Four FAANGs – a term used for Facebook, Apple, Amazon, Netflix, and Google-parent Alphabet – report their earnings this week. The current week is the busiest this earnings season with almost one third of S&P 500 and Dow Jones components reporting during the week.

FAANG earnings on tap

Apple, Amazon, Facebook, and Alphabet will all release their quarterly earnings on Thursday, 29 October.

So far only Netflix from the FAANG pack has reported its earnings. Netflix shares fell despite posting better than expected earnings, after it reported disappointing subscriber growth. Also, the company said that it expects subscriber growth in the fourth quarter to be lower than the corresponding quarter last year.

Given their mammoth market capitalisations, FAANG stocks tend to have an impact on the broader market indices. With four FAANG names set to release their earnings this week, the stock markets might also react to the earnings, setting the direction for markets, alongside the dimming hopes around stimulus talks.

Let’s now consider analyst projections for the four FAANG stocks this quarter.

Apple earnings expected to fall

Apple is the biggest FAANG share by market capitalisation. Analysts polled by Tikr expect Apple to generate revenues of $63.7 billion in the fiscal fourth quarter 2020, down 0.5% from the corresponding quarter last year. If analysts’ estimates are correct then this would be the first quarter since the second quarter of fiscal 2019 when Applelast reported a revenue decline. Apple’s adjusted earnings per share is also expected to fall 7% year on year to $0.70 in the quarter.

Delayed iPhone launch to hit earnings

The expected fall in earnings looks to be primarily because of the delayed launch of this year’s iPhone models. Typically, the new iPhone is launched a few days before the quarter’s end and the early sales get included in the quarter. However, this year, Apple delayed the event due to the pandemic – it was held earlier this month.

During Apple’s earnings release, markets will watch closely management’s commentary on the demand trend for the new iPhone 12 Pros (the Max and Mini models ship after the Pro). That said, Apple hasn’t provided a quantitative guidance for the last two weeks due to the pandemic.

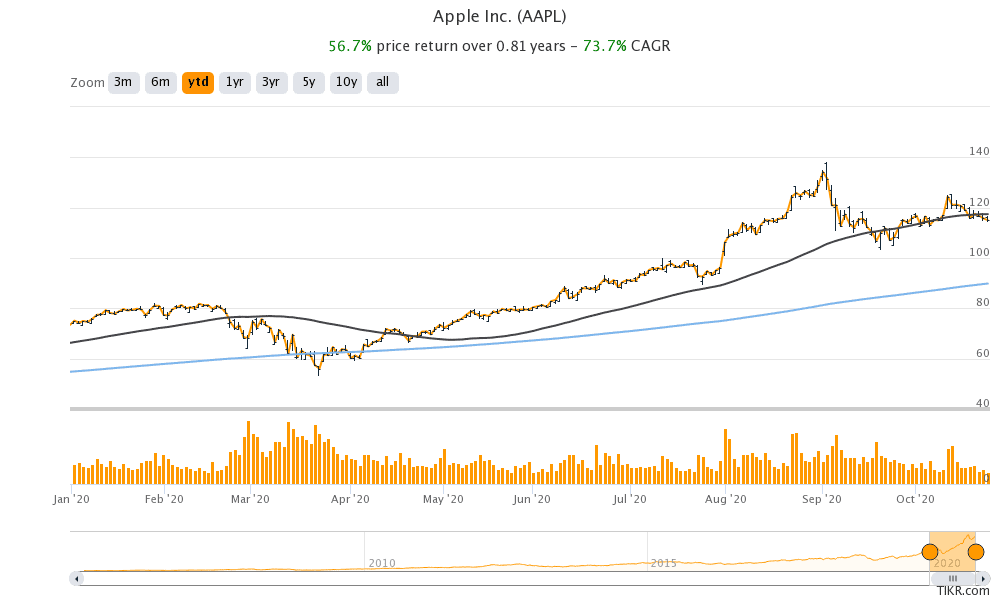

Second best-performing FAANG stock

Apple could be among the best ways to play the 5G story. However, the sharp rally in Apple shares has already lifted its valuation to the highest since 2007 when the iPhone cycle was in the early stages.

