Rishi Sunak is reportedly in talks with Arm Limited and SoftBank for a UK listing of the former. Before him, Liz Truss and Boris Johnson also tried to convince the company to list in the UK markets.

Last month, Sunak met Arm’s CEO Rene Haas in Downing Street. SoftBank’s founder Masayoshi Son also joined the meeting through a video call. One of the people briefed on the meeting described it as “very constructive.”

Johnson had also tried to convince Arm to list in the UK. Truss too tried her luck in her rather small tenure. Notably, Son last year said that he prefers a listing of Arm in the US. However, he said that a final decision is yet to be made.

Notably, Arm spun out of Acorn Computers in 1990 and went public in the UK in 1998. However, in 2016, SoftBank acquired the company and took it private, delisting it from the London Stock Exchange. The Japanese private equity major paid almost $32 billion for the company

Nvidia announced Arm Limited acquisition in 2020

In 2020, Nvidia announced that it would acquire Arm Limited for around $40 billion. SoftBank was looking for an exit from the company after having unsuccessfully tried to revive the growth. At that price, SoftBank might anyways not have made much profit on the investment.

Meanwhile, Nvidia’s acquisition of Arm faced opposition from several quarters. Hermann Hauser, a co-founder of Arm was among the first ones to speak against the acquisition. “It’s the last European technology company with global relevance and it’s being sold to the Americans,” said Hauser. He also suggested that UK regulators should help Arm list in the UK only. Hauser also started a “Save Arm” campaign to block the sale of the company to Nvidia.

Nvidia and Arm called off the deal in 2022

After around 17 months of announcing the acquisition, Arm and Nvidia called off the deal in February 2022. Nvidia also forfeited the $1.25 billion that it had paid to SoftBank to acquire Arm.

In its release, Nvidia said, “The parties agreed to terminate the Agreement because of significant regulatory challenges preventing the consummation of the transaction, despite good faith efforts by the parties. Arm will now start preparations for a public offering.”

Notably, regulators in several countries were opposing the deal due to antitrust concerns. Arm Holdings designs low-powered chips which are used in almost 95% of the world’s smartphones. While the acquisition would have helped Nvidia expand its business, regulators were visibly worried.

FTC issued a statement after Nvidia called off the Arm deal

A week after Nvidia and Arm mutually terminated the deal, Holly Vedova, Director of the FTC Bureau of Competition said, “The termination of what would have been the largest semiconductor chip merger will preserve competition for key technologies and safeguard future innovation. This result is particularly significant because it represents the first abandonment of a litigated vertical merger in many years.”

SoftBank is facing multiple headwinds

Over the last couple of years, SoftBank has faced several challenges. WeWork was among the other prominent SoftBank investments that failed to deliver. After a botched-up IPO in 2019 where WeWork was seeking a $47 billion valuation, it finally went public through a SPAC (special purpose acquisition company) merger.

WeWork stock now trades at a discount of more than 85% to the SPAC IPO price and the market cap is less than $1 billion.

DiDi was among SoftBank investments that went sour. The Chinese ride-hailing company went public in the US in 2021 in a hyped IPO. However, it soon delisted which led to massive losses for investors.

SoftBank also suffered due to the tech crackdown in China as it was the biggest stockholder in Alibaba. Notably, Chinese media highlighted foreign ownership of DiDi to justify the privacy concerns.

Qualcomm was also interested in Arm

Coming back to Arm, as the merger with Nvidia faced regulatory heat, Qualcomm signalled that it was willing to invest in the company.

“If Arm has an independent future, I think you will find there is a lot of interest from a lot of the companies within the ecosystem, including Qualcomm, to invest in Arm,” said Qualcomm’s incoming CEO, Cristiano Amon. He added, “If it moves out of SoftBank and it goes into a process of becoming a publicly-traded company, [with] a consortium of companies that invest, including many of its customers, I think those are great possibilities.”

The IPO market has been dead

Meanwhile, the IPO market has been almost dead, in the UK as well as other developed economies. New listings fell steeply last year as multiple companies postponed their IPO plans due to the deteriorating macro environment.

