Chinese EV (electric vehicle) companies have released their December 2024 and full-year deliveries and many players had a record month which coincided with the expiry of a subsidy that the Chinese government had provided. Here are the key takeaways from Chinese EV companies’ December and 2024 delivery reports.

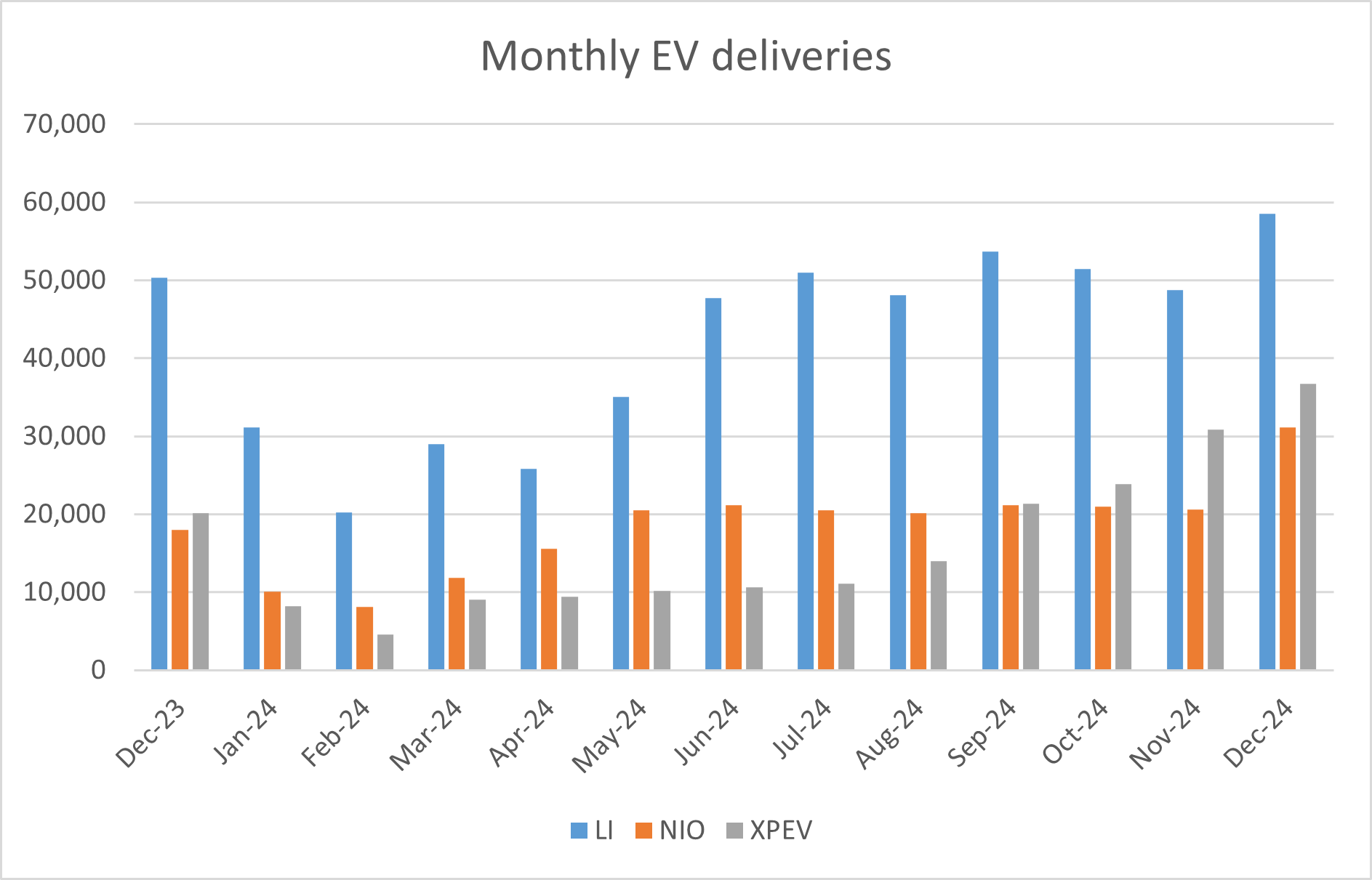

NIO delivered 31,138 vehicles in December which was 72.9% higher YoY and a new record for the Chinese EV company. Its quarterly deliveries also soared 45.2% YoY to a record 72,689. In the full year, NIO delivered 221,970 EVs – a YoY rise of 38.7%. The company’s cumulative deliveries rose to 671,564 at the end of 2024.

NIO officially launched its flagship ET9 model last year and expects to commence its deliveries in March. In April, NIO expects to officially launch Firefly, its low-cost EV model. Last week, NIO announced repurchase rights for its 2027 notes that it had issued in January 2021.

