Share markets have come a full circle over the last year. From deflation fears, we now have inflation fears. On the yields side, while it looked a year back that US interest rates would also plunge below zero, rising bond yields are now a big worry for markets. With this setup, which shares should you buy and which to avoid?

To begin with, let’s understand the relationship between inflation and share markets. Inflation has been termed as the “worst form of taxation” but a lack of inflation or deflation is not exactly good for share markets. Over the last several years, central banks in developed economies have been trying to address the low inflation situation.

How inflation impacts share prices

However, high inflation, especially sudden and uncontrolled price rise is also not good for share markets either as it would prompt the central banks to raise rates which is invariably a negative for most shares. A modest increase in prices is typically the best for share markets.

Looking at the current scenario, we have inflation creeping up globally. Both demand and supply-side issues are driving up inflation. Global economic activity is rebounding sharply in 2021 even as the pandemic situation is worsening in many countries like India and Brazil. As for the supply side, there is a chip shortage globally which is impacting the production of many goods from smartphones, cars, to white goods.

Higher commodity prices

Meanwhile, the rise in commodity prices is another driver of higher inflation. Prices of several metals like steel and copper have hit all-time highs. Prices for other raw materials like wood have also crept up. To make the matters worse, crude oil prices have strengthened in 2021 after the slump last year. Higher energy prices not only increase the transportation costs for a common person but also leads to cost-push inflation for almost all the products.

Berkshire Hathaway chairman Warren Buffett also touched upon the issue of rising inflation at this year’s annual shareholder meeting that was held virtually. “People have money in their pocket and they’re paying higher prices,” said Buffett adding that “it’s almost a buying frenzy.” Buffett also said that Berkshire Hathaway owned companies have also been raising prices. The Oracle of Omaha admitted that inflation is currently higher “than people would have anticipated six months ago.”

Central Banks might raise rates sooner to control inflation

If inflation rates rise, central banks would have little option but to apply the brakes on the monetary policy loosening that they have been following since the pandemic began in 2020. US Treasury Secretary Janet Yellen is among those backing higher rates.

“It may be that interest rates will have to rise somewhat to make sure that our economy doesn’t overheat,” said Yellen earlier this month. She added, “Even though the additional spending is relatively small relative to the size of the economy, it could cause some very modest increases in interest rates.”

Which shares to invest when inflation rises

Now, the question would be which shares to invest in and which to avoid? A federal rate hike might happen sooner than what the markets were earlier bracing for. The current inflationary environment is negative for those companies which have most of their revenues and profits skewed towards the future. Higher interest rates in the future make these shares less attractive as their cash flows are worth less in today’s dollar terms if we discount them at higher rates. The entire EV (electric vehicle) ecosystem pack would fit into this category.

Avoid companies that cannot pass along high prices to consumers

Also, as inflation rises, companies with low margins and low pricing power could end up absorbing some of the price hikes. Retail companies like Kroger and Albertsons could be losers in a high inflation environment.

That said, a high inflation environment would also create some winners. Banking shares, which have anyways outperformed the markets this year could continue to outperform in the medium term. Banks borrow on the short end of the interest rate curve and lend on the long end.

Banks could outperform in an inflationary environment

The hardening of long-term interest rates would help banks increase their net income margin. Also, a booming economy would also mean lower loan loss provisions. The flip side is the loss that banks would make on their bond portfolio as bond prices have fallen amid the rise in interest rates.

Shares of commodity-producing companies could also be winners. ArcelorMittal, the world’s largest steel company, reported stellar first-quarter results. High raw material prices and strong end-user demand would keep steel prices buoyant in the medium term which would help steel shares. While steel shares have already run up, there could be more upside ahead as we are in what looks like a new commodity supercycle.

