Tech stocks are heading to open the day in green territory for the third consecutive day, with a sustained retreat in US Treasury yields apparently supporting a move higher in the tech-heavy Nasdaq 100 stock index.

So far today, E-mini futures of the Nasdaq Composite are advancing 0.55% at 13,879.5 in early futures trading action while yields of 10-year Treasury notes are moving lower to 1.527% – their lowest level since November last year.

A slightly lower than expected trade deficit could be behind today’s downtick in Treasury yields as the US Balance of Trade came in at minus $68.9 billion or $100 million lower than analysts’ estimates for the period according to data from Koyfin. Meanwhile, the figure also represented an improvement from last month’s $75 billion reading.

Shares of Tesla (TSLA) are supporting a portion of today’s uptick in the Nasdaq 100 as they are jumping 2.7% in pre-market stock trading action after a report from China’s Passenger Car Association indicated that the electric vehicle company sold 33,463 units in May – a 29% jump compared to a month ago.

Tech stocks have been performing quite well this month compared to other sectors as they are advancing 1.7%, as tracked by the SPDR Technology Select (XLK) exchanged-traded fund (ETF), while other segments of the market like industrial and financial firms are either down or slightly changed.

The biggest stress test for tech stocks will come later in the week when inflation data for the United States is released as another beyond-expected jump in prices could prompt a bond sell-off. Such a situation would push yields higher and that could depress valuations in the tech space as that corner of the market appears to be highly susceptible to changes in the cost of capital.

Is this a moment to be in our out of the tech space?

In a recent interview with CNBC, Lindsey Bell, chief investment strategist for Ally Invest, said that even though tech stocks have lost some of their shine in a post-vaccine scenario investors should continue to incorporate these issues into their portfolio as the big names in the space tend to be favored during times of uncertainty amid their strong fundamentals.

“I don’t think investors should have ever left the tech space in general, I think they should have right-sized their portfolio to make sure they were not so overweight on tech”, said Bell in regards to how investors should manage their exposure to the sector at a time when cyclical stocks appear to be outperforming tech.

So far this year, the so-called value stocks, a name often used to classify equity issues from more traditional segments of the markets, have outperformed tech stocks, with the SPDR Energy Select (ETF) delivering an eye-popping 47% gain along with the SDPR Financial Sector ETF (XLF), which gained 29% during the same period, while the SPDR Tech Sector ETF (XLK) advanced only 8.3%.

This phenomenon known as sector rotation had been widely anticipated as a result of hopes that the economy will bounce back from its pandemic levels on the back of en-masse vaccinations.

However, what June numbers seem to show is that the tech sector is attempting to make a comeback, with these upcoming inflation numbers possibly providing either a negative or positive catalysts to the segment depending on May’s consumer price index (CPI) report.

What’s next for tech stocks?

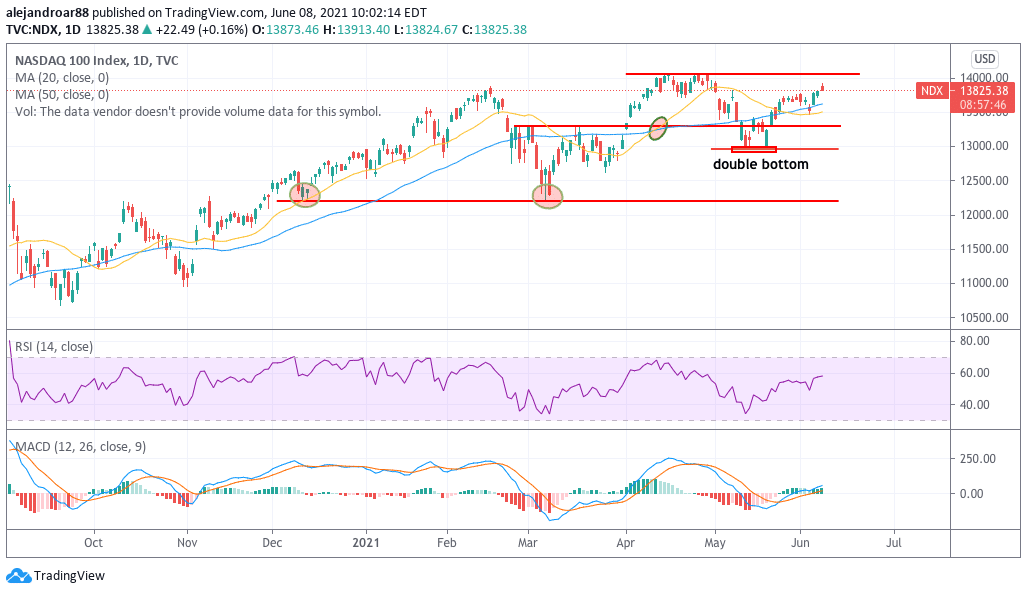

A closer look at the price action seen by the tech-heavy Nasdaq 100 – often seen as a proxy for the performance of the tech sector as a whole – shows that the index appears to be bouncing off a double-bottom formation it made on May and could be heading to retest its all-time highs soon.

This bullish outlook is reinforced by positive momentum readings in both the MACD and the RSI as both oscillators have climbed to levels that could point to an upcoming acceleration in the uptrend.

That said, the Nasdaq’s short-term moving averages posted a death cross recently and this could create room for a short-term pullback before the benchmark resumes its climb toward the 14,000 level.

Question & Answers (0)