Meta Platforms (NYSE: META) released its Q1 2024 earnings yesterday. While the Facebook parent reported better-than-expected earnings, the shares are sliding in US premarket price action today. Here are the key takeaways from the report.

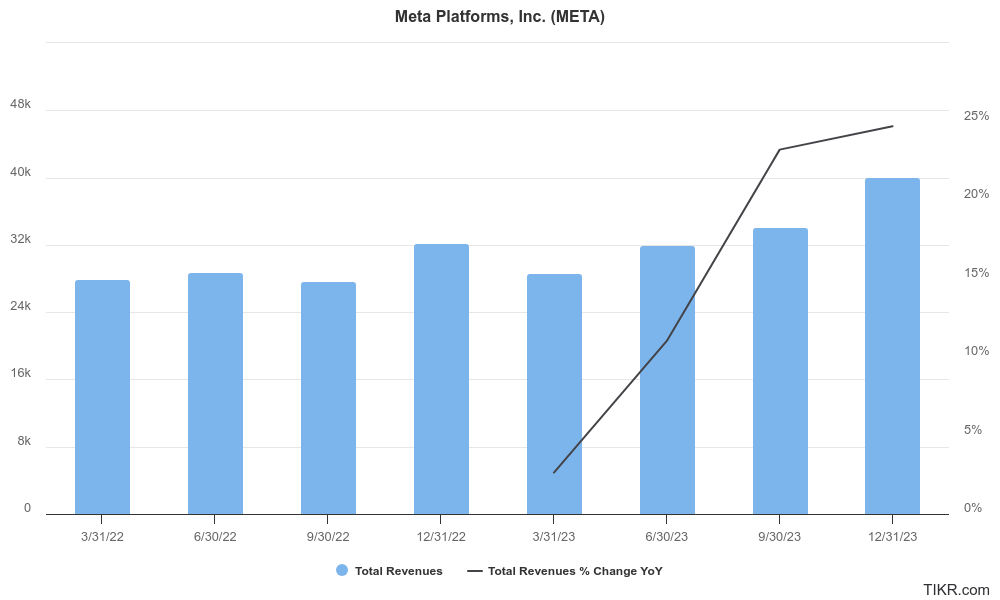

Meta reported revenues of $36.46 billion in Q1, which were 27% higher YoY and towards the upper end of its guidance. The metric was also slightly ahead of the $36.16 billion that analysts were expecting.

Meta’s earnings per share rose 114% YoY to $4.71 and easily beat consensus estimates of $4.32.

Key takeaways from Meta Platforms’ Q1 earnings

Looking at the other metrics, daily active people (DAP) across the apps rose 7% YoY to 3.24 billion while ad impressions rose 20% over the period. The average price per ad also improved by 6% YoY while the company managed to reduce its headcount by 10%.

Notably, Mark Zuckerberg listed 2023 as the “year of efficiency” for Meta, and as part of the exercise the company slashed its workforce to cut costs.

Last year, higher ad revenues from China-based advertisers helped boost Meta’s revenues. During the Q1 earnings call while the company did not quantify the contribution from China, it said revenues in Asia-Pacific rose 45% YoY in Q1.

Meta provided lower-than-expected guidance

While Meta’s Q1 earnings were ahead of estimates, its guidance and commentary on investments and capex spooked markets. It forecast revenues between $36.5 billion to $39 billion in Q2, which at the midpoint of $37.75 billion, represents a YoY growth of 18%. Consensus estimates called for a Q2 revenue of $38.3 billion.

Notably, one of the reasons Meta shares rallied after the Q4 earnings release was because of the better-than-expected guidance for Q1. However, this time around the company’s guidance spooked investors.

The company also upwardly revised its capex guidance from $30 billion-$35 billion to $37 billion-$40 billion as “we continue to accelerate our infrastructure investments to support our artificial intelligence (AI) roadmap.”

It added, “While we are not providing guidance for years beyond 2024, we expect capital expenditures will continue to increase next year as we invest aggressively to support our ambitious AI research and product development efforts.”

Year of efficiency

The commentary is in stark contrast to 2023 where the focus was on efficiencies and cost cuts. While Meta warned previously that the losses of its Reality Labs that’s building the metaverse would not wither away anytime soon, and if anything would rise YoY in 2024 also, investors are jittery over the segment’s outlook.

Reality Labs segment reported revenues of a mere $440 million in Q1 while its losses swelled to $3.85 billion in losses. The segment continues to lose billions of dollars every quarter and the cumulative losses since the end of 2020 now surpass $45 billion.

Zuckerberg doubles down on metaverse and AI investments

Zuckerberg believes AI and metaverse are the two growth drivers for Meta Platforms. During the Q1 earnings call, he drew parallels with previous such initiatives like Reels and Stories and said, “Historically, investing to build these new scaled experiences in our apps has been a very good long-term investment for us and for investors who have stuck with us”

He added, “And the initial signs are quite positive here, too. But building the leading AI will also be a larger undertaking than the other experiences we’ve added to our apps, and this is likely going to take several years.”

The Meta CEO meanwhile called upon investors to be patient and said, “Smart investors see that the product is scaling and that there is a clear monetizable opportunity there even before the revenue materializes.”

Zuckerberg stressed, “On the upside, once our new AI services reach scale, we have a strong track record of monetizing them effectively.”

Analysts react to Meta’s Q1 earnings

Wall Street analysts are circumspect on Meta shares following the Q1 earnings. Sophie Lund-Yates, an analyst at Hargreaves Lansdown said, “For all Meta’s bold AI plans, it can’t afford to take its eye off the nucleus of the business — its core advertising activities.” She added, “That doesn’t mean ignoring AI, but it does mean that spending needs to be targeted and in line with a clear strategic view.”

Jefferies analyst Brent Thill echoed similar views and said, “lighter than expected Q2 revenue guidance and increases in the total expense and capex guides could weigh on the stock.”

However, a section of the market, including Jim Cramer believes that it would make sense to buy the dip in Meta shares following the Q1 earnings.

Meanwhile, Meta shares, which were up almost 40% YTD based on yesterday’s closing prices are set to pare some of these gains and are down over 15% in premarkets as markets digest the tepid guidance and growing investments towards AI and metaverse.

Question & Answers (0)