Krispy Kreme has slashed the price of its shares by as much as 30% a day before its initial public offering (IPO), following anaemic demand seen during the first trading session of Chinese firms Didi Global (DIDI) and DingDong (DONG), both of which went public in the past couple of days.

The North Carolina-based doughnut store chain announced yesterday that it priced its shares at $17 a piece or $7 below the upper range the company had guided in late June. Back then, Krispy Kreme was looking to sell the stock at around $21 to $24 per share.

At this price, the company will be able to raise $500 million for its operations by selling a total of 29,411,765 shares along with a 30-day option granted to underwriters to buy another 4,411,764 shares at the offering price. Krispy Kreme will trade under the ticker “DNUT”.

Krispy’s IPO is being led by JP Morgan, Morgan Stanley, BofA Securities, and Citigroup while other financial services firms including Goldman Sachs, and Evercore ISI are also participating as joint book-runners.

A new chapter opening for Krispy Kreme?

This upcoming initial offering would mark a brand new chapter in the history of the company after it filed for bankruptcy back in 2005 to then be taken private in 2016 by JAB Holding Co – the parent of Keurig – in a $1.35 billion deal.

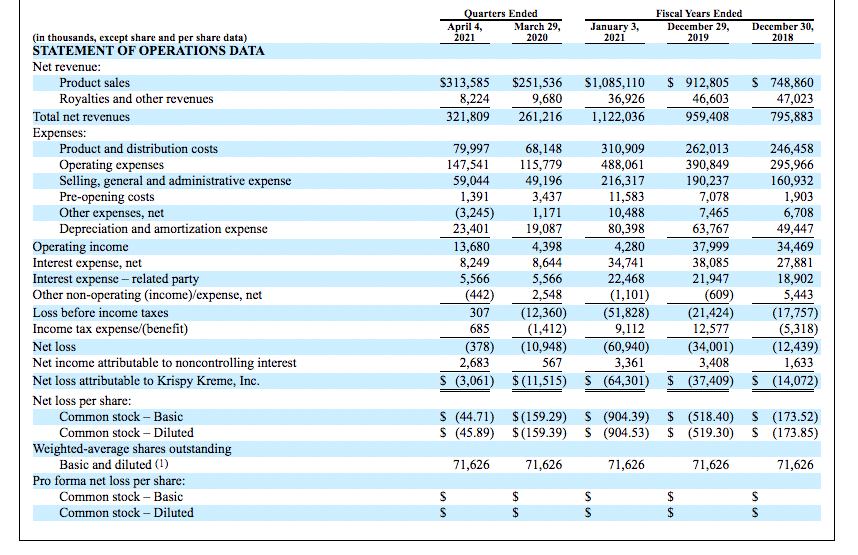

According to the company’s S-1 filing with the US Securities and Exchange Commission (SEC), sales landed at $1.12 billion last year, up 16.8% compared to a year ago, while operating income shrunk to $4.28 million, down from $38 million the company reported in 2019.

Meanwhile, Krispy Kreme lost $64 million last year, with losses progressively growing since 2018 when the company experienced a $14 million loss on sales of $795.88 million.

Moreover, the company has been reporting negative free cash flows for the past three years while cash and equivalents landed at $50.65 million by the end of the first quarter of 2021.

From 2018 to 2020, the company managed to open 2,349 new stores, resulting in a 40% jump in the number of points of access available to consumers around the world. However, its financials haven’t improved despite this ongoing expansion.

Could things turn out differently for Krispy Kreme?

A closer look at Krispy’s financials shows declining revenues, a disappointing track record of net losses, and negative free cash flows. The combination of these three factors along with the company’s estimated long-term debt of $1.55 billion on total assets of $3.11 billion (including $2.1 billion in intangibles) is casting a shadow on a firm that has already gone under water in previous years.

Since 2018, the firm has been acquiring stores in different regions including the purchase of 24 franchises that controlled a total of 165 shops in the United States along with 304 international shops, with a total investment of $465.6 million. These investments were part of the firm’s strategy to gain more control over its distribution network. Meanwhile, the company acquired in 2018 a controlling interest in a cookie vendor called Insomnia that operates in the United States and Canada.

This aggressive expansion strategy could pay off for the firm in the long run but it has not yet delivered the kind of growth or gains that investors might have been expecting as sales have actually been decreasing in the past two years.

Meanwhile, the company stated that it plans to use the $500 million it will obtain from its IPO to reduce its debt and possibly to continue acquiring more franchises and stores.

What’s next for Krispy Kreme?

Based on the indicated selling price of $17 per share and an estimated number of 105.45 million outstanding shares, Krispy Kreme is being valued at approximately $1.8 billion. This results in a price-to-sales ratio of 1.6 based on last year’s sales.

Most of this valuation is supported by the firm’s appraised brand value, which is carried in the books at around $657 million. However, the intrinsic value of that item might be a bit higher than that. Meanwhile, the company’s franchise rights are also part of its valuation along with the value of the Insomnia brand.

At best, Krispy Kreme appears to be fairly valued at this lower IPO price. However, its significant amount of debt remains a concern as interest expenses continue to eat up a large portion of the company’s operating income.

Moreover, the company’s ability to ramp up its operating income by slashing its expenses will also influence its valuation moving forward as Krispy Kreme has been unable to prove that it can deliver profits for shareholders – a situation that has not yielded positive results in the past for the firm.

Question & Answers (0)