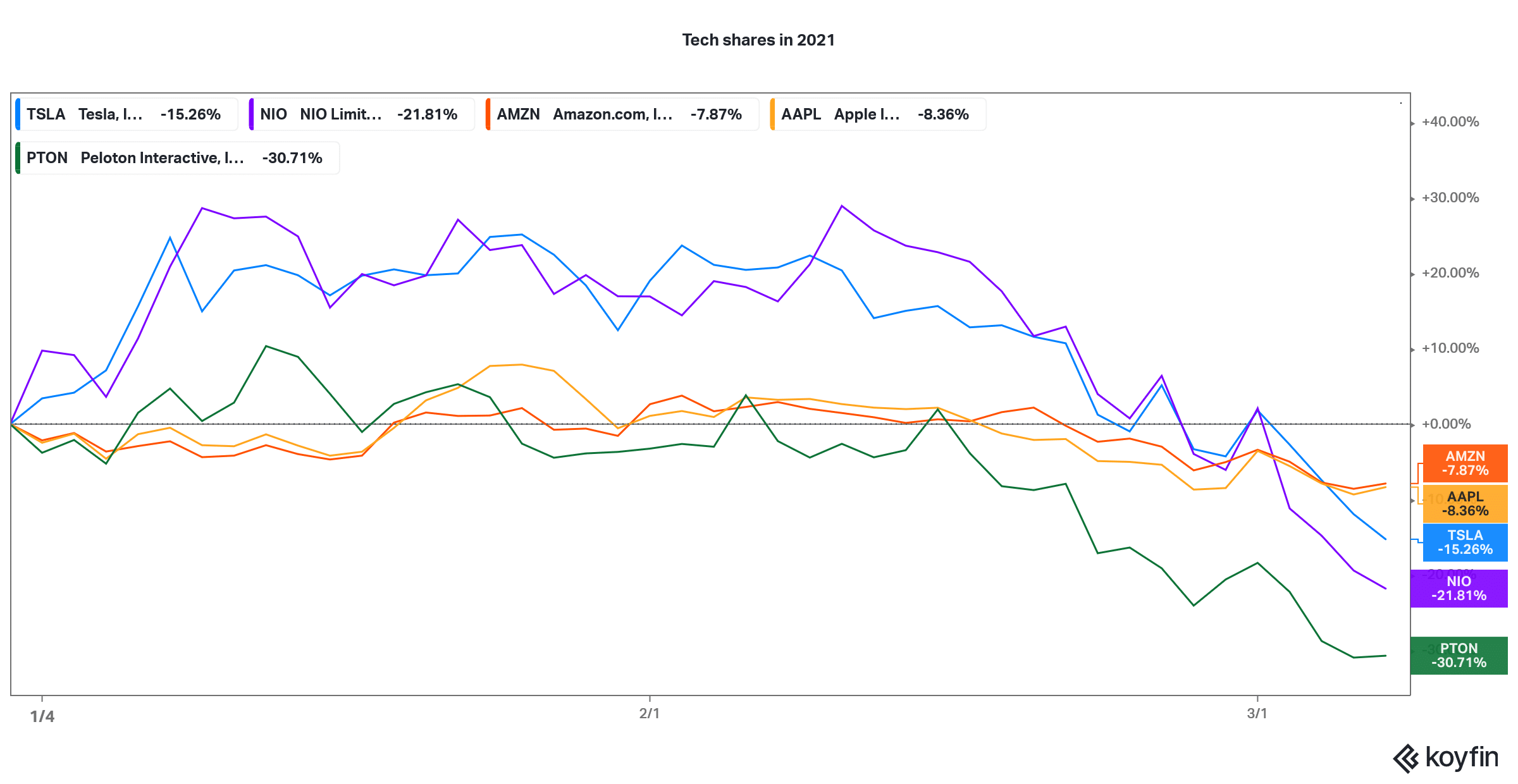

The tech-heavy Nasdaq 100 Index, which gained over 45% in 2020 despite the COVID-19 pandemic, is now negative for 2021.Those losses look likely to be extended today, with Nasdaq futures premarket declining 1.5%. Which tech shares should you buy amid the sell-off and which ones should you avoid?

For the greater part of 2020, the Bank of America Global Fund Manager Survey showed long US tech shares positions to be the most crowded trade – at one point in time the most crowded trade ever in history. This year, long bitcoin took the baton from US tech shares as a growing band of institutional investors, as well as retail investors, poured money into cryptocurrencies.

