Coinbase Review UK 2025 – Features, Fees, Pros & Cons Revealed

If you’re based in the UK and looking to buy cryptocurrencies like Bitcoin, Ethereum, and Ripple – you might be thinking about using Coinbase. The regulated broker allows you to buy, sell, and trade digital coins at the click of a button.

In this Coinbase Review UK, we explore everything you need to know about this cryptocurrency platform. This includes fees and commissions, payments, supported coins, safety, and more.

What is Coinbase?

And the latter – the Coinbase Pro section of the platform allows you to trade cryptocurrencies. This is going to suit those of you that are looking to enter the space as a day or swing trader. Launched back in 2012, Coinbase is not only one of the oldest cryptocurrency brokers in the space, but also one of the most popular. Also, did you know that Coinbase has some of the most competitive crypto savings accounts on the market?

This is because the platform now boasts a customer base of over 35 million users making it one of the larger exchanges around, along with Bithumb and Binance. Not only does this cover the UK, but clients from more than 100 countries. One of the main attractions of Coinbase is that it is great for newbies with little to no experience of how cryptocurrencies work.

This is because the platform is really easy to use, it takes just minutes to open an account, and it supports a selection of everyday payment methods. This covers UK debit cards and bank account transfers. With such a large client base, it makes sense that Coinbase is also regulated and safe – as we cover this in more detail later.

Another popular cryptocurrency exchange that we think is worth considering, is Crypto.com. In our Crypto.com review we discuss everything there is to know about this leading crypto exchange; from fees and payment methods, to crypto apps and regulations.

Supported Coins

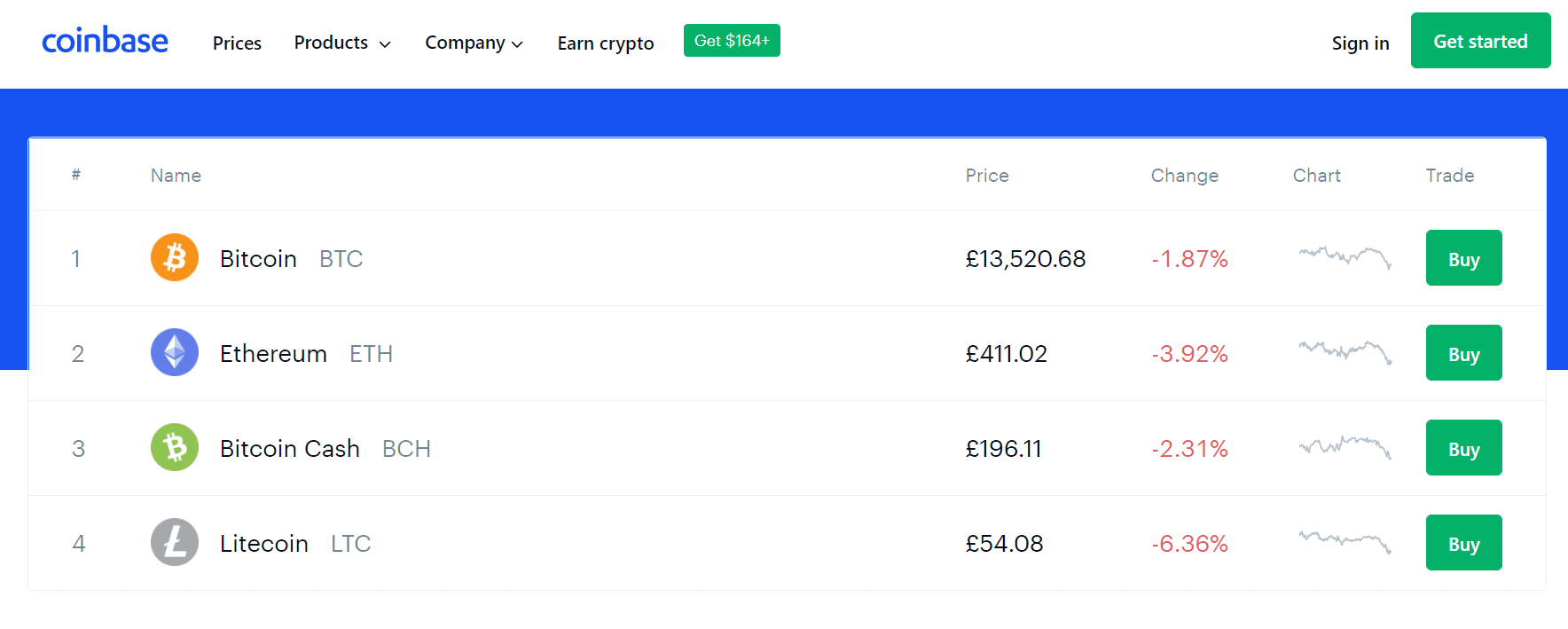

Once you have opened an account at the platform, our Coinbase Review UK found that you will have access to a good selection of cryptocurrencies, in fact, it offers one of the largest selections along with Bitfinex and Binance. In the early days of Coinbase, the platform notoriously supported just four coins – Bitcoin, Bitcoin Cash, Ethereum, and Litecoin.

