How to Invest in Bitcoin UK – Beginner’s Guide

In the 11 months prior to writing this guide, Bitcoin has gone from a price of $5,000 to over $57,000. That’s an increase of over 1,000% in less than a year.

Had you instead invested in the FTSE 100 – you would be looking at gains of 32% during the same period. As such, Bitcoin is the best-performing asset class of this pandemic-dominated era.

If you’re looking to get in on the action, this guide on How to Invest in Bitcoin UK will walk you through the process step-by-step.

This includes the process of choosing a trusted Bitcoin broker, the potential risks and rewards to consider, and what strategies you might want to undertake.

How to Invest in Bitcoin UK Quick Tutorial

Wondering how to invest in Bitcoin UK in the fastest and most cost-effective way? Follow to quickfire steps below to invest in Bitcoin in less than 10 minutes!

- Choose a Bitcoin Broker: You’ll first need to choose a trusted Bitcoin broker.

- Deposit Funds: You now need to make a deposit with a UK debit/credit card, e-wallet, or bank transfer.

- Invest in Bitcoin UK: Finally, select Bitcoin from the list of support cryptocurrencies and enter the amount you wish to buy. The minimum is just $25.

Choose a Bitcoin Investment Platform

As noted above, the most important part of the Bitcoin investment process is to select a suitable online platform carefully.

This will allow you to invest in Bitcoin from the comfort of your home and you will be able to use a convenient UK payment method to complete the purchase. You do, however, need to assess whether the platform is safe, what fees will apply, and what the minimum Bitcoin investment is.

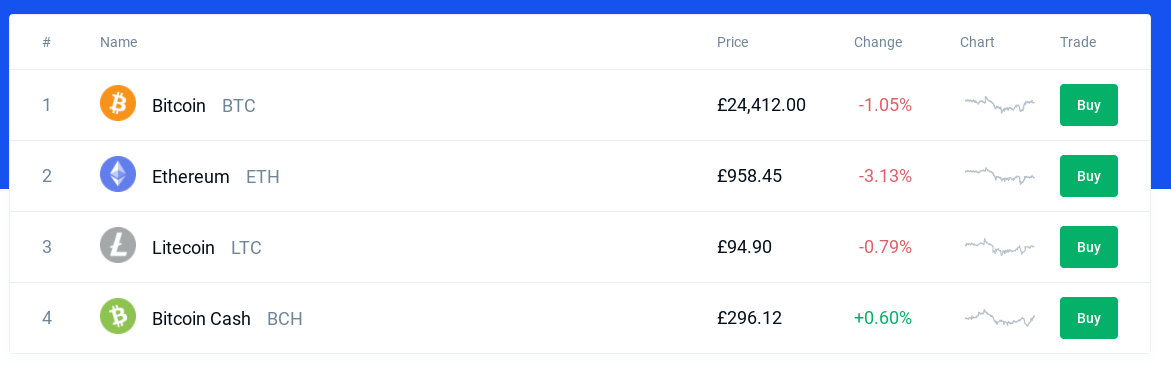

To help you choose a suitable Bitcoin trading platform, below we discuss a selection of top-rated providers.

