Over the weekend, Berkshire Hathaway held its annual shareholder meeting which was conducted online for the second consecutive year due to the COVID-19 pandemic. Here at the key takeaways from the event.

The meeting was held in Los Angeles. This is for the first time in over 50 years that the event which is known as “Woodstock for Capitalists,” was held outside Omaha, Buffett’s hometown. Many have been speculating whether Buffett is hunting for a target in the region. Disney, KB Home, and Snap are the leading publicly traded companies in the region.

Berkshire Hathaway was a net seller of shares in the first quarter

Berkshire Hathaway was a net seller of shares in the first quarter of 2021. Buffett was a net seller of shares in the first and second quarter of 2020 also as the Oracle of Omaha failed to capitalise on the crash in US share markets. He also sold all the four airline companies that Berkshire Hathaway was holding in April 2020.

Warren Buffett continues to scale up buybacks

While Buffett hasn’t been a fan of buybacks, the company has scaled up share repurchase over the last year. It repurchased $6.6 billion worth of its shares in the quarter. In 2020, Berkshire Hathaway repurchased $27.4 billion worth of its shares. Previously, the company used to repurchase shares only when they were trading up to 120% of the book value. However, the company subsequently changed the policy to a more qualitative one which gives Buffett and vice chairman Charlie Munger more leeway on deciding on buybacks.

Berkshire Hathaway’s cash pile soars

Meanwhile, despite spending generously on buybacks, Berkshire Hathaway’s cash pile increased in the quarter as it was a net seller of shares. Also, the billions of dollars that the company generates from its core operations and the massive dividends that it collects from the investee companies, adds to its cash kitty.

Commenting on buybacks, Munger said, “If you’re repurchasing stock just to bull it higher, it’s deeply immoral.” However, he added, “But if you’re repurchasing stock because it’s a fair thing to do in the interest of existing shareholders, it’s a highly moral act, and the people that are criticizing it are bonkers.”

