Things are getting from bad to worse for Chinese shares. The Hang Seng index is down 12% so far in 2024 and has fallen to a 15-month low. Chinese EV (electric vehicle) shares have fared much worse and last week NIO shares fell to the lowest levels since 2020.

Markets have been concerned about Chinese shares after a flurry of economic data showed that the world’s second-largest economy continues to sag. The country’s real estate and banking sectors continue to be in turmoil and the Chinese government has so far refrained from large-scale stimulus to revive the economy. The Chinese Central Bank has also kept policy rates on hold while markets were expecting a rate cut.

Dickie Wong, executive director at Kingston Securities believes that the sell-off in Chinese shares is a “capitulation” and added, “No matter what the central bank does, it will not change the fact that foreign investors have zero confidence in this market now.”

NIO share falls to lowest level since 2020

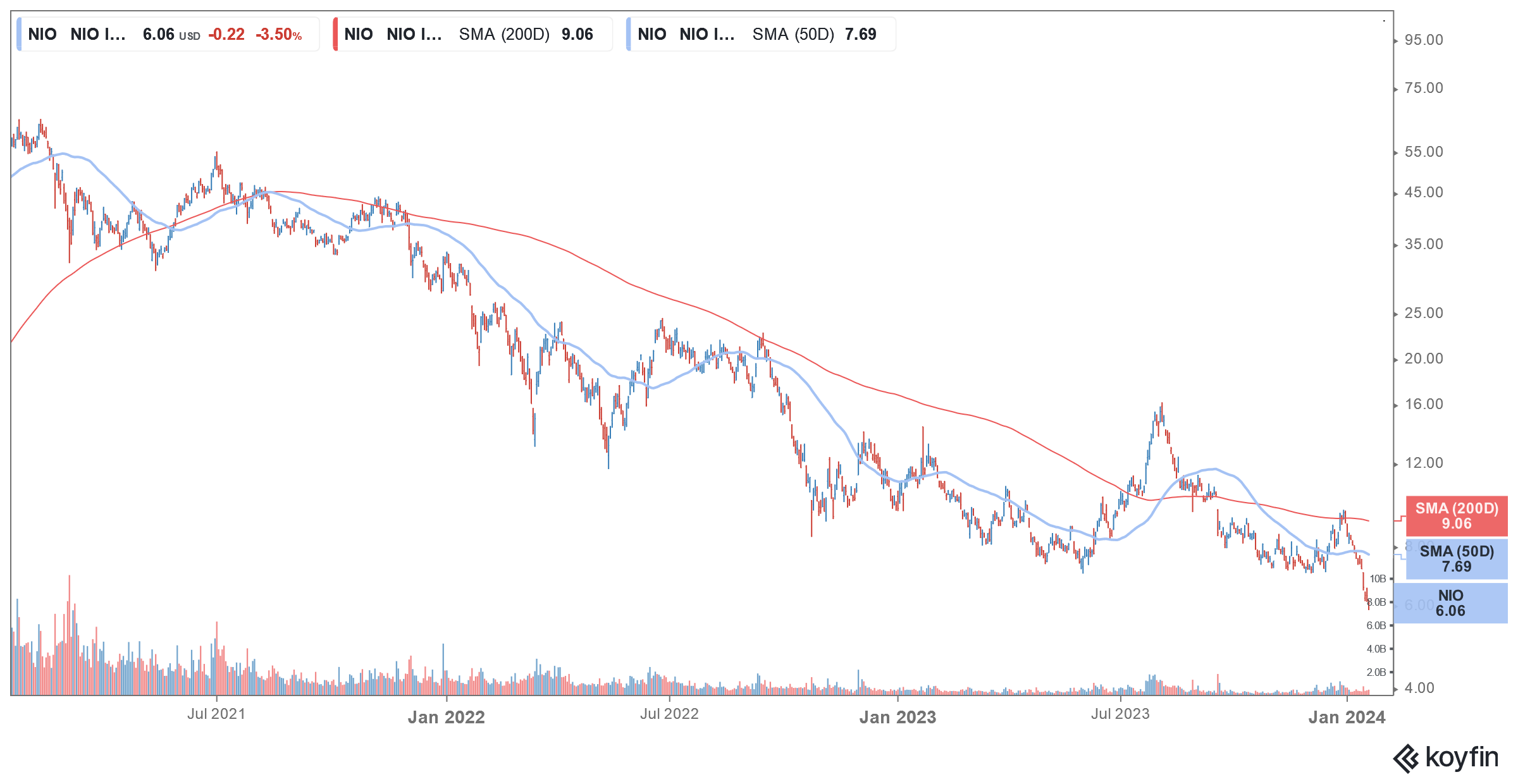

NIO share has fallen to the lowest level since June 2020 amid the growing pessimism towards Chinese shares. Notably, 2020 was a pivotal year for NIO share and from surviving a bankruptcy scare in Q1 2020, the share went on to gain over 1,110% for the year. The share hit their all-time high in early 2021 and its market cap topped $100 billion.

