Twitter (TWTR) shares jumped yesterday after the company unveiled two new features that it will be launching on its platform shortly, including a premium subscription model through which followers will get access to exclusive content from their favourite creators.

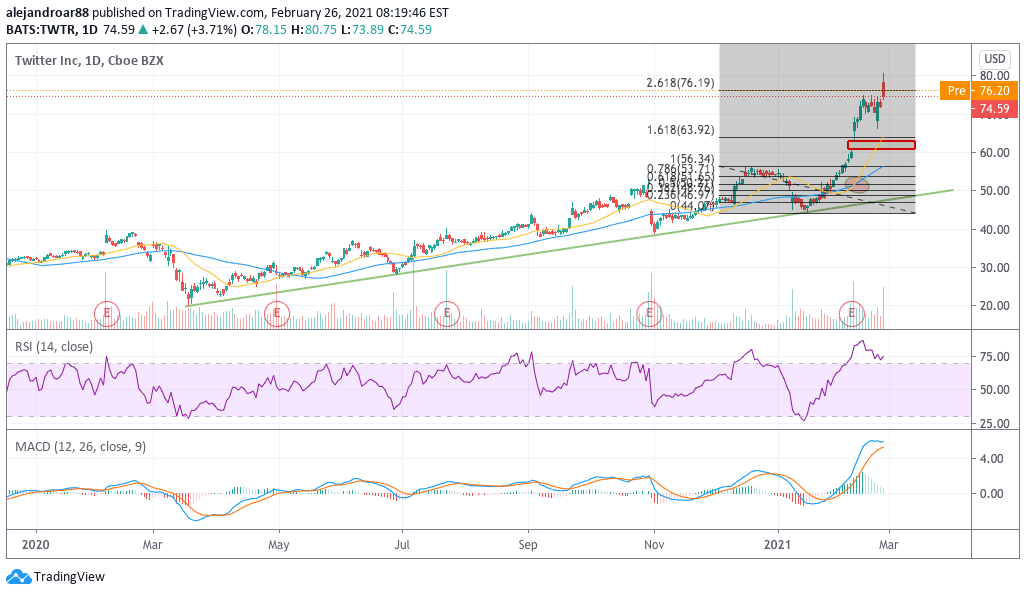

Shares of the social media platform rallied 12% to $80.75 per share in early stock trading activity, but then retreated sharply to close the session with a milder 3.7% gain at $74.6 as the tech sector took a strong hit during the day.

Twitter’s two new features include an option called “Super Follows”, in which creators can be compensated for pushing exclusive content to their fan base, including newsletters, bonus tweets, access to a community group, and a badge indicating support.

This premium feature would work as a subscription-based model, which means that users will have to pay a monthly fee to access the additional content.

Moreover, Twitter will be launching a second major new feature called “Communities”, that will allow users who share a particular interest to create groups in which they can chat and exchange ideas regularly – similar to Facebook’s Group feature.

These latest moves from the San Francisco-based social media platform would come as a result of increased pressures from certain shareholders to launch new features to further monetise its massive user base – currently comprised of 192 million users worldwide according to Twitter’s latest financial report.

Jack Dorsey, Twitter’s founder and Chief Executive, addressed some of these concerns during an event hosted by the company with analysts and investors called the “Virtual Analyst Day” in which he emphasised that it used to take Twitter between 6 to 12 months to launch a new feature while the company now aims to accomplish this task in under a few weeks.

Meanwhile, the founder of the popular social media app outlined three goals for the business for 2023 including:

- Doubling the speed of development.

- Reaching 315 million monetiseable daily active users (mDAU).

- Double the firm’s annual revenue to $7.5 billion.

These ambitious goals have appeared to entice market participants yesterday and they could be the primary driver behind the strong uptick seen by Twitter shares lately.

That said, materialising these targets will not be an easy task, as other competing platforms continue to challenge Twitter’s stand, including Snapchat (SNAP) and TikTok.

What’s next for Twitter shares?

Twitter has kicked off 2021 positively, with the stock jumping 38% in value since the year started, while Snapchat and Facebook (FB) have yielded 26% and -6.7% to investors during the same period.

Meanwhile, this performance is quite remarkable when compared to that of the tech-heavy Nasdaq 100 index, as the benchmark has retreated 0.5% since 1 January amid what seems to be the materialisation of a long-awaited rotation from tech stocks to virus-battered areas of the market such as travel, leisure, and energy.

Last year, Twitter shares produced 69% in gains for investors as tech stocks were actually favoured by the pandemic as people relied on web-based and mobile platforms to entertain themselves while confined within their homes.

Now the question would be, can this strong uptrend continue following these recent announcements?

For once, there is a scenario in which the market might have already priced in the launch of a paid feature such as “Super Follows”. If that would be the case, the reaction of the price could be the opposite of what you would expect, as some investors will take the opportunity to sell their shares now that the news is out there.

That said, the ambitious goals set forth by Mr. Dorsey during yesterday’s conference could keep the uptrend running as there is no doubt that hitting those targets would have a tremendous effect on Twitter’s financial performance.

At this point, the following weeks will probably determine how the market’s sentiment reacts to the news.

For now, Twitter’s technical setup indicates that the price action is heavily overheated, which could lead to a short-term pullback.

If that were to happen, the $62 level should provide support for any strong decline as there is a confluence between the 1.618 Fibonacci indicated in the chart and a bullish gap left behind on the day that Twitter released its financial results covering the fourth quarter of last year.

For bulls, a pullback of that nature would present a buying opportunity if they are operating in the assumption that Twitter’s results will start moving closer to those 2023 targets from now on.

Question & Answers (0)