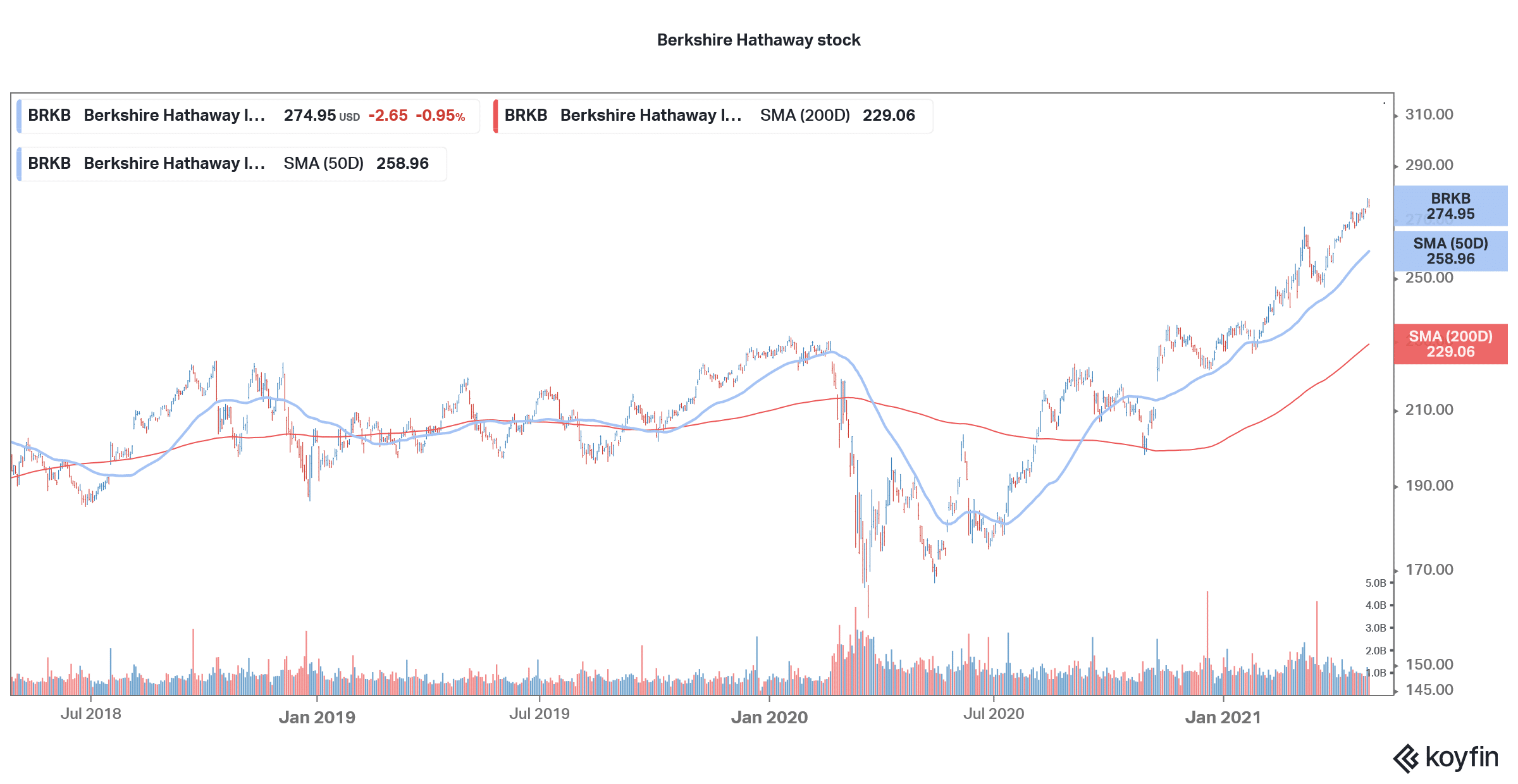

S&P 500 versus Berkshire Hathaway shares

After underperforming the S&P 500 by a wide margin in both 2019 and 2020, Berkshire Hathaway is outperforming the index this year partially because of the shift from growth to value shares. At last year’s annual shareholder meeting, Buffett had recommended that investors would be better off buying an index fund.

He reiterated his views in the 2021 annual meeting. “I recommend the S&P 500 index fund. I’ve never recommended Berkshire to anybody because I don’t want people to buy it because they think I’m tipping them into something. On my death there’s a fund for my then-widow and 90% will go into an S&P 500 index fund.”

Meanwhile, Munger held different thoughts and advocated buying Berkshire Hathaway shares instead of the index. “I personally prefer holding Berkshire to holding the market,” said Munger. The nonagenarian added, “I’m quite comfortable holding Berkshire. I think our businesses are better than the average in the market.”

Warren Buffett on bitcoin

Meanwhile, Buffett, who has called bitcoin a “rat squared poison” in the past did not comment on the rise in the cryptocurrency during Berkshire Hathaway’s annual meeting. However, Munger took the baton from Buffett and said that he “hates” the success of bitcoin.

“I don’t welcome a currency that’s so useful to kidnappers and extortionists and so forth. Nor do I like just shuffling out a few extra billions and billions and billions of dollars to someone who just invented a new financial product out of thin air,” said Munger. He added, “I think I should say modestly that I think the whole damned development is disgusting and contrary to the interests of civilization, and I’ll leave the criticism to others.”

Berkshire Hathaway and Apple

Apple is Berkshire Hathaway’s largest holding but Buffett hasn’t bought any shares since the third quarter of 2018. He sold some shares last year which the Oracle of Omaha now regrets. “We got a chance to buy it and I sold some stock last year…that was probably a mistake,” said Buffett.

According to Buffett “A car costs $35,000 and I’m sure with some people if you asked them whether they wanted to give up, had to give up, their Apple, they’d give up their car.” He termed Apple as “indispensable” and a “huge huge bargain.” Notably, Buffett sees Apple as a consumer products company and not as a tech company. He has also been supportive of Apple’s massive buybacks in the past.

