When we last covered the Aim-listed Anglo-French corona-test manufacturer Novacyt (NCYT) it was trading at 275p - it is now back above the 300p line.

As we pointed out then, there was still plenty of momentum behind this stock, but given its volatility and recent steep retracement from its all-time high, buyers would be moving cautiously.

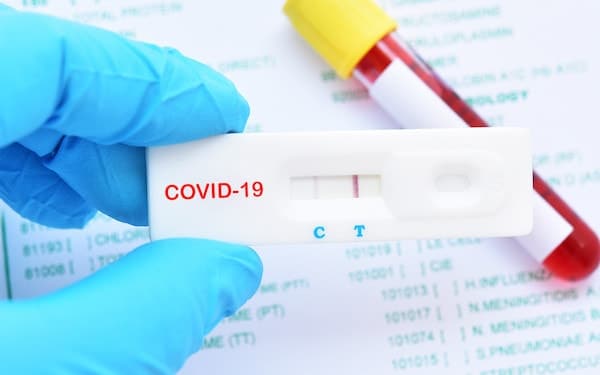

Novacyt is a leader in Covid testing, as one of the first to have had its kit on the World Health Organisation approved list.

As to be expected, the price action continues to follow the virus news. Chief among the market moving news flow for Novacyt, wasn’t so much from the advance/resurgence of the virus, but rather the state of testing technology and the marketplace, and the competitive pressures building up.

But before we come to that, driving the price higher since our last report was the three new lab tests we highlighted then as price catalysts. The new tests are COVID-HT, Exsig Direct (its near-patient extraction kit) and Exsig Mag.

Their release saw the Novacyt share price jump 6% on 27 July.

Since then another biotech minnow, Manchester-based Genedrive (GDR) (87.5p) came onto the radar of investors chasing down value among the coterie of UK-based corona virus test developers and manufacturers.

Genedrive test targets India, Africa and US markets

Genedrive’s price has been on the sort of rollercoaster (see chart above) that investors in biotech start-ups are all too familiar with (ranging from above 300p to as low as 60p since May). Let’s leave that to one side for now.

Genedrive has developed a test kit that relies on the more reliable results produced by the molecular RNA approach used by Novacyt.

The RNA or Polymerase Chain Reaction (PCR) tests use open instrument platforms provided by Big Pharma such as Abbott and Roche.

This workflow requires the mixing of a reagent, of which there was a shortage in the UK and elsewhere at the beginning of the pandemic. The mixing is time-consuming and error prone.

Genedrive’s system has the advantage – as with Novacyt’s new Exsig Direct tests in that it dispenses with the need to use a reagent.

Genedrive and Novacyt are in slightly different regional markets, so there’s plenty of room for both to grow without directly taking share from each other. The two are would-be competitors in the US, but Genedrive’s other two regions are India and Africa. Noticeably and clearly deliberately, Genedrive is not competing against Novacyt and others for NHS orders and privately bought tests.

Novacyt and Genedrive: a complementary pairing to hold

There’s another way the two stocks might complement each other. Novacyt is pitching into the richer-countries market and Genedrive a large part of the poorer-countries market. As well as in the advanced economies, the expense, speed and convenience of tests matters, but most in the ‘Global South’ where rates are climbing alarmingly and access to health services is weakest.

Genedrive’s orders are small and “indicative” at this stage, and it is awaiting regulatory approval in its key markets. Assuming it can produce at sufficient scale and meet the other requirements for take-up success, then the price could yet revisits its high.

In July Genedrive also announced the integration of its 96 Explorer software to further improve diagnostic results.

Chief executive David Budd explained at the time: “The tool was developed by repurposing the clinically validated software algorithms we use in our point-of-care Genedrive instrument software, underscoring the versatility and value in our core technology platform and providing additional differentiation to genedrive’s offerings in the COVID-19 testing market.”

So in other words, Genedrive is adding a diagnostic layer on top of the third-party PCR platforms from Roche and other suppliers.

A spokesperson for the company added in emailed comments to buyshares:

“Genedrive’s focus is India, Africa and the United States (not the NHS currently) and have received over £1.0m of indicative orders for the Genedrive 96 SARS-CoV-2 test. In terms of accuracy, the kit achieved 100% sensitivity and 98% specificity in randomised clinical specimens.”

Getting the need for labs – who’s winning the RNA Covid test race?

But its other competitive advantage might come if it is able to deliver on its promise to fully decouple the kit from the lab. That would be a significant development in the RNA corona-testing arena.

Is there a timescale on when the lab-less test might be available? “No definite timescale.”

So neither Novacyt or Genedrive has a lab-free solution ready to go just yet then, but if the RNA tests can be scaled and made cheaper by either of these companies there is an expanding pie to take a share of.

Investors should also be aware of the comments from Bill Gates about the state of testing in the US. He said US tests are “mostly garbage”.

Interestingly Gates says that the key to fixing testing in the country is changing the way the reimbursement is done. At the moment all testing companies are paid for each test conducted but with no stipulation regarding all-important turnaround times. The further out from a 24-hour limit the results come back, the less useful they are. Indeed Gates thinks they are fairly useless beyond a day turnaround. If the federal government altered the way it pays test providers by incentivising speedy turnaround and accuracy, then that should benefit the most accurate suppliers, providing in the case of genedrive it secures regulatory approval.

This is a fast-moving race and we don’t have room for a fuller survey of the other players. However, we should mention the progress made by the University of Navarra. The Spanish university has developed an alternative to PCR diagnostic platforms that is able to work at scale with a method to run tests in parallel. It has 95% sensitivity in detecting asymptomatic cases. By contrast, the faster antibody-testing method is far less accurate and only confirms the presence of the antibodies produced at some time in the past in reaction to the presence of SARS-CoV-2 and not whether someone is infected.

Fixing US testing a future tailwind for Novacyt and Genedrive

Here’s Gates on the abysmal state of US testing, which it is worth quoting at length: “The majority of all US tests are completely garbage, wasted. If you don’t care how late the date is and you reimburse at the same level, of course they’re going to take every customer. Because they are making ridiculous money, and it’s mostly rich people that are getting access to that. You have to have the reimbursement system pay a little bit extra for 24 hours, pay the normal fee for 48 hours, and pay nothing [if it isn’t done by then]. And they will fix it overnight.”

US government agencies may likely soon tighten up the testing regime, which should focus the addressable market more favourably for accurate tests and performant turnarounds. That helps both Novacyt and Genedrive.

Risks ahead but could be a valuable couple

Finally, Russia and China. Russia says it is rolling out a vaccine and the Chinese military may be ahead in the race. That last point has not received much coverage in the Western media or investor coverage, but that may be changing.

If either has a working vaccine that works and is scalable, then the testing solution providers will take a hit, but that would be ameliorated by the extent to which they can replace those revenues with other product streams. And even with a working vaccine, the need for testing does not disappear because sadly availability will be limited and/or effectively restricted to the richer countries.

And there’s another aspect of the debate only recently becoming more widely aired – what if people don’t take the vaccine?

There are some shockingly high levels of people already saying that they won’t be taking the vaccine. And f there are any mistakes borne of the speed to market imperative, that could be dangerous to take-up.

Of course those investors not already owning shares in Novacyt or Genedrive will want to weight the risks of entering at the wrong time, given the volatility in price this year.

But taking that onboard, for a racy biotech pick – with Genedrive the more speculative of the two, Novacyt and Genedrive are a good complementary pairing.

Question & Answers (0)