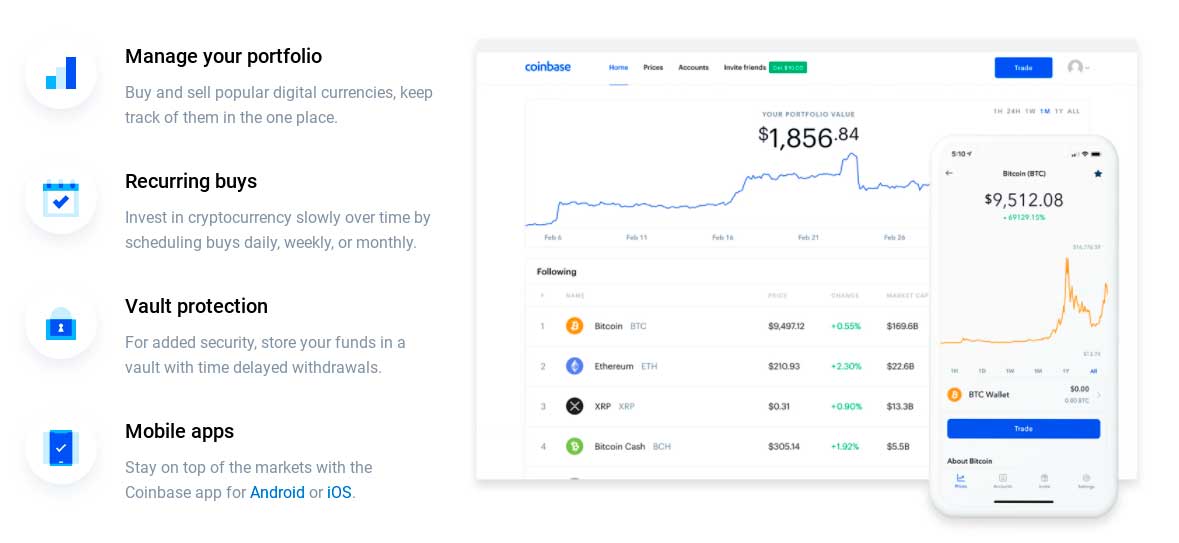

1. Coinbase – User-Friendly Bitcoin Exchange With Over 35 Million Customers

Coinbase is the next broker to consider in our guide on how to invest in Bitcoin UK. This popular online broker is now home to over 35 million clients. Although Coinbase is actually headquartered in the US, it operates in over 100+ countries – including the UK.

is the next broker to consider in our guide on how to invest in Bitcoin UK. This popular online broker is now home to over 35 million clients. Although Coinbase is actually headquartered in the US, it operates in over 100+ countries – including the UK.

As such, you can easily buy cryptocurrency and invest in Bitcoin from the comfort of your home. In terms of the positives, Coinbase has a great reputation in the cryptocurrency scene and is now authorized (via CB Payments Limited) by the FCA to accept UK residents.

In turn, this means that you can invest in Bitcoin instantly with your UK debit card. In order to do this, all you need to do is open an account, upload a copy of your passport, and choose how much you wish to invest. The main drawback of this Bitcoin exchange is that you will be charged an extortionate commission of 3.99% on both Visa and MasterCard payments.

If you want to avoid such a high fee, you will better off making a deposit via a UK bank transfer. This will delay the process, albeit, reduce your trading fee to 1.49%.

Nevertheless, Coinbase is also popular with UK investors as the platform is very simple to use. This is purposeful, as Coinbase is primarily aimed at newbies with little experience in cryptocurrency trading. We also like Coinbase for its commitment to security and sefety.

For example, the provider keeps 98% of client funds in cold storage. This simply means that the digital coins are held in offline wallets, which is the safest way of doing things. Additionally, you will need to set up a two-factor authentication on your Coinbase account, which adds an extra layer of safety.

In terms of storing your Bitcoin investment, Coinbase gives you two options. The easy route is to leave your Bitcoin in your Coinbase web wallet until you decide to cash out. But, if you want to take full control over your funds, you might consider the Coinbase wallet – which is available as an iOS and Android mobile app.

- Over 35 million customers and a great reputation

- Very user-friendly

- Deposit funds with a debit card or via bank transfer

- Ability to withdraw your coins out to a private wallet

- Handy mobile app

- Holds a license from the FCA

- 3.99% fee on debit card deposits

- 1.49% Bitcoin trading fee

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

2. BitDD – Reliable crypto exchange with free trading for 90 days

Another good crypto exchange to consider when buying bitcoin is BitDD. It is a certified platform that offers advanced currency and derivatives transaction services for cryptocurrencies like BTC, ETH, and USDT. The platform maintains the highest security and regulatory standards, instilling credibility and confidence in users. BitDD has obtained a Money Service Business – Money Service Provider (MSB) financial license from the United States Treasury Department.

BitDD currently has a large user base of over 500,000 across the world. The platform’s goal is to take it up to two million users by 2023. For this, it introduces some excellent features, functionalities, and reward programs. Let’s take a look at them.

BitDD’s key highlight is Fast Trades, a functionality that offers a set of easy-to-use analytic tools which help you step up your crypto trading strategy. Whether you are new to the market or a part-time trader, the tools will help you improve your profitability.

BitDD’s easy onboarding tools go a long way in bringing more users to the platform. You can get started on BitDD in a few easy steps. As soon as you have completed the registration process and deposited your assets, you are good to go. Another compelling factor that draws users to BitDD is free trading. New users get a 100% discount on transaction fees for the first 90 days, giving them ample time to get acquainted with the platform and its features.