However, Coinbase has since expanded in a range of other cryptocurrencies. In particular, this includes a range of less liquid projects. For example, this includes the likes of Filecoin, Band, Maker, and Compound.

If you haven’t heard of these cryptocurrencies, they have a much smaller market capitalization than Bitcoin and Ethereum etc. But, the upside is potentially much greater. You can also invest in Dogecoin, a top-rated meme coin that’s gaining a lot of traction in the crypto world.

Nevertheless, check out of the full of Coinbase supported coins below:

- ALGO

- ATOM

- BAL

- BAND

- BAT

- BTC

- BCH

- BSV

- COMP

- CVC

- DAI

- DASH

- DNT

- EOS

- ETH

- ETC

- FIL

- GNT

- KNC

- LINK

- LOOM

- LRC

- LTC

- MANA

- MKR

- NMR

- NU

- OMG

- OXT

- REN

- REP

- USDC

- UMA

- UNI

- WBTC

- XLM

- XRP

- XTZ

- YFI

- ZEC

- ZRX

At the time of writing, that’s 42 cryptocurrencies in total that Coinbase allows you to buy. The platform notes that it is continuously looking to add new digital coins to its library. But, Coinbase is very selective in which projects it allows to be listed on its site, so don’t expect hundreds of coins any time soon.

It is important to note that Coinbase Pro – which we cover in more detail later in this review, offers a wide selection of pairs, too. As such, Coinbase let’s you invest in Shiba Inu, Dogecoin, and many more meme coins with the click of a button.

Coinbase Fees

In a nutshell, Coinbase is arguably one of the most expensive cryptocurrency trading brokers in the space. There are several fees that you need to take into account, which we elaborate on in more detail below. There are many other cheap platforms out there such as Poloniex.

Deposit/Withdrawal Fees

We cover payments in much more detail later on, but we should make it clear that charges do apply when you deposit funds with British pounds. This is a bit confusing, as depending on which payment method you use, you may or may not need to pay a trading commission, too.

So, if you decide to use your UK debit card to buy cryptocurrency at Coinbase, this is known as ‘Instant Buy’. As the name implies, you will be buying your chosen digital coin instantly (after verification). In turn, you will be charged a hefty all-in fee of 3.99%. For example, if you buy Ethereum via a £500 debit card purchase, then you will pay a total fee of £19.95.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

However, if you decide to deposit funds via bank transfer (Faster Payments Network), then you won’t pay any transaction fees at all. You will, however, need to pay a trading commission once you proceed to make a cryptocurrency purchase – which we cover shortly.

When it comes to withdrawal fees, this is once again free when you opt for a UK bank transfer. However, if you decide to withdraw the funds back to your debit card (which you will need to do if you made a deposit with this payment method), then the fee is 2% (minimum £0.55).

These Coinbase fees, alongside the trading commissions which we cover below, can be confusing. As such, further down in this Coinbase Review UK we are going to give a couple of real-world examples to show you exactly what you will be paying at the broker.

Trading Commission

Trading commissions at Coinbase work in the same way as a conventional share dealing fee. Only instead of a flat fee, you will pay a variable commission.

So, the standard trading commission at Coinbase is 1.49%. This means that you will pay 1.49% when you buy a cryptocurrency, and again when you sell it. This variable percentage is multiplied by the value of your buy/sell order.

For example:

- Let’s say you want to buy £1,000 worth of Bitcoin

- You transfer funds from your UK bank account for free

- Once the funds arrive, you complete the transaction and pay 1.49% – amounting to a commission of £14.90

- A few months later, your £1,000 Bitcoin investment is now worth £1,500

- You decide to cash your profits out, so again, you pay 1.49% commission

- Only this time, this is calculated against the current value of your investment, which is £1,500

- As such, you pay £22.35

Now, we should make it clear that at 1.49%, this is a very uncompetitive commission fee. In fact, it’s significantly higher than other leading brokers in this space. Furthermore, things get even worth at Coinbase if you decide to trade small amounts. This is because rather than a variable fee, you will pay a flat fee.

For example:

- If the total transaction amount is less than £10, the fee is £0.99

- If the total transaction amount is between £10 and £25, the fee is £1.49

- If the total transaction amount is between £25 and £50, the fee is £1.99

- If the total transaction amount is between £50 and £200, the fee is £2.99

At first glance, the above flat fee structure might not sound like a lot. But, it is in percentage terms. For example, if you purchased £11 worth of Bitcoin and paid £1.49 – this works out at a variable commission of just under 15%. In turn, this means that you need to make at least 15% just to break even!

Note: Trading fees on Coinbase Pro are significantly lower. We run you through the ins and outs of this further down.

| Debit Card Instant Buy | Debit Card Withdrawal | UK Bank Transfer | Trading Commission |

| 3.99% | 2% | FREE | 1.49% |

Cryptocurrency Conversions

An additional service offered by Coinbase is that of cryptocurrency conversions. For example, this might see you swap Bitcoin for Ethereum.

At Coinbase, there would be no requirement to sell Bitocin back to pounds and the purchase Ethereum. Instead, you can do this directly which reduces the number of transactions you need to make.

However, Coinbase will add a ‘spread’ of 2% on currency conversions. This means that you will get a price that is 2% higher than the market rate. As such, this is a fee nonetheless – and an expensive one at that.

