The Share Centre Review – Features, Fees, Pros and Cons Revealed

The Share Centre has been offering do-it-yourself investors in the UK share dealing services since 1990. This broker can be attractive for UK investors looking for a low-cost brokerage with a more personal touch than large competitors offer.

The platform charges a low monthly fee and keeps its commissions relatively reasonable. You can open a standard investing account, an ISA, or a SIPP pension plan. Plus, The Share Centre provides detailed share recommendations every week, which is great for beginner investors.

The downside to The Share Centre is that you can only invest in UK assets, which limits your options for diversification. In addition, this broker’s user interface is relatively outdated and doesn’t offer a huge range of tools that many traders would consider essential, like price alerts and technical charts.

So, is this the best broker to help you invest your money? In our The Share Centre review, we’ll take a closer look at everything this platform has to offer for UK traders and investors.

What is The Share Centre?

The Share Centre was founded as a low-cost UK stock broker for retail investors in 1990. Although the platform has been around for 30 years, it’s struggled to gain a significant amount of traction. The Share Centre only serves a small number of clients compared to newer peers like Interactive Investor and manages just over £5 billion in client assets.  That said, The Share Centre makes investing relatively easy. The platform’s fees are low and the commissions are relatively straightforward to understand. While the trading platform isn’t all that advanced – in fact, most trading is done through your web account rather than a standalone software – you get access to news, analysis, and several screeners for stocks and funds.

That said, The Share Centre makes investing relatively easy. The platform’s fees are low and the commissions are relatively straightforward to understand. While the trading platform isn’t all that advanced – in fact, most trading is done through your web account rather than a standalone software – you get access to news, analysis, and several screeners for stocks and funds.

Currently, The Share Centre only operates in the UK and primarily caters to UK clients. It is regulated by Britain’s Financial Conduct Authority and all of the financial instruments you can trade are housed in the UK.

The Share Centre Accounts

One of the biggest advantages to using The Share Centre as your broker is that you can open a relatively wide range of accounts. In addition to a standard investing account, The Share Centre offers a stocks and shares ISA, a lifetime ISA, and several ready-made ISAs that are managed on your behalf. The Share Centre also offers a SIPP individual pension plan and Junior ISAs.

The ready-made The Share Centre ISA accounts are particularly interesting because they come with no account fees. There are three ready-made ISAs, two of which are designed to pay out dividends and another of which is built for growth. Let’s take a closer look the different account options available at The Share Centre:

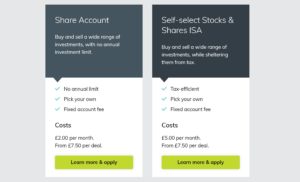

The Share Centre Share Dealing Account – This is a standard share dealing account with no limits and offers over 500 shares and a huge range of funds, among other assets. There is a £2 per month admin fee, a £7.50 fee for trades less than £750, and a 1% commission for trades above £750.

The Share Centre Self-Select Stocks and Shares ISA – This ISA has a fixed monthly account fee of just £5. You can invest £20,000 per tax year and invest in a range of shares, funds, bonds, ETFs and more.

The Share Centre Ready Made ISA – This works like a regular stocks and shares ISA apart from you don’t choose your own investments. Instead, you invest in a ready-made portfolio that is managed by expert investors.

The Share Centre Lifetime ISA – This ISA is for investors aged 18-39 and allows you to receive a government bonus on your savings of up to £1,000 per tax year. You can invest up to £4,000 per tax year and choose from a set or blend of funds.

What Shares Can You Buy on The Share Centre?

The Share Centre only offers UK assets and doesn’t provide traders access to international markets, including the US market. However, the range of shares and other financial instruments you can trade is still reasonably good.

Shares

The Share Centre offers trading on most shares on the London Stock Exchange, both on the FTSE and AIM sections of the exchange. In all, there are more than 500 shares that you can trade through this broker. So, if you’re looking to trade Tesco or Royal Mail, you’ll find them at The Share Centre. However, this broker doesn’t offer any depository receipts or access to international exchanges, so you are fully limited to buying shares of UK companies.

Funds and Investment Trusts

You can also invest in mutual funds and investment trust funds through The Share Centre. The diversity of mutual funds is pretty incredible – there are more than 4,250 funds to choose from. Helpfully, The Share Centre’s analysts curate a list of 120 funds in the Platinum Funds list that offer low fees and solid returns.

The broker also keeps lists of socially responsible funds, broken down into categories like ‘Climate change and renewable energy’ and ‘Equality and diversity.’ While other brokers offer socially responsible funds, having the ability to easily find these mutual funds through The Share Centre is helpful.