With a year-to-date return of 56%, Apple is the second-best performing FAANG stock this year. Apple is Berkshire Hathaway’s largest holding; Amazon is the other FAANG stock in Berkshire Hathaway’s portfolio.

Amazon is the best-performing FAANG stock this year

Shares of Amazon gained 73% so far in 2020, making it the best-performing FAANG share based on the metric. The pandemic has helped increase the pace of of digitisation and an increasing number of consumers are shopping online. While soaring online sales has helped bricks and mortar retailers such as Tesco make up for lost sales in stores, it has been a boon for Amazon, which posted record earnings in the second quarter.

Wall Street analysts expect Amazon’s growth juggernaut to continue in the third quarter, forecasting sales to rise 32% year over year in the quarter. Its adjusted earnings per share is expected to rise 70% over the corresponding quarter in 2019 to $7.16.

Amazon has two main business verticals, namely the cloud and the ecommerce divisions. Both these segments are seeing strong growth and investors have poured money into the Jeff Bezos-founded company, lifting its valuations.

Amazon stock is down almost 10% from its 52-week high of $3,552.25 and could be the FAANG share to watch this earnings season. Most analysts see any fall in Amazon shares as a buying opportunity.

FAANG face antitrust allegations and digital tax

That said, Amazon is battling antitrust allegations in the US as well as Europe. Lawmakers have backed calls for breaking up big tech companies. Tesla’s CEO Elon Musk also backed the idea of breaking up Amazon earlier this year. Regulators have especially been concerned with Amazon using data to gain an advantage over the millions of small sellers on its platform.

Most countries across the globe are contemplating a digital tax that would hit US tech giants and the FAANG stocks. France has already approved a digital tax and the move did not go down well with the Trump administration. Other European nations might also move forward with a digital tax.

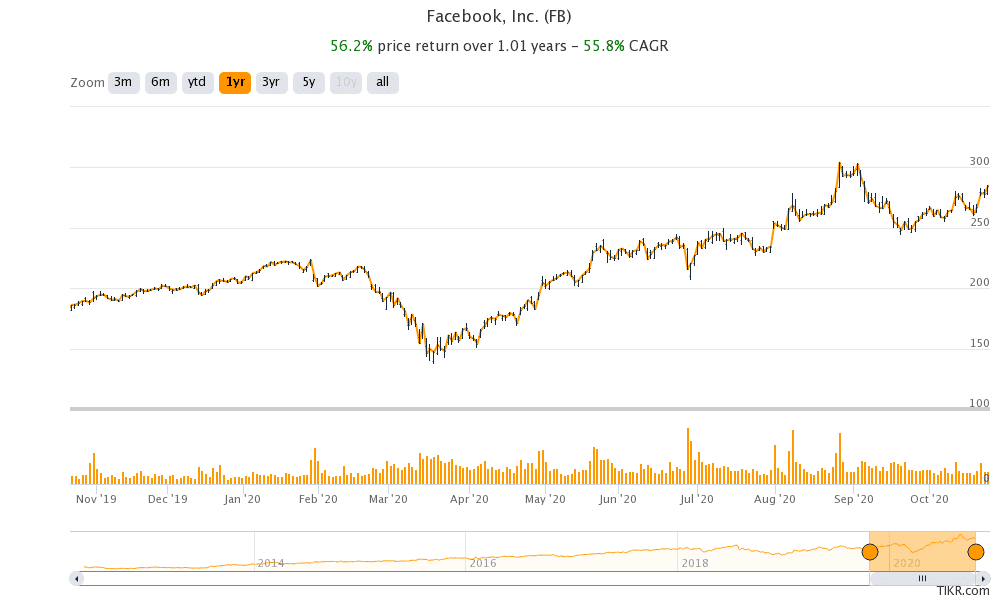

Facebook’s Q3 earnings – a SNAP in the ointment

Facebook has been under the radar this year, amid incidences of hate speech and many advertisers deciding to stop spending on the social media company. Facebook’s pain has been Snap’s gain. During the third quarter earnings call, Snap management alluded to the fact that it has seen a shift of some advertisers from Facebook.