Buffett and Munger on inflation and the federal deficit

Buffett and Munger also shared their insights on rising inflation and burgeoning US fiscal deficit. US debt to GDP is already above 100% and threatens to go much higher as the Biden administration unveils trillions of dollars of investments in infrastructure.

“People have money in their pocket and they’re paying higher prices,” said Buffett adding that “it’s almost a buying frenzy.” Berkshire Hathaway owned companies have also been raising prices. Buffett admitted that inflation is currently higher “than people would have anticipated six months ago.”

Munger raised an alarm over the rising fiscal deficit. “The Modern Monetary Theorists are more confident than they ought to be, too. I don’t think any of us know what’s going to happen with this stuff,” said Munger. Proponents of Modern Monetary theory advocate that governments can raise as much money as they can in the domestic currency.

Modern Monetary theory

However, those against the argument point to the systemic risk from higher debt even as technically no government can default on the debt in its domestic currency as they can print money to pay off the dues.

Munger added, “I do think there’s a good chance that this extreme conduct is more feasible than everybody thought. But I do know that if you just keep doing it without any limit it will end in disaster.”

Berkshire Hathaway on capital gains taxes

On a related note, the duo also commented on the proposed tax hikes from the Biden administration. The tax hike would be negative for companies like Berkshire Hathaway. Not only is Biden proposing a corporate tax hike, but he is also looking at raising the capital gains tax. As a conglomerate with billions of dollars in unrealized capital gains taxes, Berkshire Hathaway might end up paying a lot more in capital gains taxes if they are indeed raised.

Warren Buffett on Robinhood

Buffett and Munger also expressed their opinion over the popular trading app Robinhood. “It’s become a very significant part of the casino group that has joined into the stock market in the last year or year and a half,” said Buffett.

“There’s nothing illegal about it. There’s nothing immoral, but I don’t think you’d build a society around people doing it,” Buffett added. However, he said that he would like to read the IPO documents of the trading app. Robinhood is rumoured to go public this year through a direct listing. Fellow trading app eToro has announced a reverse merger with FinTech Acquisition Corp. V in a $10.4 billion deal.

“I think the degree to which a very rich society can reward people who know how to take advantage, essentially, of the gambling instincts of the American public, the worldwide public — it’s not the most admirable part of the accomplishment,” said Buffett on Robinhood. Munger was also critical of the popular trading app.

Berkshire Hathaway versus SPACs

It’s been more than two years since Buffett said that he is looking at a big acquisition which he termed as an “elephant-sized acquisition.” However, Berkshire Hathaway’s hunt for a merger target has been further complicated by scores of SPACs that are willing to pay a premium.

“If you’re running money from somebody else and you get a fee and you get the upside and you don’t have the downside, you’re going to buy something,” said Buffett on SPACs. “And frankly we’re not competitive with that. It’s an exaggerated version of what we’ve seen in kind of a gambling-type market,” added Buffett.

Cheap money

Notably, the abundance of cheap money led by low interest rates has meant that too much money is chasing too little quality assets. Even before SPACs took off in 2020, Berkshire Hathaway was facing competition from private equity companies that use leverage to shore up their capital.

“That won’t go on forever, but it’s where the money is now and Wall Street goes where the money is,” said Buffett on the SPAC mania. He added, “SPACs have been working for a while and if you secure a famous name on it you could sell almost anything.”

Berkshire Hathaway bets on boring business

Berkshire Hathaway has made most of its money betting on established companies and not on the so-called “disruptive technologies.” During the annual day, Buffett seemed to take a swipe at investors chasing high growth industries with poor financials.

“There’s a lot more to picking stocks than figuring out what’s going to be a wonderful industry in the future,” said Buffett. He gave the example of how there were 2,000 automotive companies in the early 1990s as investors were bullish on the industry. He highlighted that by 2009, only three were left and two of these went bankrupt.

Question & Answers (0)