Persimmon (PSN) shares are ticking higher in today’s stock trading action in London, despite the firm reporting a 25% drop in its underlying profits before taxes resulting from lower new home completions and a decline in the group’s total revenues amid the COVID-19 crisis.

That said, Persimmon’s upbeat guidance for its 2021 fiscal year seems to have lifted the market’s sentiment, as the British home builder emphasised that the “long term fundamentals of the UK housing market remain strong” while highlighting a 15% surge in forward sales levels compared to a year ago on the back of a low interest rate environment.

Last year, the firm saw its sales drop by nearly 9%, ending the year at £3.33 billion compared to £3.65 billion the firm sold a year ago.

Meanwhile, the number of new homes completed during 2020 slipped by 2,280 units, ending the year at 13,575 completions compared to 15,855 in 2019 as the pandemic disrupted the firm’s operations while building sites remain shut down to contain the spread of the virus.

Persimmon distributed a total of £1.10 per share in dividends last year and plans to distribute a total of £2.35 per share in 2021 subject to the approval of the Board of Directors.

This forecasted increase in Persimmon’s distributions is perhaps one of the reasons why the market is reacting positively to the company’s annual report, as it indicates that the firm expects higher levels of revenue and profitability for the year – possibly on hopes that vaccinations will put a definite end to the health emergency.

How have Persimmon shares performed lately?

Persimmon shares accumulate a 5.1% gain this year as the stock price has risen strongly ahead of the release of this annual report.

Last year, the stock price appreciated 7% as Persimmon (PSN) managed to keep building and delivering units despite the challenges presented by the pandemic and the corresponding lockdown and quarantine measures – which required the implementation of strict protocols within its sites including social distancing and other job safety measures.

The positive performance of Persimmon has been aided by the tailwind provided by a low interest rate environment, as home buyers take the opportunity to secure low borrowing costs when purchasing a property.

Apart from Persimmon, other home builders in the United Kingdom have highlighted the positive momentum that the construction sector is living as reflected by comments from Barratt Developments (BDEV) and Taylor Wimpey (TW) – both of which have shared positive remarks about the state of the market.

Meanwhile, the British government is set to announce positive measures that should further aid the market, including a program that will provide guarantees for mortgages, allowing buyers to purchase properties of up to £600,000 with a 5% deposit.

Such a move would help first-time buyers in securing the purchase of a new home, which would possibly result in higher revenue for Persimmon and its peers on short notice.

That said, a potentially weak labour market could affect the demand for new homes as well, as prospective buyers could cut back on their budgets or postpone their purchases if unemployment remains at historically high levels for longer than expected.

What’s next for Persimmon shares?

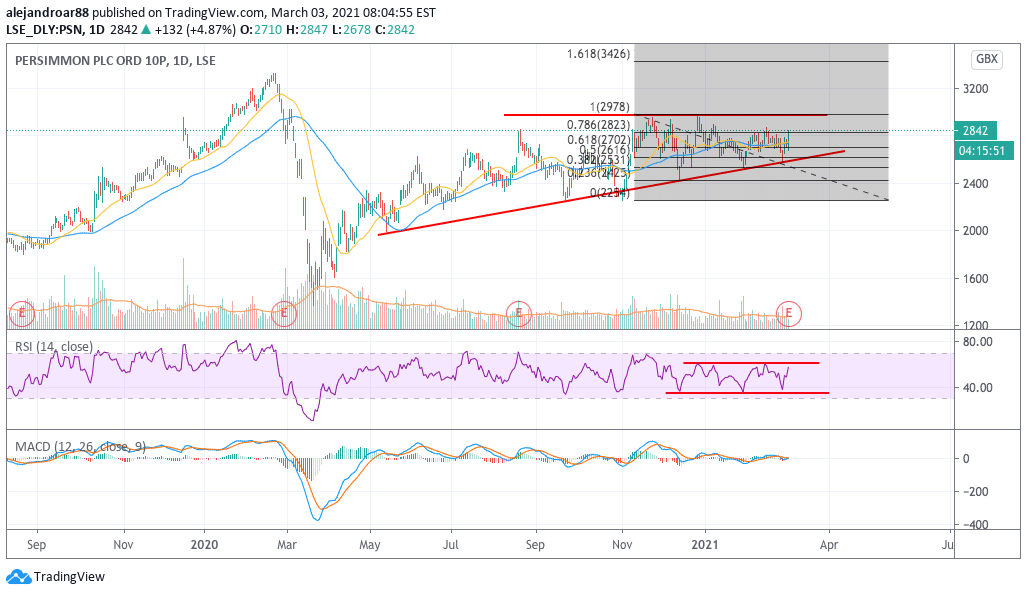

The price of Persimmon shares has been posting a series of higher lows lately while struggling to move past the 3,000p ceiling.

This positive uptrend should lead to the break of that particular threshold as long as the situation continues to play out in favour of the British home builder – meaning that vaccinations continue their advance at a decent pace and that this soon-to-be-released mortgage guarantee program satisfies the market’s expectation.

At this point, a break above the 60 level in the RSI accompanied by another tag or break of the 3,000p ceiling should signal the beginning of a brand new uptrend for Persimmon shares, with a first target set at 3,300p – the stock’s all-time high posted days before the pandemic-led market crash.

Question & Answers (0)