Facebook shares are up 38% so far in the year. Looking at the consensus estimates, analysts expect the company to report revenues of $19.7 billion, a year over year rise of 12%. Ad rates improved in the third quarter and that should help Facebook’s bottom line. However, analysts expect Facebook’s adjusted earnings per share to fall by 10.1% to $1.91 in the third quarter.

Facebook and US elections

During Facebook’s third quarter earnings call, markets would look for commentary from the management on how the company has been taking steps to prevent any possible chaos after the US elections. US President Donald Trump might contest the elections in the event of his defeat.

Facebook has been under scrutiny since the 2016 presidential election, amid reports that its platform was used by foreign entities and states to influence US voters. The huge amounts of data that FAANG companies hold have been making several regulators apprehensive.

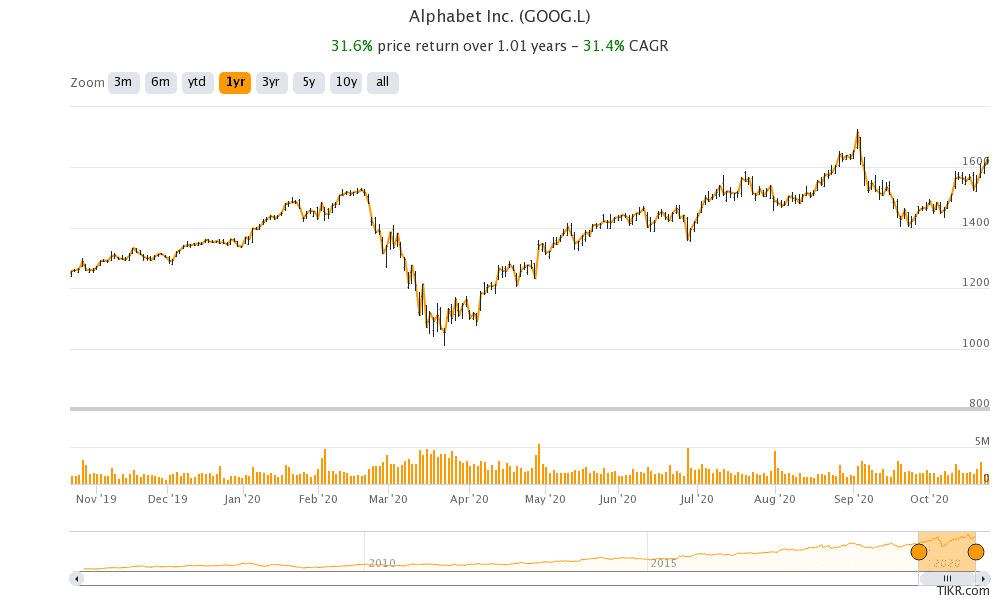

Alphabet is the worst performing FAANG this year

Alphabet is up 22% so far in 2020 and is the worst-performing FAANG stock. Analysts expect Alphabet to post revenues of $42.8 billion in the third quarter, a year over year increase of 5.7%. The company’s revenues fell 1.7% in the second quarter as ad rates plummeted during the pandemic.

Both Alphabet and Apple have been facing scrutiny over the alleged monopolistic behaviour on their app store. In August, both the companies had booted Epic Games saying that the maker of popular games Fortnite violated the terms. Epic Games sued the companies accusing them of unfair behaviour.

During Alphabet’s earnings call, markets will watch out for direction on ad rates as well as ad spends by advertisers.

Overall, the week looks action-packed with four FAANG earnings, three of them with market capitalisations of more than a trillion dollars each.

Question & Answers (0)