Tesla shares rallied over 15% yesterday after the company received tentative approval to offer its advanced driver-assistance service in China. Separately, the company announced a deal with Baidu and would use the Chinese tech giant’s mapping and navigation technology for the service.

Tesla markets its advanced autonomous driving as FSD (full self-driving). However, it is worth noting that the nomenclature could be misleading as it is not level 4 autonomous driving and even Tesla advises drivers to keep their hands on the steering all the time even when it is on the Autopilot. There have been multiple instances of crashes involving Autopilot and the US NHTSA (National Highway Transport Safety Administration) is investigating the company.

Tesla shares rally on hopes of China FSD rollout

While Tesla offers some autonomous driving features in China, it faces several restrictions. Along with limited functionality, there were also issues related to how Tesla would use the data. China incidentally banned Tesla vehicles in some government and military installations over spying concerns.

The company is anyways battling brutal competition and a price war in China, which is its second-largest market after the US, and home to its most productive Shanghai Gigafactory. China has granted tentative approval to the FSD rollout after Elon Musk’s visit to the country.

No wonder, Wedbush Securities termed the billionaire’s China visit a “watershed moment.” It added, “This trip will be significant for Tesla and Musk further strengthening its EV footprint within the Chinese market at a pivotal time.”

Tesla is battling a severe slowdown

Tesla is battling a severe slowdown and its Q1 deliveries fell 8.5% YoY to 386,810. It was the first time since 2020 that the company reported a YoY fall in deliveries and went on to show that even Tesla is not immune from the EV industry slowdown.

While Musk sounded confident that the company’s 2024 deliveries would be higher than the previous year, Tesla would need to spur volumes in the coming quarters to achieve that goal.

EV demand is slowing down

EV demand has been quite weak prompting companies to readjust their production plans. For instance, both Ford and General Motors which have committed billions of dollars towards building EV plants are delaying their investments. Startup EV companies have been under even severe stress and are grappling with continued cash burn. Several startup EV companies have either gone bankrupt or are on the verge of doing so.

Even Tesla has delayed the construction of its upcoming plant in Mexico while Musk delayed his India visit to discuss the construction of a plant there.

Tesla is also facing severe competition in China from domestic Chinese automakers. Musk meanwhile has been all praise for Chinese EV companies and during the Q4 2023 earnings call earlier this year he said, “Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.”

He added, “The Chinese car companies are the most competitive car companies in the world. So, I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established.”

US-China spar over data issues

One of the reasons Tesla did not had permission for a full FSD rollout in China was due to concerns over data. The company’s mapping deal with a Chinese company helps address some of the fears and could very well be the template for other companies, especially after President Joe Biden signed a bill that might lead to a ban on TikTok in the US.

China has been even more protective of the data of its citizens. It has banned government employees from using Apple’s iPhone and the Cupertino-based company removed Meta Platforms’ apps from the Chinese App Store earlier this month on orders from the government. Meta’s apps like WhatsApp and Threads were anyways mostly inaccessible to Chinese users but Apple removing them from the App Store makes it even tougher to access these apps in the country.

China has also ordered Chinese ride-hailing app Didi to delist from the US over concerns over the data of millions of Chinese consumers that the company has.

Coming back to Tesla, the company getting approval for a full FSD rollout in China looks positive. Musk sees autonomous driving as the key enabler of Tesla’s valuation and the company is set to unveil its robotaxi on August 8.

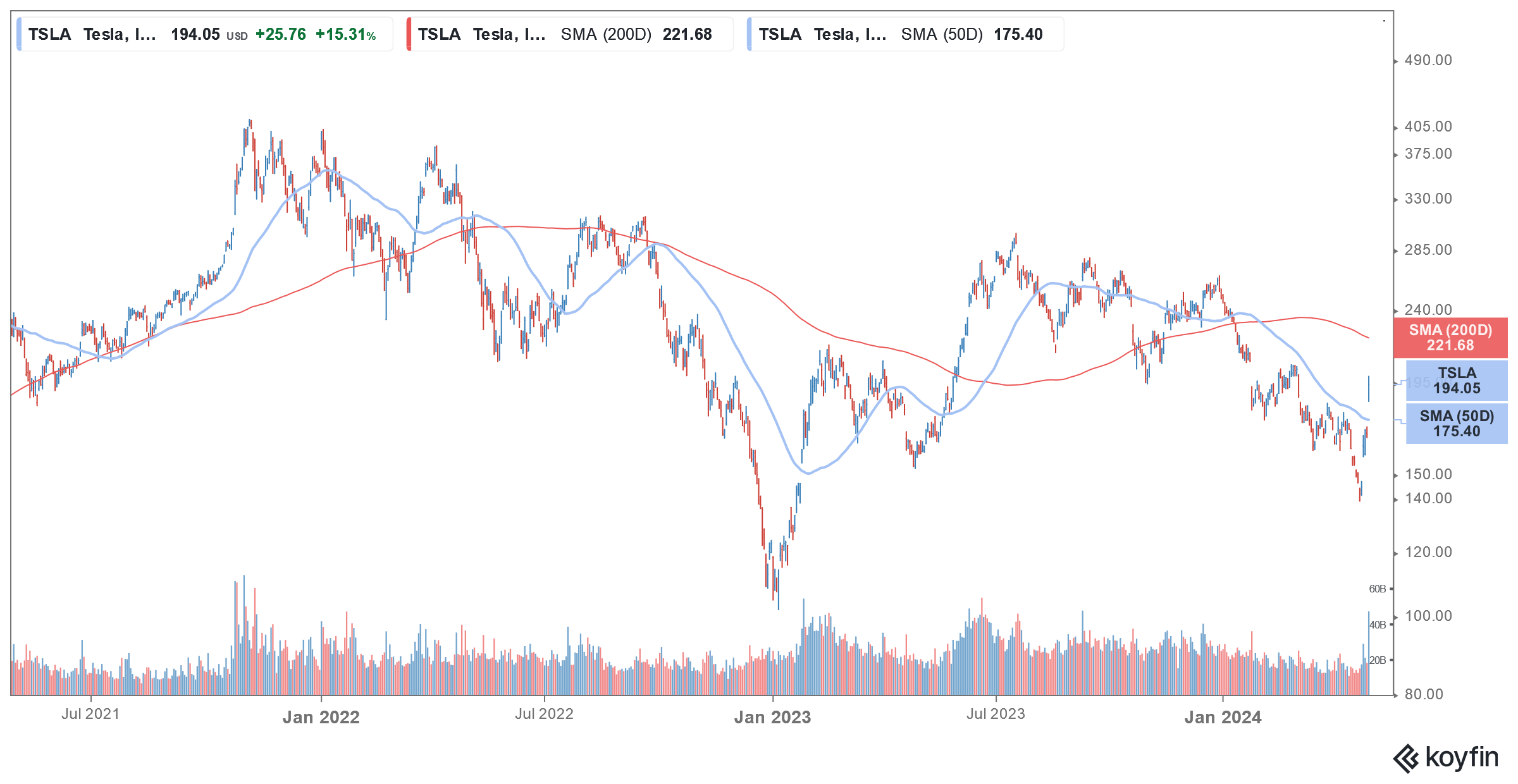

As EV sales have been tepid, Tesla might need to double down the focus on its software business to support its valuations which is still much higher than legacy automakers despite having fallen by over half from its 2021 peak.

Question & Answers (0)