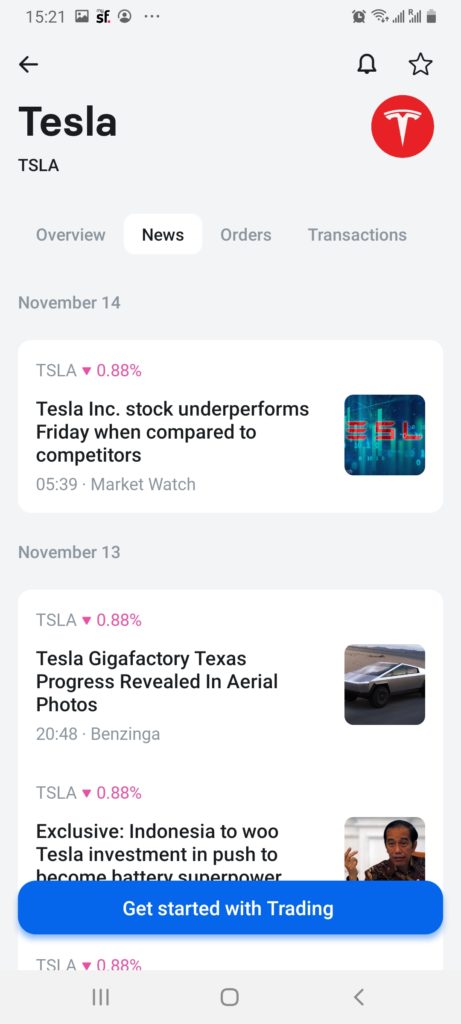

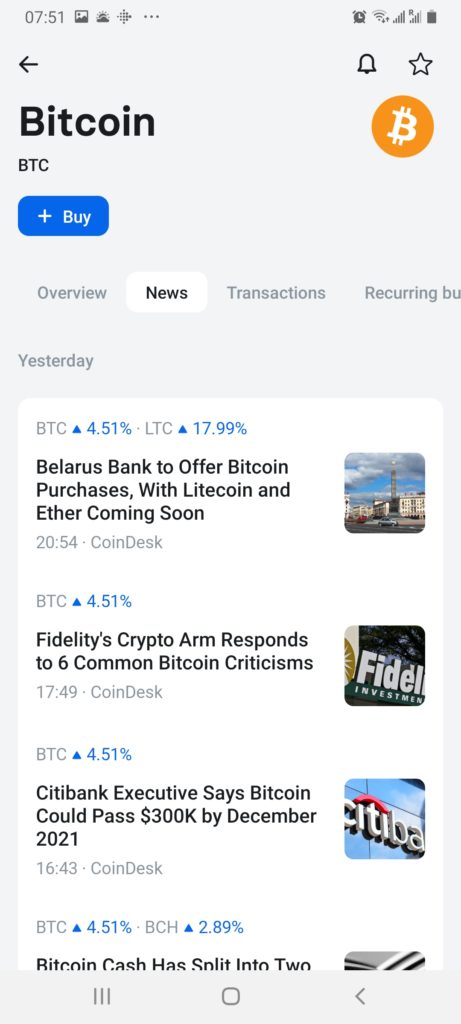

With that said, our Revolut Trading Review found that the app can be handy when it comes to fundamental research. This is because the app has integrated real-time news stories with various leading providers.

For example, if it’s cryptocurrencies that you are interested in, you’ll get news from CoinDesk and the CoinTelegraph directly from within the app. These are two of the most respected cryptocurrency news platforms in the space. As such, you’ll get news billions throughout the trading day.

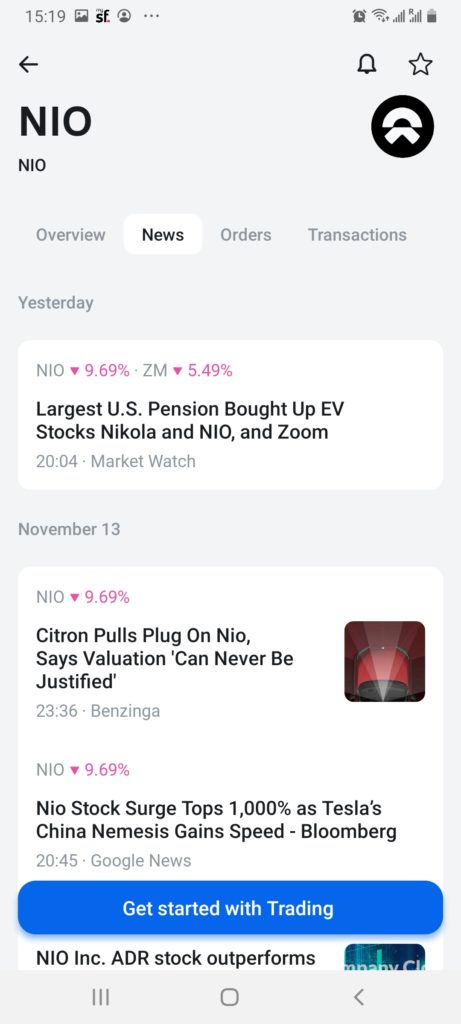

In the case of fundamental news in the stocks and shares department, Revolut does not disappoint. On the contrary, it has also integrated its news stories from a variety of leading sources. This includes the likes of Market Watch, Google News, and Benzinga. In order to access this news, all you need to do is click on the respective stock.