Coinbase Buying Limits

Coinbase allows you to buy up to £10,000 worth of cryptocurrency per day – which is huge. However, you will need to go through a verification process before you are able to do this.

As we cover later in this Coinbase UK 2022 review, this will require a copy of your passport or driver’s license. Additional limits also apply when you use a debit card.

This will vary depending on your account status, but it’s usually £750 when you first sign up. After that, you can get higher limits by providing additional verification documents. If you’re wondering how to buy Bitcoin with Skrill, you can learn more about the process by reading our in-depth guide.

Coinbase Pro

The main Coinbase website focuses on traditional brokerage services. That is to say, you can use a debit card to buy Litecoin or even buy Bitcoin with Paypal. This is with the view of investing in a cryptocurrency and holding on to the coins for several months or years – much like you would when you buy shares.

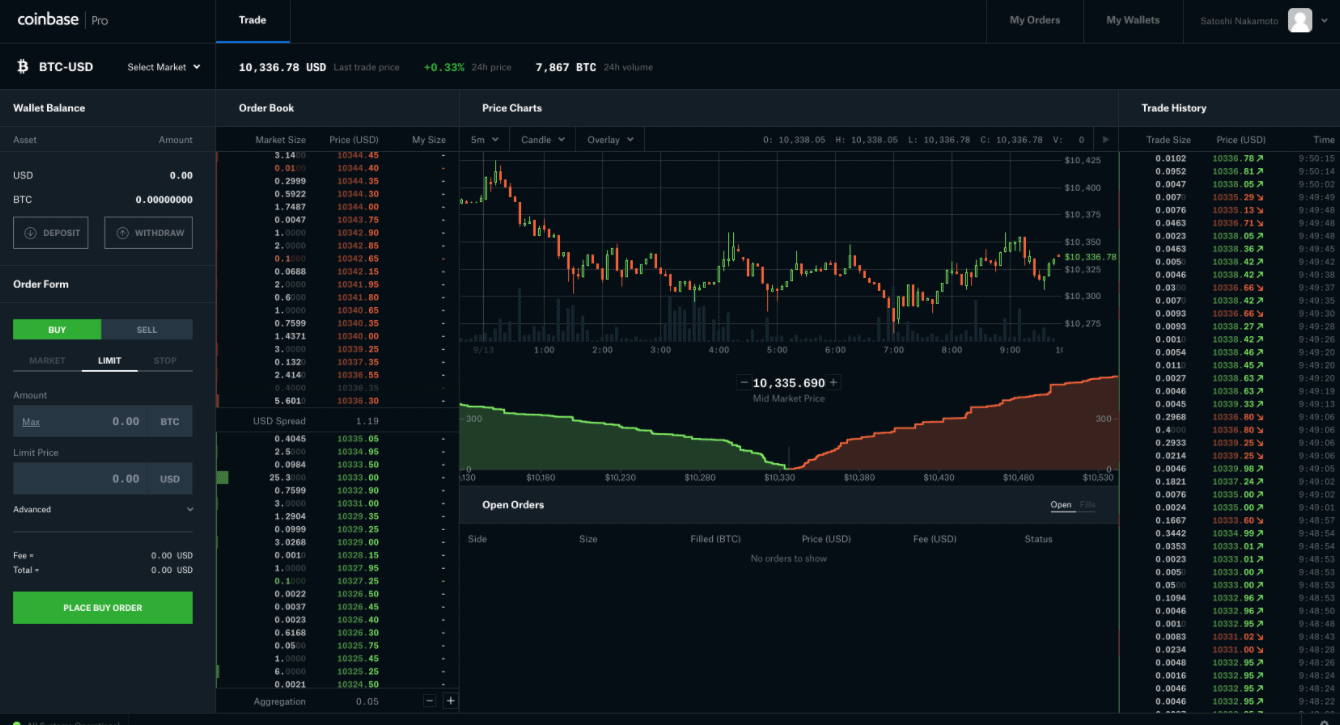

However, the provider also offers a fully-fledged trading arena. This is suited for experienced traders that are looking to actively buy and sell cryptocurrency pairs. For example, you might buy BTC/USD and hold on to the position for just a few hours – looking to take advantage of short-term volatility.

If this sounds like something you are interested in pursuing, Coinbase Pro offers both fiat-to-crypto and crypto-to-crypto pairs.

For those unaware:

- Fiat-to-crypto pairs at Coinbase contain one fiat currency and one cryptocurrency. For example, ETH/USD contains Ethereum and the US dollar. In turn, you are looking to speculate on whether you think the exchange rate between Ethereum and the US dollar will rise or fall.

- Crypto-to-crypto pairs at Coinbase Pro contain two competing cryptocurrencies. For example, BCH/BTC is a pair that contains Bitcoin Cash and Bitcoin. As such, you are looking to speculate on the future value of the exchange rate between these two digital coins.

As you might have noticed, both of the examples are not dissimilar to traditional forex trading.

Nevertheless, by trading cryptocurrencies on the Coinbase Pro platform, you will have access to much more in the way of tools and features. For example, you can set up both buy and sell positions – which allows you to speculate on a cryptocurrency going down in value.

