Chinese EV (electric vehicle) companies including NIO, Xpeng Motors, Li Auto, and BYD have reported their February deliveries. Here are the key takeaways from the reports.

Notably, China’s economic activity tends to be tepid around the Lunar New Year holidays which fell in February this year. As a result, the February deliveries of Chinese EV companies fell sharply as compared to January.

Chinese EV companies report February deliveries

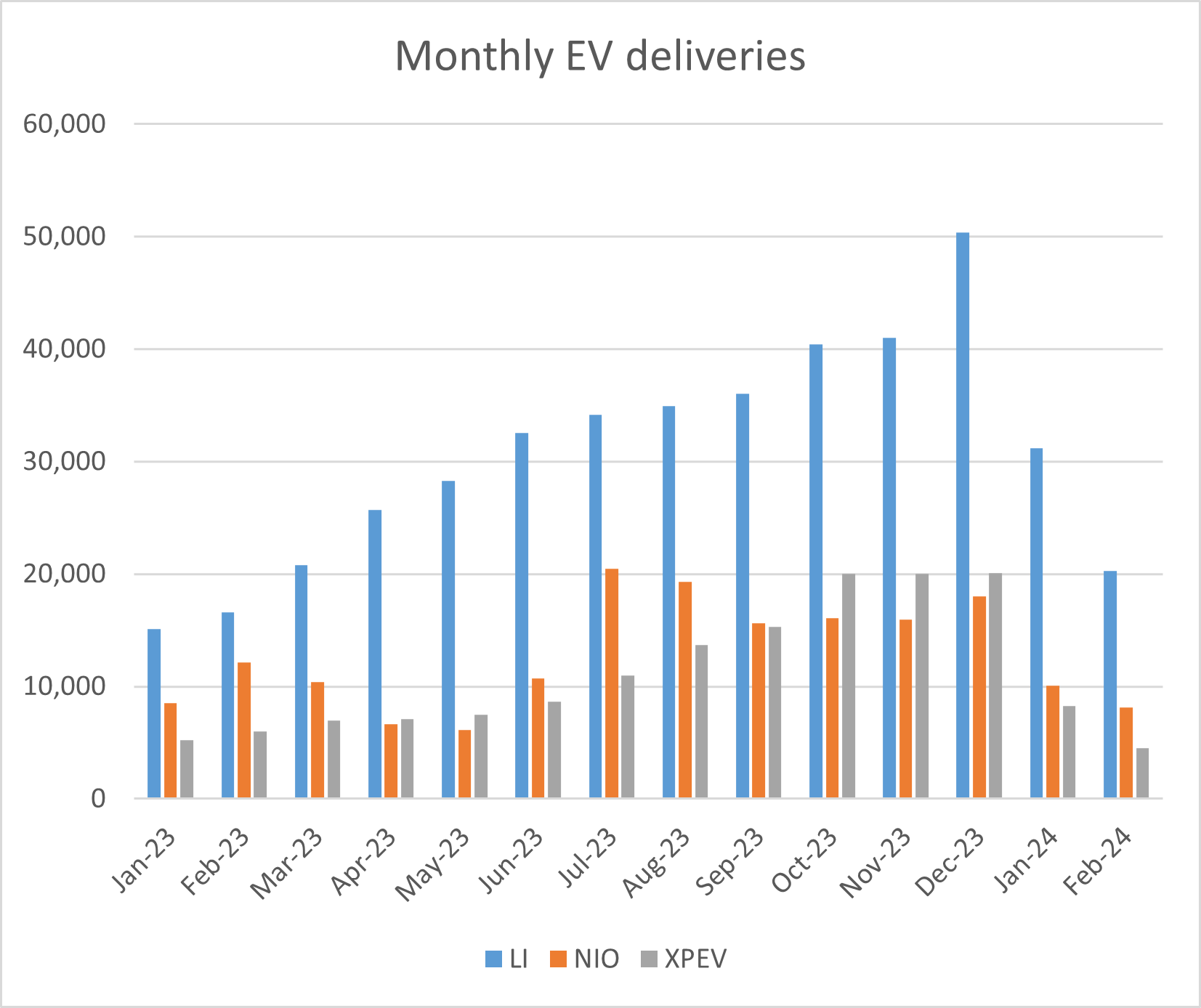

NIO delivered 8,132 EVs in February which was 19.1% lower as compared to January, and 33.1% lower than the 12,157 vehicles delivered in February 2023. The company delivered 18,187 vehicles in the first two months of the year which is below the 20,663 that it delivered in the corresponding period last year NIO’s cumulative deliveries reached 467,781 at the end of February.