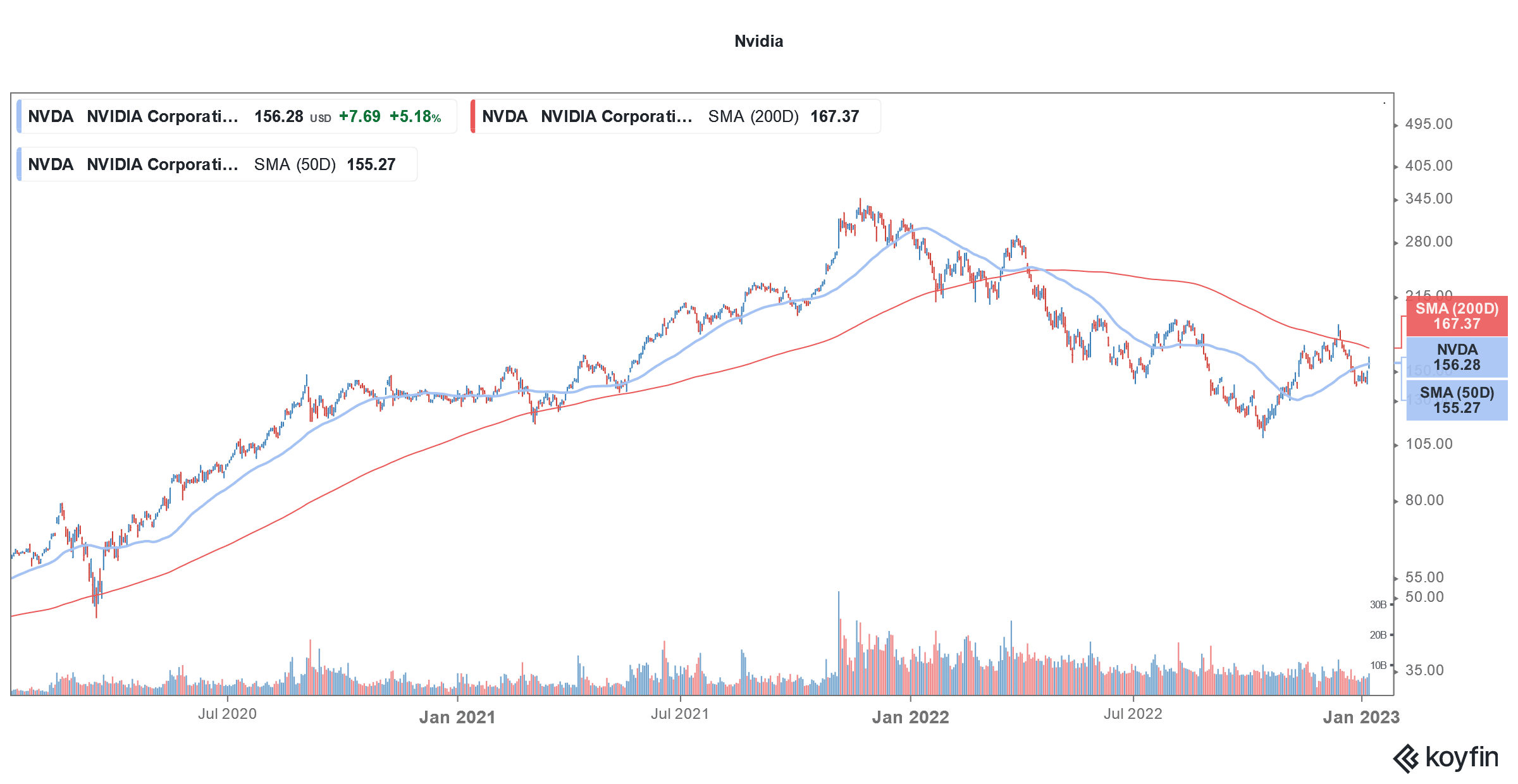

2022 was a tough year for share markets, particularly for tech names. Apple was still the best-performing FAANG share of 2022 and fell around 28%. Alphabet was second with a drawdown of 39%. Amazon, Netflix, and Meta Platforms lost over half of their market caps in 2022. Meta Platforms was the worst performing FAANG share of 2022.

Incidentally, all the FAANG shares underperformed the S&P 500 last year. Only Apple managed to outperform the Nasdaq Composite.

If Arm indeed decides to IPO in the UK, it would need to battle the tepid market for IPOs coupled with the looming recession in the country.

As for Sunak, an Arm IPO would be a shot in the arm. Arm is among the most revered tech companies in the country and a domestic listing would help propel the UK’s image as a global financial powerhouse.

Question & Answers (0)