Additionally, you will have a good selection of order types to choose from. This includes both stop-loss and take-profit orders, which is crucial for risk-management purposes. You can also opt for limits orders, which allows you to enter your trade at a price of your choosing.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

Coinbase Pro is also worth considering if you want to use a third-party cryptocurrency robot. To do this, you simply need to obtain your unique Coinbase Pro API from within your account and then paste it into the robot provider’s website. In doing so, the robot can trade on your behalf.

Coinbase Pro also gives you a lot of flexibility in terms of research and analysis. This is because its charts are fully customizable. However, in comparison to MT4, Coinbase Pro is lacking when it comes to technical indicators and advanced chart drawing tools.

Coinbase Wallet

Once you have bought a cryptocurrency at Coinbase Pro, you then have two options in terms of storage. In some cases, people in the UK like to withdraw their coins out to a private wallet.

This might come in the form of a mobile, desktop, or hardware wallet. In doing so, they are 100% responsible for keeping their wallet safe and away from unauthorized actors.

If you don’t have any experience with cryptocurrency wallets, then you might decide to keep your purchased coins at Coinbase. Again, you’ve got a couple of options here. You can either use the Coinbase web wallet or download its mobile app wallet.

Let’s explore each option in more detail:

Coinbase Web Wallet

The most convenient way of storing your coins is to simply leave them in your Coinbase account. Some commentators will argue that this is the least secure way of storing your digital currencies.

This is true, as if the platform gets hacked by a third-party bad actor, you could lose your entire balance. This has happened many times in the past at several well-known cryptocurrency exchanges, albeit, not at Coinbase to date.

However, we would argue that the security practices employed by Coinbase are industry-leading.

This includes:

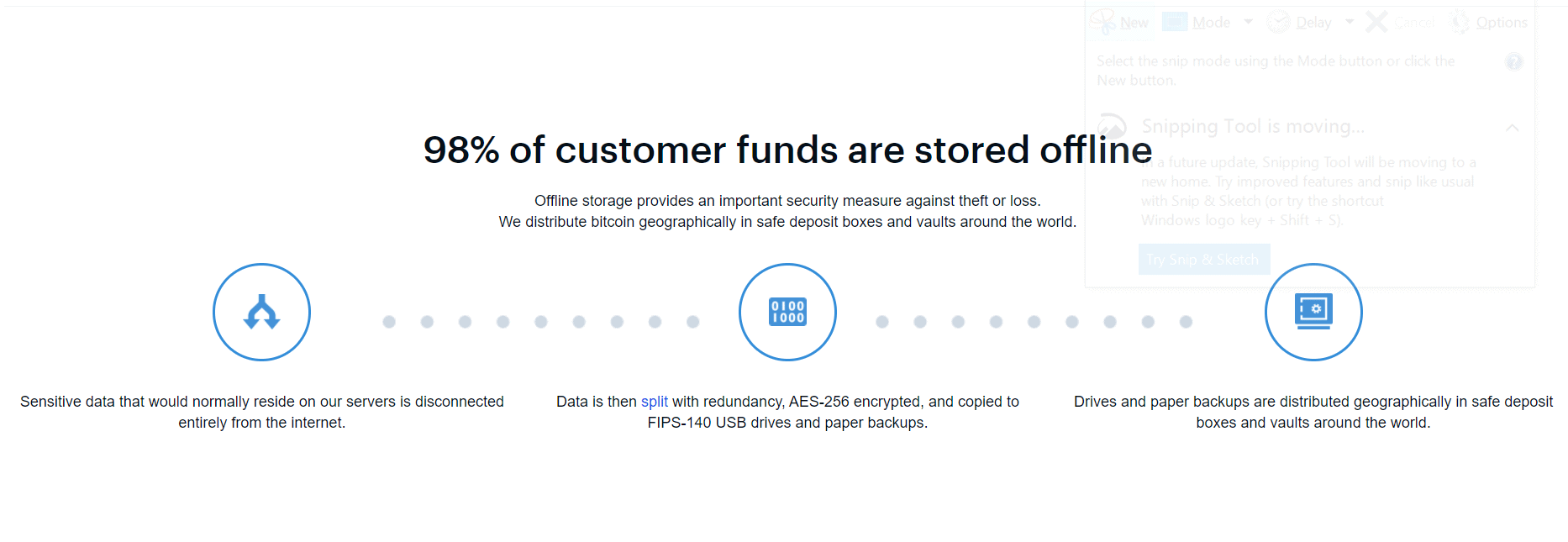

Cold Storage

The term ‘cold storage’ means that the digital coins are stored in a hardware wallet that remains offline at all times. As such, this makes it virtually impossible for somebody to hack the wallet remotely.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

At Coinbase, 98% of its cryptocurrency holdings are kept in cold storage. The balance is held in online wallets to facilitate withdrawal requests and exchange liquidity.

Two-Factor Authentication

Additionally, Coinbase makes it mandatory that all account holders set up two-factor authentication (2FA). This is a security feature that requires you to confirm access to your account via a secondary device.

For example, when you log in to your Coinbase account, the platform will send a text message to your mobile phone. This will contain a unique code, which you then need to enter into the Coinbase website to gain access to your account.