Earlier this year, NIO shares fell to the lowest level since June 2020 amid the growing pessimism towards Chinese shares. Notably, 2020 was a pivotal year for NIO share and from surviving a bankruptcy scare in Q1 2020, the share went on to gain over 1,110% for the year. The share hit their all-time high in early 2021 and its market cap topped $100 billion.

Since then, the share has been in a freefall, and after closing in the red for three consecutive years, it has already lost 31.7% in 2024. Other Chinese EV shares have also tanked amid the pessimism towards Chinese companies

Xpeng Motors’ deliveries plummet

Xpeng Motors February EV deliveries fell to a mere 4,545. It delivered 8,250 cars in January. For context, the company delivered 6,010 vehicles in February and 5,218 in January of last year. Notably, Xpeng Motors deliveries bottomed in January 2023 and rose on a monthly basis in all the remaining months last year topping 20,000 each in all months in Q4.

Now, the company’s deliveries have fallen on a monthly basis for two consecutive months and also came in below 10,000 units in both months. Its cumulative deliveries at the end of February were 413,106.

In its release, the startup Chinese EV company said, “With the capacity ramp-up and the debottlenecking of certain components’ supply post-Chinese New Year, we will accelerate the delivery of the X9 in March.”

It also provided an update on its autonomous driving software and said, “Given XNGP’s extensive coverage and cutting-edge smart driving experience, the monthly active user penetration rate of XNGP urban smart driving reached 83% in February, leading the industry in terms of active user scale, user experience, and mileage penetration rate.”

Xpeng Motors has warned of a “bloodbath” in the EV industry

In an employee memo last month, Xpeng Motors’ CEO He Xiaopeng said that the price war in the EV industry could end in a “bloodbath.” Notably, there has been a brutal price war in the Chinese EV industry since Q4 of 2022 when Tesla started to cut car prices to spur sales.

Tesla’s price cuts were followed by similar announcements from other carmakers including Xpeng Motors, Ford, Toyota, and Nissan.

Last year, even NIO lowered car prices. Previously the company had categorically said that it wouldn’t join the price war.

The Elon Musk-run company has since lowered prices multiple times including in January. Last year, The China Association of Auto Manufacturers (CAAM) tried to bring about a truce in the price war but soon rescinded the pledge admitting it was against the country’s antitrust laws.

Li Auto’s February deliveries

Li Auto delivered 20,251 vehicles in February 2024 which was 21.8% higher YoY. The company’s cumulative deliveries reached 684,780 at the end of February.

“Even with the impact of Chinese New Year and some trims of Li L series models sold out as we prepare for switching to new models, our average daily delivery in February (excluding the eight-day Chinese New Year holiday period) still increased significantly compared with that of February 2023,” said the company in its release.

Li Auto is coming up with new models and expects its March deliveries to rise to around 50,000.

BYD became the largest EV seller last year

BYD sold 122,311 new energy vehicles – which include both battery electric cars and plug-in hybrids. The deliveries fell 36.7% YoY and 39.3% as compared to February 2023.

In Q4 2023, China’s BYD surpassed Tesla to become the largest seller of EVs globally. In May last year, Musk termed China-based EV maker BYD “highly competitive.” Notably in 2011, the billionaire had laughed at the possibility of BYD as a competitor to Tesla.

Musk meanwhile has been all praise for Chinese EV companies and during the Q4 2022 earnings call last month he said, “Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.”

He added, “The Chinese car companies are the most competitive car companies in the world. So, I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established.”

Musk on Chinese EV companies

To be sure, this is not the first time that Musk has praised Chinese EV companies and he has made similar comments multiple times in the past including during Tesla’s Q4 2022 earnings call.

“I think we have a lot of respect for the car companies in China. They are the most competitive in the world. That is our experience,” Musk had then said.

The billionaire added, “And the Chinese market is the most competitive. They work the hardest and they work the smartest. That’s — so a lot of respect for the China car companies that we’re competing against. And so, if I would have guessed, there are probably some company out of China as the most likely to be second to Tesla.”

Ford CEO Jim Farley has also praised Chinese EV companies. Notably, Ford has slowed down its ambitious pivot to build electric cars and is instead doubling down on hybrids.

Meanwhile, China continues to be saddled with excess EV production capacity and the problem seems to be getting worse as Chinese tech giants also contemplate entering the industry.

Looking at the premarket price action today, while NIO and Xpeng Motors are up slightly, Li Auto is in the red after recording strong gains in the previous month.

Question & Answers (0)