US inflation data released this morning came in hotter-than-expected and the CPI rose 3.7% on an annualized basis and 0.6% on a monthly basis, seasonally adjusted.

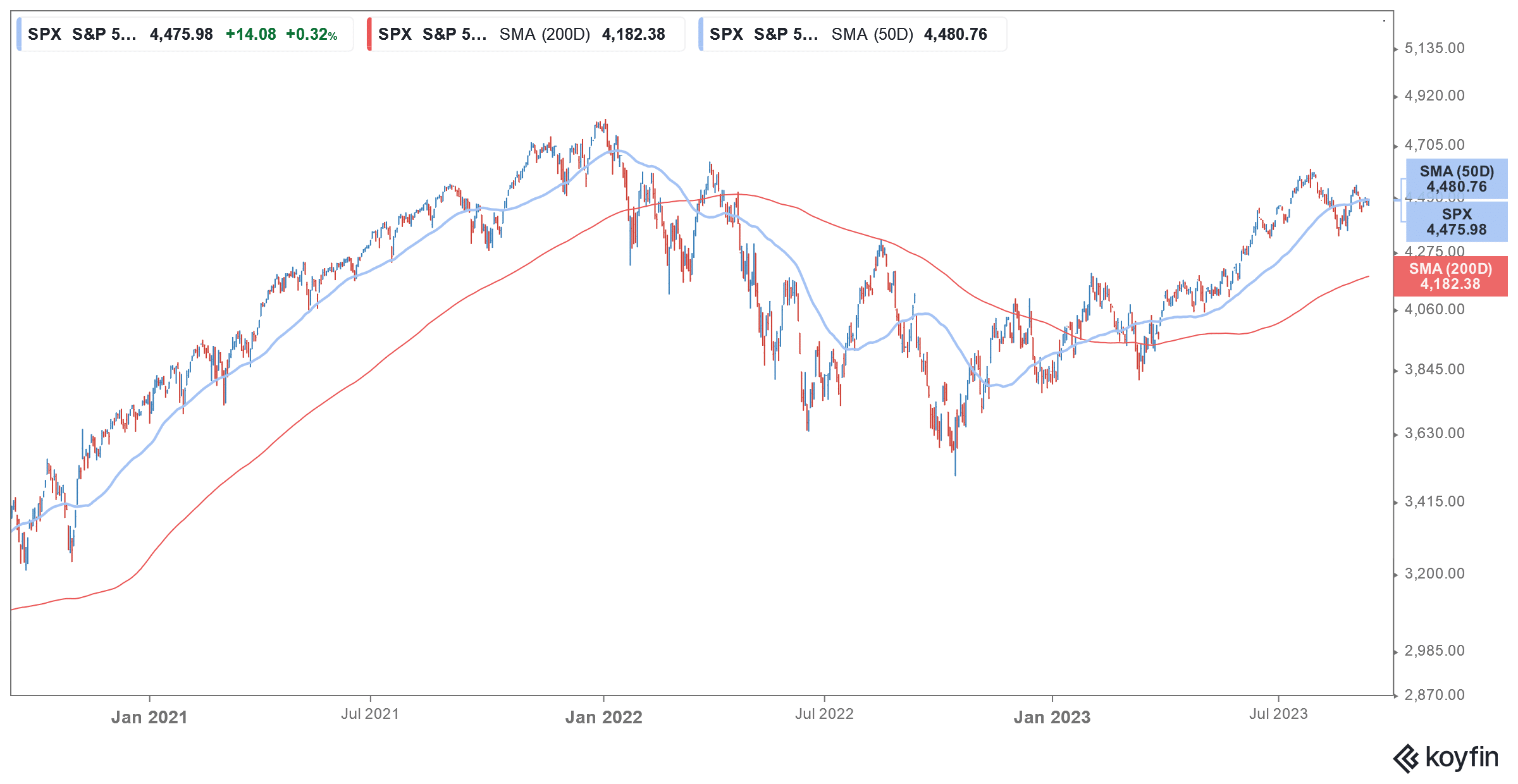

US inflation in the current cycle peaked at an annualized rate of 9.1% in June 2022 and then fell every month until June 2023 when it hit 3%. However, annualized inflation inched up in July and August as the low base effect has started to wane.