Then, if you attempt to log in to your Coinbase account with a device that it does not recognize, you need to confirm it via email. These safeguards, although impossible, does make it difficult for an external actor to hack your account remotely.

Withdrawal Protections

Even if somebody was able to access your Coinbase account without your say-so, it would be difficult for them to walk away with your funds. For example, they wouldn’t be able to withdraw your money back to a bank account or debit card other than what you have already linked to your account.

They might try to withdraw the coins to an external digital wallet, but this in itself would be challenging. For example, the withdrawal request would need to be verified via text message. If the hacker doesn’t have access to your phone, they wouldn’t be able to bypass this security feature.

And, if you choose to switch it on, you can also elect to have all withdrawals confirmed by email, too. As such, the hacker would also need access to your email address in addition to your mobile phone.

The Vault

In addition to the safeguards discussed above, you also have the Coinbase ‘Vault’. Put simply, once you manually confirm a withdrawal request (within 24 hours), Coinbase will then implement a 48-hour timelock. This means that the funds will not be released for two days.

As such, if the unlikely happened and a hacker was able to bypass the aforementioned security controls, you would still have 48-hours to cancel the withdrawal request and notify Coinbase of the breach.

Coinbase Mobile Wallet

Although most users in the UK will opt for the Coinbase web wallet, some prefer to take full control over their cryptocurrency funds. If this sounds like you, it might be worth considering the Coinbase mobile wallet.

This can be downloaded free of charge on both iOS and Android devices. The wallet supports Bitcoin, Ethereum, Bitcoin Cash, Ethereum Classic, Litecoin, and all ERC-20 tokens. The Coinbase wallet works much the same as any other mobile wallet in the space.

That is to say, you can elect to log in with a PIN or fingerprint ID. You can also elect to send and receive coins from within the wallet. A QR scanner tool is also included with the wallet, which allows you to easily scan somebody’s public address so that you can make a transfer.

