The price war in the Chinese EV industry, which is the world’s largest in terms of total annual deliveries, has escalated even further after Tesla offered new incentives to spur sales. The Elon Musk-run company had lowered prices in China earlier this year also continuing its long streak of price cuts.

On its official Weibo account, Tesla said, that it would offer incentives upto 34,600 yuan (or around $4,807) for those buyers who take deliveries of Model 3 and Model Y by the end of March.

These include an 8,000-yuan discount on car insurance products and another 10,000-yuan discount if the buyer chooses a change of paint.

China EV price war escalates

The company is also offering a preferential financing plan that could lead to potential savings of up to 16,600 yuan for buyers of Model Y.

To be sure, its not uncommon for Tesla to offer such incentives towards the end of a quarter and it has used free Supercharging as a marketing tool to spur sales in the US market multiple times.

However, for almost 18 months now Tesla has been on a price-cutting spree as the company looks to increase its deliveries at a time when the overall EV industry is battling a severe growth slowdown.

Musk has been quite vocal about the fact that Tesla would prioritize delivery growth even at the cost of sacrificing margins. The company’s operating margins are already down to just about 8% which is less than half of what they were at the peak.

Chinese EV companies reported a fall in February deliveries

Meanwhile, Tesla’s recent round of incentives comes shortly after Chinese EV companies reported tepid deliveries for February.

BYD for instance sold 122,311 new energy vehicles in February – which include both battery electric cars and plug-in hybrids. The deliveries fell 36.7% YoY and 39.3% as compared to February 2023.

In Q4 2023, China’s BYD surpassed Tesla to become the largest seller of EVs globally. In May last year, Musk termed China-based EV maker BYD “highly competitive.” Notably in 2011, the billionaire had laughed at the possibility of BYD as a competitor to Tesla.

