The earnings season for FAANG shares wrapped up last week and while it was overall a good quarter for the tech giants, Apple’s fiscal Q1 earnings failed to please investors and the shares closed lower after the release. Here are the key takeaways from the report and how Wall Street analysts reacted to the earnings.

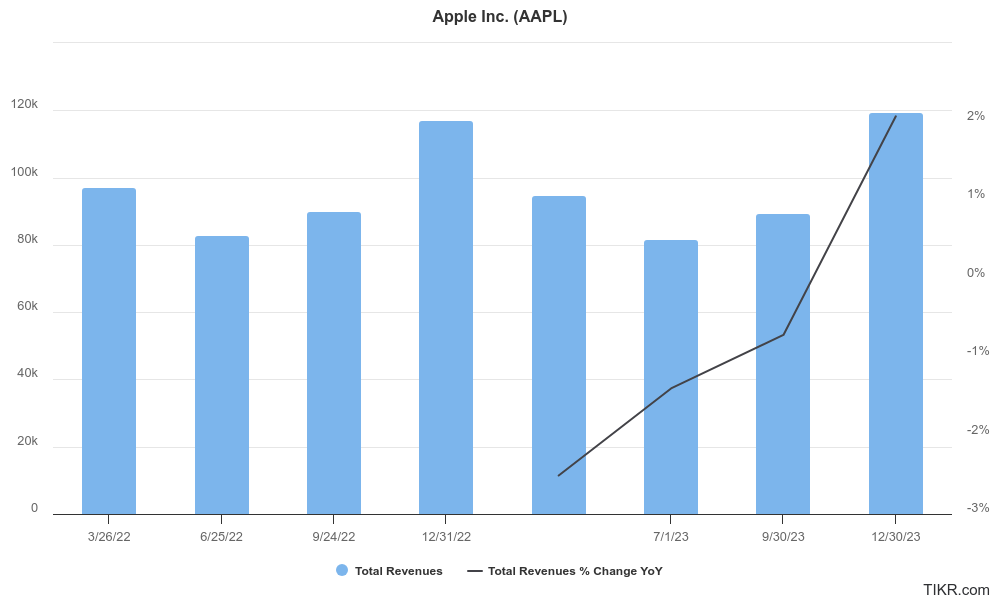

Apple reported revenues of $119.58 billion in the quarter which was 2% higher as compared to the corresponding quarter last year and ahead of the $117.91 billion that analysts expected. It was the first time after a gap of four quarters that the Tim Cook-led company reported a YoY rise in revenues. In the last fiscal year, the company’s revenues fell YoY in all four quarters.

Apple Q1 earnings

Apple’s fiscal Q1 earnings per share rose to a record high of $2.18 which was ahead of the $2.10 that analysts were expecting.

Looking at the breakdown by different products, iPhone revenues came in at $69.70 billion which was ahead of $67.82 billion that analysts expected. Mac revenues of $7.78 billion were also slightly higher than the consensus estimate of $7.73 billion but iPad of $7.02 billion was below the $7.33 billion that analysts expected.

While Apple’s Services revenues rose to a record high of $23.12 billion it trailed the $23.35 billion that analysts expected. Importantly, the company’s installed device base rose to an all-time high of 2.2 billion.

The company announced a dividend of $0.24 per share. In her prepared remarks, Apple CFO Luca Maestri said, “During the quarter, we generated nearly $40 billion of operating cash flow, and returned almost $27 billion to our shareholders. We are confident in our future, and continue to make significant investments across our business to support our long-term growth plans.”

Apple spooked markets with its guidance

While Apple’s earnings were overall good, the company spooked markets with its guidance and said, it expects “both our March quarter total company revenue and iPhone revenue to be similar to a year ago.” The guidance removes the impact of the pent-up demand to the tune of $5 billion that the company saw in the March quarter of last year.

The company added, “We expect gross margin to be between 46% and 47%. We expect OpEx to be between $14.3 billion and $14.5 billion.”

Analysts are mixed after AAPL’s earnings release

In January, three brokerages downgraded Apple shares, which is quite a rarity for the company. After the earnings release also, Wall Street analysts continue to have divergent views on Apple.

KeyBanc analyst Brandon Nispel maintained his sector weight rating on the shares but did not assign a target price.

“F2Q24 guidance likely came in below expectations, and we believe expectations need to move lower, yet again. With investors focused on U.S. upgrade rates and China competition, both the Americas segment and China segment came in below expectations, and we do not believe the dynamics are likely to change in the near term,” said Nispel.

He added, “This, paired with AAPL’s still premium valuation and limited growth, suggests that AAPL is likely to be range-bound and perform in line with the Nasdaq at best.”

Barclays analyst Tim Long also struck a cautious tone and pruned his target price by $2 while maintaining his underweight rating.

“AAPL has been in a historically bad run, with y/y revenue declines in all four quarters of FY23, and 1HFY24 looking down y/y as well. We see nothing in the pipeline to help improve the numbers, which over time should pressure the multiple. … Near term, we expect heightened macro uncertainty and demand weakness to remain an overhang. We think the elevated P/E multiple is harder to justify given limited estimates upgrade potential,” said Long.

Morgan Stanley continues to be bullish on Apple shares

Meanwhile, Morgan Stanley analyst Eric Woodring maintained his overweight rating and $220 target price on Apple and is not too perturbed by the company’s current valuations which some analysts find elevated.

“In our view, bears will continue to argue that fundamentals do not support Apple’s current valuation. But sentiment is already negatively skewed, and without a catalyst for derating … we’re not sure what ‘breaks’ the story. Instead, we see tonight’s guide down as a clearing event,” said Woodring.

What risks does Apple face?

The slowdown in China coupled with the growing US-China tensions is a potent risk for Apple. Notably, in fiscal Q1 Apple reported a YoY revenue rise in all regions except Greater China where sales fell 13%.

Apple CEO Tim Cook sought to downplay the fall in the company’s sales in China and said, “If you look at the 13 and then you do a double click to look at Mainland China and look at constant currency, the dollar is very strong versus the RMB.”

He added, “And so that -13 goes to a mid-single digit number. And so that’s how we did on the phone last quarter. The good news is that we’re four out of the top six top-selling smartphones in urban China.”

Notably, Apple is facing stiff competition from domestic Chinese smartphone companies and some analysts believe that the company’s troubles in China are far from over.

Will Wong, senior research manager at IDC, told CNBC, “Two key factors were holding Apple back in 4Q23 — a more cautious and rational spending sentiment and the challenge from Huawei which created more buzz in the market than the new iPhone 15 series.”

Wong added, “We don’t expect the iPhone’s shipment growth to return to positive territory in 2024 in China, with Huawei expected to remain the key competitor while more advanced technologies like AI and foldable grabbing more attention from consumers,” Wong added.

AAPL also joins the AI bandwagon

Apple was the worst performing FAANG share in 2023 and is at the bottom of the pack in 2023 also. Meanwhile, while artificial intelligence (AI) has been the buzzword in tech companies’ recent earnings, the word hasn’t featured prominently in Apple’s earnings call.

The company’s CEO Tim Cook said in his prepared remarks, “As we look ahead, we will continue to invest in these and other technologies that will shape the future. That includes artificial intelligence, where we continue to spend a tremendous amount of time and effort, and we’re excited to share the details of our ongoing work in that space later this year.”

AI euphoria has helped propel tech stocks, especially Nvidia which is now the fifth largest US company. Markets now await more details on Apple’s AI endeavors which Cook has said the company would provide later in the year.

Question & Answers (0)