The Share Centre also has a list of 26 investment trust funds you can invest in. These are perhaps the best way to gain international exposure through this broker, since the investment trusts cover emerging markets in Asia, different sectors of the US stock market, and specific asset classes like bonds and real estate. All investment trusts are rated for risk by The Share Centre’s analysts to help you decide which is right for you.

ETFs

The Share Centre’s selection of exchange-traded funds (ETFs) is somewhat disappointing. There are just over 40 ETFs to choose from, which is a fraction of the number that most other major stock brokers offer. The good news is that the ETFs on offer do cover a variety of asset classes, including commodities and real estate. You can also trade ETFs that focus on specific countries, regions, or sectors of the global stock market.

The Share Centre Fees & Commissions

The Share Centre is renowned for its relatively low fees, although it’s not quite as cheap as any commission-free brokerage or even some competitors like Interactive Investor. The Share Centre fees vary depending on the type of account you open.

Standard Trading Account

With a standard trading account, you pay a fixed monthly fee of £2 plus a flat commission of £7.50 per trade. That’s pretty good if you can make a significant number of trades each month, but there’s a catch. If your trade is worth more than £750, the commission switches from £7.50 to 1% of the trade value.

If you place a lot of trades larger than £750, The Share Centre does have an alternative pricing structure for you. You can pay a quarterly fee of £24 (on top of the £2 monthly account fee) and in exchange you get a flat £7.50 commission on all trades, regardless of size.

ISAs

If you open an ISA, your fees depend on the type of ISA. Lifetime and ready-made ISAs are free of charge and there are no trade commissions. You just pay the fund fees associated with the funds that you are invested in with these accounts.

For a DIY stocks and shares ISA, the account fee is £5 per month. Trading commissions are the same as for a standard trading account, and you have the same option to pay an extra £24 each quarter to limit your commission to £7.50 for all trades regardless of size.

Additional Fees

One of the nice things about The Share Centre is that there are almost no additional fees to worry about. There are no deposit or withdrawal fees, and since all investments are priced in pounds you don’t need to deal with currency conversion charges. The only possible fee is for same-day withdrawals, which cost £25 (free withdrawals take three to five days).

The Share Centre Platform and Trading Tools

The Share Centre’s platform is an online portal rather than a standalone desktop app. It’s a little bit outdated, with few of the modern and sleek touches that you’ll find at other brokers. But despite the old-fashioned look, we found that the online trading platform is straightforward to use and navigate.

It’s important to note that The Share Centre’s platform is designed for investors only, not active day traders. The price data is often slightly delayed (on the order of several seconds) and the website simply doesn’t respond quickly enough to enable you to react to tick-by-tick price changes.

The options for trading are also limited. You can place basic order types, including market, limit, and stop loss orders. However, there is no way to specify the expiration date for an order or to add more complex risk management layers like fill or kill orders.

Another thing that’s notably missing from The Share Centre’s trading platform is price alerts. You cannot set them at all with this brokerage, which is something of a significant blow even for long-term investors. Without alerts to keep an eye on dips in price for shares in your watchlist, it’s up to you to keep eyes on the market every day to spot buying opportunities.

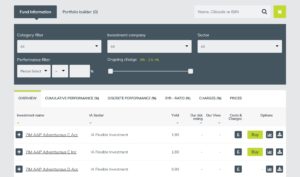

Perhaps the most helpful thing that The Share Centre offers is a fund screener, which makes it significantly easier to sort through the more than 4,000 mutual funds the broker has. The screener parameters aren’t all that in-depth, but you can filter available funds by managing firm, market sector, historical performance, or fee.

Research and Analysis at The Share Centre

Our The Share Centre review found that the broker provides a reasonable amount of research for investors, although it should be noted that the broker focuses much more on fundamental financial data than technical analysis. With every share, you get access to the company’s income statement, cash flow, and balance sheet.

Better yet, The Share Centre provides its own take on many of the shares and funds in its catalogue. Analysts from the broker will offer their take on the pros and cons of a company along with a narrative of their argument for why it’s a buy or not. The Share Centre’s analysts also recommend one share per week, which is a very simple way to discover new investments. That said, there isn’t a record of how the analyst recommendations have performed over time. The analysts also recommend one mutual fund each month.

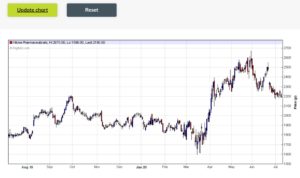

If you’re looking for technical charting, you’ll probably want to search elsewhere. The Share Centre does provide charts for shares and funds, but they are extremely limited. The interface is clunky – you have to click ‘Update’ to add indicators – and less than 10 common indicators are available to overlay on the price data. There are also no drawing tools to use and you cannot zoom in on a specific time period for more detailed price data.