BitDD has launched a welcome rewards program worth 8888 USDT as part of expanding its user base. If you have trouble getting started on BitDD, you can seek assistance any time of the day. Your VIP account manager helps you with understanding the platform’s unique features and reward programs.

- Free trading for 90 days

- Chance to win up to 500 USDT

- 24*7 assistance

- Exclusive “Fast Trades”

- Limited collection of cryptocurrencies

- Lack of advanced functionalities

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

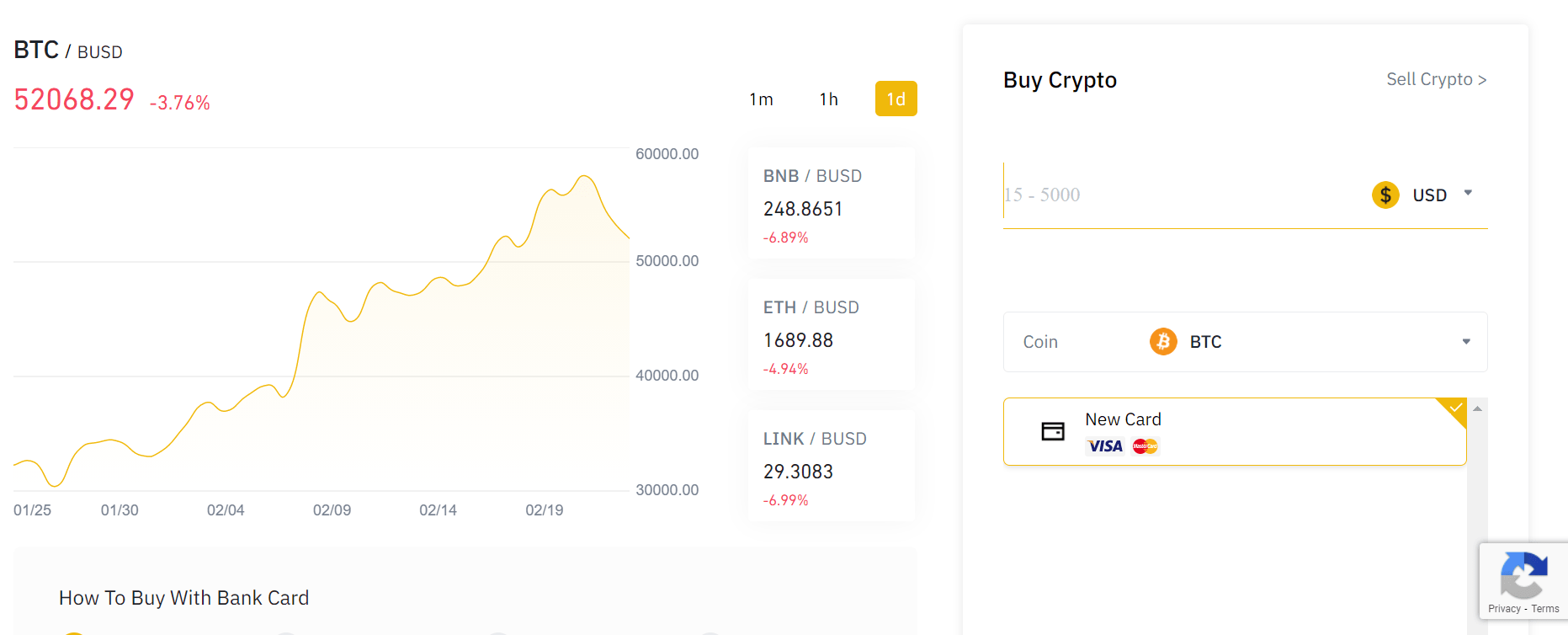

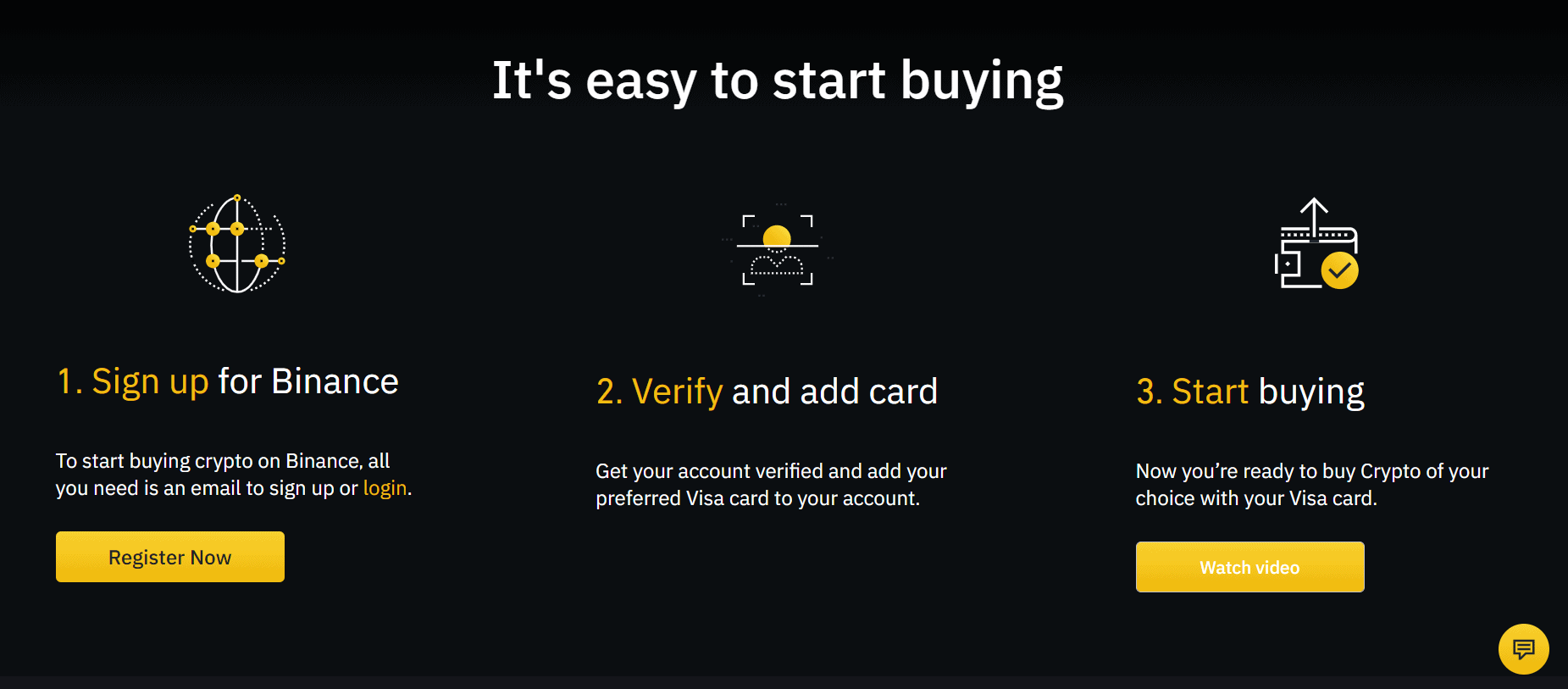

3. Binance – Largest Cryptocurrency Exchange for Trading Volume and Liquidity

In particular, Binance is the largest cryptocurrency exchange in terms of trading volumes. In the past 24 hours alone, the platform has processed more than $114 billion worth of transactions – which is more than traditional brokerage firms could ever dream of.

In terms of investing in Bitcoin from the comfort of your home, Binance allows you to complete the process with a UK debit or credit card. The fees are slightly on the high side though, as you’ll be charged 3% per Bitcoin purchase. From time to time, Binance runs a promotion on this commission, with the most recent one reducing the fee to 1%.

Alternatively, if you are happy to fund the transaction via a UK bank transfer, you will avoid this fee. This will, however, delay the process by at least a couple of days. Once you have funded your account, Binance charges a small trading commission of 0.1%.

In terms of storage, Binance does allow you to keep your coins in a convenient web wallet. Although less secure than withdrawing them to a private cryptocurrency wallet, Binance does offer a number of key safeguards. For example, you’ll have access to two-factor authentication, as well as IP and wallet address whitelisting.

Additionally, the vast bulk of client funds are kept in cold storage and you also have the Safe Asset Fund for Users (SAFU) to fall back on. This is an ever-growing insurance pot that is funded by transaction fees and is in place to compensate users in the event of a hack.