What’s happening with tech shares?

Tech shares have been very volatile over the last couple of weeks. There are three main factors driving the sell-off in tech shares:

- Rising bond yields: Rising bond yields, where the yields on the US 10-year treasury bond have surged over 70% in 2021 to a pre-pandemic high of 1.6% is spooking investors. While the Fed has signalled that it is no hurry to raise rates, rising bond yields are raising fears of an end to the easing cycle.

- Soaring valuations: The valuations of some of the tech shares had soared amid the rally. The shares which had the most expensive valuations are taking a breather amid the sell-off.

- Return to normalcy and sectoral shift: Last year, US tech shares had soared as the pandemic fuelled demand for many of them. The tech sector was largely immune to the pandemic and if anything, it amplified the pace of digitisation and led to higher sales for tech majors. Now, markets are bracing themselves for a return to pre-pandemic level consumer behaviour as a large part of the world population would be inoculated against the coronavirus by the end of the year.

Don’t buy all tech shares

To sum it up, markets seem to be asking the question: can tech shares repeat last year’s financial performance? And, if not, are their rich valuation justified. That said, as a result of the broad-based sell-off in tech shares, some of them may be offering good entry points. However, there are plenty that could still be overvalued and prone to further downside.

Electric vehicle shares

Last year, electric vehicle shares, that include Tesla, NIO, XPeng, and Li Auto, rallied sharply. At its peak, Tesla’s market capitalisation was above $800 billion while NIO’s reached almost $100 billion. There have been big drawdowns in electric vehicle shares and Tesla and NIO are respectively down 34% and 43% from their 52-week highs.

Tesla and NIO are down sharply

Both Tesla and NIO are down on a year-to-date basis after having risen 740% and 1,110% respectively in 2020. The rally in EV stocks in 2020 had all the features of a bubble including it being driven out of FOMO (fear of missing out) at times.

While there is a broad consensus that the future of the automotive industry is zero-emission, there is no way the valuation of Tesla and NIO can be justified. Electric vehicle companies will face more competition as tech majors like Apple are also planning to launch their electric cars. Overall, given the increasing competition and still high valuations, I would stay away from electric vehicle shares for now.

Big Tech: Which FAANG should you buy?

Looking at the FAANG space, Apple and Amazon appear to be good tech shares to buy after the crash. Apple is down 16% from its 52-week highs. While Berkshire Hathaway has been selling Apple shares, it continues to be its second-largest shareholder with a 5.4% stake.

Apple shares trade at an NTM (next-12 months) PE multiple of 28x, which looks reasonable considering its growth outlook and the fact that Apple is now increasingly seen as a tech and software company and not a hardware company. Also, the shares have seen a rerating due to the upcoming 5G super-cycle that will fuel demand for Apple products.

Gene Munster on Apple

Gene Munster of Loup Ventures, who had correctly predicted Apple’s market capitalisation hitting $2 trillion, forecasts that it will be the best-performing FAANG in 2021, for the third year in a row.

Munster expects the work-from-home theme to positively impact Apple shares. “This is generally thought of as a play on iPhone, a 5G play. That’s good. That will impact the numbers in a positive way, but this acceleration of digital transformation, I think it’s powerful,” said Munster. He added, “People working from anywhere are going to be arming up in the next 12 to 24 months, buying more Macs, iPads, services.”

Amazon looks like another good tech share to buy

Amazon shares have looked weak after they peaked in September 2020. US tech shares sold off in September amid positive trial results from COVID-19 vaccine candidates. Amazon stock is now down around 15% from its 52-week highs.