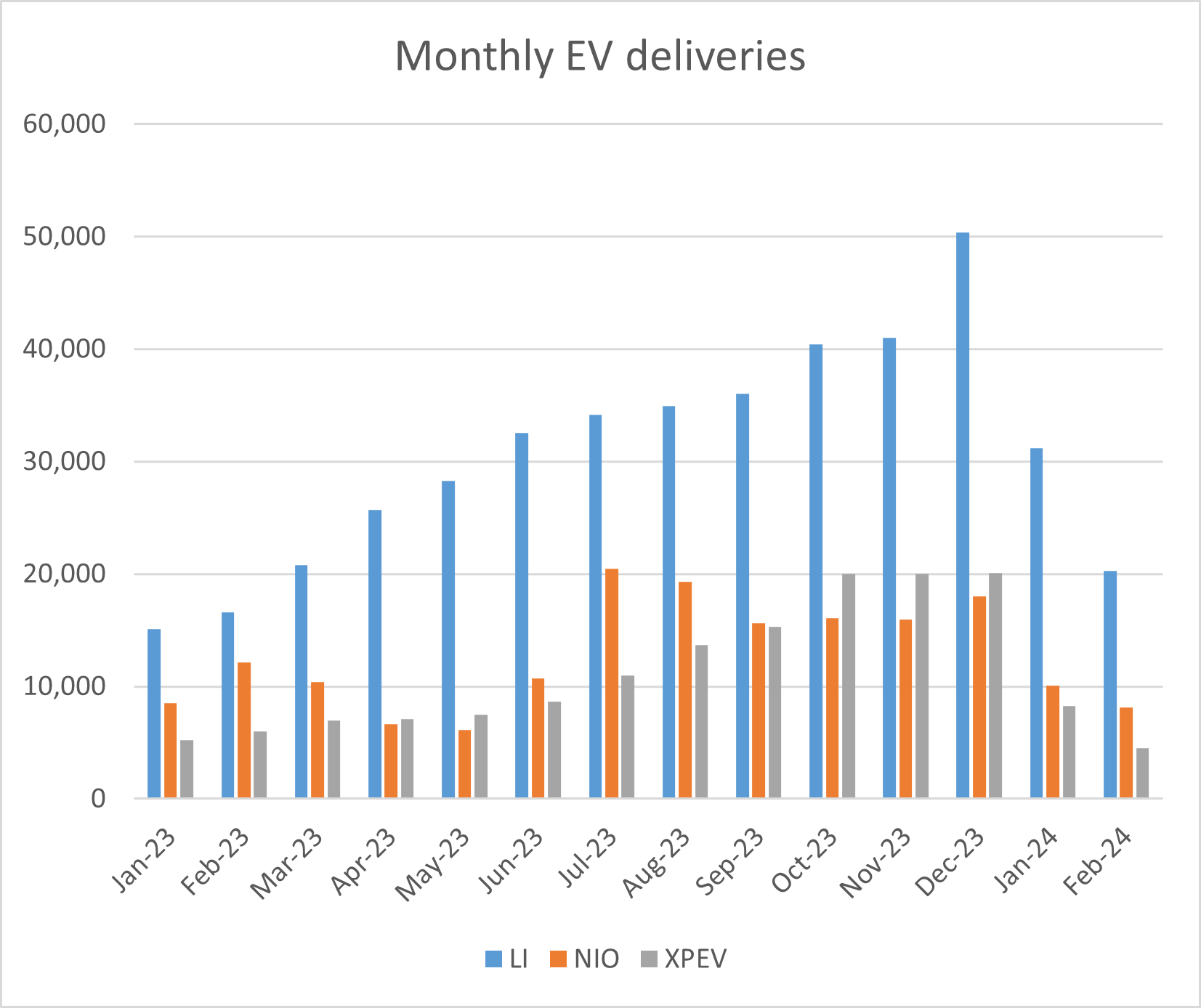

Li Auto delivered 20,251 vehicles in February 2024 which was 21.8% higher YoY. The company’s cumulative deliveries reached 684,780 at the end of February.

Xpeng Motors February deliveries fell to multi-month lows

Xpeng Motors February EV deliveries fell to a mere 4,545. It delivered 8,250 cars in January. For context, the company delivered 6,010 vehicles in February and 5,218 in January of last year. Notably, Xpeng Motors deliveries bottomed in January 2023 and rose on a monthly basis in all the remaining months last year topping 20,000 each in all months in Q4.

Now, the company’s deliveries have fallen on a monthly basis for two consecutive months and also came in below 10,000 units in both months. Its cumulative deliveries at the end of February were 413,106.

NIO delivered 8,132 EVs in February which was 19.1% lower as compared to January, and 33.1% lower than the 12,157 vehicles delivered in February 2023. The company delivered 18,187 vehicles in the first two months of the year which is below the 20,663 that it delivered in the corresponding period last year NIO’s cumulative deliveries reached 467,781 at the end of February.

Xpeng Motors warned of a bloodbath in the EV industry

In an employee memo in February, Xpeng Motors’ CEO He Xiaopeng said that the price war in the EV industry could end in a “bloodbath.” Notably, there has been a brutal price war in the Chinese EV industry since Q4 of 2022 when Tesla started to cut car prices to spur sales.

Tesla’s price cuts were followed by similar announcements from other carmakers including Xpeng Motors, Ford, Toyota, and Nissan.

Last year, even NIO lowered car prices. Previously the company had categorically said that it wouldn’t join the price war.

The Elon Musk-run company has since lowered prices multiple times including in January. Last year, The China Association of Auto Manufacturers (CAAM) tried to bring about a truce in the EV price war but soon rescinded the pledge admitting it was against the country’s antitrust laws.

China is saddled with excess EV production capacity

China is now saddled with excess EV capacity and the problem seems to be getting worse as Chinese tech giants also contemplate entering the industry. The country is looking to rein in the problem of EV overcapacity but so far it hasn’t helped much.

Musk meanwhile has been all praise for Chinese EV companies and during the Q4 2022 earnings call last month he said, “Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.”

He added, “The Chinese car companies are the most competitive car companies in the world. So, I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established.”

The US electric vehicle market is also witnessing a slowdown

The EV industry slowdown is not limited to China and dealer lots in the US are also filled with unsold inventory of electric cars. Last month, both Lucid Motors and Rivian gave a tepid production guidance for 2024 with the latter’s guidance implying a slight YoY fall in deliveries.

Even Tesla, which was once looking to grow deliveries at a CAGR of 50% over the long-term has missed that milestone for two consecutive years. The company did not provide quantitative guidance for 2024 but warned that the growth “may be notably lower than the growth rate achieved in 2023.”

The perennial losses and tough capital market conditions have been too much to handle for many startup EV companies and many companies including UK-based Arrival have gone out of business.

The pessimism is also reflected in the price action of EV shares all of which trade at a fraction of their all-time highs. Even Tesla’s share price is around half of its 2021 peak as the company continues to battle a growth slowdown and rising competition both domestically as well as internationally.

Question & Answers (0)