Much like Coinbase, Binance also gives you the option of utilizing its own native crypto wallet. In what it calls the ‘Trust Wallet, this is to be downloaded and installed onto your mobile device. The wallet is simple to use and comes with a variety of internal controls to keep your funds safe.

- Largest cryptocurrency exchange UK in terms of trading volume

- Hundreds of cryptocurrency pairs supported

- Trading commission of just 0.1%

- Supports UK debit/credit cards and bank transfers

- Great reputation in the cryptocurrency scene

- Ideal for advanced traders that seek sophisticated tools and features

- Not great for newbie investors

- A standard charge of 2% on debit/credit card deposits

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

Research Bitcoin Investment

Once you have chosen a Bitcoin broker that you like the look of, it’s then time to take a step back. By this, we mean that you should learn how to invest in Bitcoin UK properly, by considering the high risks and potential rewards involved. After all, Bitcoin – and all cryptocurrencies for that matter, are not only speculative but super-volatile.

To ensure you invest in Bitcoin with your eyes wide open – spend some time exploring the sections below.

What is Bitcoin?

Many people in the UK are aware of Bitcoin’s rapid surge in value but don’t actually know what it is. In its most basic form, Bitcoin is a digital currency – meaning that it does not exist physically. Instead, Bitcoin is based on blockchain technology – which is like a public accounting ledger that can be accessed online.

- The blockchain ensures that Bitcoin is not controlled or owned by any single party.

- The technology is not backed by any government, nation, or central bank either. Instead, Bitcoin is decentralized, meaning there is no centralized authority – like a bank.

- Bitcoin itself was designed with the view of replacing the global monetary system – namely fiat currencies like the US dollar, euro, and British pound.

- In turn, you can send, receive, and transfer Bitcoin from wallet to wallet without needing to go through a third party. You can do this through a web wallet, mobile wallet, desktop wallet, or hardware wallet.

Bitcoin transactions are not only anonymous, but it takes just 10 minutes for the transfer to be confirmed. Plus, irrespective of how much Bitcoin you are transferring, fees are usually less than a pound. When you also factor in the highly secure and private framework of Bitcoin, it’s no wonder that the technology is often referred to as the ‘next internet’.

Note: To truly understand the ins and outs of how Bitcoin works – consider the book ‘Mastering Bitcoin: Unlocking Digital Cryptocurrencies by Andreas Antonopoulos

Ways to Invest in Bitcoin

In this section of our guide on how to invest in Bitcoin UK, we are going to explore some of different the ways that you can enter the market.

Buy Bitcoin Outright

The easiest, safest, and most cost-effective way to invest in Bitcoin in the UK is to use a regulated broker. In doing so, you can buy Bitcoin with your UK debit/credit and even an e-wallet like Paypal.

Perhaps most importantly, you only need to meet a minimum Bitcoin investment of $25. In simple terms, this means that you can invest in Bitcoin in dribs and drabs as opposed to going ‘all in’ with more money than perhaps you can afford to lose.

Such a small minimum stake also allows you to adopt a ‘dollar-cost averaging’ strategy – which we explain in more detail further down this guide on how to invest in Bitcoin UK.

Invest in a Crypto Portfolio

Another way to invest in Bitcoin is to consider a diversified cryptocurrency portfolio.

This will allow you to invest in a full basket of different digital currencies. In turn, you will be taking a diversified approach through a single investment. We cover Bitcoin diversification in more detail further down.