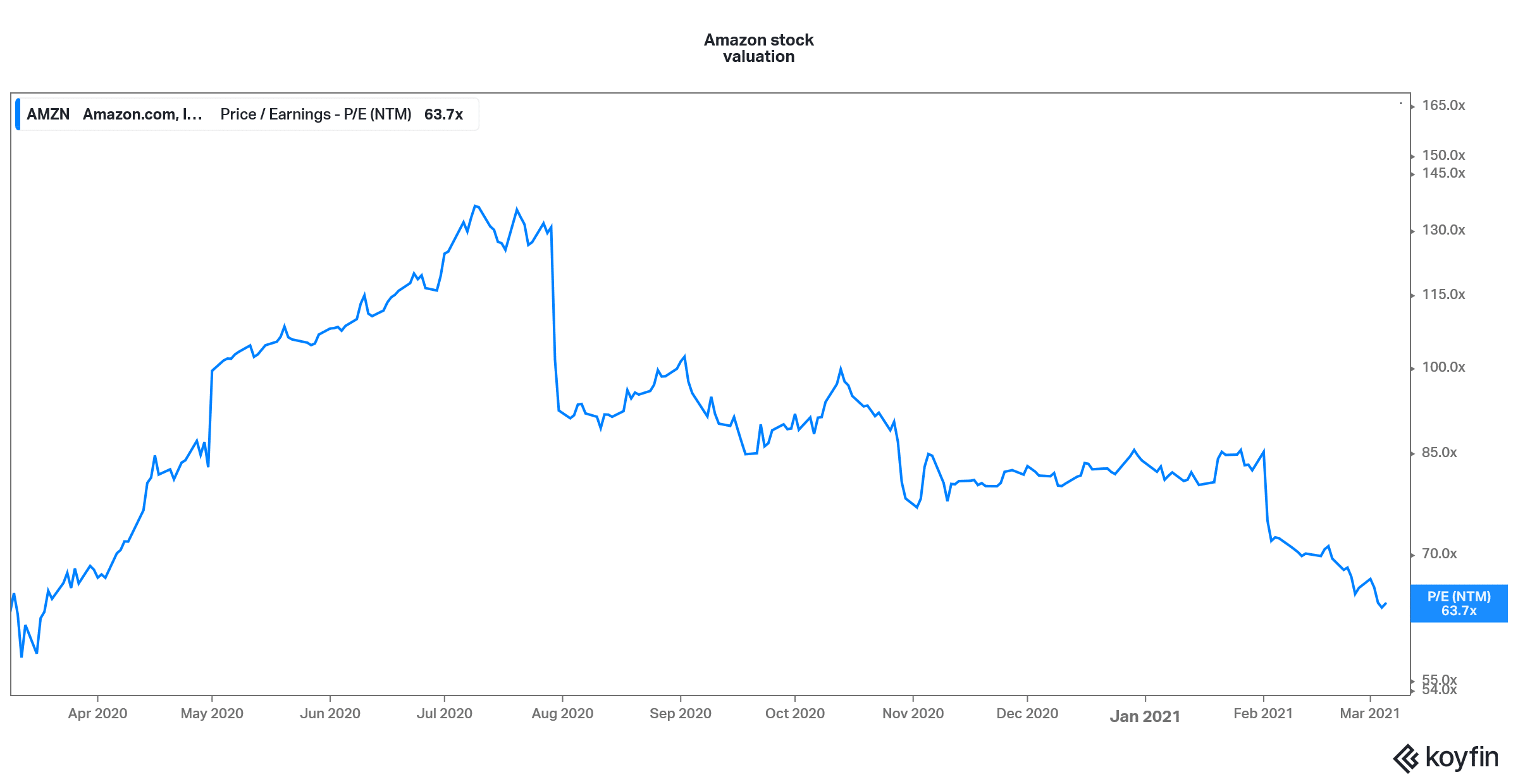

That said, it could be a good time to buy the shares and bet on the long-term outlook. The shares trade at an NTM PE multiple of 63.7x which is the lowest since March 2020 when the US stock markets had tumbled amid fears over the spread of COVID-19.

Amazon is a play in cloud and eCommerce

Amazon is a long-term growth story driven by the global shift towards e-commerce. Unlike some of the other such shifts that we saw in 2020 due to the pandemic and lockdowns, the shift from offline to online retail is a secular story.

Amazon is an interesting tech play due to its exposure to the cloud market with its AWS (Amazon Web Services) which is the market leader. Both cloud and e-commerce have a positive long-term outlook and Amazon looks a good way to play the story.

Looking beyond tech shares

Beyond the usual tech shares, Peloton shares also look a good buy. It is down almost 40% from its 52-week highs. Along with the broader markets sell-off, supply chain issues have led to a fall in Peloton shares. However, the demand for home gyms is expected to be strong over the next decade, which makes Peloton a good share to buy. It now trades at an NTM price to sales multiple of 6.1x as compared to double-digit multiples that it traded in 2020.

Question & Answers (0)