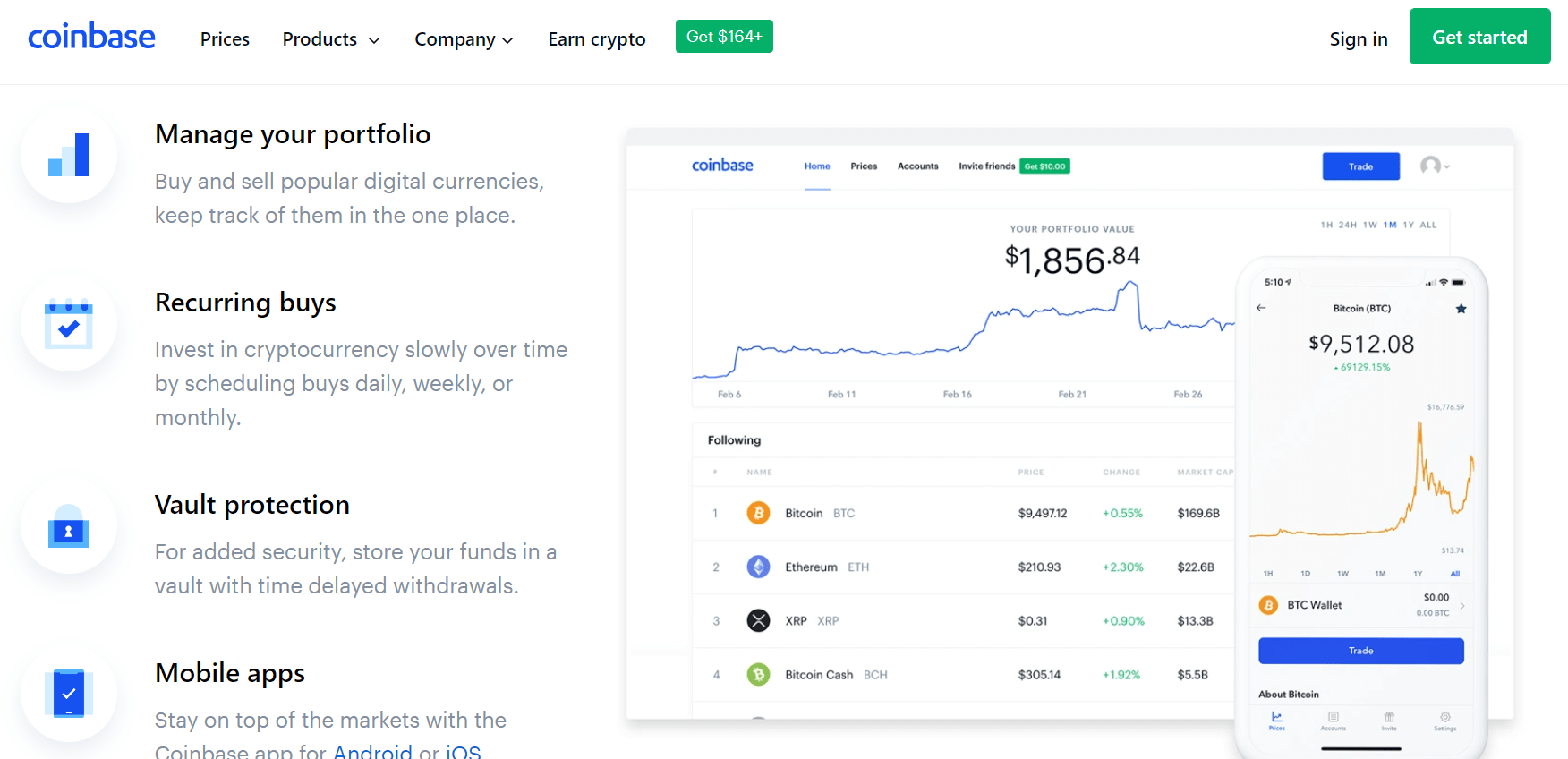

Coinbase Mobile App

The Coinbase mobile app is a great way to access your account on the move. In fact, you can perform most of the same account features as found on the main desktop website.

For example, the Coinbase app allows you to buy, sell, and convert cryptocurrencies at the click of a button. You can instantly view the value of your portfolio by loading up the app, as well as perform deposit and withdrawal requests.

In terms of user-friendliness, the Coinbase app has excellent ratings on both Google Play and the App Store. For example, the latter has a rating of 4.7/5 – which is based on over 875,000 individual reviews. Over on Google Play, the app is rated 4.5/5 across more than 230,000 reviews.

Coinbase User Experience

As we briefly covered earlier in this Coinbase Review UK, one of the main attractions of the platform is that it is super user-friendly. In fact, Coinbase is largely the go-to broker for those in the UK that are looking to buy cryptocurrencies for the very first time.

This is because of how easy the website is to use and is similar to competing exchanges like Phemex and Binance. For example, opening an account takes minutes and simply requires some personal information. Uploading your passport or driver’s license is simple too, as you can take a snapshot with your webcam in real-time. In most cases, the document will be approved instantly.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

Then, it’s just a case of making an instant deposit with your debit card. In terms of the trading process itself, this is also straight forward. For example, you simply need to click on the digital currency you are interested in buying and then enter the amount you wish to invest.

Coinbase then breaks everything down before you confirm the order. This includes the amount you are buying and at what exchange rate, alongside the fees and confirmations that you are paying pounds in pence. Then, once you confirm the purchase, the funds are instantly added to your Coinbase web wallet.

Coinbase Trading Tools and Features

In terms of core trading tools, Coinbase is relatively thin on the ground. This is because the platform was designed to facilitate simple, fast, and seamless cryptocurrency purchases. In other words, the vast majority of people use Coinbase to buy a cryptocurrency with the view of holding on to the digital coins in the long run.

Over at Coinbase Pro, you will have access to more advanced trading features. We discuss this in more detail, but this generally includes several order types, risk management tools, and advanced chart analysis.

With that said, one feature in particular that we like on the main Coinbase website is that of recurring buys. As the name suggests, this allows you to buy your chosen cryptocurrency at a fixed amount on a set date. For example, you might decide to buy £20 worth of Bitcoin every Friday.

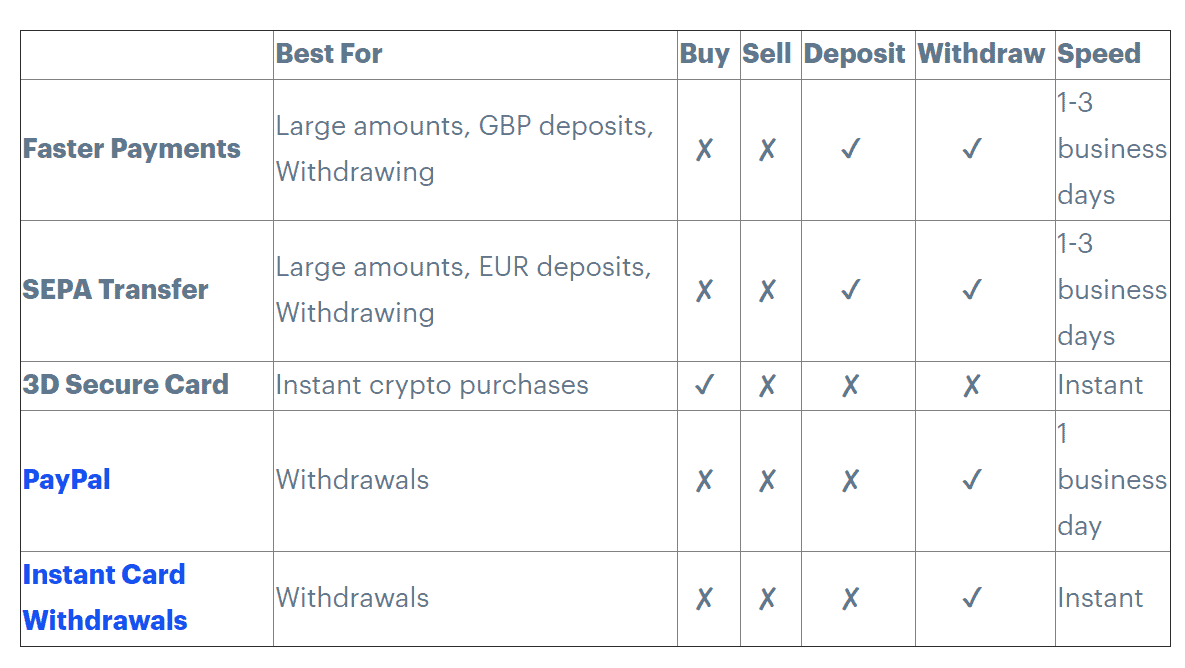

Coinbase Payments

We briefly covered payments earlier within our section on Coinbase fees and commissions. However, we should go into a little bit more detail on this to ensure you understand how the payment process works.

