Berkshire Hathaway has released its second-quarter 13F yesterday. The filing shows the holdings that fund managers have at the end of the quarter and the buys and sells during the quarter.

Berkshire Hathaway had released its second-quarter earnings earlier this month only which revealed that the Warren Buffett-led conglomerate was a net seller of stocks in the quarter. This was the third consecutive quarter where the company was a net seller of stocks which means that it sold more stocks than it bought in the quarter.

Over the last couple of years, Buffett hasn’t been able to identify many new stocks to buy. He was a net seller of stocks in the first and second quarter of 2020 also. The Oracle of Omaha was selling stocks even during the crash last year. This came as a surprise to many as he has long preached to be greedy when others are fearful.

Berkshire Hathaway 13F

Meanwhile, the second quarter of 2021 was even more muted for Berkshire Hathaway than we’ve seen over the last couple of years. There was no new addition to the portfolio. The conglomerate sold shares of pharma companies in the quarter. Berkshire Hathaway exited its stake in Biogen and also trimmed the stakes in Merck, Bristol-Myers Squibb, and AbbVie. Notably, the company took a stake in drugmakers in the second half of 2020 when the COVID-19 cases in the US were rising.

Buffett sells drugmaker stocks

However, it has been trimming stakes, in these stocks and had sold some shares in these three companies in the first quarter also. Berkshire Hathaway had added more shares of Bristol Myers Squib and Merck in the fourth quarter of 2020. Generally, Buffett starts with small positions in companies and then gradually scales up. Apple is a prime example where the company gradually increased its stake between 2016 and 2018. While Berkshire Hathaway hasn’t added any new Apple shares since the third quarter of 2018 and instead sold some shares, the iPhone maker is its largest holding by a wide margin.

Berkshire Hathaway sold $411 million worth of shares of Axalta Coating Systems. The company has been holding these shares since 2015. It also lowered the stake in General Motors shares by around 10% in the quarter. The largest automaker in the US has been strong this year and shares recently hit their highest level since it emerged out of bankruptcy.

Berkshire Hathaway bought Kroger shares

Berkshire Hathaway increased its stake in Kroger by 21% in the quarter. The conglomerate had bought Kroger shares first in 2019 and added to the position in the first quarter of 2019 also. The company also increased the stake in British insurance company Aon in the second quarter and holds over a $1 billion stake. Berkshire had first disclosed a stake in Aon in the first quarter of 2021.

Buffett runs a concentrated portfolio

Berkshire Hathaway has a concentrated portfolio and Apple is the largest holding with a $121 billion value. He sold some shares last year which the Oracle of Omaha now regrets. “We got a chance to buy it and I sold some stock last year…that was probably a mistake,” said Buffett. The Oracle of Omaha has admired Apple products and leadership. Last year, he also ditched his flip phone for an Apple iPhone.

According to Buffett “A car costs $35,000 and I’m sure with some people if you asked them whether they wanted to give up, had to give up, their Apple, they’d give up their car.” He termed Apple as “indispensable” and a “huge huge bargain.” Notably, Buffett sees Apple as a consumer products company and not as a tech company.

Berkshire Hathaway top holdings

Apart from Apple, Bank of America, American Express, and Coca-Cola are the other top four holdings for Berkshire Hathaway. The company hasn’t added any new American Express and Coca-Cola shares for years now. However, it added more Bank of America shares over the last year. Buffett also made an exception for Bank of America shares and lifted the stake above 10%, something which he has tried to avoid in the past. Notably, while Berkshire Hathaway has fully exited names like JPMorgan Chase and Goldman Sachs, and sold most of Wells Fargo shares, he continued to add more Bank of America shares.

Cash pile

Berkshire Hathaway was a net seller of shares to the tune of $1.1 billion in the quarter. It repurchased $6 billion worth of its shares in the quarter but ended up with a massive cash pile of $144.1 billion at the end of the second quarter. It has been a high-class problem for Buffett and vice chairman Charlie Munger.

While the business has been generating a lot of cash, and Berkshire collects billions of dollars as dividends from investee companies, the duo hasn’t been able to identify good investment opportunities. The company has found some solace in repurchases but could slow them down now after the massive rise in Berkshire Hathaway shares in 2021. The second quarter repurchases were lower than what the company made in the first quarter.

Berkshire Hathaway earnings

Berkshire Hathaway’s earnings had soared in the second quarter amid the recovery in the US economy. Its revenues increased to $69.1 billion versus $56.8 billion in the second quarter of 2020. The net income, which can be volatile due to mark to market losses on the equity portfolio, was $28 billion in the quarter. Meanwhile, the operating income, which is a better metric for the conglomerate was $6.69 billion in the quarter—21% higher than what it posted in the corresponding quarter in 2020.