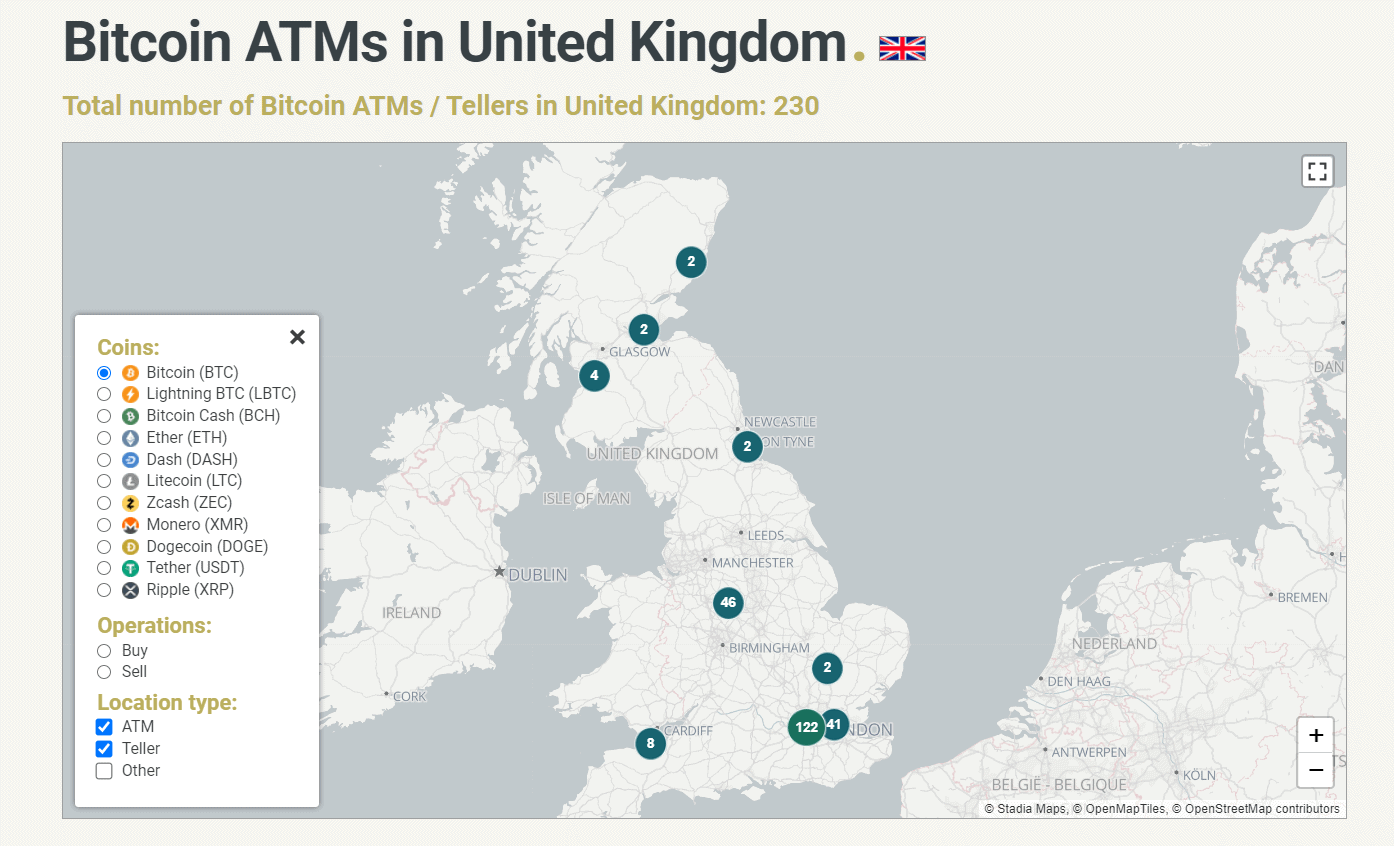

Use a UK Bitcoin ATM

According to CoinATMRadar, the UK is now home to 230 Bitcoin ATMs. This covers the length and breadth of the UK across all four home nations.

- Put simply, if you do have a Bitcoin ATM close to where you live, you can instantly make an investment by inserting cash into the terminal.

- You will select the amount you wish to buy on-screen – such as £50

- Once you insert the required cash via paper notes, a QR Code will appear

- Then, you need to scan the QR Code with your mobile Bitcoin wallet

- In doing so, the Bitcoin should arrive in your private wallet in 10-20 minutes

There are both benefits and drawbacks to taking this option to invest in Bitcoin. In terms of the pros, you don’t need to worry about opening a brokerage account. Instead, you can simply rock up to the ATM and complete the purchase in minutes.

However, the average transaction fee that you will be charged by the Bitcoin ATM is 10%. This means that by making a £100 investment – you’ll be left with just £90 worth of Bitcoin.

Secondly, you also need to be in possession of a Bitcoin wallet to claim the coins. If you’re a complete novice and don’t know how to use cryptocurrency wallets, this could be problematic.

Bitcoin Stocks

There isn’t a ‘Bitcoin stock‘ per-say, as the digital currency is an asset class in its own right. You can, however, invest in stocks that are loosely related to the success of Bitcoin.

For example:

- FinTech stock Square – which saw its shares increase by triple-digit percentages in 2020, has a strong presence in the Bitcoin scene.

