Chinese EV (electric vehicle) companies including NIO, Xpeng Motors, Li Auto, and BYD have reported their April deliveries. Here are the key takeaways from the reports and what they tell us about the health of the world’s largest EV market.

NIO delivered 15,620 vehicles in April which was up 134.6% YoY and 31.6% as compared to March. The company’s cumulative deliveries reached 495,267 at the end of April. Notably, NIO has begun the deliveries of its ET7 from April 30 and expects the new model to spur volumes in the coming quarters.

NIO also announced that it has entered into a strategic cooperation on charging and swapping with Lotus Technology which is a leading global luxury electric vehicle maker. NIO provides battery swapping service which helps lower the initial buying price of the vehicle as the buyer can take the battery on a subscription.

NIO impressed markets with its April deliveries

Earlier this year, NIO shares fell to the lowest level since June 2020 amid the growing pessimism towards Chinese shares. Notably, 2020 was a pivotal year for NIO share and from surviving a bankruptcy scare in Q1 2020, the share went on to gain over 1,110% for the year. The share hit their all-time high in early 2021 and its market cap topped $100 billion.

Since then, the share has been in a freefall, and after closing in the red for three consecutive years, it is down 38% in 2024 despite having rebounded from the lows. Other Chinese EV shares have also tanked amid the pessimism towards Chinese companies.