For example, by heading over to the Tesla stock page and clicking on the ‘News’ button, you’ll be presented with heaps of relevant stories. In turn, this allows you to make an informed decision as to whether or not the stock purchase is right for you.

On the flip side, the Revolut trading app doesn’t offer much in the way of education.

Payments on the Revolut Trading App

When it comes to funding your trading and investment endeavours – the process could not be easier. After all, the app will simply take the required amount from your main Revolut bank account. For example, if you invest £200 into Facebook stocks, Revolut will instantly process the purchase by deducting the amount from your available balance.

Of course, there might come a time where you do not have sufficient funds in your Revolut account. In this instance, you can easily add cash to cover your required investment.

This includes:

- UK Bank Transfer: You can easily add money to your Revolut account via a UK bank transfer. As the banking app now supports the Faster Payments Network, the transfer will be credited to your account instantly.

- Debit Card: You can also add funds with a debit card.

There are no fees to deposit funds into your Revolut account. However, if using a debit card issued outside of the EEA (European Economic Area), then the app notes that it “may charge a small fee just to cover our costs.” What this amounts to remains to be seen, albeit, it’s somewhat irrelevant if you’re looking to use a UK-issued debit card anyway.

When it comes to withdrawals, all investment cashouts will see the funds automatically added to your Revolut bank account. This is why the application is so popular with everyday UK investors.

After all, there is no requirement to wait days on-end for your chosen brokerage site to process a withdrawal. On the contrary, the process at Revolut is instant. Then, you can leave the funds in your Revolut bank account or transfer them to another UK-based account.

Customer Service at Revolut Trading

Customer service at Revolut has improved in leaps and bounds over the past year or so. Previous to this, it was well documented that Revolut bank account holders were forced to wait days just to get a reply on the live chat feature.

And of course – as there is no telephone number offered, this is the only way to make direct contact. But, the good news is that things have since improved drastically. In most cases, once you get past the automated customer service bot, you should be connected to an agent in just a few minutes. Support is typically available around the clock.

Alternatively, you might try social media if you are having little success getting hold of somebody, but just make sure you don’t publish any sensitive account details.

Is Revolut Trading Safe?

This section of our Revolut Trading Review is potentially the most important. The reason being is that there is a lot of ambiguity surrounding the regulatory status of the app. With this in mind, we are now going to unravel each and every fine detail that you need to be made aware of before opening an account.

So, first and foremost, Revolut is licensed in the UK by the Financial Conduct Authority (FCA). But, we must make it clear that the app is licensed as a bank. To ensure we quote Revolut word-for-word, the platform notes that it has an “electronic money or e-money licence in the UK, not a banking licence”.

So what does it mean for the safety of your funds?

Well, the most crucial thing to note is that you will not be covered by the Financial Services Compensation Scheme (FSCS). This means that you do not benefit from the industry-standard £85,000 protection in the event of a Revolut collapse. To counter this – and as per FCA regulations.

Revolut keeps client funds in segregated bank accounts at Lloyds. This means that in theory, Revolut can not access your money for its own operations. With that being said, Revolut does make it somewhat clear that both its cryptocurrency and commodity trading department is not regulated by the FCA. As such, this is something you should bear in mind.

In terms of account security, you will need to set up a unique PIN number which is then required on all login attempts. You can also elect to use the app’s biometric login feature – which requires your fingerprint. Additionally, we should note that your Revolut account can only be installed on one phone at a time. This should safeguard you from the risk of external malpractice.

Revolut Trading Pros and Cons

Pros

- Buy shares in over 750+ US firms

- Invest in the future value of cryptocurrencies and gold/silver

- Zero-commission trading – various limits depending on the account type

- Super easy to use

- Combine the fruits of mobile banking and investments

- Takes just minutes to open an account

- Great news integrations to assist your research journey

Cons

- No UK stocks

- Unable to withdraw cryptocurrencies to a private wallet

- You need to Metal account at £12.99 to get unlimited commission-free trades

- Only two commodities supported – gold and silver

- Unable to apply leverage or short-sell

Revolut Trading Review – The Verdict

Let’s be clear – Revolut is by no means the best mobile trading platform there is in the UK. But – the application certainly serves a purpose. That is to say, if you are looking for a super-easy way to invest in the American stock market – Revolut allows you to do this with ease.

In fact, the stand out selling point for us is the ability to combine every banking services with online investments. And of course – it is notable that the Revolut app allows you to place 3, 8, or an unlimited number of commission-free trades per month – depending on which plan you are on.

Revolut – Mobile Banking and Trading at the Click of a Button

FAQs

Is Revolut regulated?

Yes, Revolut is regulated by the Financial Conduct Authority (FCA). However, the app is regulated as an e-money provider and not a bank.

Is Revolut good for trading?

The Revolut trading app comes with its pros and cons. On the one hand, you can invest in over 750+ US stocks commission-free (limits apply), as well as cryptocurrencies and commodities. However, the platform itself is somewhat basic, so it won't be suitable if you are looking for an advanced trading application.

Does Revolut trading pay dividends?

Yes - if you hold dividend-paying stocks in your Revolut trading portfolio, you will be entitled to your share as and when the company makes a distribution.

Can you withdraw Bitcoin from Revolut?

Although you are not accessing Bitcoin through CFDs, Revolut does not allow you to withdraw your Bitcoin. Instead, you are merely speculating on the price of Bitcoin increasing in the future.

What is the Revolut minimum stock trade size?

Revolut supports fictional shares, meaning that you can invest from just $1 into your chosen stock.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up