How to Buy Pfizer Shares Online in the UK

With a market capitalization of $213.662B, Pfizer is the second-largest biotechnology and pharmaceutical company in the world. The US Healthcare company also ranks no 64 on the 2020 Fortune 500 list of the largest US corporations by total revenue, which is why many investors find Pfizer shares so appealing.

If you’re considering adding Pfizer to your share portfolio, this guide will cover everything you need to know. We show you how to buy Pfizer shares online in the UK, suggest top UK stock brokers and provide a step-by-step walkthrough of how you can buy Pfizer shares.

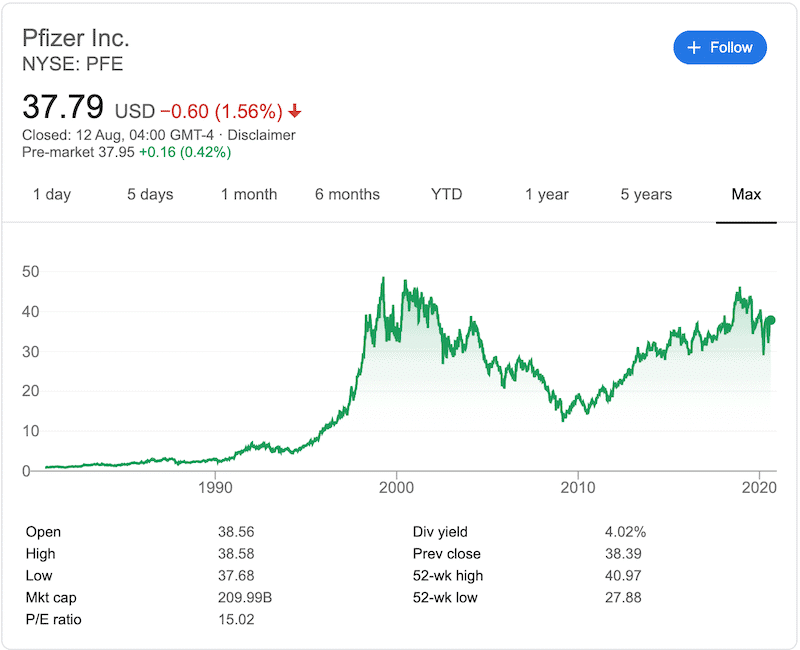

But you also need to ensure that your chosen broker is regulated in the UK and that it offers low trading fees, and unique trading platforms and features. To help you find the right one, let’s take a look at two of the most trusted and well-regulated UK stock brokers that allow you to buy Pfizer shares. Plus500 is 100% commission free for share CFD trading, meaning you don’t have to pay a fixed commission when you buy and sell shares. In addition, the spreads on Plus500’s platform are very low, so it is one of the most cost-effective stock brokers in the UK. On this platform, you will find some of the best shares to buy of companies listed in the US, the UK, and Germany. This broker also offers one of the most popular and user-friendly stock trading platforms. It includes price alerts, risk management tools, an economic calendar, and a built-in charting package. For the on the go traders, Plus500 allows using guaranteed stop and trailing stop orders that can be added to your trades in order to efficiently manage your risk. In terms of regulation and safety of your funds, you should not have any concerns when trading at Plus500 as it is regulated by the FCA. To get started, you’ll have to meet the minimum deposit requirements of £100. You can do this with a debit card, credit card, electronic wallet (PayPal or Skrill) or UK bank account. Pros: Cons: 72% of retail investors lose money trading CFDs with this provider Even though Pfizer is one of the largest companies in the world and is considered as a blue-chip company, that doesn’t necessarily mean that it’s the best investment right now. As such, we would suggest that you do some research about Pfizer’s share price performance, the company’s history, and forecast for the future. Pfizer was founded in 1849 in New York City by Charles Pfizer and his cousin Charles F. Erhart. At the beginning, the two men have used a loan from Pfizer’s father as capital in order to produce a palatable anti-parasitic drug called Santonin, which was a huge success. The demand for disinfectants, preservatives, and painkillers throughout the American Civil War doubled the company’s revenue, and again, during WW2 Pfizer was the only company that had the ability to develop and market mass production of penicillin for treatment of wounded soldiers and citizens. Pfizer continued to expand during the following decades. In 1955, the company signed a major partnership with the Japanese company Taito to produce and distribute antibiotics. In the 70’s, Pfizer continued with several acquisitions such as the pharmaceutical manufacturer Mack Illertissen. Nowadays, some of the most well-known drugs of Pfizer include Advil, Bextra, Celebrex, Diflucan, Lyrica, Robitussin, and Viagra. Pfizer first went public in 1942, and since then, its shares have grown at an annualized rate of 14.4%. It also joined the Dow Jones index in 2004, and during this period of time, the Pfizer share price has underperformed the index. The same as any other major blue-chip company, Pfizer’s share price has been trading in a range over the past three decades. This can be attributed to the fact that the company pays a solid dividend, and saw steady and moderate growth in its healthcare sector. Pfizer has been in the news lately due to its prospective COVID-19 vaccine candidate. But even though Pfizer is one of the leading pharma firms to manufacture a COVID-19 antiviral treatment, its YTD return is a negative -0.59% at the moment. Ultimately, Pfizer is a company that offers several layers of valuations and is a defensive stock that is typically resilient to economic recessions. Pfizer is a favorite dividend-paying stock among investors looking for a yield on their savings. This company pays an annual dividend of $1.52 per share, with a dividend yield of 4.02%. In this sense, Pfizer pays a similar quarterly dividend when compared to other healthcare companies that pay an average dividend of $0.38 every quarter. Nevertheless, this is much higher than 2% you can expect from the average of the companies listed on the S&P 500. With this in mind, below you will find reasons why investors and analysts are bullish on Pfizer shares. According to the market consensus, it appears that Pfizer share is currently undervalued, particularly when taking into consideration Pfizer’s growing pipeline and the efforts to develop the Covid-19 vaccine. At the time of writing, Pfizer is trading at $38.06 per share and its price-earnings ratio is 15.08. As the Healthcare Services average PE ratio stands at around 25.50 as of August 10, 2020, it seems that Pfizer share is currently trading at a discount. One notable aspect about Pfizer is that it has a lot of cash – over the past