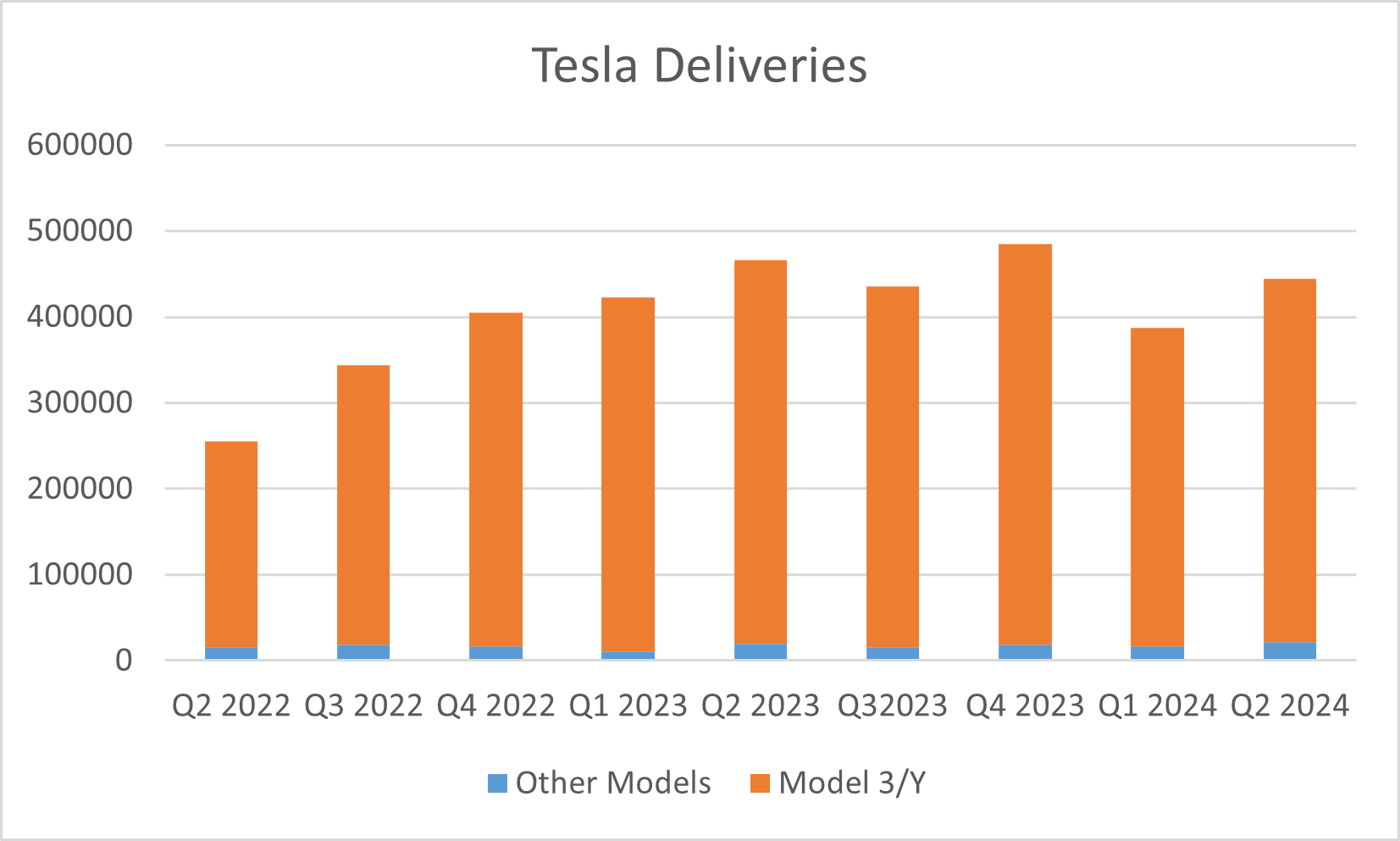

While Tesla still remains the biggest seller of electric cars in the US by a margin, its market share has dipped below 50% in Q2 per a report from Cox Automotive. Notably, Tesla’s deliveries have fallen YoY for two consecutive quarters and the Elon Musk-run company has failed to boost shipments despite cutting prices.