Li Auto Hit a New Milestone in 2024

Li Auto delivered a record 58,513 vehicles in December which was 16.2% higher as compared to the corresponding month last year. In the full year, the company delivered 500,508 vehicles which was a new milestone for the Chinese NEV (new energy vehicle) industry.

“With this milestone, the Company has achieved annual deliveries of over 500,000 vehicles within just five years since its first delivery, setting the record for the fastest growth among premium auto brands in the Chinese market,” said Li Auto in its release.

Li Auto hit another milestone as its cumulative deliveries surpassed 1 million and reached 1,133,872 at the end of 2024. Notably, Li Auto is among the rare NEV companies in China that are posting profits as most players are struggling with perennial losses.

China EV price war

Notably, there has been a brutal price war in the Chinese EV industry since Q4 of 2022 when Tesla started to cut car prices to spur sales. Tesla’s price cuts were followed by similar announcements from other carmakers including Xpeng Motors, Ford, Toyota, and Nissan. Last year, even NIO lowered car prices. Previously the company had categorically said that it wouldn’t join the price war.

As new EV models hit the road, the price war might only escalate in the coming months as companies try to push sales through aggressive pricing. These price cuts have meanwhile taken a toll on the margins of all companies – including Tesla, whose margins were once the envy of the automotive industry.

Zeekr’s deliveries doubled in December

Zeekr delivered 27,190 vehicles in December which was more than twice what it delivered in the corresponding month last year. It delivered 222,123 vehicles in 2024 which was 87% higher compared to the previous year. The company’s cumulative deliveries reached 418,756 vehicles at the end of 2024. It is targeting annual deliveries of 320,000 in 2025 which is 44% higher than the last year.

The Geely-backed company went public last year only and joined the ranks of multiple other Chinese EV companies that trade on the US markets.

Xpeng Motors reported record EV deliveries

Xpeng Motors delivered 36,695 EVs in December. The company’s deliveries rose 82% YoY and hit a new record during the month. Importantly, it was the second consecutive month that the company’s monthly EV deliveries topped 30,000. Xpeng Motors said that monthly deliveries of its Mona MO3 were over 10,000 for the fourth consecutive month.

“The MONA M03 achieved its 50,000th vehicle production milestone in just four months since its launch, setting a new record for XPENG’s fastest production rollout and continuing to break delivery records for pure electric vehicle production among emerging automakers in China,” said Xpeng Motors in its release.

Notably, the low-cost Mona models have been a hit with Chinese consumers and have helped propel Xpeng Motors’ EV deliveries.

Xpeng Motors also has autonomous driving capabilities which are among the most advanced in China. In its release, Xpeng Motors said, “XNGP‘s monthly active user penetration rate in urban driving reached 85.12% in December. This month, XPENG hosted the XPENG Turing AI Smart Driving Open Day, showcasing China’s first “door-to-door” capabilities. Looking ahead, XPENG aims to deploy its one-step end-to-end large models to more driving scenarios, further elevating customers’ smart driving experiences.”

Xpeng Motors is also working on robotaxis and humanoids like Tesla. The company also has a flying car subsidiary.

BYD’s 2024 EV deliveries were slightly short of Tesla

BYD delivered 514,809 vehicles in December and while the sales were up by just about 1.6% as compared to November, it was a record high and the third consecutive month when the company’s deliveries were above 500,000 units. Notably, BYD sells both BEVs (battery electric vehicles) and PHEVs (plug-in hybrid vehicles) and is the biggest global seller in the category.

However, when it comes to BEVs, Tesla is still the market leader, and the Elon Musk-run company delivered 1.79 million EVs last year which was slightly ahead of BYD’s 1.76 million deliveries. That said, it was the first time that Tesla’s EV deliveries dipped on a YoY basis as the company struggled to grow sales in an increasingly competitive market.

Tesla’s EV deliveries fell in 2024

Notably, Tesla was optimistic about its 2024 deliveries rising on a YoY basis and Musk even touted up to 30% delivery growth for 2025. Tesla stock soared after Donald Trump’s election and the company added over $300 billion to its market cap in November. Brokerages also turned incrementally bullish on the US EV giant after Trump’s election.

Morgan Stanley listed Tesla as a top pick for 2025. In its note, the brokerage said, “From our ongoing client discussions, we hear enthusiasm for all things AI, datacenters, renewable energy, robotics and on-shoring. Investors acknowledge the importance of the United States maintaining leadership in such technologies in an increasingly competitive and complex geopolitical environment.”

Deutsche Bank also named TSLA as a top pick for 2025 and said, “While there has been debate over the right approach to achieving full autonomy, our view is that true commercial success in robotaxi is achieved through end-to-end AI. As such, we believe Tesla is well positioned.”

Meanwhile, Tesla’s Q4 EV delivery numbers came in as a disappointment and the stock is down sharply in early US price action today. Chinese EV companies are trading on a mixed note and while Xpeng Motors is in the red, NIO and Li Auto are trading in the green.

Question & Answers (0)