year, Pfizer’s profitable operations generated $12.6 billion in free cash flow. This will enable the company to continue its expansion and maintain its position as the world’s leading biopharma producer. In August, Pfizer reported better-than-expected second-quarter earnings and upgraded its outlook for the second half of 2020. The pharmaceutical company came out with quarterly earnings of $0.78 per share, beating analysts consensus. In fact, over the last four quarters, Pfizer has surpassed EPS estimates three times. On top of that, Pfizer reported a profit of $9.52 billion and revenues of $11.8 billion. This has revealed the company’s business resiliency during challenging times. Pfizer upgraded its full-year outlook, with EPS expectations in between $2.85 to $2.95, up from its previous guidance of $2.82 to $2.92. It also raised its income expectations to $48.6 billion to $50.6 billion for 2020, up from its previous forecast of $48.5 billion to $50.5 billion. In March 2020, Pfizer launched a plan to collaborate with large and small pharmaceutical companies in order to work together in developing and marketing a COVID-19 vaccine. Pfizer and BioNTech have entered into a global partnership agreement to develop a coronavirus vaccine to prevent COVID-19 infection. And while Pfizer and BioNTech are among several companies that have joined the race to develop a vaccine to fight the virus, this collaboration might be successful. This joint operation ensures that the U.S. government will pay both companies $1.95 billion upon the receipt of the first 100 million doses, following FDA approval of the vaccine. Then, Pfizer announced a multi-year agreement with Gilead Sciences to manufacture and supply Gilead’s coronavirus treatment remdesivir. As of August 2020, Gilead is one of the leading candidates for treating patients with Covid-19. Pfizer also partners with Direct Relief, a humanitarian aid organization, in order to provide Covid-19 supplies to hospitals across all 50 United States and 80 countries. Check out our Pfizer share price forecast to learn more about whether or not this stock is a buy.. Those that prefer high volatility shares will find better solutions when trading shares such as Apple, Amazon, and Netflix. But if you are looking for a long-term investment option, Pfizer may be the safest option for you. Long-term investors could not only benefit from the share price appreciation but also from dividend payments. Pfizer has shown extremely strong performance in recent years and its financial stability is impressive. Further, Pfizer EPS has grown by 23% per year over three years, and the average annual share price increased by 4.8%. This essentially means that the share price has grown modestly compared to the company’s EPS. Pfizer management is optimistic about the second half of 2020 as COVID-19 restrictions are less severe now. If the company succeeds in developing a functional Covid-19 vaccine, the share will get a strong boost. Otherwise, Pfizer is a solid dividend share to buy and hold. The COVID-19 pandemic has made it clear that healthcare companies have the potential to bring treatment to this disease. Pfizer is a blue-chip biopharma company with a huge potential to develop a coronavirus vaccine, alongside its operational activities. As a pharmaceutical giant with high profitability, there’s a good chance Pfizer shares will provide a great return in the form of share price increase or dividend distribution. On top of that, as it will be a smart decision to avoid shares that depend entirely on success from developing Covid-19 vaccine, Pfizer is an ideal share to buy under the circumstance of the coronavirus pandemic. Simply click the link below to get started! Interested in investing in other pharmaceutical companies that are involved in developing a coronavirus vaccine? Check out the list below. Pfizer is listed on the NYSE, LSE, Euronext, and Swiss stock exchanges. Pfizer’s main listing is on the New York Stock Exchange under the ticker symbol PFE. Yes, Pfizer pays quarterly dividends for shareholders of the company. The next payable dividend will be on September 1, 2020. Yes, if you own a CFD contract of Pfizer shares before the ex-date, you will receive a dividend payment. The minimum amount of your share investments depends on your choice of broker. While traditional brokers typically require to buy a specified number of shares, CFD brokers like eToro allow you to buy fractional shares of a company, so basically you do not have any restrictions as to the number of shares you have to buy. WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site. Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy. Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

Step 1: Find a UK Stock Broker That Offers Pfizer Shares

1. Plus500 – Share CFD Platform with Low Fees

Step 2: Research Pfizer Shares

Pfizer Share Price History

Pfizer Dividend Information

Should I Buy Pfizer Shares?

The Pfizer Share Price is Fairly Cheap

Resilient Earnings and Growth Potential

Partnership with Gilead, BioNTech and Direct Relief to Battle Against Covid-19

Pfizer Shares Buy or Sell?

The Verdict

Other Vaccine Shares

FAQs

What stock exchange is Pfizer listed on?

Does Pfizer pay dividends?

Can I collect Pfizer dividends when trading CFDs?

What is the minimum number of Pfizer shares that I can buy?

Tom Chen