DingDong shares settled their first day of trading only two cents about their listing price after the company slashed the size of its listing by nearly 70% as the founder and Chief Executive, Liang Changlin, emphasized that the firm has just gone through a $1 billion funding round and that additional capital wasn’t “essential”.

Shares of the Chinese online grocery delivery firm ended yesterday’s stock trading session at $23.52 per share, settling only two cents above the listing price while the company secured a total of $95.69 million from the offering, down from an initially expected figure of $357 million.

DingDong stated that it plans to use half of the proceeds received from the offering to increase its penetration in the markets it currently serves while 30% will be invested in improving the firm’s “upstream capabilities”.

The offering was priced at the lower end of the range the company guided a few days ago, with a total of 3.7 million American Depositary Shares (ADS) being sold to investors versus a total of 14 million units it initially planned to release. Two ADSs account for one ordinary share of DingDong.

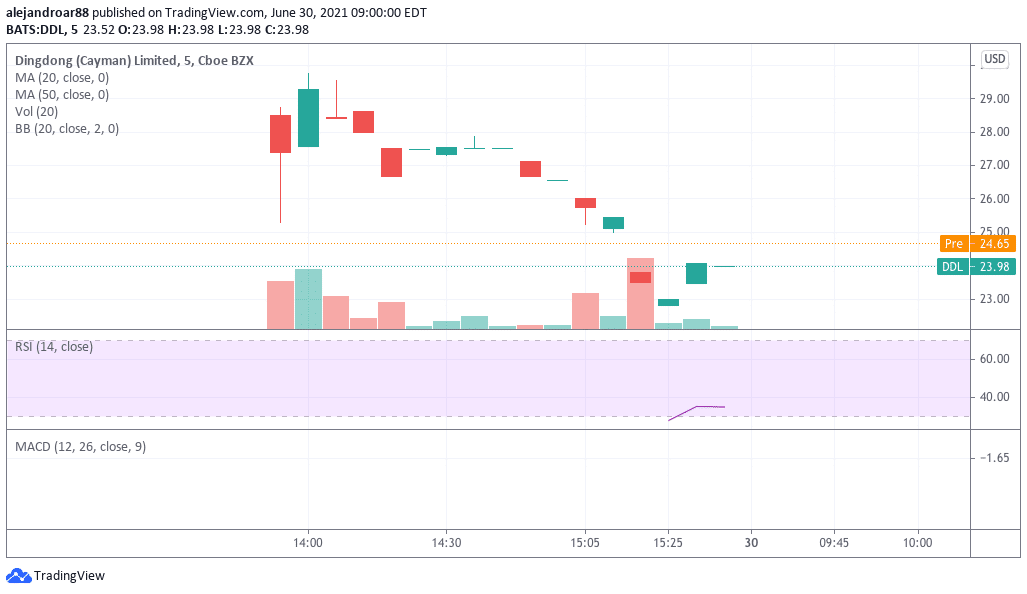

The stock gained as much as 27.7% during intraday action at $30 per share but then settled at $23.52, with a total of 2.47 million shares exchanging hands during the session according to data from TradingView.

Morgan Stanley, BofA Securities, and Credit Suisse USA acted as the lead bookrunners for the offering while Mission Capital Management also participated as an underwriter for the deal.

More information about DingDong

DingDong, now trading in America under the ticker DDL, is a Chinese online grocery delivery service backed by SoftBank. The company ended 2020 with sales of $1.73 billion according to the prospectus filed with the US Securities and Exchange Commission (SEC) while gross merchandise volumes (GSV) landed at $1.99 billion by the end of the same period.

The company covers a total of 29 cities at the moment while it served an average of 4.6 million transacting users during 2020, up from 2.6 million the year before. Meanwhile, in 2020, the firm processed a total of 198.5 million orders from customers, more than doubling the volume it handled in 2019 when it processed 93.9 million orders.

The firm highlighted China’s incredibly large grocery market and elevated on-demand e-commerce volumes as the main opportunities for the business, with the total market being expected to grow to $79.26 billion by the end of 2025.

DingDong’s financials indicate that the company produces a negative gross margin after the cost of goods and fulfillment expenses are deducted from sales, although those negative margins shrunk from 33% to 17% from 2019 to 2020.

Meanwhile, the company reported a net loss of $484.9 million by the end of 2020, which resulted in a lower 28% net loss margin compared to the 48.3% the firm reported last year. Moreover, the company had a total of $673 million in cash and equivalents by the end of 2020.

Changlin Liang is the single largest shareholder in the company with a 30.3% ownership and an 82.2% aggregate voting power. Meanwhile, the top institutional shareholders include DDL Group Limited with 15.7%, EatBetter Holding Limited with 11.6%.

What’s next for DingDong?

Based on a total market capitalization of $8.3 billion DingDong is being valued at 4.5 times its 2020 sales – excluding cash – while the firm continues to lose significant amounts every year. Although the total addressable market is quite high, the company’s poor financials might stand in the way of obtaining a higher valuation multiple at the moment.

Meanwhile, yesterday’s 5-minute price action shows consistent selling since the opening bell although the stock is gaining 4.8% in pre-market action this morning.

Question & Answers (0)