The price of Kingfisher shares is advancing for the eleventh day in a row in mid-day stock trading action, after the company posted a strong jump in profits during 2020 aided by higher do-it-yourself (DIY) home improvement activity from shoppers during the pandemic.

Sales of the UK-based home-improvement retailer jumped 6.8% on a constant currency basis at £12.34 billion while gross profits moved higher in a similar proportion as well during the company’s 2020/2021 fiscal year.

The management team indicated that a combination of higher DIY activity from consumers during the pandemic along with the positive performance of its e-commerce platform allowed the firm to push its revenues higher despite the restrictions imposed by European governments to curve the spread of the virus.

It is important to remember that Kingfisher’s establishments in most corners of Europe were allowed to remain open as they were deemed essential during the health emergency.

Meanwhile, the firm’s adjusted pre-tax gains jumped 44% at £786 million as a result of cost-cutting measures implemented during the crisis including the furloughing of around 50% of the group’s employees during April 2020, with these measures being extended until June last year while being progressively lifted since then.

Kingfisher (KGF) also reduced discretionary expenses, optimised inventory purchases, and halted non-essential maintenance for its stores during the crisis. All these decisions helped the firm in pushing its operating profit margins higher last year.

Kingfisher increases dividend by 147%

The home-improvement giant is upping its annual dividend to 8.25p per share, representing a 147% jump compared to 2019’s distributions of 3.33p. This dividend includes a 5.50p per share disbursement that will be paid in July 2021 upon receiving approval from stockholders.

In regards to the future, Kingfisher expects to see a decline in the level of sales growth during the second half of its 2021/2022 fiscal year as a result of strong year-on-year comparables.

That said, the company identified a potentially positive business trend related to flexible work arrangements, indicating that the demand for DIY home-improvement could continue to rise in the future as properties’ wear-and-tear should increase as a result of home-based work.

“There is no doubt that the trend of flexible working arrangements has accelerated forward many years”, said Kingfisher’s Chief Executive, Thierry Garnier, to reporters following the release of the company’s financial results.

The firm’s top executive continued: “Over time these factors will lead to material changes such as more wear and tear on the home and the need to organise living space differently thereby creating a structurally supportive shift for home improvement”.

How have Kingfisher shares performed so far this year?

Since 2021 started, the price of Kingfisher shares has risen 15.6% as the United Kingdom continues to head out of the virus crisis on the back of vaccinations.

Meanwhile, the reintroduction of lockdowns in other corners of the continent including France – an important market for Kingfisher – could lead to a sustained uptrend in the firm’s sales during the next quarter as a result of lockdown-driven DIY home improvement.

Last year, the stock advanced 24.6% after investors realised that the sector would emerge among those benefitted by the health emergency.

What’s next for Kingfisher shares?

At this point, Kingfisher shares are being valued at roughly 11 times the firm’s adjusted after-tax profits. This number could appear to be quite attractive from a fundamental perspective although chances are that profits will not land anywhere near those levels by the end of the firm’s 2021/2022 fiscal year if sales were to normalise after the pandemic while costs should climb back near pre-pandemic levels.

The consensus estimate for adjusted after-tax profits for Kingfisher is currently sitting at £495 million, which gives us a price-to-earnings ratio of 13 – still decent and quite attractive, especially if the firm meets its dividend payout ratio goal of 40% – 50% its adjusted EPS.

If that target were to be achieved, next year’s dividend, based on analysts’ EPS estimates, should be around 11.7p – representing a 42% jump compared to this year’s dividend and a dividend yield of 3.6% based on today’s stock price.

Therefore, a bullish thesis for Kingfisher would focus on some of the following elements:

- A potential market-wide multiple expansion once the pandemic is over and economic conditions are better.

- Better-than-expected adjusted earnings during the 2021/2022 fiscal year as a result of a persisting DIY trend derived from a higher number of home-based workers.

- A reduction in the dividend yield to the 2% – 2.5% range as investors value the stability of the firm’s business in an environment marked by low or even negative interest rates.

If those catalysts were to take place, a target of 400p – 500p could be drafted for Kingfisher for the next 12 months at least.

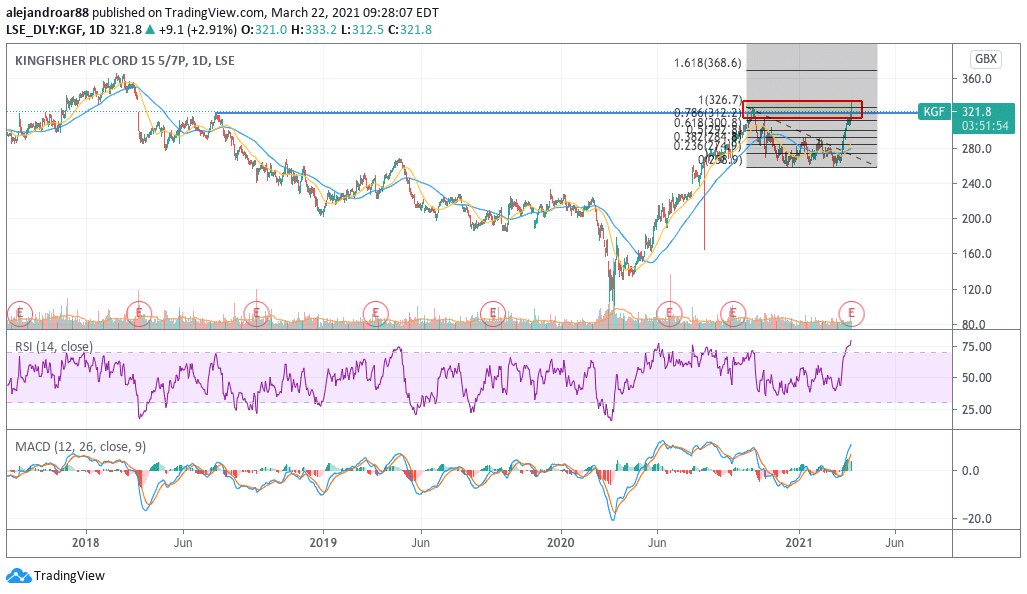

Meanwhile, from a technical standpoint, a second tag of the stock’s 320p resistance indicated in the chart could lead to the definite break of this threshold, with a first short-term target set at 370p per share for the stock if a fresh bullish cycle were to start following today’s encouraging report.

This view is reinforced by the RSI and MACD – both of which are signaling a strong positive momentum in the share price, while the stock’s short-term moving averages have just posted a golden cross – a short-term bullish signal that could support the continuation of this uptrend in the following months.

Question & Answers (0)