Shares of Chinese ride-hailing company Didi Global fell sharply on Friday and look set to tumble tomorrow when the US markets open after the holiday. China has taken down the DiDi Chuxing from the country’s app stores triggering a sell-off in the shares.

China has been concerned over the alleged monopolies and data collection policies of its tech giants. So far, Alibaba has borne the brunt of the country’s crackdown and earlier this year the company agreed to pay a $2.8 billion fine. The country has also shelved the IPO of Alibaba-backed Ant Financial which was set to be the biggest IPO ever. China’s crackdown on Alibaba has been the prime reason the shares have underperformed over the last year despite looking attractively priced.

China tightens the screws on Didi

Meanwhile, China is now tightening the screws on Didi which recently went public and listed on the US markets. The Cyberspace Administration of China (CAC) has banned new downloads of the Didi app in China. However, in a major respite, the users who had downloaded the app prior to the takedown will be able to use the services. Redex Research director Kirk Boodry called the move “aggressive.” He added, ″(It) indicates the process could take a while, but they have a large installed base so near-term impact (is) likely muted for now.”

Meanwhile, the takedown will still hurt Didi’s financial performance. “The Company expects that the app takedown may have an adverse impact on its revenue in China,” Didi said in the release.

Didi had warned in the IPO

The crackdown is coming at an adverse moment just days after Didi raised $4.4 billion in its US listing. To be sure, the crackdown hasn’t exactly come out of the blues and Didi had warned about it in its filings. Commenting on the regulatory issues in China, Didi said in the IPO filings that “We cannot assure you that the regulatory authorities will be satisfied with our self-inspection results or that we will not be subject to any penalty with respect to any violations of anti-monopoly, anti-unfair competition, pricing, advertisement, privacy protection, food safety, product quality, tax and other related laws and regulations.” It added, “We expect that these areas will receive greater and continued attention and scrutiny from regulators and the general public going forward.”

Global Times backs the probe

The Global Times, a tabloid backed by China’s Communist Party sees Didi’s “bid data analysis” as a security threat and backed a probe against the company. “We must never let any internet giant control a super database that has more detailed personal information than the state, let alone giving it the right to use the data at will,” said the Global Times.

Didi has taken a reconciliatory approach and has said it will comply with the orders. “The Company will strive to rectify any problems, improve its risk prevention awareness and technological capabilities, protect users’ privacy and data security, and continue to provide secure and convenient services to its users,” said Didi in its release.

Didi had updated the policy

Incidentally, Didi had updated its privacy policy a day before its US IPO. The company termed it as a “regular update.” Meanwhile, China’s crackdown on Didi highlights yet another risk of investing in Chinese companies. US-listed Chinese companies find themselves in a strange situation. On the one hand, Chinese tech companies are facing troubles in China over data privacy and monopolistic concerns. On the other hand, the US is also cracking down on companies that are seen as too close to the Chinese government or the army. The US also wants greater scrutiny of US-listed Chinese companies after US investors lost heavily in the Luckin Coffee accounting scandal. Chinese companies that don’t comply with the orders, risk getting delisted from the US exchanges.

Notably, the Global Times wants scrutiny of Didi as it is listed in the US and two of its largest shareholders are foreign entities. Softbank is the largest shareholder in Didi while Uber also owns a sizeable stake in the company which is even higher than the 6.5% stake that Didi founder Cheng Wei owns. Uber took the stake in Didi after it sold its Chinese operations to the company. The US ride-hailing company has faced competition from domestic giants in overseas markets. It also sold its India food delivery business to Zomato.

Chinese companies

Chinese companies also acknowledge the risks and have been looking at a dual listing in Hong Kong. Both Alibaba and JD.com have gone for a dual listing in Hong Kong. Alibaba even gave a miss to US markets for Ant Financial IPO and was looking at a dual listing in Shanghai and Hong Kong. However, Jack Ma’s outbursts against the company’s financial regulators led to a stalling of the IPO.

Meanwhile, despite the risks, there is a strong appetite for Chinese companies among US investors. Full Truck Alliance which offers fleet sharing services and is known as the “Uber of trucks” also went public through a US listing last month. However, the performance of Chinese companies which listed in 2021, hasn’t been great. Out of the 34 Chinese companies that went public through a US listing in the first half of the year, nearly two-thirds are trading below the IPO price.