So, Coinbase is a regulated entity, meaning that it has the legal remit to accept fiat currency. This is something that the vast majority of Bitcoin exchanges in the space are unable to do, as they operate without a license.

However, we should note that Coinbase – much like its pricing structure, is somewhat confusing when it comes to which payment methods you can and can’t use – depending on whether you are buying a cryptocurrency instantly, depositing funds, or withdrawing funds.

Debit Cards

For example, you can instantly buy a cryptocurrency when you use your UK debit card. This can be issued by either Visa or MasterCard. You can also make a withdrawal back to your debit card.

However, Coinbase only supports debit cards that are backed by 3D Secure. If yours isn’t, you will get an error message when you attempt to make a deposit.

UK Bank Transfer

The other option you have at Coinbase is to transfer funds from your UK bank account. You will need to obtain the required bank details from within your Coinbase account. Make sure you include the unique reference number shown on-screen when you set up the transfer.

In terms of processing times, this will take between 1 and 3 working days – even if your bank supports the Faster Payments Network. As such, if you want to buy cryptocurrencies instantly, you will need to use a debit card. Once again, this will cost you 3.99% in transaction fees, so do bear this in mind.

Withdrawals back to a bank account usually arrive fairly quickly. In some cases, this can be on a same-day or next-day basis.

Paypal

Strangely, although Coinbase does not allow you to deposit funds with Paypal, it does allow you to make a withdrawal back to the e-wallet provider. However, as per anti-money laundering rules in the UK, you will likely only be able to transfer your profits back to Paypal.

For example, let’s suppose that you deposited £500 into Coinbase with your debit card and used the cash to buy Bitcoin. When you sell your Bitcoin it is worth £1,500. In this scenario, you would need to withdraw at least £500 back to your bank account and the balance could then be sent to Paypal.

Note: If you want to buy cryptocurrencies with Paypal, the FCA broker supports this on both deposits and withdrawals. In fact, the platform also supports Skrill and Neteller.

Credit Cards

Coinbase used to accept credit cards, but it no longer does.

Coinbase Minimum Deposit

Coinbase only stipulates a minimum deposit amount if you decide to transfer funds via SWIFT. There is no reason why you would need to use SWIFT as the platform supports standard UK bank transfers. Nevertheless, SWIFT transfers come with a minimum deposit of £1,000, while withdrawals must be at an amount of £500 or more.

Coinbase Regulation & Licensing

It is also true than many platforms have been hacked – either remotely or in terms of internal malpractice. This has resulted in billions of dollars worth of cryptocurrency being lost or stolen since Bitcoin was launched in 2009.

While this is, of course, concerning, the good news is that there are cryptocurrency platforms in the online space that take safety and regulation extremely seriously.

Without a doubt, Coinbase is at the forefront of this.

So, in its home country of the US – Coinbase is registered as a Money Services Business with FinCEN. In the UK, the platform is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011, via CB Payments Limited.

In fact, in 2018, Coinbase was actually the first cryptocurrency exchange to obtain a UK bank account. This is no easy feat in the UK, as cryptocurrency-related companies often find it difficult to access financial services.

We should also note that Coinbase has insurance in place to counter the threat of an external hack. Take note, this only covers lost funds in the event that Coinbase itself was compromised, and not your individual account.

Coinbase Contact and Customer Service

With more than 35 million verified account holders under its belt, one would assume that Coinbase offers top-notch customer support. However, this couldn’t be further from the truth.

Firstly, there is no way to speak with an agent over the phone. Coinbase notes that its telephone support line is automated and can only be used to lock your account in the event of a breach.

Secondly, when you click on the live chat button, you will only be able to ‘speak’ with a bot. When you use the age-old trick of typing in ‘live agent’, you are told to create a support ticket.

As such, this is the only way that you can get assistance on your account – meaning real-time support is not offered by Coinbase.

How to Use Coinbase

If you’ve read our Coinbase Review UK from start to finish, you should now have a fairly good idea as to whether or not this cryptocurrency broker is right for you. If you think that it is, we are now going to walk you through the process of opening an account, depositing funds, and buying a cryptocurrency.