- This is because it allows Americans to buy and sell Bitcoin via the mobile app.

- In turn, as more and more people invest in Bitcoin, this should have a positive impact on Square’s stock price.

There are several other stocks somewhat related to the success of Bitcoin – such as Riot Blockchain, and MicroStrategy. With that said, there is no guarantee that the value of your chosen crypto-related stock will correlate to the price of Bitcoin, as there are many other variables to take into account.

How Much to Invest in Bitcoin?

At the time of writing one Bitcoin is valued at over £34,000, so you may be wondering how much you should invest and whether you can afford it.

The good news is that you don’t have to buy whole Bitcoins at a time. Bitcoins can be split into smaller units to make smaller transactions possible. For example, a Satoshi is equivalent to 100 millionth of a Bitcoin and is the smallest Bitcoin unit.

Is Bitcoin a Good Investment?

In this part of our guide on how to invest in Bitcoin UK, we are going to explore the long-term viability of this innovative digital asset.

Best Performing Asset of the Past Decade

There is no asset class in existence – even in the emerging markets, that has seen financial returns quite like Bitcoin over the past decade. If we were to rewind back to 2009 when the technology was first launched, Bitcoin didn’t have a value.

- Even in the proceeding few years, a single Bitcoin would have cost you a small fraction of a penny. At the time of writing in February 2021, Bitcoin has since surpassed $57,000.

- In simple terms, had you invested back in the early days of this digital asset, you would now be looking at gains in the millions of percentage points.

- On the one hand, it’s easy to look at such significant gains in hindsight, as Bitcoin was virtually unknown for many years.

- With that said, it’s important to remember that as recently as March 2020 – you could have got your hands on Bitcoin at a price of around $5,000.

Based on the $57,000 figure mentioned above, this means that the digital currency has generated returns of more than 1,000% in less than one year of trading.

The Sky is the Limit

It’s difficult to put an exact figure on how much Bitcoin could be worth in the future. But, many well-known commentators in this space have their eyes set on gold.

That is to say, as Bitcoin possesses many of the same characteristics as gold (store of value, finite supply, fractionable, etc.) – some argue that a realizable long-term target for Bitcoin is to overtake the precious metal in terms of market capitalization.

At the time of writing in February 2021:

- Bitcoin has a total market capitalization of $937 billion

- Gold has an estimated total market capitalization of $9-$10 trillion

As per the above, if Bitcoin were to overtake gold in terms of circulating valuation, this would require a further upswing of 10x.

Some Bitcoin enthusiasts go one step further are argue that in the long-term, Bitcoin could replace the US dollar as the world’s reserve currency. If these wild projections did one day come to fruition, the sky really is the limit.

Major Companies and Institutions

Perhaps the biggest sign that Bitcoin is here to stay in the recognition it has received from some of the most influential stakeholders globally.

- At the forefront of this is Tesla – the world’s largest carmaker with a market valuation of over $680 billion. The firm – which is led by cryptocurrency enthusiast Elon Musk, recently announced that it had invested over $1.5 billion of its cash reserves into Bitcoin.

- You then have the likes of Paypal, which recently begun facilitating Bitcoin purchases through its platform.

- Previously discussed Bitcoin broker Coinbase is expected to go public later this year, with the firm expected to attract a market valuation of $100 billion.

There are many, many other examples of large-scale companies entering the Bitcoin space, which is only a good thing from an investment perspective.

Risks of Bitcoin Investment

There is no getting away from the fact that Bitcoin has generated some uncanny returns over the past few years. However, it is crucial to recognize that investing in this digital asset is fraught with risk.

Speculative and Volatile

In the case of Bitcoin, what goes up often comes crashing straight back down. This is because Bitcoin is a highly speculative and volatile asset class. Although it has enjoyed great success over the past year since hitting lows of $5,000 – there is no guarantee that this will always be the case.

To illustrate this point firmly, it’s worth remembering what happened in 2017.

- Bitcoin started 2017 at a price of around $1,000

- By the end of the year, the digital currency hit highs of $20,000

- That’s a 12-month increase of 1,900%

- However, Bitcoin then went on a prolonged downward spiral, hitting lows of $3,000 just 12 months later

- This means that those buying Bitcoin at its 2017 peak would have seen their investment drop by over 85%

Ultimately, it wasn’t until December 2020 that Bitcoin once again breached the $20,000 mark – a mere three years later. The key point is that Bitcoin is overly volatile and super-unpredictable – so there is no guarantee that you will make money.