In its report, Cox Automotive said that US electric vehicle (EV) sales hit a record high of 330,000 in Q2 even as Tesla’s deliveries dropped.

According to Cox’s industry insights director Stephanie Valdez Streaty, “While Tesla’s sales continue to decline, with its share of EV sales now below 50 percent for the first time, the overall electric vehicle competitive landscape intensifies further.”

She added, that rising competition “is leading to continued price pressure, helping push EV adoption slowly higher.”

Tesla US market share slips

Notably, Tesla’s US market share peaked at 82.5% in Q3 2019 and has since been sliding. However, in absolute terms, the company’s volumes are up significantly as the US EV market has expanded and sales rose over 1 million last year for the first time.

According to Cox, Ford was the second largest EV seller in the US with a market share of 7.2% followed by Kia at 5.4%. Most automakers have cut EV prices amid an industry-wide price war triggered by Tesla which has been pretty straightforward about prioritizing deliveries over margins.

EV price war

The Elon Musk-run company has lowered prices multiple times in markets outside the US also. Last year, The China Association of Auto Manufacturers (CAAM) tried to bring about a truce in the EV price war but soon rescinded the pledge admitting it was against the country’s antitrust laws.

Even in the US, Ford lowered prices for its electric cars to boost adoption. These price cuts have worsened losses at its EV business which it rechristened Model e.

EV demand hasn’t been as strong as markets expected prompting companies to readjust their production plans. For instance, both Ford and General Motors which have committed billions of dollars towards building EV plants are delaying their investments. Startup EV companies have been under even severe stress and are grappling with continued cash burn. Several startup EV companies have either gone bankrupt or are on the verge of doing so.

According to Streaty, “Automakers that deliver the right product at the right price and offer an excellent consumer experience will lead the way in EV adoption.”

Tesla has almost given up on 50% CAGR guidance

Tesla, which was once looking to grow deliveries at a CAGR of 50% over the long term has missed that milestone for two consecutive years. The company did not provide quantitative guidance for 2024 but warned that the growth “may be notably lower than the growth rate achieved in 2023.”

While Musk sounded confident about YoY growth in 2024, the task has become tougher after a decline in the first half of the year. It was incidentally the first time in a decade that Tesla’s deliveries fell YoY for two consecutive quarters.

Tesla has all but given up the 50% CAGR guidance and has instead been harping on its artificial intelligence (AI) capabilities.

TSLA robotaxi event

Tesla was set to unveil its robotaxi on August 8 but reports suggest that the event could be delayed to October.

Tesla markets its advanced autonomous driving as FSD (full self-driving). However, it is worth noting that the nomenclature could be misleading as it is not level 4 autonomous driving, and even Tesla advises drivers to keep their hands on the steering all the time even when it is on the Autopilot. There have been multiple instances of crashes involving Autopilot and the US NHTSA (National Highway Transport Safety Administration) is investigating the company.

However, in April the company received a tentative approval to offer its FSD in China. Separately, Tesla announced that it would use Baidu’s mapping and navigation technology for the service.

The partnership wasn’t surprising given how protective China is about the data of its citizens. China incidentally banned Tesla vehicles in some government and military installations over spying concerns. The country also ordered Chinese ride-hailing app Didi to delist from the US over concerns over the data of millions of Chinese consumers that the company has.

BYD and Tesla are competing for the EV crown

Tesla and Chinese EV giant BYD have been fighting for the crown of the biggest EV seller globally. BYD which sells both battery electric vehicles (BEV) and plug-in hybrid vehicles delivered a record 341,658 cars in June. The rise was led by a record 195,032 PHEV sales. Incidentally, the company’s PHEV sales have hit record highs for four consecutive months. Its BEV deliveries were 145,179 in June and while the metric rose 13.2% YoY it fell almost 1% as compared to June.

In the second quarter, the company’s NEV sales rose 40.2% YoY to 986,720 units. Of these BEV sales were 426,039 units and while sales rose almost 21% it trailed that of Tesla which has reclaimed its title as the biggest EV seller after losing it to BYD last year.

BYD is the market leader in China though – just as Tesla is in the US. The company sells models for as low as $10,000 which has helped it capture market share in the world’s second-largest economy. Tesla too is working on a low-cost model which should help it increase its target market and add to its limited arsenal of models.

Question & Answers (0)