US President Joe Biden unveiled the $2 trillion infrastructure spending programme yesterday, named the American Jobs Plan. Here are the details of the plan and what it means for different industries and shares.

While President Donald Trump fulfilled many of his promises, his proposed infrastructure investments did not see the light of day. Now, the Biden administration intends to spend massively on the country’s infrastructure, and to pay for it by undoing some of the tax cuts that the Trump administration had implemented.

Biden’s infrastructure plans

To begin with, there is little denying that the US needs to spend heavily on infrastructure after years of underinvestment. According to the White House report that unveiled the infra plans, while the US is the world’s biggest economy, it ranks 13th on the overall quality of infrastructure.

The report said, “After decades of disinvestment, our roads, bridges, and water systems are crumbling. Our electric grid is vulnerable to catastrophic outages.” The report added, “It has never been more important for us to invest in strengthening our infrastructure and competitiveness, and in creating the good-paying, union jobs of the future.”

Highlights of the infrastructure bill

Transportation will get the lion’s share in the plan. The Biden administration intends to invest $621 billion in improving the transportation infrastructure. The plan calls for repairing the roads and bridges and said that almost 20% of the country’s major roads and highways are in poor condition. It also talks about modernising the public transport system and investing in passenger and rail freight.

The plan also proposes investing $174 billion in the electric vehicle ecosystem as part of the investment in transportation. The plan says that “It will give consumers point of sale rebates and tax incentives to buy American-made EVs (electric vehicles), while ensuring that these vehicles are affordable for all families and manufactured by workers with good jobs.” It talks about incentives to scale up the electric vehicle charging stations to 500,000 by 2030.

