How to Buy Kingfisher Shares UK – With 0% Commission

Home improvement retailer Kingfisher plc has been one of the few FTSE 100 companies to benefit from the coronavirus pandemic.

Kingfisher owns brands like B&Q, Castorama, Brico Dépôt, and Screwfix, all of which saw skyrocketing sales in the aftermath of the lockdowns in the UK and Europe. As people sought to remodel their homes and adapt to working from home, Kingfisher’s stores saw far more traffic both in-person and online compared to before the pandemic.

With a coronavirus vaccine campaign underway in the UK, is now a good time to buy Kingfisher shares? In this guide, we’ll take a closer look at the case for Kingfisher and explain how to buy Kingfisher shares in the UK with 0% commission.

Step 1: Find a UK Stock Broker That Offers Kingfisher Shares

When choosing a broker, it’s important to look at how much they charge for trading. We recommend 0% commission brokers whenever possible, since this saves you a significant amount of money over time. You’ll also want to check whether a broker allows you to buy shares outright or trade share CFDs, or both.

Trading tools are also critical. Your broker will be your main source of information about a share’s price movements and expert analysis, so make sure the trading platform has all the features you need.

With that in mind, let’s take a closer look at two of our top-recommended UK brokers you can use to buy Kingfisher shares today.

1. Fineco Bank – 0% Commission CFD Trading & Affordable Share Dealing

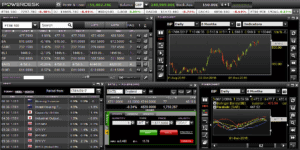

One of the best things about this broker is that it provides you with access to the versatile PowerDesk trading platform. This software offers dozens of built-in technical indicators and a large degree of flexibility to customise your analysis. The platform layout itself is also highly flexible, enabling you to compare multiple charts simultaneously.

Fineco Bank also has a fair number of research and analysis tools. For example, the broker offers an in-depth stock screener that can help you find promising companies to trade. You also get access to a market news feed inside PowerDesk and an economic calendar. Fineco Bank also hosts frequent webinars so you can benefit from the insight of the company’s trading analysts.

On top of share trading, Fineco offers CFD trading for a wide variety of assets. You can trade forex, commodities, cryptocurrencies, bonds, and even stock options. There is no minimum deposit for trading with Fineco Bank and the broker’s CFD spreads are below the industry average across the board.

Although Fineco Bank is relatively new in the UK, the bank has been around for over 20 years and is a publicly traded company in Italy. That, along with the fact that it’s regulated by the Bank of Italy, makes Fineco Bank very trustworthy. Plus, UK accounts are backed by the Financial Services Compensation Scheme.

Pros

Cons

Your money is at risk.

Step 2: Research Kingfisher Shares

Before you jump into Kingfisher shares, it’s important to do your research on this company. Kingfisher has had an extremely strong year in the face of the coronavirus pandemic, but the company’s share price had been edging downward in the years before 2020. So, the key question is whether this company can sustain its rebound and continue to grow its share price after the pandemic ends.

Kingfisher Share Price History & Market Capitalisation

Kingfisher shares have had a bumpy ride over the company’s 25-year run on the London Stock Exchange. After listing at around 133 pence, the shares skyrocketed to over 850 pence in 1998. In the bear market that followed, Kingfisher shares fell back to just 200 pence.

Since the 2008 recession, which was another low point for Kingfisher shares, the company gained value to a high of 427 pence in 2014. After a pullback, the shares traded around 350 pence for much of 2015 and 2016. From 2017 to 2019, declining same-store sales and a relatively small online presence led investors to slowly abandon Kingfisher. Shares fell to just 220 pence heading into 2020.

In March, the stock market crash hit Kingfisher shares hard. The company’s stock price dropped to 101 pence and Kingfisher was booted out of the FTSE 100. However, pent-up consumer demand during the lockdowns in the UK and Europe led to a massive increase in sales in the second quarter. Kingfisher’s share price recovery outpaced the broader market – in fact, the share price doubled from March to July. In July, Kingfisher was readmitted to the FTSE 100 index.

The share price continued to rise throughout the summer, reaching a high of 326 pence in October. Since then, shares have fallen on news of a second wave of lockdowns and vaccines from Pfizer and Moderna that could lead to a quick end to the pandemic.

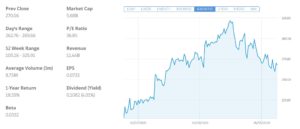

At the current price of 268 pence, Kingfisher has a market cap of £5.64 billion. While the company sported an attractive price-to-earnings (P/E) ratio of under 15 for much of the first half of the year, Kingfisher no longer looks like a value investment. The company has a P/E ratio of 36.9 and a reported earnings per share (EPS) of £0.073 compared to £0.103 last year.