Hacks and Scams

An additional risk that needs to be taken seriously when investing in Bitcoin is that the industry is still dominated by hacks and scams. Regarding the former, there have been countless examples of Bitcoin exchanges having their servers breached – resulting in a loss of client funds.

- In many cases, the hack was worth tens of millions of pounds. As you might know, if your Bitcoin is hacked and stolen – it’s gone forever.

- In other words, there is no third party to call in an attempt to get your money back.

- Additionally, Bitcoin appears to be the currency of choice for scammers. This is because of the anonymous characteristics of the blockchain.

- Common scams involve malware attacks on desktop devices, sim card swapping, and age-old pyramid schemes.

If you’re wondering how to invest in Bitcoin UK in the safest way possible, you’ll want to stick with an FCA-regulated brokerage firm. This ensures that you can invest in Bitcoin and store your digital assets safely until you are ready to cash out.

Is Crypto Taxed in The UK?

Yes, crypto is taxed in the UK as capital gains tax. This means that any money you make from investing in Bitcoin will be subject to tax in the UK. If you invest in Bitcoin and make profit, you will need to include this as part of your self assessment tax return at the end of the financial year. The amount of tax that you pay will depend on the tax bracket that you fall into. Self assessment tax returns are usually filed in April and are used by HMRC to access how much tax you need to pay on your earnings.

Bitcoin Investment Strategies

In this part of our guide on how to invest in Bitcoin UK, we are going to explore some of the best strategies to consider deploying.

After all, it’s crucial to have both an entry and exit plan when investing – irrespective of the asset class or financial market.

Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy used in all walks of the financial marketplace. In its most basic form, this strategy will see you invest modest amounts into Bitcoin – but on a periodic basis.

For example, you might decide to invest £20 per week for the foreseeable future. In doing so, you can forget about the ups and downs of market volatility – as you are in it for the long run.

More specifically, every time you execute your weekly/monthly investment, you will get a different cost price. Sure, the value of Bitcoin might continue to rise and fall in a volatile manner, but all this does for you is average the price out over the course of time.

For example

- Week 1: You invest £100 into Bitcoin at a cost price of $50,000

- Week 2: You invest £100 into Bitcoin at a cost price of $35,000

- Week 3: You invest £100 into Bitcoin at a cost price of $40,000

- Week 4: You invest £100 into Bitcoin at a cost price of $55,000

As per the above, you made one £100 Bitcoin purchase at the end of each week – paying a different cost price on each occasion. In turn, your dollar-cost averaging strategy resulted in an average price of $45,000.

Diversification

In addition to a dollar-cost averaging strategy, it is also important that you diversify.

For example, instead of putting all of your crypto investment funds into Bitcoin, it could be worth spreading your capital out over several different digital assets.

- This will, in theory, reduce your long-term risks, as you are not overexposed to a single cryptocurrency.

- The key problem with this is that you will need to store all of your purchased coins in a private wallet.

- This can get confusing, as some wallets only support specific coins.

- As such, you might need to obtain a collection of private wallets to keep your diversified portfolio safe.

Buy the Dip

In the 24 hours prior to writing this guide on how to invest in Bitcoin UK, the digital currency has dropped in value by just over 10%. Whether this is a short-term dip or a sign of a more prolonged market correction remains to be seen.

However, if you are a firm believer that Bitcoin is here to stay in the long run – market dips such as the one described above presents an excellent buying opportunity. This isn’t the case just with Bitcoin, with all assets.

- In terms of how to implement such a strategy – this is dependent on you and your financial goals.

- With that said, some investors will religiously buy Bitcoin every time it closes the trading day at a pre-defined loss – such as 5% or more.

- In doing so, you are effectively investing in Bitcoin at a discount on each purchase.

In many ways, this is a dollar-cost averaging strategy in itself – as long as you keep your stakes constant.

Conclusion

With financial returns of over 1,000% in the past year alone, more and more people in the UK are looking to invest in Bitcoin. You do need to keep your stakes modest, not least because Bitcoin is volatile and highly speculative.

It’s also wise to mitigate your risks by considering a dollar-cost averaging strategy and to diversify your investment well. You do, of course, also need to find a suitable broker that can facilitate your Bitcoin investment.