Morrisons shares are leaping in early stock trading action today after the Board of Directors accepted a bid from the Fortress Investment Group to acquire its business for a total of £6.3 billion ($8.7 billion) to be paid in cash.

According to documents published by Morrisons on Saturday, the offer results in a 42% premium compared to the stock Friday’s closing price of 178p while the proposal values the firm at 8.3 times its underlying EBITDA for the 52 weeks ended on 31 January 21.

Morrisons (MRW) shareholders will also be entitled to receive a special dividend of 2p per share apart from the 252p that Fortress will be paying for every share of the company.

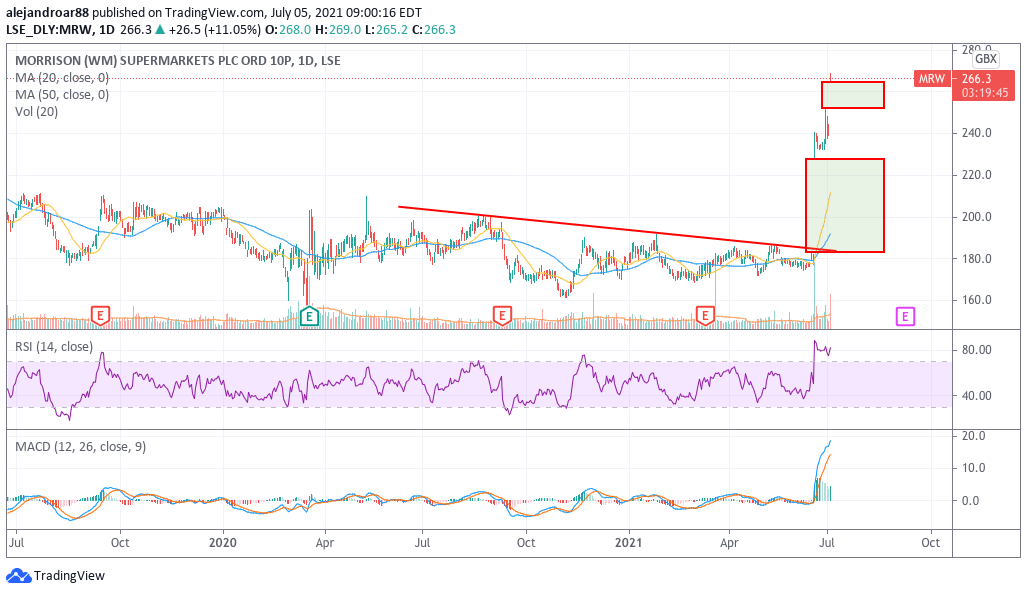

Morrisons shares are surging 11% at 266.1p so far this morning while the share price has leaped 49% since 18 June as the company received and rejected a previous takeover proposal from Clayton, Dubilier & Rice Funds that priced Morrisons’ stock at 230 pence.

This previous takeover attempt was rejected by the Board on the grounds that it “significantly undervalued Morrisons and its future prospects”.

Meanwhile, Fortress’s bid for the British supermarket chain, which is 10.5% higher than the one presented by Clayton, has been deemed by the Board as “fair and reasonable” and they intend to recommend the proposal at the General Meeting for its approval.

Fortress will be partnering with Canada’s Pension Plan Investment Board (CPP Investments) and Koch Real Estate Investments who will be contributing a portion of the equity to be paid to Morrisons’ existing shareholders to complete the transaction.

According to the prospectus, Fortress plans to keep Morrisons as a standalone company that will continue to be managed by its current senior management. Meanwhile, the investment company further stated that it plans to maintain Morrisons’ pension plan unchanged while it does not expect to engage in any sale-and-leaseback transactions that modify the firm’s portfolio of properties on short notice.

A little background on Fortress

The Fortress Investment Group is an American fund that manages over $53 billion in assets for over 1,800 institutional clients. The fund is also an independent subsidiary of SoftBank, the Japanese conglomerate led by billionaire investor and founder of the Vision Fund, Masayoshi Son.

Fortress cited the acquisition of British wine retailer Majestic Wine back in 2019 for a total of £95 million as its most important prior experience in the retail landscape. However, Morrisons will become the largest transaction made by Fortress in this challenging sector and could prove to be a very different animal as the supermarket chain has struggled to remain competitive against emerging online grocery companies such as Ocado (OCDO) and Amazon Fresh.

Prior to the 18 June uptick, Morrisons shares had delivered a 3.5% gain since the year started while they lost 5.8% of their value last year amid the impact that the pandemic had on the firm’s bottom-line performance.

Fortress expects to complete its due diligence on Morrisons six months after the deal’s effective date. This means that the acquisition may go through by the end of the first quarter of 2021. Morrisons shares will be delisted and the company will become a private entity once the deal is completed.

What’s next for Morrisons shares?

At the moment this is written, Morrisons shares are trading 12.2 pence above the offering price at 266.2p. The premium that some investors are paying on Morrisons at the moment is hard to justify as it is highly likely that the deal will come through during the first semester of next year at the indicated price.

On the other hand, as with any takeover transaction, Fortress could back down from its offer if during the due diligence process it finds material evidence that undermines its investment thesis.

Question & Answers (0)