Since then, the share has been in a freefall, and after closing in the red for three consecutive years, it has already lost 28% in 2024. Rival Chinese automaker Xpeng Motors lost 31% but was in the green last year. 2023 was a mixed year for Chinese EV companies and while NIO shares fell 7% during the year, Xpeng Motors and Li Auto respectively rose 47% and 83%.

NIO delivered a YoY rise in December deliveries

NIO delivered 18,012 vehicles in December which was 13.9% higher than what it did in 2022. The company’s deliveries rose 25% to 50,045 vehicles in Q4. In the full year, the company’s deliveries rose 30.7% to 160,038 and its cumulative deliveries reached 449,594.

In Q3, NIO reported revenues of $2.61 billion – 46.6% higher YoY and 117.4% higher than the second quarter. The company’s vehicle sales revenues rose 45.9% YoY to $2.39 million.

The price war has taken a toll on EV companies’ margins

In Q3, NIO generated gross profits of $208.8 million and while it was 12.2% lower than the corresponding quarter last year, it was up sharply from the previous quarter. Also, its gross margins also improved to 8% in Q3 as compared to 1% in Q2. The company’s vehicle margin also rose to 11% versus 6.2% in the second quarter.

The Chinese EV company expects vehicle margins to rise to 15% in the fourth quarter and expects them to rise to between 15%-18% in 2024.

The margins of EV companies have taken a hit amid the price war which intensified further when Tesla lowered car prices in China earlier this month.

NIO reported a net loss of $663.9 million in the third quarter continuing its streak of losses. Like fellow startup EV companies, NIO is also looking at ways to cut its losses and cash burn and last year announced a 10% reduction in its workforce along with other cost-cut measures. It has also revamped its sales team to spur sales.

NIO bagged investment from UAE’s CYVN Holdings

Last month, NIO bagged a $2.2 billion investment from UAE’s CYVN Holdings which was its second investment from the investment giant

In July, CYHN invested $738.5 million in newly issued shares of NIO and purchased another $350 million from Tencent CYVN also got two directors on NIO’s board as part of the deal.

Cash-rich countries in the Middle East are pivoting to green energy. Saudi Arabia for instance has formed a joint venture with Foxconn to produce electric cars in the country. The country’s sovereign wealth fund PIF (public investment trust) has invested billions of dollars in Lucid Motors and is the largest shareholder of the company with over 60% stake.

Volkswagen invested in Xpeng Motors

NIO is not the only Chinese EV company getting international attention and last year Volkswagen partnered with Xpeng Motors to build two EVs on its platform. The German auto giant also bought a stake in the company for a total consideration of $700 million. The deal was a pathbreaker for the Chinese EV industry as it reflected the confidence of the global auto giant in a startup EV company.

Xpeng Motors has been advancing its autonomous driving capabilities and in August it also acquired the self-driving assets of Chinese ride-hailing app Didi. As part of the $744 million deal, Didi took a 3.25% stake in Xpeng in exchange for its EV and autonomous driving assets. Xpeng has expanded its self-driving capabilities to over 250 Chinese cities one year ahead of schedule.

Analysts on NIO share

Meanwhile, analysts are mixed on NIO share amid the turmoil and earlier this month, Bank of America downgraded the share from a buy to neutral and said, “NIO does not have new models for 1Q-3Q24, therefore its volume sales growth could be lower.”

Deutsche Bank analyst Edison Yu is optimistic about NIO’s upcoming ET9 and said, “The new ET9 appears to be a proper flagship model featuring the latest cutting-edge tech (new AD chip replacing Orin, 3 lidars, 900V, 5C charging) and premium features (steer-by-wire, SkyRide suspension).”

He however added, “NIO Day didn’t change our thesis or near-term expectations. In a best-case scenario, ET9 can generate incremental excitement around the brand and act as a halo vehicle. Tactically, the key for the share will be boosting sales volume after the big sales force revamp.”

Meanwhile, NIO and other Chinese shares like Xpeng Motors and Alibaba are trading lower in US premarket price action today as the sell-off in Chinese shares continues unabated.

Question & Answers (0)