The FTSE 100 index is surging 1.3% today above the 6400 level, after AstraZeneca (AZN)‘s announcement showcased what would be the third effective vaccine in the Western world, successfully instilling positive sentiment among market participants.

News from America on President Donald Trump giving the first signals of an upcoming concession to President-elect Joe Biden, is also contributing to today’s uptick in global markets – including the ‘footsie’ – while higher oil prices are pushing the index’s oil & gas sector as well.

Reports indicated yesterday that President Trump gave the green light to the General Services Administration (GSA) to grant Biden’s team access to federal funds to support the transition between the two administrations.

Trump tweeted that he authorised the head of the GSA, Emily Murphy, and his own White House team to initiate the traditional protocols for a transition of power, a development that has lifted market sentiment today as a peaceful transfer of power in January seems highly likely.

Meanwhile, the number of daily coronavirus cases in the United Kingdom has started to retreat, with the tally now moving below 20,000 after making a single-day record of 33,470 positive cases on 12 November, according to virus-tracking website Worldometers.

Lockdown measures implemented during this second wave of the virus have depressed economic activity in the country, as reflected by the latest IHS Markit PMI reading in November, with the UK Composite Index sliding to 47.4.

However, although negative, the decline was less steep than expected, as economists and financial experts polled by Reuters expected a 44.1 reading during the month.

Which stocks are driving the FTSE 100 today?

Most FTSE 100 constituents are performing positively today, although the banking and oil sector are providing the biggest boost to the index.

Shares of BP Plc (BP) are advancing 7.3% at 272.1p so far, followed by Royal Dutch Shell (RDSA), whose shares are also surging 5.5% at 1,370p in mid-day stock trading activity, aided by higher oil prices.

Banks and financial services firms are also contributing to today’s uptick in the footsie, with Lloyds Banking Group (LLOY) leading the rally, surging 4.1% so far today at 38.75p, followed by Barclays (BARC) and Standard Chartered (STAN), which are trading 3.5% and 2.5% higher, respectively.

Industrials, on the other hand, seem to be putting a cap on the index’s advance. Only five of the sector’s 13 constituents are seeing gains today, led by Rolls-Royce (RR) shares, which are advancing 7.4% at 114.9p on the back of more positive news from the vaccine front.

What’s next for the FTSE 100 index?

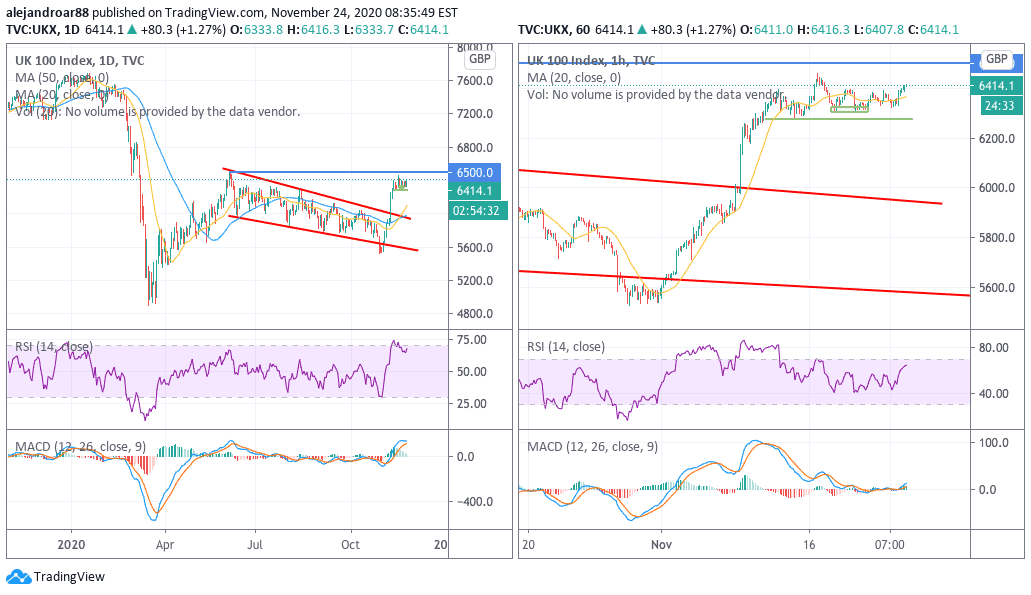

The combination of a post-US-election rally and vaccine optimism have contributed to the recent uptick in the FTSE 100, which is emerging from the depths after plunging to the 5500 in late October.

The British benchmark has successfully reversed a downward price channel that emerged after its June post-pandemic highs, with the price now potentially headed to retest those levels.

That said, although the index has managed to trim some of the losses it has seen this year, the footsie remains 15.5% down since 1 January.

The daily chart shows how that break above the channel has lifted the index to a five-month high, while reaching overbought levels on the RSI oscillator.

Meanwhile, the 1-hour chart shows that the intraday price action seems to have found a floor at the 6,300 psychological threshold, which could serve as a platform for take-off in the days to come.

It would be plausible to see the FTSE 100 moving above the June highs, given the positive backdrop and the current technical setup. However, it can also be expected that, once those levels are reached, the index could spend some time in consolidation mode until new catalysts show up to push the index higher.

Question & Answers (0)