Xpeng Motors continues to disappoint

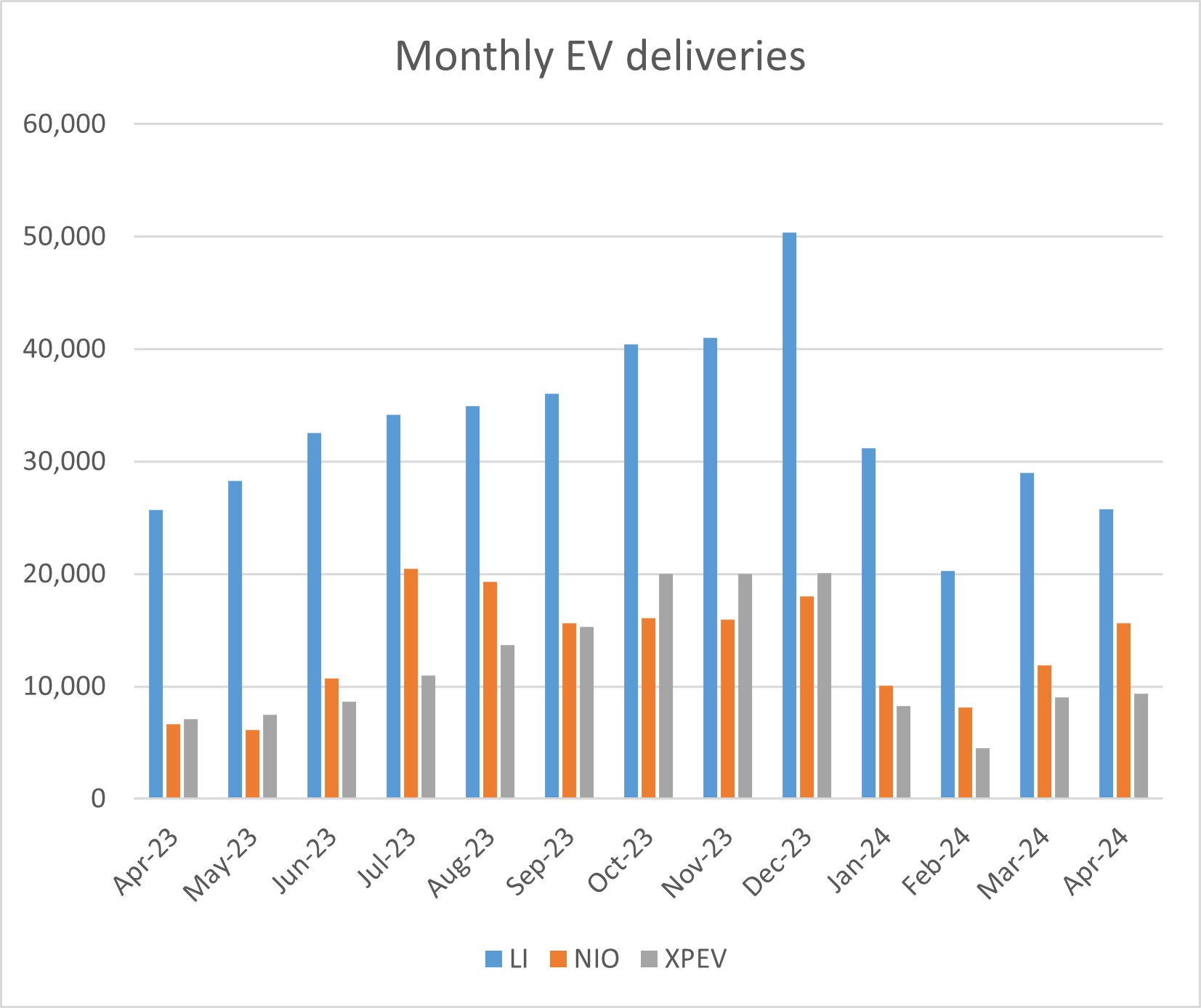

Xpeng Motors delivered 9,393 EVs in April which was 33% higher YoY and 4% on a monthly basis. Xpeng Motors’ monthly deliveries have been below 10,000 for four consecutive months now. Its monthly deliveries were below 10,000 in the first six months of 2023 also but shipments rose in the back half of the year. Its EV deliveries were above 20,000 in all three months of Q4 but have since fallen.

Xpeng Motors’ cumulative deliveries rose to 431,525 at the end of April which is below other Chinese EV companies like Li Auto and NIO.

Li Auto’s deliveries fell on a monthly basis

Li Auto delivered 25,787 vehicles in April and while the deliveries were similar to the corresponding month last year, they fell steeply from the 28,984 vehicles that it delivered in March. The company’s deliveries peaked at 50,353 in December and have since fallen.

Its cumulative deliveries reached 739,551 at the end of April. The company expects its delivery performance to improve in the coming months and CEO Xiang Li said, “Li L6, our first model priced under RMB300,000, has garnered widespread popularity among young families following its April debut. We will commence large-scale deliveries in May.”

BYD became the biggest EV company in Q4

BYD delivered 313,245 vehicles in April. The company’s deliveries rose 49% YoY and 3.6% on a monthly basis. Its battery electric vehicle (BEV) sales were 134,465, down 3.9% as compared to March. However, plug-in hybrid vehicle (PHEV) sales rose 9.8% over the period to 177,583.

In Q4 2023, BYD became the biggest EV seller globally and snatched the crown that Tesla held for years. However, in Q1 2024, Tesla reclaimed the title despite reporting an 8.5% YoY fall in its deliveries.

EV demand has slowed down

EV demand has been quite weak prompting companies to readjust their production plans. For instance, both Ford and General Motors which have committed billions of dollars towards building EV plants are delaying their investments. Startup EV companies have been under even severe stress and are grappling with continued cash burn. Several startup EV companies have either gone bankrupt or are on the verge of doing so.

Even Tesla has delayed the construction of its upcoming plant in Mexico while Musk delayed his India visit to discuss the construction of a plant there.

Tesla is also facing severe competition in China from domestic Chinese automakers. Musk meanwhile has been all praise for Chinese EV companies and during the Q4 2023 earnings call earlier this year he said, “Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.”

He added, “The Chinese car companies are the most competitive car companies in the world. So, I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established.”

The EU is contemplating imposing tariffs on Chinese EVs

Meanwhile, Chinese EV companies are facing the heat in Europe and the EU is contemplating imposing tariffs on imports of EVs from China.

Rhodium Group, which expects the EU to impose tariffs between 15%-30% on Chinese EVs believes the region would need to keep tariffs at 55% to curb imports. It said, “Even if the duties come in at the higher end of this range, some China-based producers will still be able to generate comfortable profit margins on the cars they export to Europe because of the substantial cost advantages they enjoy.”

Meanwhile, Chinese EV companies might contemplate producing cars in Europe to evade the tariffs and Xpeng Motors has hinted that it could consider building a production plant in the region to keep its cars competitive.

Question & Answers (0)