The Share Centre App

The Share Centre has a mobile investment app for iOS and Android devices. The Share Centre app operates very similarly to the broker’s web interface and gives you access to all the same news, investment recommendations, fund screeners, and more. You can easily monitor your watchlists from the app and place trades, and you get access to all of the same order types for managing risk.

The one major thing that The Share Centre app is missing is price alerts. This is a significant drawback, since much of the point of having a mobile trading app in the first place is to take advantage of short-lived trading opportunities when they happen. You cannot set price alerts through the app in any capacity at this time.

Payments at The Share Centre

The number of ways you can fund your account at The Share Center is relatively small. The broker accepts bank transfers or debit cards, but not credit cards or e-wallets. If you pay by debit card, you can start trading on your account immediately. Bank transfers may take up to five days to clear before you can begin trading.

Withdrawals can only be made to the same account that you deposited money from, unless you call in to The Share Centre’s customer service team to verify the new account. Withdrawals typically take three to five days to process, although you can request a same-day withdrawal for a £25 fee.

The Share Centre Contact and Customer Service

The Share Centre offers customer service by phone and email. If you want to call in via the Share Centre phone number, the service team is available from 8 am to 4:30 pm on weekdays only. Those are relatively limited hours, especially considering that many of The Share Centre’s competitors are offering 24/7 help along with a live chat option.

However, our The Share Centre review did find the brokers service representatives to be very knowledgeable. They were quick to answer the phone and seemed to fully understand the ins and outs of the broker’s platform.

The Share Centre is based in Aylesbury.

The Share Centre contact number: 01296 41 42 43

The Share Centre contact email: [email protected]

The Share Centre address: Floor 1, Oxford House, Oxford Rd, Aylesbury HP21 8SZ

Is The Share Centre Safe?

The Share Centre has been operating in the UK for 30 years and is generally considered a very trustworthy brokerage. While it’s not traded on a public exchange and does not disclose its financials, it is closely regulated by the UK’s Financial Conduct Authority. This is a highly respected regulatory authority, and it has not raised any issues with The Share Centre.

The other thing to know about The Share Centre is that all accounts are backed up by the UK’s Financial Services Compensation Scheme. This insures your account for up to £85,000 in the event that The Share Centre ever goes bankrupt – not that there are any signs of this happening anytime soon.

The Share Centre Pros & Cons

Pros

- Low monthly account fee

- Access to nearly all shares on the London Stock Exchange

- More than 4,000 mutual funds to trade

- Access to a diverse selection of ETFs and investment trusts

- Share and fund recommendations and analysis

- Offers ISA and SIPP accounts

- Mobile investment app

Cons

- No technical charting

- Limited number of ETFs

- No access to international shares

- Trade commissions can be expensive

- Customer service is only available on weekdays

The Verdict

The Share Centre is a nice brokerage that offers low-cost trading on UK shares, mutual funds, investment trusts, and ETFs. This broker can be a reasonable choice if you need an ISA or SIPP account and want access to a wide variety of funds, but it wouldn’t be our first pick for general investing.

That’s because the trade commissions are relatively high and there is no access to international markets. In addition, while we appreciate The Share Centre’s weekly recommendations for shares to invest in, the lack of serious technical charting capabilities is a major drawback.

It’s not clear what type of investor The Share Centre is catering to. It is neither as inexpensive as some of its competitors, nor does it offer more advanced tools. While the platform is easy to use, it’s not all that modern and doesn’t include a lot of differentiating factors.

FAQs

Can I invest in IPO shares with The Share Centre?

Yes, The Share Centre does offer shares of IPOs (initial public offerings) to its account holders on occasion. However, there are typically only a few IPOs each year with this brokerage.

Can I trade stock indices with The Share Centre?

The Share Centre doesn’t offer any direct trading of stock indices, either for the London Stock Exchange or for international exchanges. You can find some ETFs and mutual funds that track the world’s major market or sector-specific indices, though, which gives you a similar level of exposure.

Does The Share Centre offer trading on international shares?

All of the individual shares that you can trade through The Share Centre are traded on the London Stock Exchange. You cannot trade depository receipts or trade shares on another exchange. You can get exposure to international shares through ETFs, investment trusts, and mutual funds.

Is there a minimum deposit required to start trading on The Share Centre?

No, The Share Centre does not require a minimum deposit. You just need to pay your first month’s account fee, which is £2 for a standard trading account or £5 for an ISA.

What ready-made ISA portfolios does The Share Centre offer?

The Share Centre has three pre-made ISA portfolios that are managed for you, without requiring any research or trading on your part. They are Income, Income & Growth, and Growth. The Income portfolio is managed to yield dividends twice a year, while the Growth portfolio is managed for share price appreciation.

Who owns The Share Centre?

The Share Centre is a subsidiary of Share plc. In February 2020, the broker Interactive Investor agreed to acquire The Share Centre.