Kingfisher Shares Dividend Information

Kingfisher has long been considered a good dividend stock in the UK, paying out a yield of nearly 5% in 2019. However, the company, like many of its peers in the FTSE 100, canceled its dividend in response to the coronavirus pandemic. Although the company has performed better than expected this year, it has not announced when or if the dividend will return.

Should I Buy Kingfisher?

A few months ago, there was little question that Kingfisher was a good buy. The company was seeing an explosion in same-store sales compared to 2019 and the share price was still dramatically undervalued.

Now, however, the case for Kingfisher isn’t so clear-cut. The company is trading with a frothy P/E ratio of nearly 37. In addition, while the COVID-19 pandemic will drag on in the UK and Europe for several more months, life is expected to return to a ‘new normal’ in the latter half of 2021.

The big question for Kingfisher is whether, in this new normal, people will continue purchasing home improvement products at the same rate in 2021 or 2022 as they have in 2020. On the one hand, work from home is likely to be more normal going forward, which means that many people will continue to modify or remodel their homes to create better working spaces. On the other hand, offices are going to reopen and people will be spending far less time in their homes than they did this year.

While we’re generally optimistic that many of the pandemic trends will continue in the post-COVID-19 world, it’s hard to see how Kingfisher could sustain the level of sales needed to justify it’s current share price. The company was experiencing declining sales and earnings for several years before 2020, and there’s ultimately little that Kingfisher has done to change that long-term trend.

To be sure, Kingfisher has made some changes. Online sales accounted for 19% of all sales in the first half of 2020 compared to just 7% in the first half of 2019. The company has made curbside pickup a key part of its online sales, which is something that customers genuinely seem to appreciate.

However, this alone won’t be enough to turn around Kingfisher’s long-term decline. Without a serious re-evaluation of what parts of its business are making money and which are adding costs, we expect Kingfisher’s earnings to steadily decline throughout 2021. For that reason, we think traders would be better off selling Kingfisher shares or keeping this company on a watchlist for now.

Kingfisher Shares: Buy or Sell?

Kingfisher has had a banner year in the face of the COVID-19 pandemic. The company has seen same-store sales increase compared to 2019 and online sales have jumped to nearly one-fifth of the company’s revenue.

However, there are a number of reasons to think that this good news is a short-lived bump in the midst of a larger downward trend. As soon as the pandemic comes to an end, the pent-up demand for home renovation will dissipate. As people spend less time in their homes, they’ll also feel less urgency to remodel or work on home improvement projects.

That isn’t a disaster for Kingfisher – it means a return to the sales levels the company experienced in 2019. But justifying the current P/E ratio of over 36 means that Kingfisher has to be growing, not shrinking. Simply put, it seems likely that Kingfisher’s share price will drop precipitously at the first sign of slowing sales.

For that reason we recommend that UK traders sell Kingfisher shares rather than buy Kingfisher shares. Keep in mind that short selling is inherently risky and that there is no guarantee that Kingfisher won’t come out of the pandemic stronger than it went into it.

The Verdict

Home improvement retailer Kingfisher has been one of the rare UK companies to benefit from the coronavirus pandemic. Kingfisher saw a significant spike in sales over the summer as people turned to home improvement projects and creating home offices.

However, we don’t expect Kingfisher’s good fortune to last much beyond the end of the pandemic. The company’s current share price anticipates growth, but Kingfisher is still fighting a multi-year decline in sales and earnings. For that reason, we think traders and investors are better off short selling Kingfisher than buying Kingfisher shares in the UK.

FAQs

What is Kingfisher’s stock ticker symbol?

Kingfisher trades on the London Stock Exchange under the ticker ‘KGF.’

Who is Kingfisher’s current chief executive?

Kingfisher’s CEO is Thierry Garnier, who has been at the company’s helm since 2019.

Can I buy Kingfisher shares in an ISA or SIPP?

Since Kingfisher is a member of the FTSE 100 index, most UK ISA and SIPP brokers allow you to invest in this company. However, your broker may not allow you to short sell Kingfisher within an ISA or SIPP account.

What countries does Kingfisher operate in?

Kingfisher has stores in the UK, Ireland, France, Spain, Portugal, Romania, Poland, Russia, and Turkey.

How many retail locations does Kingfisher have?

Kingfisher has over 1,300 stores, although 980 of these are in the UK and Ireland.