US inflation rises as energy prices rise

In its release, the US Bureau of Labor Statistics said, “The index for gasoline was the largest contributor to the monthly all items increase, accounting for over half of the increase. Also contributing to the August monthly increase was continued advancement in the shelter index, which rose for the 40th consecutive month.”

Notably, the fall in energy prices helped bring down the US inflation. However, global energy prices have risen to multi-month highs amid production cuts by major producers which had pushed up prices.

Meanwhile, it is not that only the energy prices have contributed to the rise in inflation – and even the core inflation which excludes the volatile food and energy prices rose 0.3% on a monthly basis in August. It was incidentally the first time since February that the metric – which is a better inflation indicator – rose on a monthly basis.

Analysts on inflation data

Lisa Sturtevant, chief economist at Bright MLS said, “Housing continues to contribute an outsized share to the inflation measures.” She added, “Rent growth has slowed considerably and median rents nationally fell year-over-year in August. … However, it takes months for those aggregate rent trends to show up in the CPI measures, which the Fed must take into account when it takes its ‘data driven’ approach to deciding on interest rate policy at their meeting … later this month.”

Fed meeting is scheduled for later this month

The Fed meeting for September is scheduled for later this month and traders still expect the US central bank to hold rates at the same level. In fact, the CME FedWatch tool shows that 97% of traders believe that the Fed would keep rates at the current levels of 5.25%-5.50%. Before the inflation data, 92% of traders were of the view that the Fed wouldn’t raise rates in September.

Interestingly, despite hotter-than-expected inflation data, traders have raised the odds of the Fed holding rates steady this month. As Andrew Hunter, deputy chief U.S. economist at Capital Economics said, “Overall, there is nothing here to change the Fed’s plans to hold interest rates unchanged at next week’s [Federal Open Market Committee] meeting.”

However, nearly 40% of traders believe that the Fed would raise rates by 25 basis points at the next meeting in November.

Traders are meanwhile optimistic that the Fed would cut rates next year and only 1.7% of traders believe that rates would be at current or higher levels by the end of 2024.

Powell did not rule out consecutive rate hikes to tame inflation

The Fed’s June dot plot showed that FOMC members see another 50 basis point rate hike in 2023 while chair Jerome Powell hasn’t ruled out consecutive rate hikes to tame inflation. The US Central Bank had raised rates by 25 basis points at its last meeting also.

Minutes of Fed’s meeting

The Fed has been on a rate-hiking spree for over a year now. It raised rates by 25 basis points in March 2022 and by 50 basis points in May. In the next four meetings, it raised rates by 75 basis points each before lowering the pace of hikes to 50 basis points in December.

The US central bank raised rates four times in 2023 by 25 basis points each and only paused its rate hikes momentarily in June after the regional banking crisis. The minutes of the Fed’s July meeting which were released last month said, “Most survey respondents had a modal expectation that a July rate hike would be the last of this tightening cycle, although most respondents also perceived that additional monetary policy tightening after the July FOMC meeting was possible.”

They added, “However, they stressed that inflation remained unacceptably high and that further evidence would be required for them to be confident that inflation was clearly on a path toward the Committee’s 2 percent objective. Participants continued to view a period of below-trend growth in real GDP and some softening in labor market conditions as needed to bring aggregate supply and aggregate demand into better balance and reduce inflation pressures sufficiently to return inflation to 2 percent over time.”

US inflation is proving quite sticky

US inflation has proved quite sticky amid rising wages and shelter costs. Incidentally, in 2020, the Fed changed its approach and now targets an average inflation of 2%. The mandate gives it more leeway in deciding on monetary policy, unlike the previous framework where it strived to keep inflation below 2% at all times.

On several occasions, Powell has said that the Fed is not considering rate cuts anytime soon. He has dashed hopes of a “pivot” multiple times dashing the hopes of those traders who are betting on a policy reversal.

Question & Answers (0)