London Stock Exchange welcomed Novacyt ("Novacyt" or the "Company") to the start of dealings in its shares and admission to the AIM market on 1 November 2017

Paris-based clinical diagnostics biotech Novacyt (NCYT) is Europe’s small cap star of the pandemic.

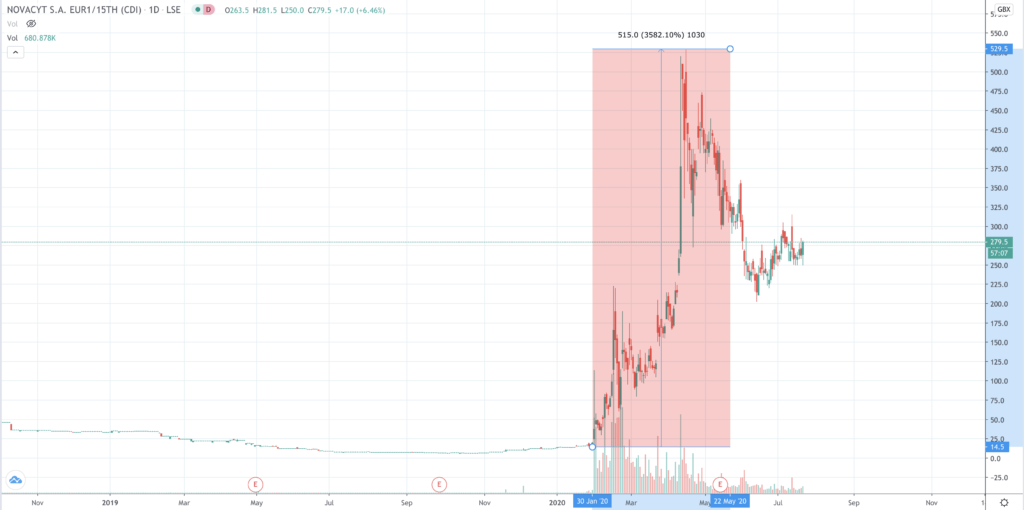

Its share price has rocketed as much as 3,576% since January in response to the global pandemic and the success of its Covid test, which was one of the first to be manufactured at scale.

The shares climbed to their high on 16 April, a week before the company won a giant contract to supply the UK government with Covid test kits, printing 529p

A leader in testing for Covid, its products have become subject to almost insatiable demand from governments and institutions around the world.

Trading statements in early June and on 13 July have confirmed what stock buyers had already anticipated: demand for its test was off the scale.

In June it reported that its Primerdesign product saw total sales worth £40 million with another £80 million worth of orders in the pipeline.

By way of comparison, Novacyt revenue for the previous year was £12 million. In July’s trading statement it reports a 900% increase in revenue for the first half, with a headline figure of £63.3 million, with 91% of that amount being booked in the second quarter.

Novacyt sees ongoing demand into 2021

Significantly, Novacyt says that it expects “ongoing demand” into 2021 – a reflection of the acceleration in the pandemic globally. Indicative of the forward demand, a number of contract have already been extended in the second half and some into 2021 already.

The actual test produced by the Primerdesign division is a Covid-19 polymerase chain reaction molecular test.

Molecular testing establishes the presence of the pathogen by detecting the presence of genetic material of the SARS-Cov-2 virus ,which makes it much more reliable than other methods such as serological testing that relies on determining the presence of antibodies.

The advantage of the antibody tests available from companies such as Cepheid and Mesa Biotech, however, is that they are much faster.

Serious competition to Novacyt is more likely to come from a molecular offering.

A new test developed jointly by Brunel, Surrey and Lancaster universities may yet prove a runner up against the Primerdesign product as far as speed of diagnosis is concerned, but for now Novacyt is still out in front.

Primerdesign has its origins as a spinout from another UK higher education institution – Southampton University.

Novacyt debt-free for first time

Impressively, despite investment to keep pace with demand, the company continues to strengthen its cash position, at £18 million for the end of June compared to £1.6 million at the end of 2019.

The company’s balance sheet has been protected – if not enhanced – by the relatively low cost of production of its test, which is manufactured at nine dedicated sites.

A buoyant cash positions means the firm is debt-free for the first time in the company’s history.

The Anglo-French biotech is also expanding in the US where it has inked a major deal with what it describes as a “a new global strategic partner”.

Novacyt is not resting on its laurels.

Its leading position in testing is buttressed by the launch of three new products (COVID-HT, Exsig Direct and Exsig Mag) aimed at supporting lab testing.

When chief executive Graham Mullis described the first half as “transformational” for the company, he wasn’t exaggerating.

Primerdesign is currently on sale in at least 130 countries around the world, with Germany and the UK leading the way, but not France where it has experienced a rare setback.

That is perhaps surprising given that it is based in France and might have expected a better reception for its testing product there.

However, the French medical authorities are lukewarm on the Novacyt test because it only targets a single gene, even though it does have clinical approval in the country from the highly regarded Institut Pasteur.

The big question for shareholders, and for those on the sidelines looking in, is what happens when a vaccine eventually comes along? That would clearly mean much less testing and presumably a huge hit to the firm’s revenues.

Share price depends on the pandemic’s staying power

Not wanting to be too ghoulish but the longer the pandemic lasts, the better for Novacyt.

In that light, the tendency to look for good news, and the biases that creates in stock market participants’ assessment of hoped-for vaccines, means investors should be aware that despite the announcements from the likes of AstraZeneca and Moderna, it is still likely to be the first half of next year at the earliest before mass production of a good-enough vaccine takes place.

Additionally, the speed with which Novacyt brought its Covid test to market suggests a nimble company adept at facing new challenges. The company has its roots in oncology diagnostics.

The shares are trading more than 5% higher today at 275p, which is indicative of plenty of momentum still in play for this stock. The price distance from the all-time high allows bulls to set their sights on a substantial return on investment even after such a stellar half-year performance.

Having pulled back markedly from its mid-April peak, now may be good time for those looking for a medium-term trading opportunity, but suffice to say that depends on an assessment of the outlook on Covid.

Sadly for the US – but happily for Novacyt shareholders – the pandemic is threatening to get out of control there and this should imply a continued strengthening of demand for the firm’s molecular test.

Question & Answers (0)