Cybersecurity threats are a growing concern for companies and governments around the world as cloud-based applications and other trends that increasingly rely on the usage of information technologies – like remote working – push businesses into the digital realm.

The latest cyber-attacks suffered by the US government have highlighted the importance of cybersecurity, as top institutions in the country including the US Treasury, Commerce, and Energy Department, along with private companies such as Microsoft (MSFT), have also warned that they have been affected by what the government has described as a “significant and ongoing cybersecurity campaign”.

The attack, which initially targeted network management software provided by Texas-based firm SolarWinds Corporation (SWI),has been called “a grave risk to the federal government” by the US Cybersecurity and Infrastructure Security Agency. It has resulted in significant damage to network infrastructures and crucial systems within the affected governmental agencies.

This is not the first incident that has compromised the systems of US institutions recently, with other breaches including the exposure of personal information of employees at the US Defense Information Systems Agency in February. There were also attacks on healthcare providers and pharmaceutical companies developing COVID-19 vaccine in April, and an incident in which hackers obtained voter’s information to spread fake news in October are part of a growing list of attempts that have successfully breached crucial systems within the country.

In this context, cybersecurity solutions providers are favourably positioned to grow, as the demand from both public and private institutions is likely to surge over the coming years, amid an accelerated digital transformation trend that has been sweeping the world during the pandemic.

Among those, this cybersecurity stock – Massachusetts-based privileged-access solutions provider CyberArk Software (CYBR) – could offer significant upside potential amid these latest developments.

How has this cybersecurity stock performed this year?

CyberArk has delivered a 7% gain so far this year, with the stock jumping to positive territory recently amid a strong reaction to market players to a recent report from Wedbush Securities, in which the financial services firm highlighted that security vendors will likely benefit from an increase in cybersecurity budgets during 2021 and beyond.

CyberArk, which specialises in providing advanced solutions that focus on managing access and credentials for users in cloud-based environments, is among those that could “become front and center on this phase of cloud deployments among governments and enterprises” according to the firm’s analysts Daniel Ives and Strecker Backe.

This positive backdrop for CyberArk would possibly catalyse the company’s growth over the coming months as both individuals and businesses rely more on cloud-based technologies to support remote work and other similar trends.

What’s next for CyberArk shares?

CyberArk sales have moved from $103 million at the end of 2014 to nearly $434 million in 2019 while the company currently serves more than 50% of Fortune 500 businesses in the United States.

Meanwhile, net income has jumped from $10 million to as much as $63 million during the same period, with the company currently being valued at 73 times its 2019 earnings – a measure that portraits the firm’s valuation much better than the temporarily depressed last-twelve-months net profits, which has been affected by a short-term strategy change.

CyberArk is currently pursuing a change in its business model, aiming to move from perpetual licensing to a subscription-based model, which could end up ramping up the firm’s recurring revenues over the coming years.

Meanwhile, on the technical front, the company’s shares have jumped strongly after its Q3 earnings release, which indicates that market players feel optimistic about this upcoming transformation in the firm’s business model.

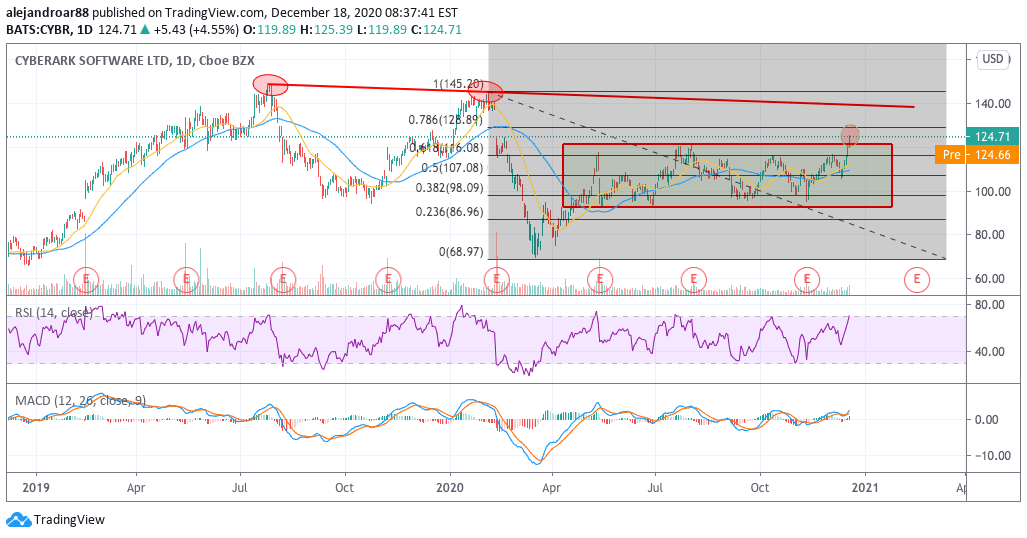

The chart above shows the strength of this uptrend, which has now broken above CYBR’s post-pandemic highs, while it has also moved above the 0.618 Fibonacci retracement – indicating that the bullish move has gained significant traction.

The first short-term target for CyberArk, based on these projections, would be the $129 level, which would represent a 4% upside for traders in the near term, while the upper trend line shown in the chart might also be another stopping point for the shares, currently sitting at the $140 level.

Both the RSI and the MACD are showing bullish readings, with the RSI posting a new high amid the bull run while the MACD has already sent a buy signal while it remains in positive territory.

Question & Answers (0)