Didi shares could fall

Didi priced its ADR at $14 per share and opened at $16.65 which was almost 19% higher than the IPO price. The shares went on to hit a high of $18.01 but eventually closed at $14.14 which is very near the day’s low of $14.1. Didi shares lost 13.7% from the opening price and managed to only marginally close above the issue price.

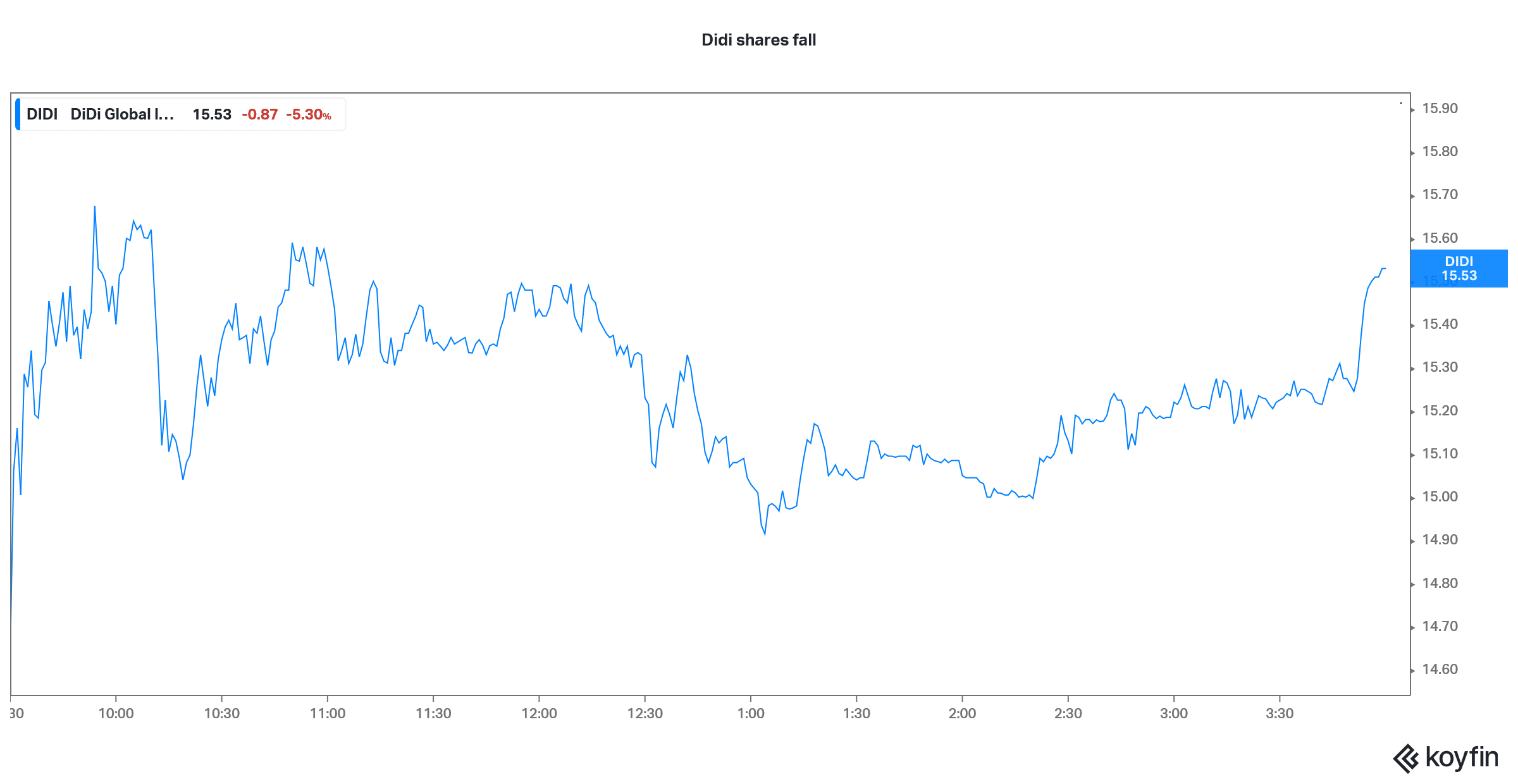

The shares closed down 5.3% at $15.53 on Friday. Looking at the post-market price action, the shares could fall more when the US markets open tomorrow.

Question & Answers (0)