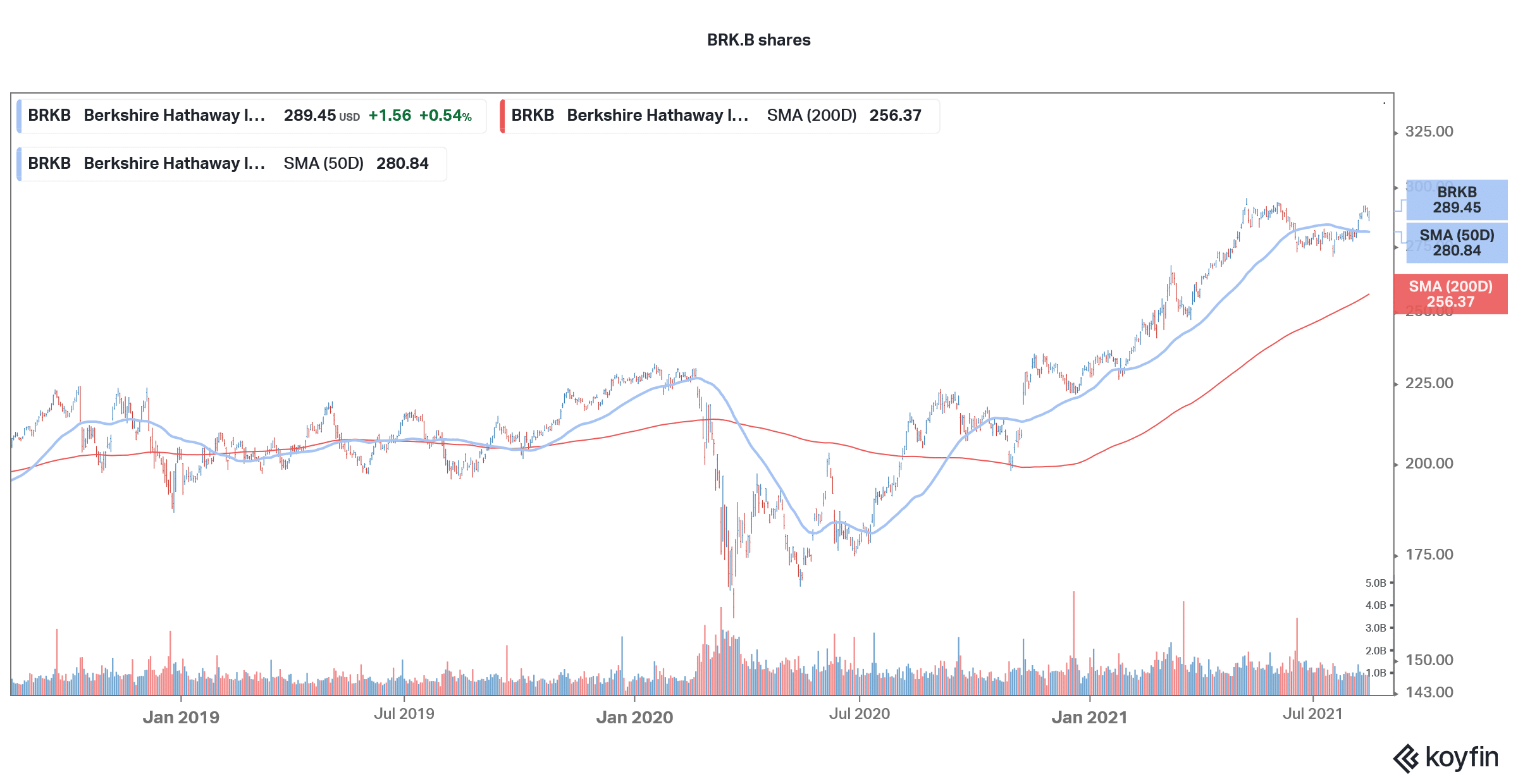

Berkshire Hathaway shares are outperforming the S&P 500 slightly in 2021. However, it is coming after two consecutive years of underperformance where the shares underperformed the index by double-digit percentages. The pivot towards value shares has helped Berkshire shares in 2021.

Buffett might continue to be patient

The massive cash that the company holds might come into play if the markets crash. However, despite fears of overvaluation and a market crash, we’ve instead seen fresh all-time highs. Under such a scenario, Buffett might continue to be patient and wait for his elusive “elephant-sized acquisition.

Berkshire Hathaway shares were trading flat in US premarket price action today but are up almost 27% for the year.

Question & Answers (0)