Meta Platforms shares rose over 20% on Friday and hit a new record high after the company reported an impressive set of numbers for the fourth quarter. The company created a record as the spike added $196 billion to its market cap which is the highest ever in history for any company.

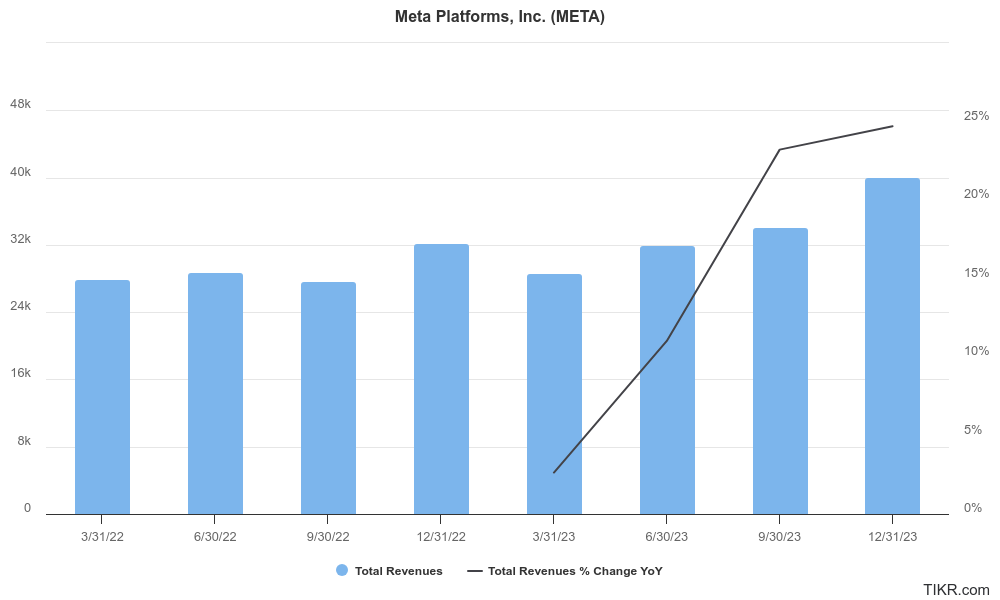

The Facebook parent reported revenues of $40.1 billion in the December quarter which were ahead of the $39.18 billion that analysts expected. The metric rose 25% YoY which is the highest pace of increase since mid-2021. The company’s revenues rose 16% in 2023 which is a significant improvement from the previous year when it reported its first ever annual decline in revenues.

Meta reported better-than-expected earnings

Meta reported an earnings per share of $5.33 which was well ahead of the $4.96 that analysts expected and over thrice of what it posted in the corresponding quarter last year. The company’s CEO Mark Zuckerberg last year said that 2023 would be the “year of efficiency” for the company and the move played off well with the share being the best performing among the FAANG pack. The share has continued its good run in 2024 as well and is the best-performing FAANG share on a YTD basis.

Meanwhile, apart from the headline metrics, Meta reported strong operating numbers also. For instance, its monthly active users were 3.07 billion which was ahead of the 3.06 billion that analysts expected. The daily active user count also increased to 2.11 billion – ahead of the 2.08 billion that Wall Street expected. The company’s average revenue per user of $13.12 was also higher than the $12.81 that analysts predicted.

Meta provided better-than-expected guidance

Meta’s Q1 guidance also surpassed estimates. It forecast revenues between $34.5 billion and $37 billion in the quarter which easily beat analysts’ estimate of $33.8 billion. The company expects total operating expenses in 2024 would be between $94 billion to $99 billion as it continues to work on efficiency and cut costs across the board.

It however increased the upper end of its 2024 capex guidance and now expects to spend between $30 billion to $37 billion in the year. Meta CFO Susan Li said, “Our expectation is generally that we will need to invest more to support our AI work in the years ahead, and we’re seeing some of that reflected in 2024.”

Meta announced a $50 billion share buyback program and initiated a dividend. Its cash pile soared to $65.4 billion at the end of 2023 as the company added nearly $25 billion to its cash kitty during the year.

Meta’s strong growth comes at a time when Alphabet left markets disappointed with the revenues of Google search as it continues to play catchup in the artificial intelligence (AI) space.

Zuckerberg sees AI as a massive opportunity

Zuckerberg meanwhile sees AI as a massive opportunity in the short term. During the earnings call, he said, “moving forward, a major goal will be building the most popular and most advanced AI products and services.”

He added, “And if we succeed, everyone who uses our services will have a world-class AI assistant to help get things done, every creator will have an AI that their community can engage with, every business will have an AI that their customers can interact with to buy goods and get support, and every developer will have a state-of-the-art open source model to build with.”

Zuckerberg sees metaverse as a key long-term driver but the company’s Reality Labs continues to post widening losses. While the segment posted revenues of over $1 billion in the quarter, its losses ballooned to a record $4.65 billion. The segment posted an operating loss of $16.1 billion in 2023 which was higher than the 2022 loss of $13.7 billion.

Meta expects losses to widen in 2024 and said, “we expect operating losses to increase meaningfully year-over-year due to our ongoing product development efforts in AR/VR and our investments to further scale our ecosystem.”

Analysts see more upside in Meta shares

After the stellar Q4 earnings report and Q1 guidance, Wall Street analysts went overboard raising Meta’s target price. Raymond James analyst Josh Beck raised his target price to $550 and said in a client note, “While perhaps less tangible than NVDA GPUs or MSFT Azure/Copilot opportunities, we see a $25B to $60B incremental AI/ GenAI revenue opportunity unfolding through AI-bolstered engagement and performance gains in addition to GenAI-enhanced B2C messaging bots and creative asset creation capabilities.”

Barclays analyst Ross Sandler also raised his target price to $550 and said, “The META story continues to shine relative to mega cap tech, and we think the winning streak can continue for the foreseeable future, attracting more long-term investors (yes, we still think META is under-owned vs. peers).”

Stifel analyst Mark Kelley also raised his target price to $527 and said, “The company is firing on all cylinders and continues to hammer home the notion that this will be a more efficient and leaner organization going forward, despite the heavy AI investment cycle that is well underway. Commentary across Reels, Advantage+, and Shopping were positive, and we expect the next wave of advertiser-focused AI tools to keep this momentum going. The icing on the cake is the dividend that will bring in a new class of investors, and should enable another re-rating for shares.”

The analyst titled his note “A Monumental Quarter” which looks apt considering the impressive set of numbers. Markets also rewarded the shares and while investors’ wealth increased, Zuckerberg also added $28 billion to his net worth becoming the fourth richest person ahead of Microsoft founder Bill Gates.

Tech rally

While there have been concerns over the sustainability of the tech rally which helped propel US shares higher in 2023 as well, the Q4 earnings reports from tech giants, especially Meta, Amazon, and Netflix impressed markets.

Alphabet and Apple played dampeners though and both the shares closed lower after their earnings release. While the former’s advertising revenues disappointed markets, Apple’s commentary on sales outlook for the March quarter and a 13% fall in China sales in the December quarter spooked investors.

As for Meta, after impressing markets with its earnings last year, the company has started 2024 also on a positive note. The shares are already up 37.2% in the year and the company has rejoined the $1 trillion market cap club even as Tesla which too dropped out of the coveted group struggles to reclaim its $1 trillion status.

Question & Answers (0)