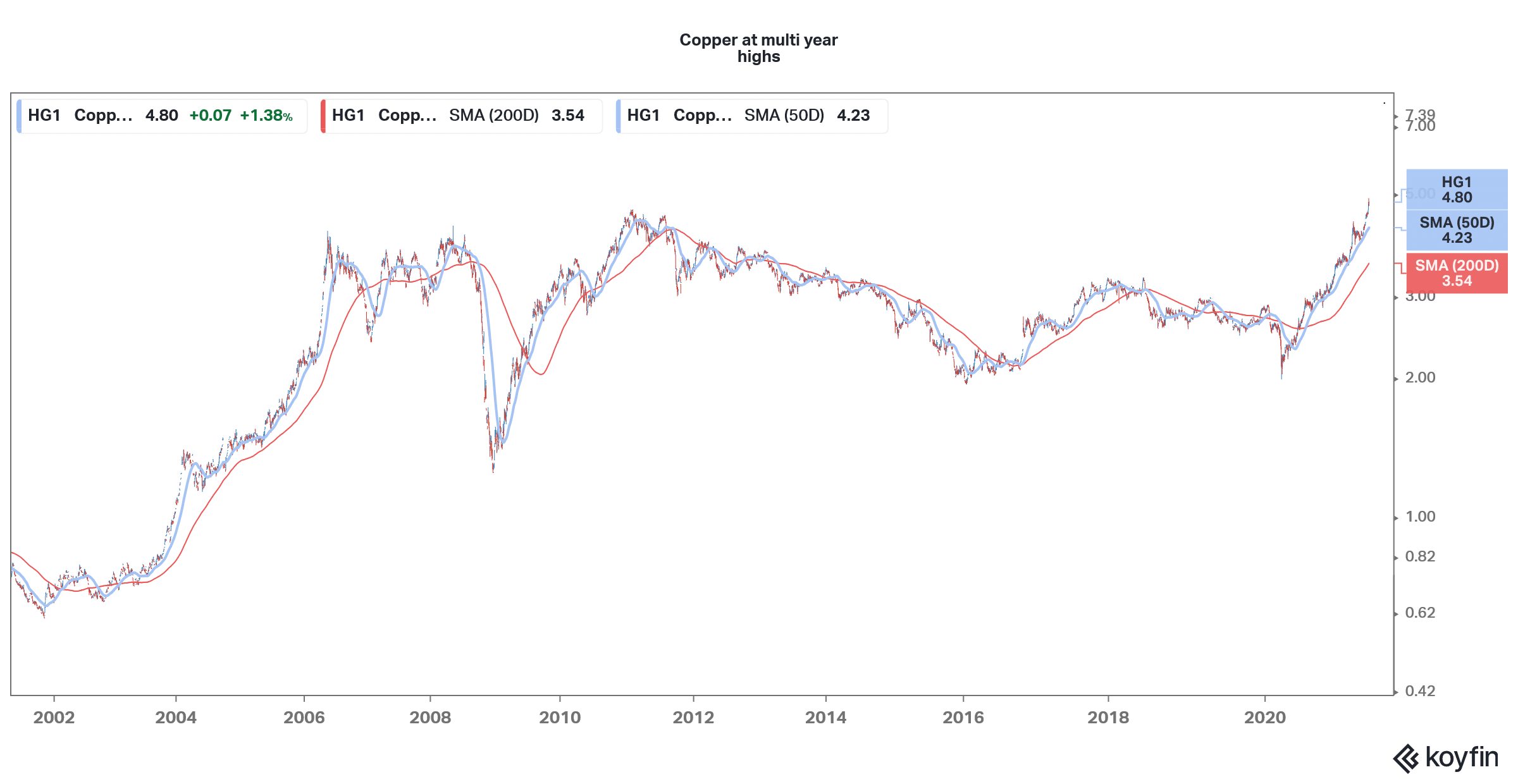

Copper prices at record highs

Shares of copper-producing companies should continue to deliver good returns. Like steel, copper producers have also run up but there could be more upside ahead as the markets still haven’t valued commodity companies on the assumption that higher commodity prices are here to stay for some time.

Energy companies can do well in inflation

Shares of energy companies could also benefit from inflation. Historically, energy prices tend to perform well in an inflationary environment. The relationship between energy prices and inflation is actually two way. Higher energy prices lead to inflation as energy is a key input for many companies. Also, rising inflation leads to higher demand for real assets like energy which leads to higher prices.

Consumer staples companies can also outperform in an inflationary environment as they can pass along the price hikes to consumers. Simply put, people don’t stop using daily use goods like toothpaste if their prices rise. If anything, consumer staples companies tend to raise prices more than what their input prices rise, and try to increase their margins.

Value shares could also be good bets in the current environment. Value shares have outperformed growth shares in 2021 after years of underperformance and the trend could continue in the near term also.

Question & Answers (0)