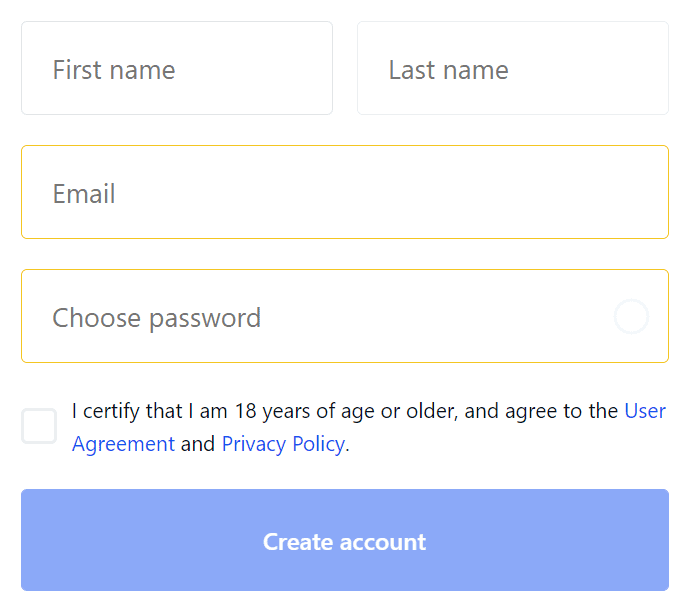

Step 1: Open a Coinbase Account

First and foremost, you will need to head over to the Coinbase website and open an account. As we have covered throughout this review, Coinbase needs to verify all account holders.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

As such, you will need to enter your full name, address, and date of birth, as well as your email address and mobile phone number.

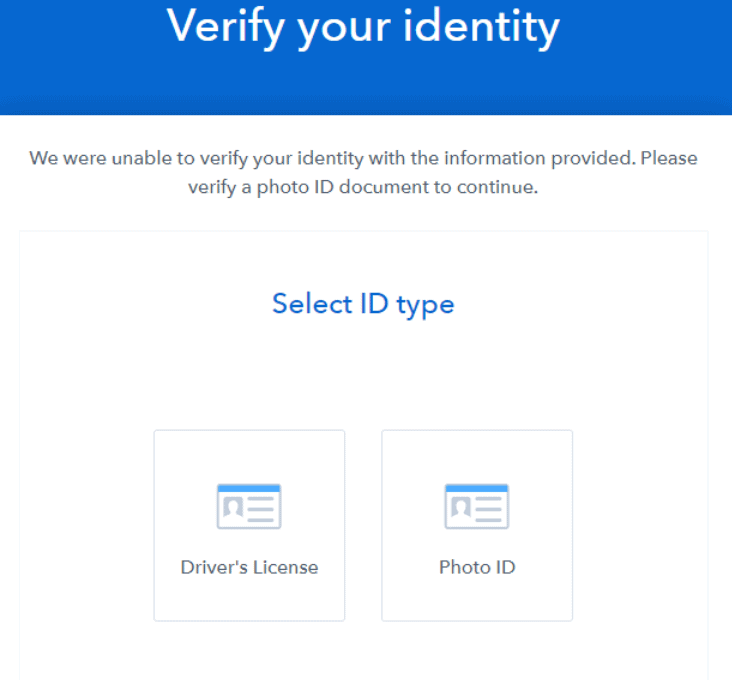

Step 2: Verify Identity

You will now be asked to verify your identity by uploading a copy of your passport or driver’s license. If you are using your desktop device, then you need to hold your chosen document in front of your webcam.

This can be a tedious process, as the image needs to be clear and crisp. If Coinbase isn’t able to clearly see the document, it will ask you to repeat the process. This can go on and on if the quality of your webcam is below-par. In this instance, you will be able to provide a copy of your document in PDF format.

Alternatively, if you opted to sign up via the Coinbase app, you can take a picture of your document with your phone camera. This is likely to be a lot better in terms of image quality, so the process is usually less cumbersome.

Step 3: Deposit Funds / Instant Buy

Once your document has been verified by Coinbase – which is usually instant once the technology is happy with the image quality, you can fund your account.

If you decide to use a debit card, you can buy your chosen cryptocurrency instantly. For example, if you want to buy £200 worth of Bitcoin, as soon as your debit card is processed the digital currency will be added to your portfolio straight away.

However, if you decide to transfer funds from your UK bank account, the process is slightly different. This is because you first need to wait 1-3 days for the funds to arrive. Then, you will be able to manually buy your chosen cryptocurrency. This is just a case of selected your preferred coin and entering the amount that you wish to buy.

Step 4: Storage

Once you have completed the purchase process, you then need to make a decision on storage. As we covered earlier, you can either leave the coins in your Binance web wallet or elect to withdraw them to a private wallet. Or, you can download the Coinbase wallet via the provider’s app.

Step 5: Sell

When you get around to selling your cryptocurrency, the process at Coinbase is relatively straight forward. If you decided to keep the coins at Coinbase, then you just need to click on the ‘Sell’ button.

In doing so, the cryptocurrency will be sold back to British pounds and the funds added to your cash balance. Then, you withdraw the money out. This is also the process if you decided to keep your coins in the Coinbase wallet app.

If, however, you decided to withdraw the cryptocurrency to a private wallet, you will first need to transfer the funds into your Coinbase wallet address. Once the funds arrive, you can then make the conversion back to British pounds and proceed with the withdrawal.

The Verdict

In summary, there is no doubt that Coinbase is one of the best cryptocurrency brokers in the space. This is validated by the 35 million+ verified account holders that it has under its belt.

The main attractions here are a super user-friendly experience, support for UK debit cards and bank transfers, and a safe and secure way to access heaps of popular digital currencies.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.