Winners and losers

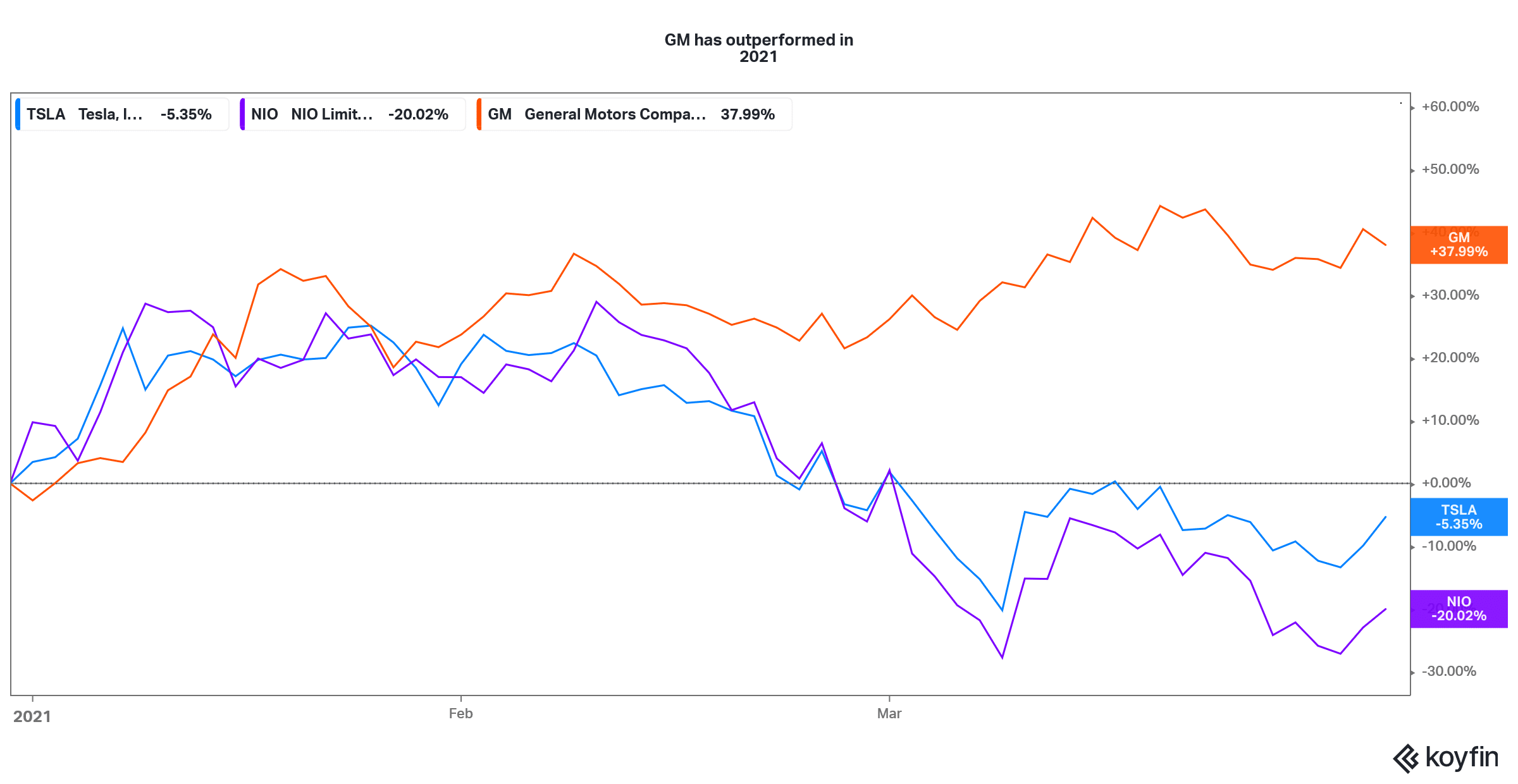

The incentives for buying electric cars are good for all US electric vehicle companies. It is especially positive for companies like Tesla and General Motors that don’t qualify for the Federal tax credit as they have already sold over 200,000 electric cars. While Biden’s plan hasn’t outlined the incentives for electric car companies, Daniel Ives of Wedbush Securities expects the Federal tax credit to rise to $10,000 from $7,500, and expects the lifting of the ceiling of 200,000 cars per producer.

The focus on electrifying government fleet and school buses is also positive for companies like Workhorse. The share had fallen previously after it lost out on a contract from the US Postal Service.

Also, the impetus towards electric vehicle charging infrastructure is good news for charging companies like Blinks Charging and ChargePoint. These shares were trading higher in US premarket trading after Biden unveiled his infrastructure plans.

Companies like General Electric would also benefit given their exposure to the renewable energy sector. However, renewable energy does not account for a big chunk of the company’s earnings. Also, while oil shares would benefit from higher asphalt demand, it might not offset the negative impact from the administration’s pessimistic view of the fossil fuel sector. The oil and gas sector faces long term headwinds from the pivot towards electric vehicles from internal combustion engine cars.

ETFs to watch amid Biden’s jobs plan

If you are looking at a diversified passive exposure to play the Biden infrastructure and jobs plan, you can do so through various ETFs. The Invesco Water Resources ETF (PHO) will benefit from the increased spending on waterways and drinking waters system.

Renewable ETFs like the First Trust Global Wind Energy (FAN) and Invesco Solar ETF (TAN) would also benefit from the Biden administration’s impetus towards renewable energy generation.

Transportation ETFs like the SPDR S&P Transportation ETF (XTN) and iShares Transportation Average ETF (IYT) would also benefit as the Biden administration plans to spend billions on improving the country’s transportation sector.

Higher infrastructure spending to benefit steel and aluminium companies

Also, the focus to build physical assets like roads and bridges is positive for US steel and aluminium companies. US steel shares are up sharply over the last year as domestic steel prices are hovering near multi-year highs. Among steel companies, Nucor, the largest US-based steel company, could be among the biggest beneficiaries if the country revamps its infrastructure. Nucor is the largest rebar supplier in North America and the product is mainly used in non-residential construction including on highways and bridges.

While President Trump had claimed that the US steel industry was “thriving” under his watch, all leading US steel shares underperformed the markets in his tenure. Steel shares have bounced back after Biden’s election, partially due to the shift from tech to cyclical and value shares.

Boe Biden is bullish

Biden is bullish on his massive infrastructure bill. “These are investments we have to make,” said Biden on revamping the country’s infrastructure. He added, “We can afford to make them. To put it another way — we can’t afford not to.”

Meanwhile, the plan also talks about increasing the corporate tax rate from 21% to 28% so that “corporations pay their fair share of taxes.” Also, it proposes to tax US companies on a country-by-country basis so that they also pay taxes on businesses in tax havens. The plan also says that “It will also eliminate the rule that allows U.S. companies to pay zero taxes on the first 10 percent of return when they locate investments in foreign countries.”

The losers from Biden’s infrastructure and jobs plan

The proposal to hike the corporate tax rate is negative for US companies especially the tech giants. Notably, Trump’s tax cuts had helped the share markets as it led to an increase in EPS by cutting the tax rates. Now, with Biden proposing to increase the tax rates, corporate earnings will fall and the valuations, that already looks stretched, will start to look even higher.

While the US Chamber of Commerce welcomed the infrastructure plan, it expressed concern over the tax hikes. It said, “we believe the proposal is dangerously misguided when it comes to how to pay for infrastructure.” It added, “We strongly oppose the general tax increases proposed by the administration which will slow the economic recovery and make the U.S. less competitive globally – the exact opposite of the goals of the infrastructure plan.”

Someone has to pay

Meanwhile, while the massive stimulus package announced by both the Trump and Biden administration helped the US economy, in the medium to long term the extravaganza has to be repaid. US debt to GDP ratio has already crossed 100% and is set to rise further with the stimulus and infrastructure investments that the Biden administration is announcing.

To bridge the revenue shortfall, the country has little option but to increase taxes. If the fiscal extravagance is not repaid, it would have a long-term impact on the country’s financial stability and its status as the world’s strongest economy.

Question & Answers (0)